One of my favorite things to do when studying a company is going line by line through each of the financial statements to see if I can articulate the reality of the accounting.

If there is a gap in my understanding, that's a great way to know if it's outside of my circle or if I need to do more work.

Let's go through an example of how I do this, using the latest Celsius 10-Q, the energy drink company (not investment advice, for educational purposes).

I like starting with the income statement because it's usually the simplest. I'll go through each line briefly and then tie it to what is actually happening in the business. Accounting is just the language of business.

INCOME STATEMENT

1. Revenue

The best model for understanding revenue is just price x quantity. So number of cases of energy drinks sold multiplied by the price. That's the reality of the business.

But even something as simple as revenue can be fairly complicated.

If you read the footnotes, it turns out that there are co-marketing dollars spent by Pepsi to help with sales velocity. These are recognized as contra-revenue items and they build up on the balance sheet (which we'll get to).

And then, with revenue, you have distribution points so for this business, Pepsi is now the exclusive distributor but Amazon and Costco still make up about 8-9% of sales each.

Lastly, you have timing. Understanding when revenue is recognized is important. For Celsius, it's when the product is shipped to the distributor and then there is about 2-3 months until Celsius receives the cash for that.

So that's how you can use the financial statements as a jumping off point for more research. It's just thinking through the reality of the business, but using the accounting as a starting point and then asking questions.

2. COGS

Obviously, you have the materials cost here. The cans from $BALL (among others), the concentrate costs, the shipping, the co-packing/bottling fees. Hard goods inflation affects this but there isn't a whole lot of differentiation here so supplier don't have too much leverage.

Inventory holding costs fall into this category too and the associated warehouse expenses.

3. SG&A

This is all of the other expenses. Things like advertising, salaries, office space, R&D for new flavors, merchandise displays, and sponsorships, among everything else that isn't directly associated with the product, itself (can/liquid, etc).

4. Interest/taxes

The company is making a little bit off of its $760 million in cash. And then, well, taxes.

5. Dividends

Celsius also has to pay a small dividend to Pepsi as part of its preferred convertible stock agreement when Pepsi bought 8.5% of the company and bought out all of Celsius's distribution agreements.

Ok, that's it for the income statement. Fairly straight-forward but even a simple business like this one has wrinkles.

In summary, Celsius has several co-packing relationships where they actually create the concentrates that are put in cans and shipped to Pepsi/Amazon/Costco distribution hubs. The company also spends marketing dollars in creative ways to increase the sales velocity because that will give them greater shelf space. Pepsi is also highly incentivized to get them great displays/space in stores. That's the simple business of selling energy drinks.

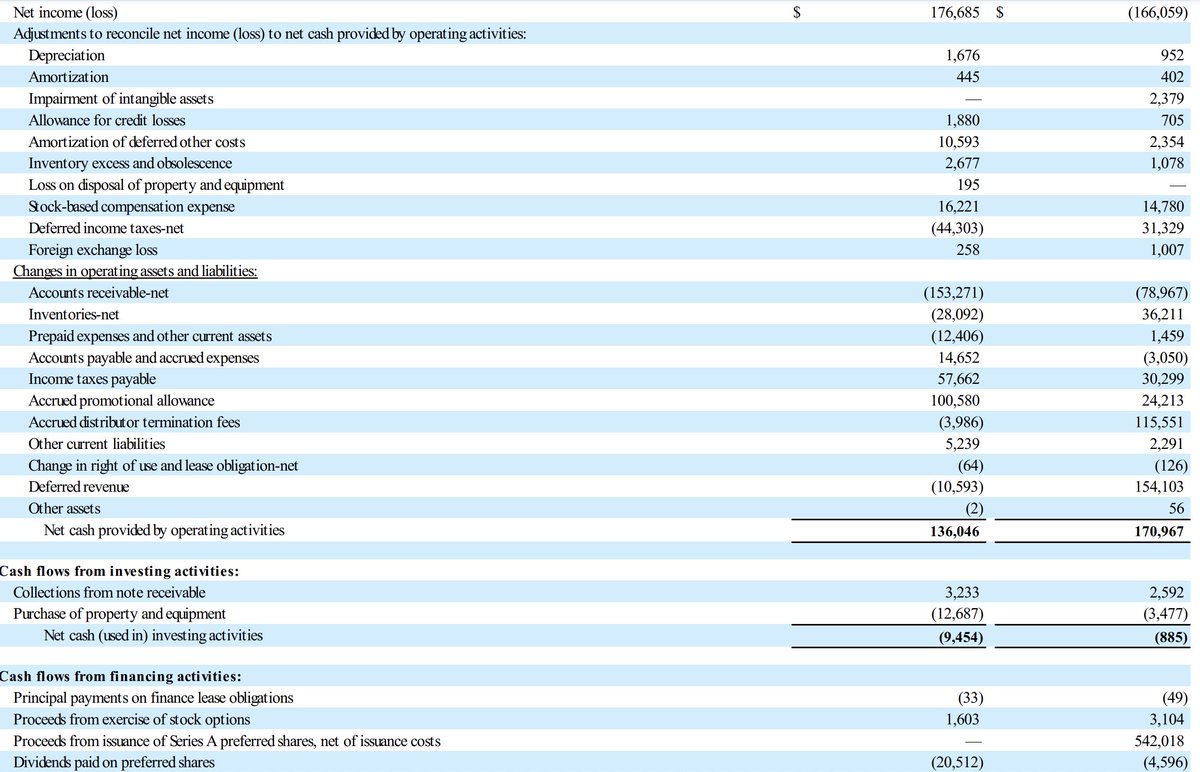

Ok, next, I go to the cash flow statement.

It starts with net income at the top. Then...

1. Depreciation/amortization

The depreciation is actually mainly from coolers that Celsius owns that are placed in stores. These coolers make up 90% of PPE and are straight-lined between 3-7 years depending on the model.

2. Credit losses

This is mainly from a Chinese distributor called Qifeng, where Celsius made a small loan to get them up and running and the deal hasn't turned out very well. The aggregate expected loss for this is about $2.8 million.

3. Amortization of deferred other costs

This is sort of confusing but it gets cancelled out by the deferred revenue because of one piece of the Pepsi agreement from last year.

Basically, Pepsi gave Celsius $550 million in cash and then an extra $282 million to buy out its contracts with all other distributors. This was capitalized as an asset and then amortized over 20 years, even though it worked its way through the income statement in Q3 and Q4 of 2022.

So you'll see the same contra-charge in deferred revenue, so we'll skip that when we get to it.

4. Inventory excess and storage

This is mainly obsolescence. Maybe if a flavor doesn't sell well at all, it will get scrapped and charged off.

5. Stock-based comp and deferred taxes

Pretty straight-forward. You can get a nitty-gritty understanding of the option strike prices and RSU/PSU breakdown but maybe not the best use of time, especially when SBC is small like it is here.

Deferred tax liabilities are typically from a depreciated asset and deferred tax assets can be from multiple things but in this case, it's from the discrepancy between what Pepsi actually paid out $210 million in distribution termination agreements and then value of the excess in the preferred shares ($282 million). This created a deferred tax asset. There is also some loss carryover from the past.

Ok, this is getting really long at this point, just a couple more things and then I'll probably skip the balance sheet (unless there is a lot of interest in this and then I can do a part 2).

6. Accounts receivable

This is one of the most important working capital things to watch. It represents revenue where cash hasn't been received yet.

So in this case, it would be if a bunch of cases of Celsius have been shipped to Pepsi but Pepsi hasn't paid cash for them yet. They are on credit, essentially.

If AR is growing much faster than revenue, then you know the company is extending payment terms. Celsius's AR has been growing because Pepsi can dictate more aggressive payment terms because they add so much value. But it's nothing super worrying here yet.

7. Inventories

This is also very important to watch. If inventories are piling up, that probably means drinks aren't flying off shelves. Inventories increasing a lot would mean that Pepsi or other distribution points haven't ordered enough because there is still a lot of product in the channel. Alternatively, an inventory build can also be if a company is launching in a new geography and they want to ensure product availability like how Celsius is launching in Canada in Q1.

8. Accrued expenses/accounts payable

To touch on AP, if it increases this could mean that Celsius has negotiated stronger payment terms with co-packers. Think of AP as supplier-facing and AR as customer-facing.

9. Accrued promotional allowance

This is that reduction-in-revenue thing I was talking about at the beginning. Pepsi spends marketing dollars or discounts products where it comes out of their pocket to stimulate demand.

Ok, that's pretty much it as far as the big things go. If you understand the income statement and the cash flow statement in fine detail, you can typically triangulate into the balance sheet. Nothing should be too much of a surprise.

If you've read this far, great job! Hope this was helpful.

If there is a gap in my understanding, that's a great way to know if it's outside of my circle or if I need to do more work.

Let's go through an example of how I do this, using the latest Celsius 10-Q, the energy drink company (not investment advice, for educational purposes).

I like starting with the income statement because it's usually the simplest. I'll go through each line briefly and then tie it to what is actually happening in the business. Accounting is just the language of business.

INCOME STATEMENT

1. Revenue

The best model for understanding revenue is just price x quantity. So number of cases of energy drinks sold multiplied by the price. That's the reality of the business.

But even something as simple as revenue can be fairly complicated.

If you read the footnotes, it turns out that there are co-marketing dollars spent by Pepsi to help with sales velocity. These are recognized as contra-revenue items and they build up on the balance sheet (which we'll get to).

And then, with revenue, you have distribution points so for this business, Pepsi is now the exclusive distributor but Amazon and Costco still make up about 8-9% of sales each.

Lastly, you have timing. Understanding when revenue is recognized is important. For Celsius, it's when the product is shipped to the distributor and then there is about 2-3 months until Celsius receives the cash for that.

So that's how you can use the financial statements as a jumping off point for more research. It's just thinking through the reality of the business, but using the accounting as a starting point and then asking questions.

2. COGS

Obviously, you have the materials cost here. The cans from $BALL (among others), the concentrate costs, the shipping, the co-packing/bottling fees. Hard goods inflation affects this but there isn't a whole lot of differentiation here so supplier don't have too much leverage.

Inventory holding costs fall into this category too and the associated warehouse expenses.

3. SG&A

This is all of the other expenses. Things like advertising, salaries, office space, R&D for new flavors, merchandise displays, and sponsorships, among everything else that isn't directly associated with the product, itself (can/liquid, etc).

4. Interest/taxes

The company is making a little bit off of its $760 million in cash. And then, well, taxes.

5. Dividends

Celsius also has to pay a small dividend to Pepsi as part of its preferred convertible stock agreement when Pepsi bought 8.5% of the company and bought out all of Celsius's distribution agreements.

Ok, that's it for the income statement. Fairly straight-forward but even a simple business like this one has wrinkles.

In summary, Celsius has several co-packing relationships where they actually create the concentrates that are put in cans and shipped to Pepsi/Amazon/Costco distribution hubs. The company also spends marketing dollars in creative ways to increase the sales velocity because that will give them greater shelf space. Pepsi is also highly incentivized to get them great displays/space in stores. That's the simple business of selling energy drinks.

Ok, next, I go to the cash flow statement.

It starts with net income at the top. Then...

1. Depreciation/amortization

The depreciation is actually mainly from coolers that Celsius owns that are placed in stores. These coolers make up 90% of PPE and are straight-lined between 3-7 years depending on the model.

2. Credit losses

This is mainly from a Chinese distributor called Qifeng, where Celsius made a small loan to get them up and running and the deal hasn't turned out very well. The aggregate expected loss for this is about $2.8 million.

3. Amortization of deferred other costs

This is sort of confusing but it gets cancelled out by the deferred revenue because of one piece of the Pepsi agreement from last year.

Basically, Pepsi gave Celsius $550 million in cash and then an extra $282 million to buy out its contracts with all other distributors. This was capitalized as an asset and then amortized over 20 years, even though it worked its way through the income statement in Q3 and Q4 of 2022.

So you'll see the same contra-charge in deferred revenue, so we'll skip that when we get to it.

4. Inventory excess and storage

This is mainly obsolescence. Maybe if a flavor doesn't sell well at all, it will get scrapped and charged off.

5. Stock-based comp and deferred taxes

Pretty straight-forward. You can get a nitty-gritty understanding of the option strike prices and RSU/PSU breakdown but maybe not the best use of time, especially when SBC is small like it is here.

Deferred tax liabilities are typically from a depreciated asset and deferred tax assets can be from multiple things but in this case, it's from the discrepancy between what Pepsi actually paid out $210 million in distribution termination agreements and then value of the excess in the preferred shares ($282 million). This created a deferred tax asset. There is also some loss carryover from the past.

Ok, this is getting really long at this point, just a couple more things and then I'll probably skip the balance sheet (unless there is a lot of interest in this and then I can do a part 2).

6. Accounts receivable

This is one of the most important working capital things to watch. It represents revenue where cash hasn't been received yet.

So in this case, it would be if a bunch of cases of Celsius have been shipped to Pepsi but Pepsi hasn't paid cash for them yet. They are on credit, essentially.

If AR is growing much faster than revenue, then you know the company is extending payment terms. Celsius's AR has been growing because Pepsi can dictate more aggressive payment terms because they add so much value. But it's nothing super worrying here yet.

7. Inventories

This is also very important to watch. If inventories are piling up, that probably means drinks aren't flying off shelves. Inventories increasing a lot would mean that Pepsi or other distribution points haven't ordered enough because there is still a lot of product in the channel. Alternatively, an inventory build can also be if a company is launching in a new geography and they want to ensure product availability like how Celsius is launching in Canada in Q1.

8. Accrued expenses/accounts payable

To touch on AP, if it increases this could mean that Celsius has negotiated stronger payment terms with co-packers. Think of AP as supplier-facing and AR as customer-facing.

9. Accrued promotional allowance

This is that reduction-in-revenue thing I was talking about at the beginning. Pepsi spends marketing dollars or discounts products where it comes out of their pocket to stimulate demand.

Ok, that's pretty much it as far as the big things go. If you understand the income statement and the cash flow statement in fine detail, you can typically triangulate into the balance sheet. Nothing should be too much of a surprise.

If you've read this far, great job! Hope this was helpful.

Testing out some long form X 😅 $CELH

For some more analysis too: business-breakdowns.com

Loading suggestions...