Marks explains his "20 Most Important Things" you must know if you want to become a successful investor.

I will summarize them all below and share some personal notes, as an active participant in the liquid crypto markets.

Let's get started!

I will summarize them all below and share some personal notes, as an active participant in the liquid crypto markets.

Let's get started!

I believe $MKR is value. It's slightly underperformed recently but I believe the intrinsic cashflow that flows to tokenholders will eventually be appreciated by the markets.

Metrics can be seen at makerburn (dot) com

Metrics can be seen at makerburn (dot) com

If I see value, I need to hold it firmly. Of course I could be wrong, but it's my job to identify that and take profits if the market tells me to.

The markets are hard because you can be right on something but not be rewarded right away.

The markets are hard because you can be right on something but not be rewarded right away.

People tell me, "Why would I buy $BTC when I can buy a memecoin and 1000x if $BTC hits ATHs?"

I mean yea that could happen, but you're also opening yourself up to survivorship bias. For every memecoin that 1000x, there are likely hundreds/thousands that go to zero or rugged.

I mean yea that could happen, but you're also opening yourself up to survivorship bias. For every memecoin that 1000x, there are likely hundreds/thousands that go to zero or rugged.

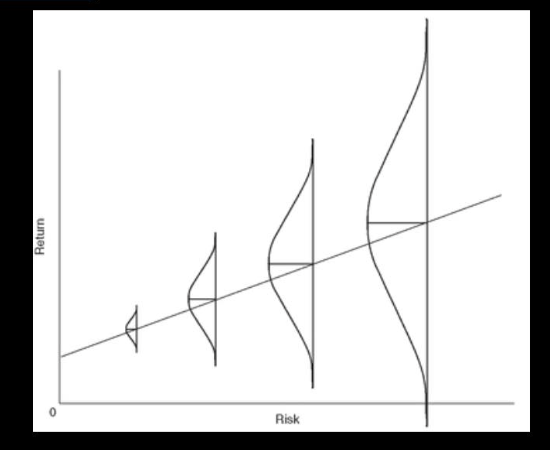

So in bull markets, people take on more risks which increase overall risk in the markets.

In bear markets, people take on less risk which increase the potential for return in the future.

We all remember the sentiment at market tops & bottoms and understand what Marks is saying.

In bear markets, people take on less risk which increase the potential for return in the future.

We all remember the sentiment at market tops & bottoms and understand what Marks is saying.

I think this idea is incredibly important in crypto.

Everyday people are shilling their coins and most of the time, influencers are being paid by projects to promote a coin to their audience.

Sure, you can make money if you're early, but was it really worth the risk?

Everyday people are shilling their coins and most of the time, influencers are being paid by projects to promote a coin to their audience.

Sure, you can make money if you're early, but was it really worth the risk?

Another example is when people try to trade events like unlocks. Sure, you might make money but what's your edge?

Unless you have asymmetric info, it's probably better to just sit and wait for opportunities to come to you.

Unless you have asymmetric info, it's probably better to just sit and wait for opportunities to come to you.

I think it's important to appreciate how luck plays a big part in all of our lives.

Taleb points out that the things that happened are only a small subsection of things that COULD have happened.

This is important to internalize to manage your ego and listen to others.

Taleb points out that the things that happened are only a small subsection of things that COULD have happened.

This is important to internalize to manage your ego and listen to others.

It's also worth noting that if everyone thinks something bad won't happen, they'll engage in risky behavior which will alter the environment.

So then the bad thing becomes more likely to happen, and take out a lot of people with it.

So then the bad thing becomes more likely to happen, and take out a lot of people with it.

My favorite section of the book was the baseball analogy of not needing to take unnecessary swings because there's no way to strike out in crypto.

The only way to strike out is by not managing risk and being penalized for it.

Crypto is volatile enough, so I won't use leverage.

The only way to strike out is by not managing risk and being penalized for it.

Crypto is volatile enough, so I won't use leverage.

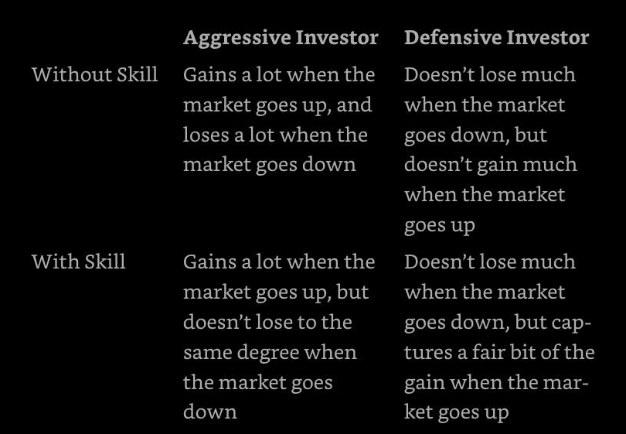

A lot of people in crypto come for the quick gains and losses, but I think it's good to try to think about the market from a value investor's perspective.

I'm trying to take on more of this type of approach where I identify "value" and firmly hold onto it.

I'm trying to take on more of this type of approach where I identify "value" and firmly hold onto it.

The markets are especially tough because you can be right and have the market not move in your way.

You can also be wrong and have the market move in your way.

Luck and randomness plays a big role in our short-term performance.

You can also be wrong and have the market move in your way.

Luck and randomness plays a big role in our short-term performance.

Also, crypto sentiment is an interesting phenomenon because people's views on the markets are dictated by what's trending on social media.

This makes things more viral, but also can send the pendulum too far out on the risk curve, which eventually gets people rekt.

This makes things more viral, but also can send the pendulum too far out on the risk curve, which eventually gets people rekt.

I think patience is most important in crypto, because people overestimate what can happen in the short-term, but underestimate what can happen in the medium/long-term.

If you actually believe in crypto, a buy and hold approach for market winners is a good bet.

If you actually believe in crypto, a buy and hold approach for market winners is a good bet.

How do we find these winners? I have no idea.

But Marks believes that if you avoid the losers, the winners will eventually find you. So I will continue to research and provide free content so we can all try to improve ourselves in the markets.

Hope you enjoyed the summary!

But Marks believes that if you avoid the losers, the winners will eventually find you. So I will continue to research and provide free content so we can all try to improve ourselves in the markets.

Hope you enjoyed the summary!

If you want me to do more of this, please consider liking/retweeting the initial post. Otherwise I'll just keep these to myself.

Also check out my megathread of book summaries which I will update over time as I read more books.

Loading suggestions...