The value in any stock is subjective.

Learn to identify it.

Here are 5 steps to find the right investment opportunities:

Learn to identify it.

Here are 5 steps to find the right investment opportunities:

1. Look for sustainable competitive advantages (moats).

A company with a unique advantage can protect its market share and profitability.

Examples include brand name, patents, and franchise licenses.

Avoid companies with no clear competitive advantage.

A company with a unique advantage can protect its market share and profitability.

Examples include brand name, patents, and franchise licenses.

Avoid companies with no clear competitive advantage.

3. Analyze management.

Look for:

- CEO track record

- Insider ownership

- Company culture

- Stewardship

Management can make or break a company's success.

Look for:

- CEO track record

- Insider ownership

- Company culture

- Stewardship

Management can make or break a company's success.

4. Study industry and market trends.

Identify the:

- Industry drivers

- Competitive environment

- Market cyclicalities

Invest in industries with good long-term prospects and avoid industries in decline.

Identify the:

- Industry drivers

- Competitive environment

- Market cyclicalities

Invest in industries with good long-term prospects and avoid industries in decline.

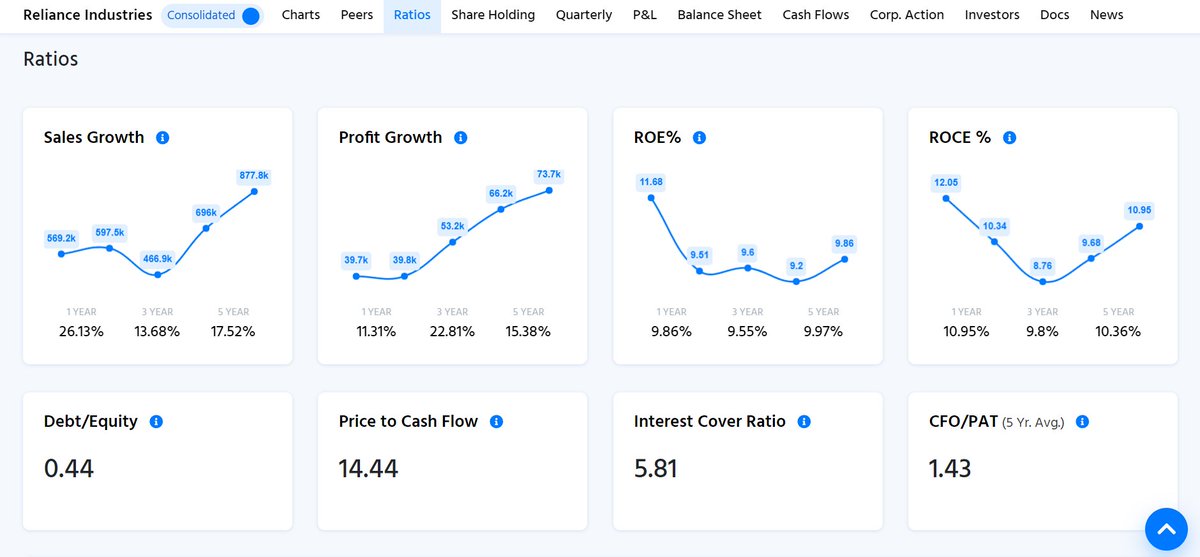

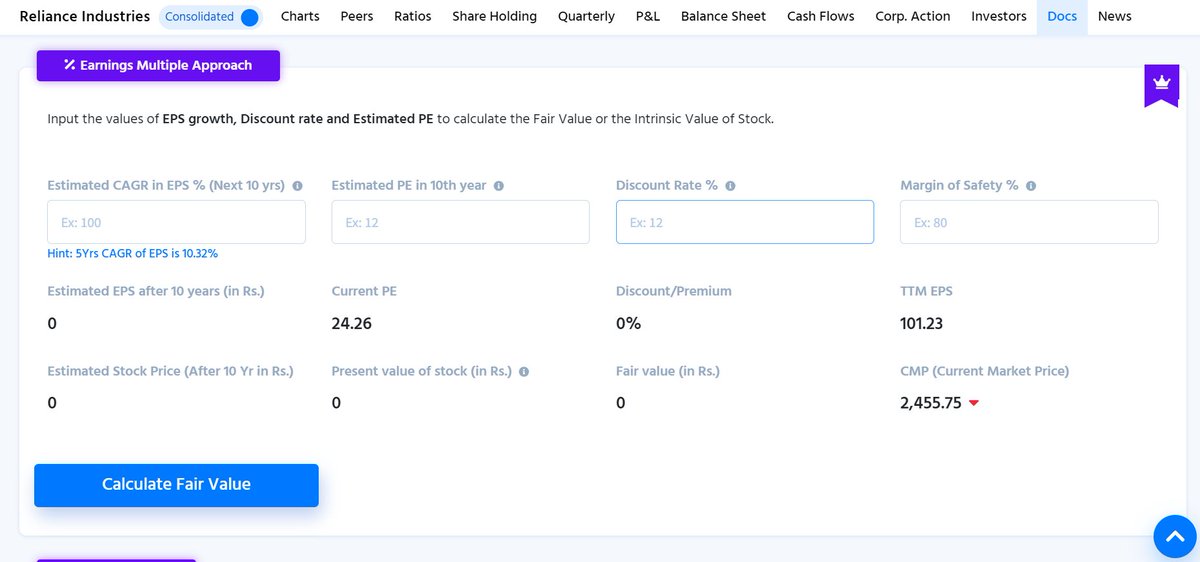

5. Determine stock valuation.

Use:

- P/E ratio

- P/B ratio

- Dividend yield

- Earnings growth projections

Compare these metrics to competitors and industry to determine if the stock is overvalued or undervalued.

Try inbuilt valuation calculator on ticker.finology.in

Use:

- P/E ratio

- P/B ratio

- Dividend yield

- Earnings growth projections

Compare these metrics to competitors and industry to determine if the stock is overvalued or undervalued.

Try inbuilt valuation calculator on ticker.finology.in

Always approach stock investing with a long-term mindset.

Stick to your investment strategy despite short-term market fluctuations.

Stick to your investment strategy despite short-term market fluctuations.

Loading suggestions...