The Reverse Repo Facility

Lots of talk about how it's dwindling fast and may soon be empty...but does it really matter?

Yes, it matters. A whole lot more than you may think.

Time for a Fed 🧵👇

Lots of talk about how it's dwindling fast and may soon be empty...but does it really matter?

Yes, it matters. A whole lot more than you may think.

Time for a Fed 🧵👇

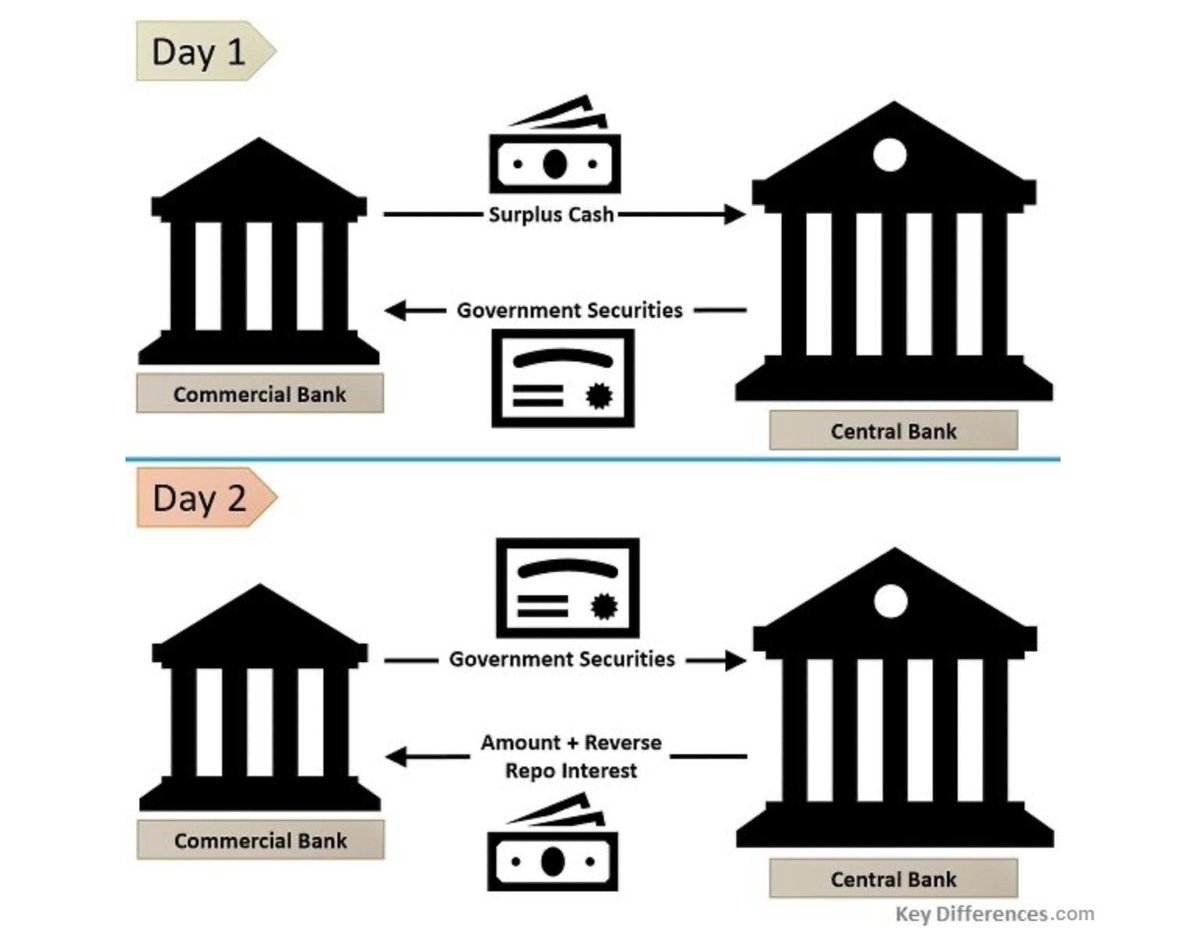

🎯 Repo vs Reverse Repo

What are they, and what're their differences?

Put simply, they are two overnight lending markets run by the Federal Open Market Committee (FOMC)

All purchases and sales (open market operations) are made by the NY Fed Open Market Trading Desk (the Desk)

What are they, and what're their differences?

Put simply, they are two overnight lending markets run by the Federal Open Market Committee (FOMC)

All purchases and sales (open market operations) are made by the NY Fed Open Market Trading Desk (the Desk)

The Repo

A repo is basically a repurchase agreement between two parties

The term can be used in many different types of transactions, but we most often hear it used to describe overnight transactions of US Treasuries.

A repo is basically a repurchase agreement between two parties

The term can be used in many different types of transactions, but we most often hear it used to describe overnight transactions of US Treasuries.

See, when a bank needs cash to cover short term obligations, it can sell USTs to the Fed (in return for cash) agreeing to buy them back just 24 to 48 hours later at a slightly higher price

This is called a Repo or 'Repurchase Agreement'.

This is called a Repo or 'Repurchase Agreement'.

So, if there is a lack of liquidity in the system, banks may be looking to loan their US Treasuries to the Fed for cash to cover short-term needs

Got it.

Got it.

But what if there's too much cash in the system, and banks who are looking to generate interest on that cash aren't able to buy any more USTs, because they're at their internal and/or Fed-mandated limits?

Well, that's where the *Reverse* Repurchase Agreement comes into play.

Well, that's where the *Reverse* Repurchase Agreement comes into play.

The Reverse Repo

Much like the repo transaction, where a bank sells US Treasuries to the Fed, in a *Reverse Repo*, the bank buys US Treasuries from the Fed

But why would they do this?

Much like the repo transaction, where a bank sells US Treasuries to the Fed, in a *Reverse Repo*, the bank buys US Treasuries from the Fed

But why would they do this?

Simple.

When a bank has too much cash on its balance sheet, it can utilize the reverse repo to generate a rate of return on that cash in the overnight market

In essence, the bank *parks* its cash at the Fed.

When a bank has too much cash on its balance sheet, it can utilize the reverse repo to generate a rate of return on that cash in the overnight market

In essence, the bank *parks* its cash at the Fed.

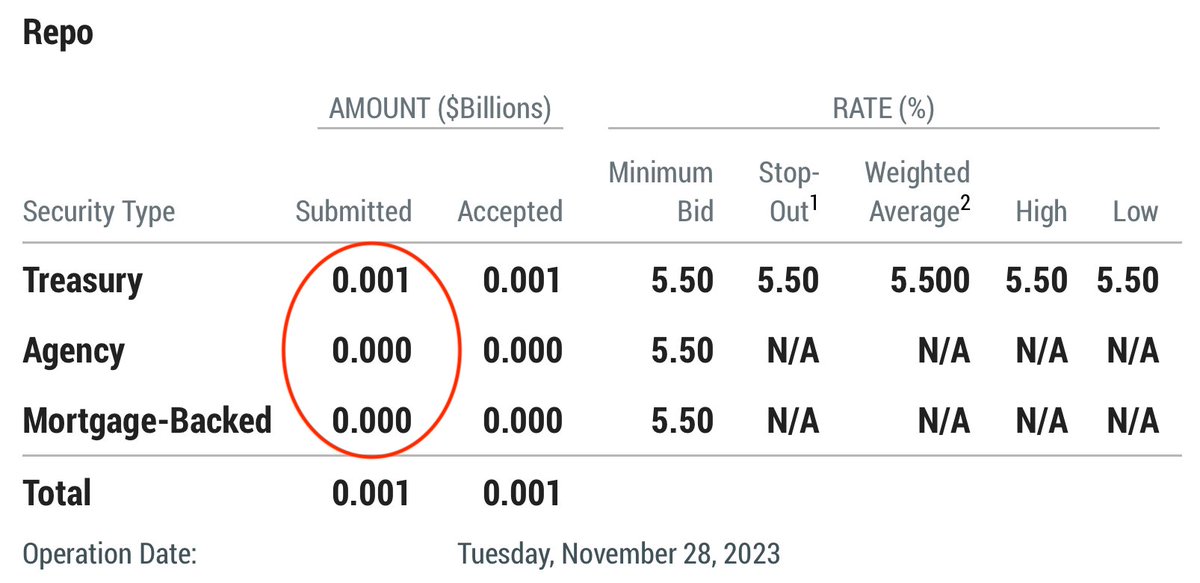

The reason for this is that the major banks are not strapped for cash, but rather swimming in it

And so, all the focus and action has been in the Reverse Repo markets

But how did this happen? Why are these banks swimming in, stuffed to the gills with, all this cash?

And so, all the focus and action has been in the Reverse Repo markets

But how did this happen? Why are these banks swimming in, stuffed to the gills with, all this cash?

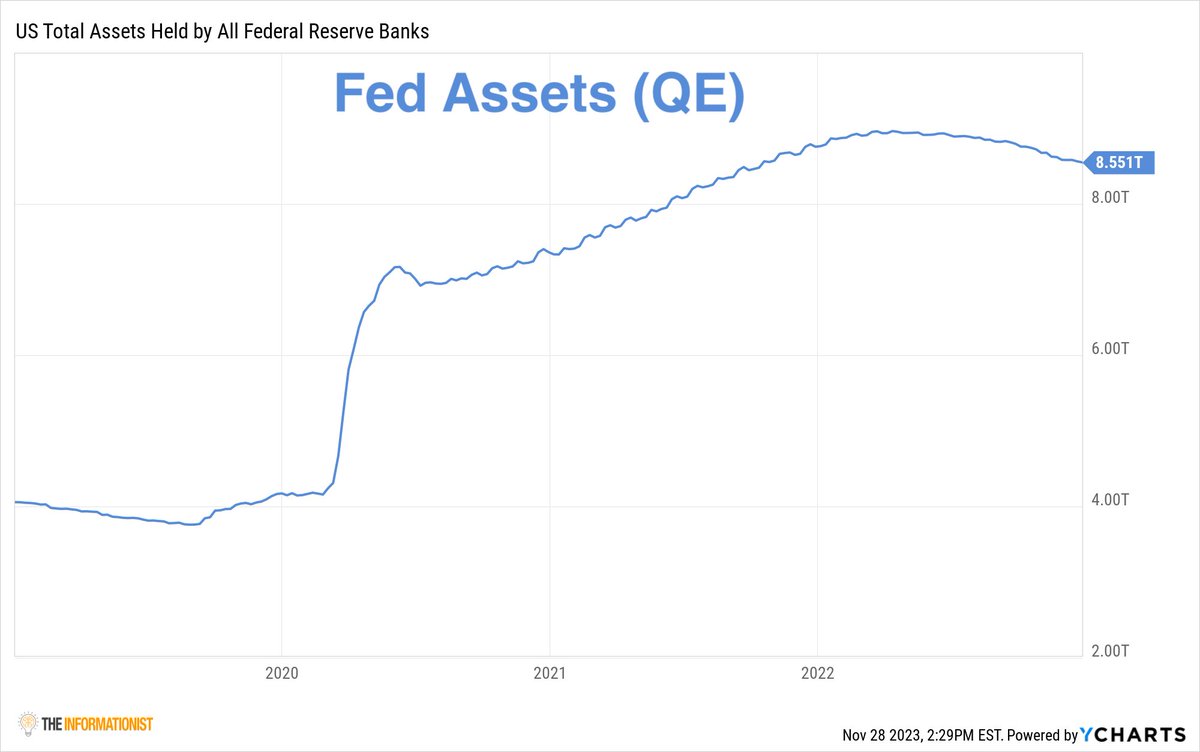

You got it

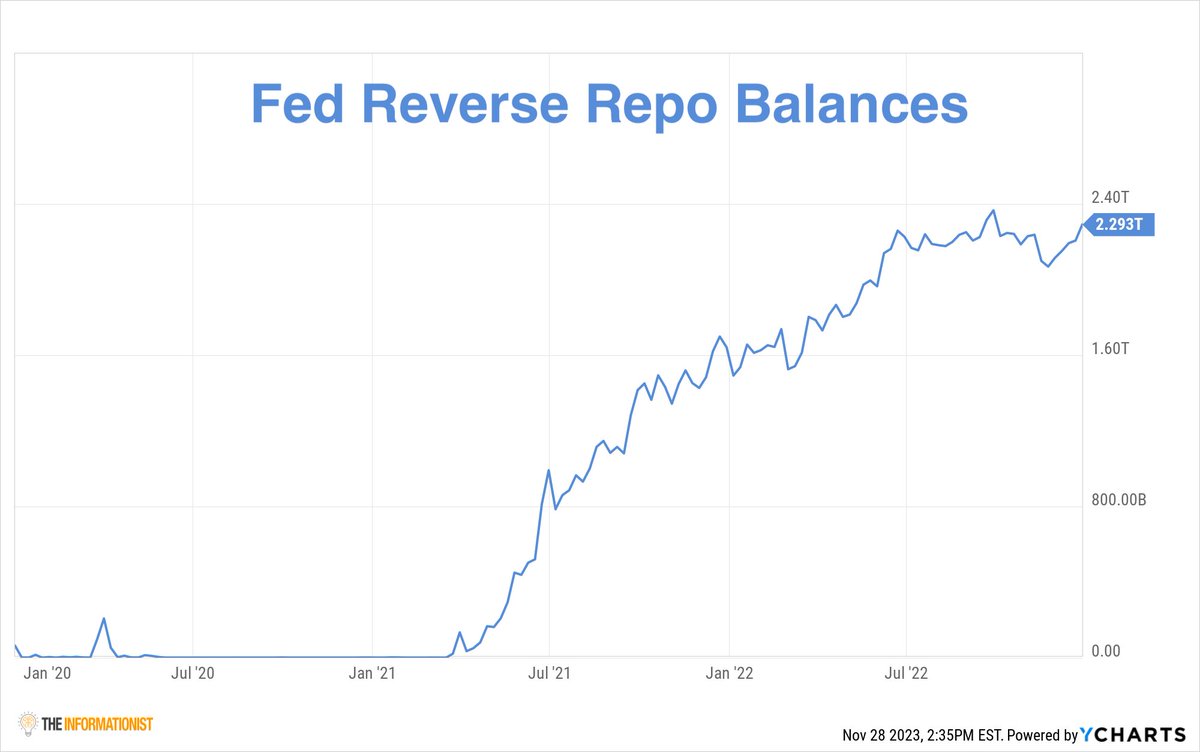

QE (almost infinity) in 2020 and 2021

See, when the Treasury and the Fed teamed up to 'inject liquidity' into the markets, they hit the banks with something of a cash tidal wave.

QE (almost infinity) in 2020 and 2021

See, when the Treasury and the Fed teamed up to 'inject liquidity' into the markets, they hit the banks with something of a cash tidal wave.

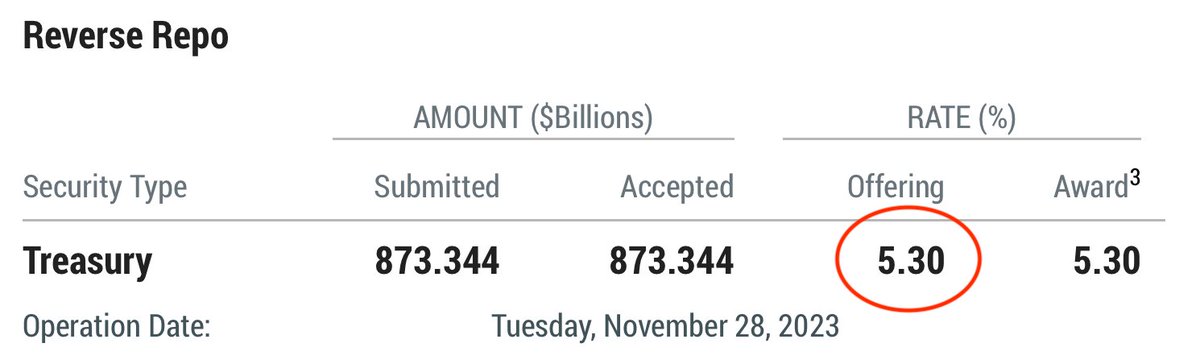

The Fed then pays the bank the current Fed Fund influenced Reverse Repo Rate as a yield on those balances

Which, as you can see the Reverse Repo Operations Schedule above, is 5.30% (annualized) yield this week

What a deal!

Which, as you can see the Reverse Repo Operations Schedule above, is 5.30% (annualized) yield this week

What a deal!

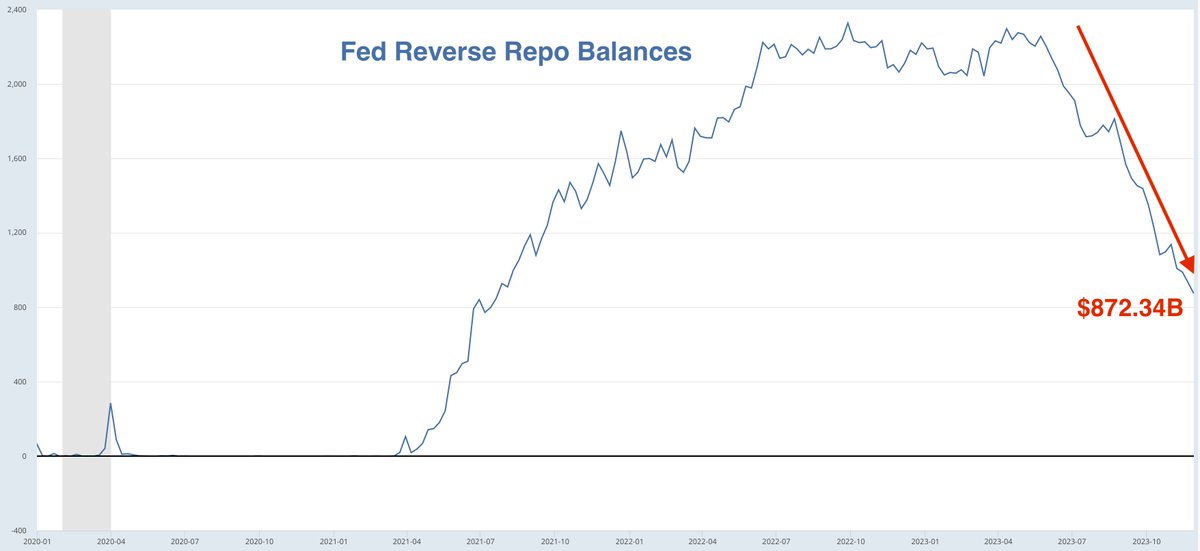

But that $2.4T of Reverse Repo Facility balances has been falling recently and is now down quite a bit.

But why? Where's all the excess cash going?

But why? Where's all the excess cash going?

✍️ Draining the RRF

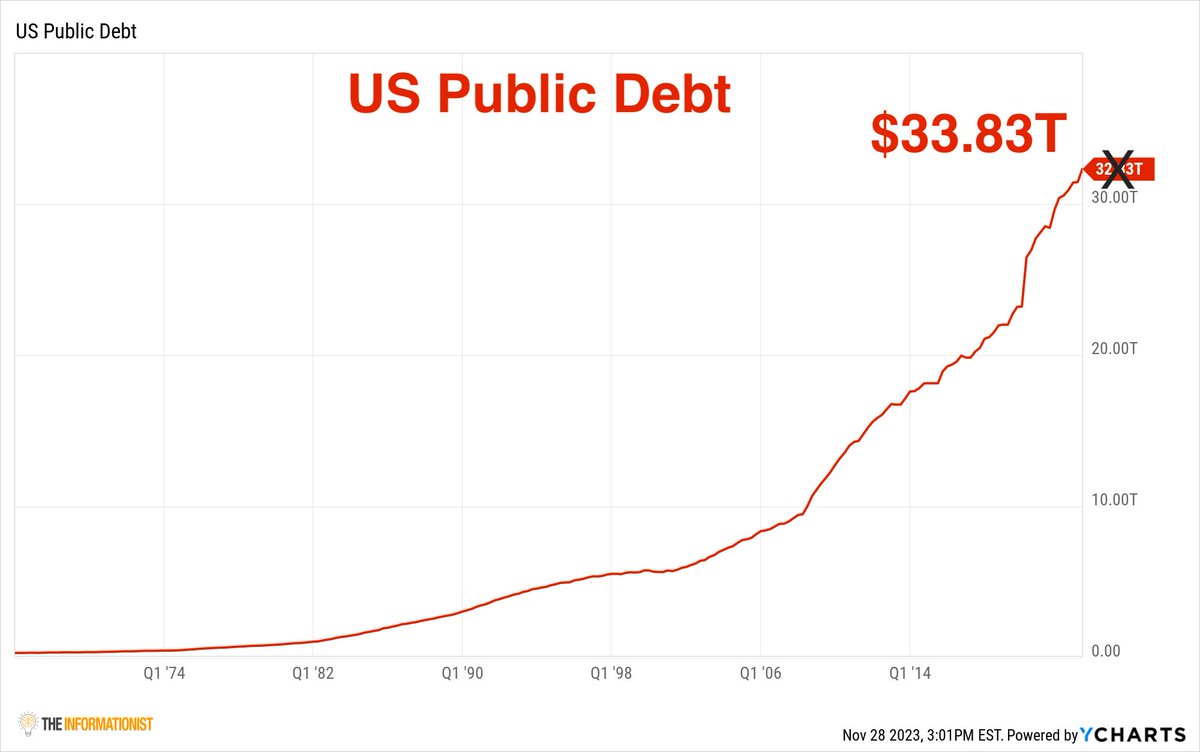

Again, unless you've been completely ignoring all news and media (good for you, seriously), then you've likely also noticed that there's been quite a bit of talk about the expanding US deficit and ballooning US debt this year.

Again, unless you've been completely ignoring all news and media (good for you, seriously), then you've likely also noticed that there's been quite a bit of talk about the expanding US deficit and ballooning US debt this year.

This phenomenon is called the Debt Spiral, and it's apparent mathematically that we have already entered one

If you want to know more about that you can read all about it in a thread posted over a year ago, right here:

x.com

If you want to know more about that you can read all about it in a thread posted over a year ago, right here:

x.com

Bottom line, the US is spending too much compared to the amount of productivity and taxes it is (read: its citizens and companies are) generating, and this excess spending is causing the need for the Treasury to borrow more and more...

...and more.

...and more.

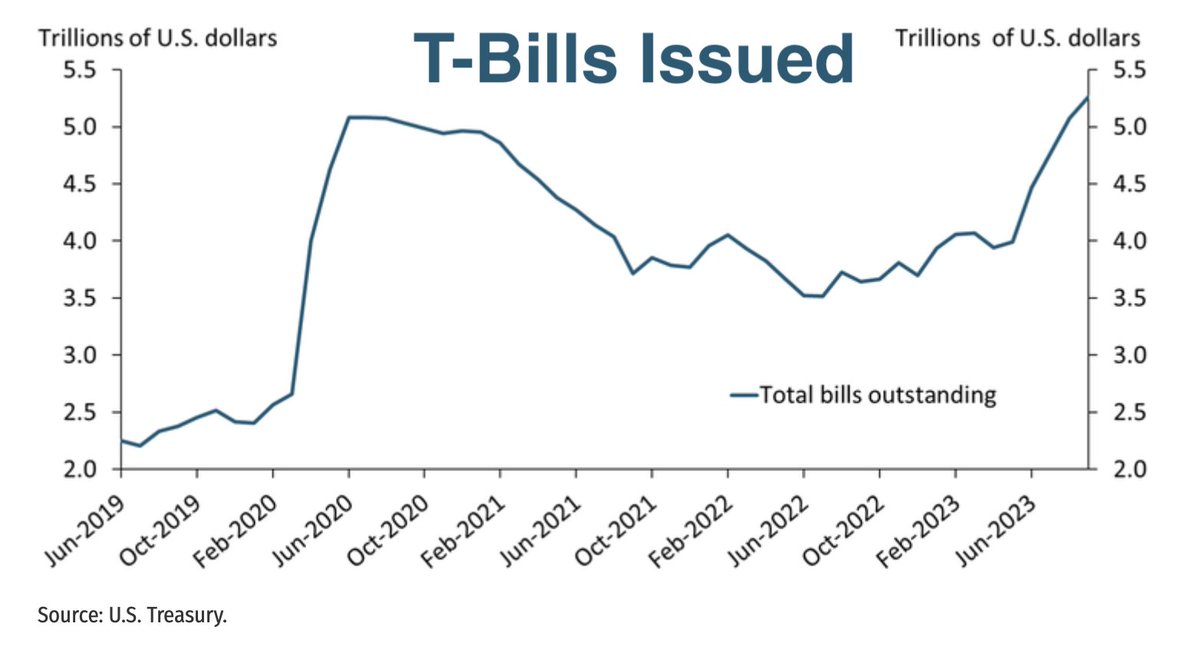

The Treasury has pivoted to short-term T-Bill auctions for two reasons

1) To avoid locking into long-term high interest rates which would exacerbate the deficit and interest expense

2) They can tease capital back out of the Reverse Repo with yields slightly higher than 5.3%

1) To avoid locking into long-term high interest rates which would exacerbate the deficit and interest expense

2) They can tease capital back out of the Reverse Repo with yields slightly higher than 5.3%

The Treasury's Q4 refunding plan reiterated they would continue this, and they're OK with staying well above a normal ratio of ~20% T-Bills and 80% Bonds

In fact, the Treasury has effectively inverted this ratio, auctioning ~65% T-bills and ~35% Bonds this past year.

In fact, the Treasury has effectively inverted this ratio, auctioning ~65% T-bills and ~35% Bonds this past year.

Using the Treasury estimated $1.5T+ of upcoming auctions between now and the end of the first quarter of 2024, it seems the Reverse Repo will soon be drained

But if the Treasury keeps the same pace of auctions as the last couple of months, the RRF could be drained by January.

But if the Treasury keeps the same pace of auctions as the last couple of months, the RRF could be drained by January.

Either way, it appears that is the direction the Treasury is headed, and the RRF will, in fact, soon be back to zero

Then, the only backstop is investors continuing to move cash into money markets because of attractive yields

But when rates start to fall, then what?

Then, the only backstop is investors continuing to move cash into money markets because of attractive yields

But when rates start to fall, then what?

🧠 Where will the Treasury Turn?

With the gov't running $2T annual federal deficits, the Treasury simply cannot stop issuing debt

And this is *before we hit a recession* and the deficits *increase*.

With the gov't running $2T annual federal deficits, the Treasury simply cannot stop issuing debt

And this is *before we hit a recession* and the deficits *increase*.

Where will the Treasury turn for even *more* capital?

Can they just issue longer term bonds instead?

Can they just issue longer term bonds instead?

If you've been following me, you know that the last Treasury 30-yr bond auction was abysmal, signaling a steep drop-off in demand and confidence in long-term US Treasuries

If you've not yet read about that, you can find a thread on it right here:

x.com

If you've not yet read about that, you can find a thread on it right here:

x.com

TL;DR: international and institutional demand fell off a cliff this past auction, and the Treasury may have difficulty growing the sizes of auctions necessary to meet demand when they need to move further out on the yield curve.

When the Reverse Repo Facility is drained and the Treasury can no longer use that excess capital to fund additional debt,

they may have to turn to more drastic measures, such as...

they may have to turn to more drastic measures, such as...

• Adjusting Capital Requirements

The Fed and regulatory agencies could lower the capital requirements for banks

This means banks would need to hold less capital against certain assets, freeing up more funds for investment, including in longer-term Treasury bonds.

The Fed and regulatory agencies could lower the capital requirements for banks

This means banks would need to hold less capital against certain assets, freeing up more funds for investment, including in longer-term Treasury bonds.

• Modifying Collateral Rules

The Fed could alter the rules regarding what types of collateral can be used in various Fed lending facilities, which might encourage more purchases of Treasury bonds.

The Fed could alter the rules regarding what types of collateral can be used in various Fed lending facilities, which might encourage more purchases of Treasury bonds.

• Tweaking Regs

Regulatory changes could be made that *require* financial institutions to hold more long-term Treasuries

I.e., changes could be made to the liquidity coverage ratio (LCR) requirements to encourage or require holding longer-term government securities.

Regulatory changes could be made that *require* financial institutions to hold more long-term Treasuries

I.e., changes could be made to the liquidity coverage ratio (LCR) requirements to encourage or require holding longer-term government securities.

Additional options may include some sort of stealth injection of capital into banks or the markets in order to ensure sufficient liquidity for debt auctions

Think: four letter acronyms like the BTFP or similar programs they can and I expect they will implement.

Think: four letter acronyms like the BTFP or similar programs they can and I expect they will implement.

Then, of course, we have the upcoming 2024 Treasury Regular Buyback Program

What this is and how it will be used remains to be seen, but this could act as a quasi-yield curve control or *stealth QE program*

We will see...

What this is and how it will be used remains to be seen, but this could act as a quasi-yield curve control or *stealth QE program*

We will see...

Any way you cut it, the RRF lifeline is dwindling and soon ending

Your guess as to where the Treasury turns and what exactly they end up doing is as good as mine, but I watching Treasury auctions and the debt markets carefully.

Your guess as to where the Treasury turns and what exactly they end up doing is as good as mine, but I watching Treasury auctions and the debt markets carefully.

Because one thing we can be absolutely sure of...

The government is not going to stop or even slow down spending any time soon, and they will eventually have little choice but to print more money.

The government is not going to stop or even slow down spending any time soon, and they will eventually have little choice but to print more money.

And then?

The Reverse Repo Facility will just be filled right back up again.

What a deal, indeed.

The Reverse Repo Facility will just be filled right back up again.

What a deal, indeed.

This thread is a summary of a recent issue of 💡The Informationist, the free newsletter that simplifies one financial concept for you weekly.

You can join 25K readers here: jameslavish.com

You can join 25K readers here: jameslavish.com

Loading suggestions...