This process of putting asset shares on the blockchain is called Tokenization.

Anything can be turned into real-world assets.

But, let's take a look at the 3 largest projects in that category to get a feel for RWAs:

Anything can be turned into real-world assets.

But, let's take a look at the 3 largest projects in that category to get a feel for RWAs:

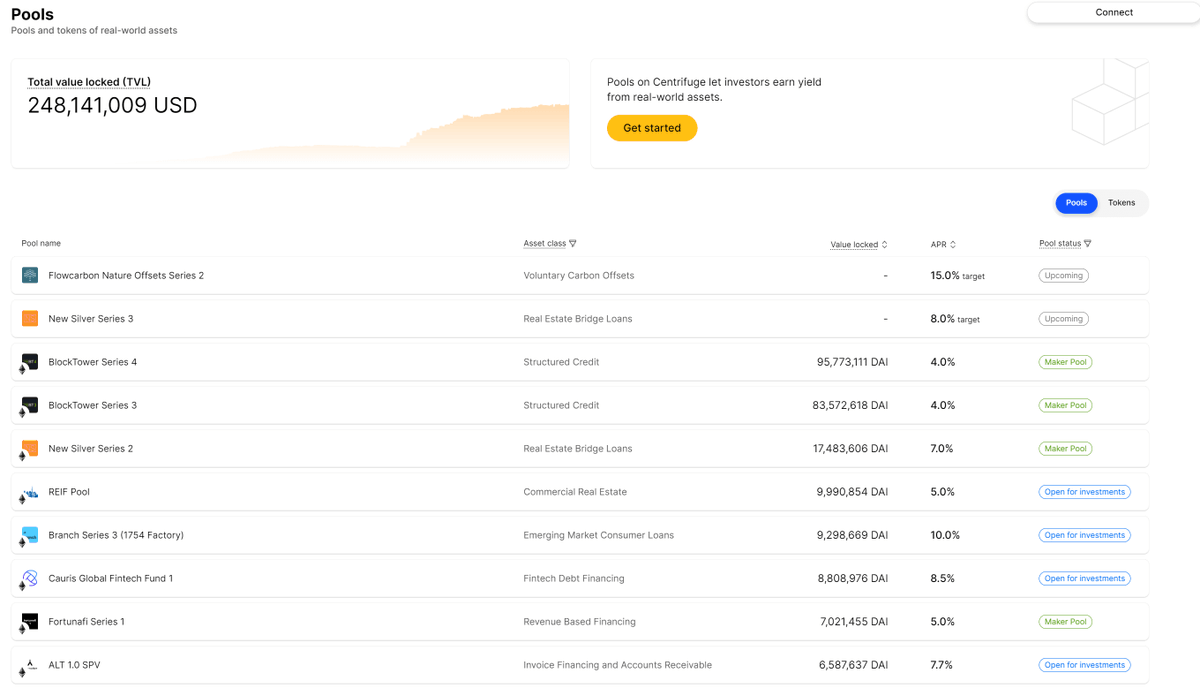

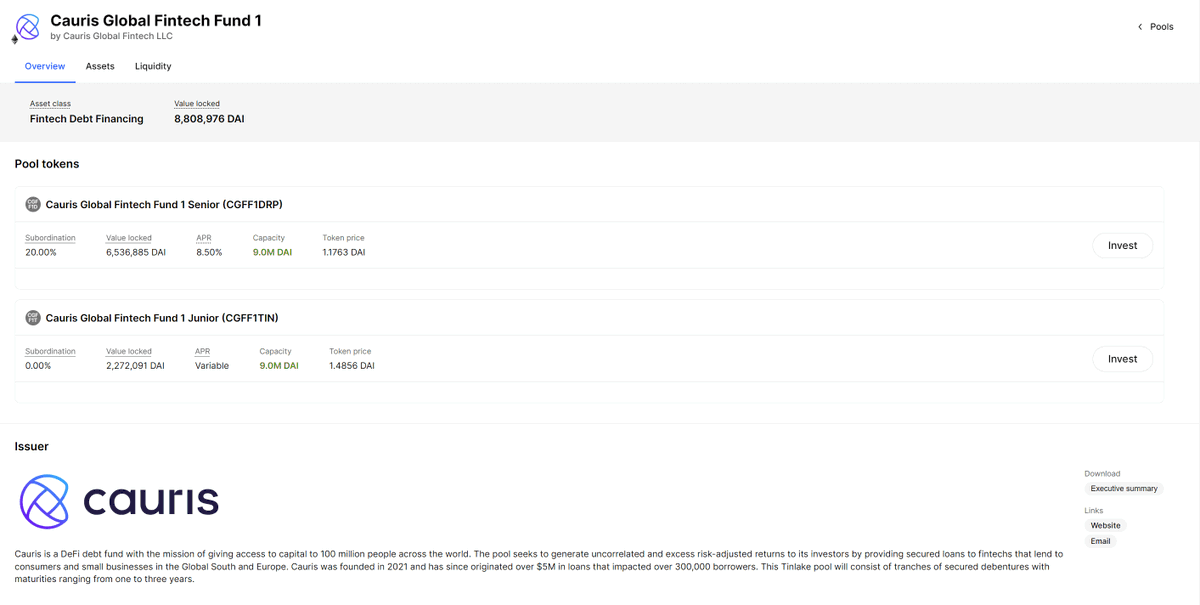

1/ @centrifuge is an infrastructure project for financing RWAs.

• Transparent

• Fully collateralized

• Legal recourse for LPs

They lower the cost by connecting Borrowers and Lenders directly without middlemen.

• Transparent

• Fully collateralized

• Legal recourse for LPs

They lower the cost by connecting Borrowers and Lenders directly without middlemen.

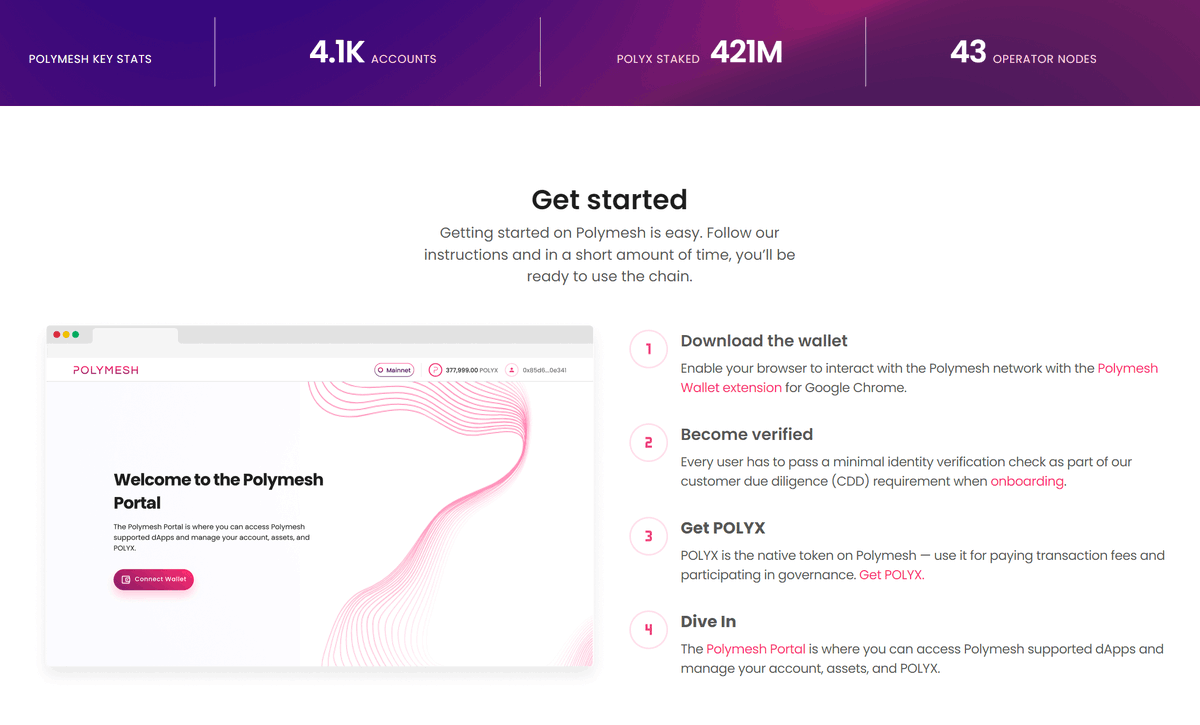

2/ @PolymeshNetwork is a blockchain for regulated capital markets such as securities.

It comes with 5 key features.

1) Can't be forked

2) Users need to KYC

3) Scalable compliance

4) Data protection

5) All parties need to sign a TX

Shh, don't get scared.

It comes with 5 key features.

1) Can't be forked

2) Users need to KYC

3) Scalable compliance

4) Data protection

5) All parties need to sign a TX

Shh, don't get scared.

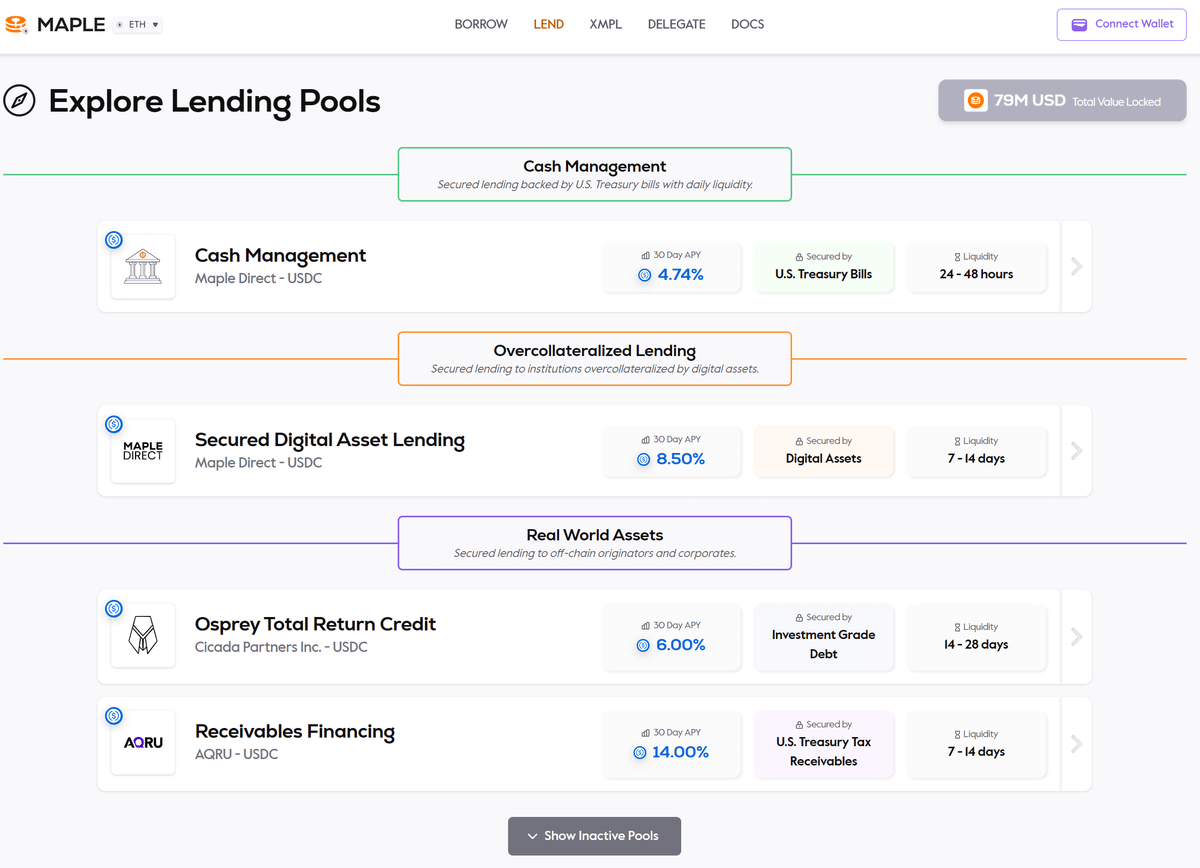

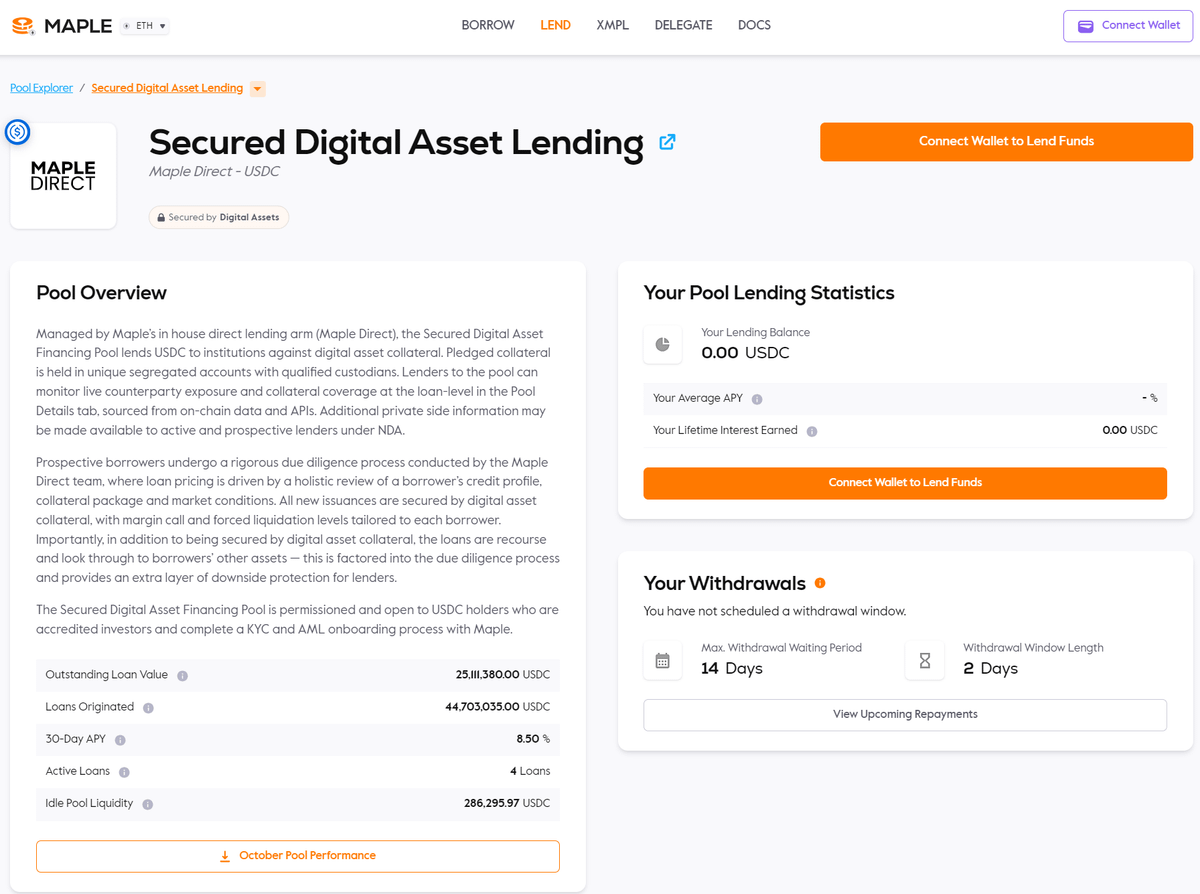

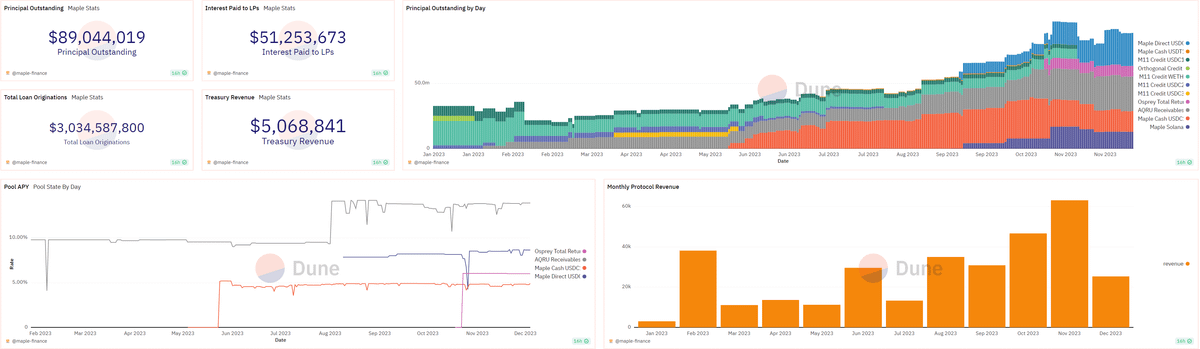

3/ @maplefinance an institutional capital market on the blockchain.

It offers pools with different:

• Strategies

• Risk profiles

• Interest payments

Lenders have full recourse over assets (for some pools) & can download interest statements anytime.

It offers pools with different:

• Strategies

• Risk profiles

• Interest payments

Lenders have full recourse over assets (for some pools) & can download interest statements anytime.

Conclusion:

RWAs protocols bridge real world finance to the blockchain.

Web 3.0 users might not be used to KYC and regulations.

However, this makes it attractive to institutions.

RWAs protocols bridge real world finance to the blockchain.

Web 3.0 users might not be used to KYC and regulations.

However, this makes it attractive to institutions.

RWA protocols seem to have a strong focus on Liquidity Pools.

The APR is small but sustainable.

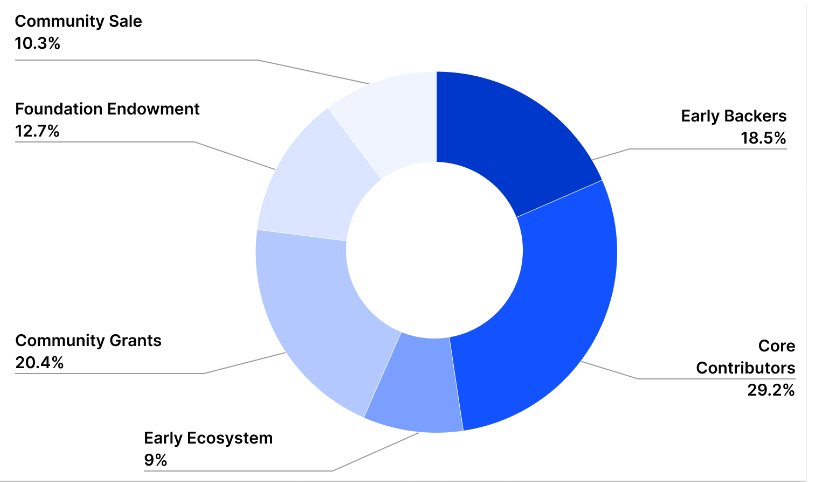

I personally won't invest in the tokens we looked at.

Governance & Gas are weak use cases & I don't know how to value them correctly.

What do you think?

The APR is small but sustainable.

I personally won't invest in the tokens we looked at.

Governance & Gas are weak use cases & I don't know how to value them correctly.

What do you think?

Hey there,

Thank you for taking the time to read my thread.

If you want you can do me a favor by liking/reposting my content.

Just click the link below to repost the first post in this thread.

Thanks, with that you can put a smile on my face. :)

Thank you for taking the time to read my thread.

If you want you can do me a favor by liking/reposting my content.

Just click the link below to repost the first post in this thread.

Thanks, with that you can put a smile on my face. :)

Loading suggestions...