Go to NSE website buff.ly and download the historical data for any index for which you want to perform the data analysis. It contains the Open,High,Low, Close values along with shares traded & turnover.

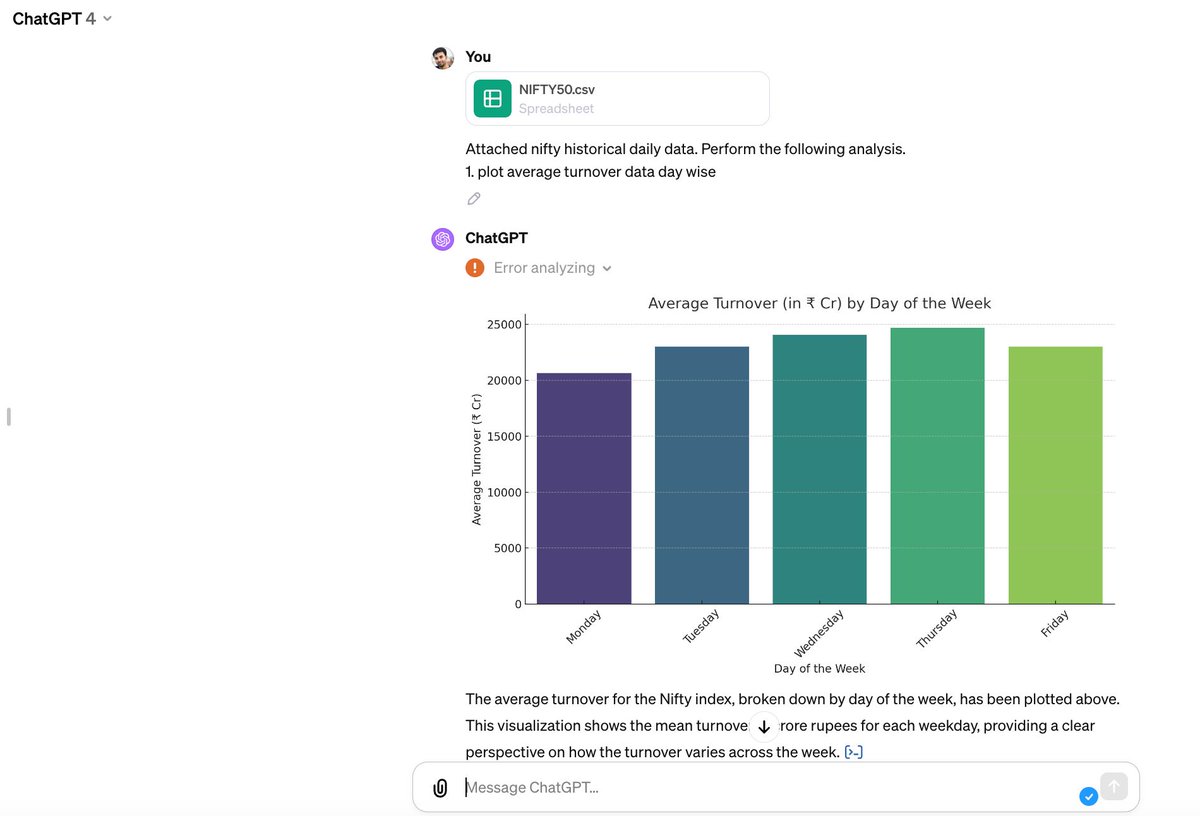

According to the analysis:

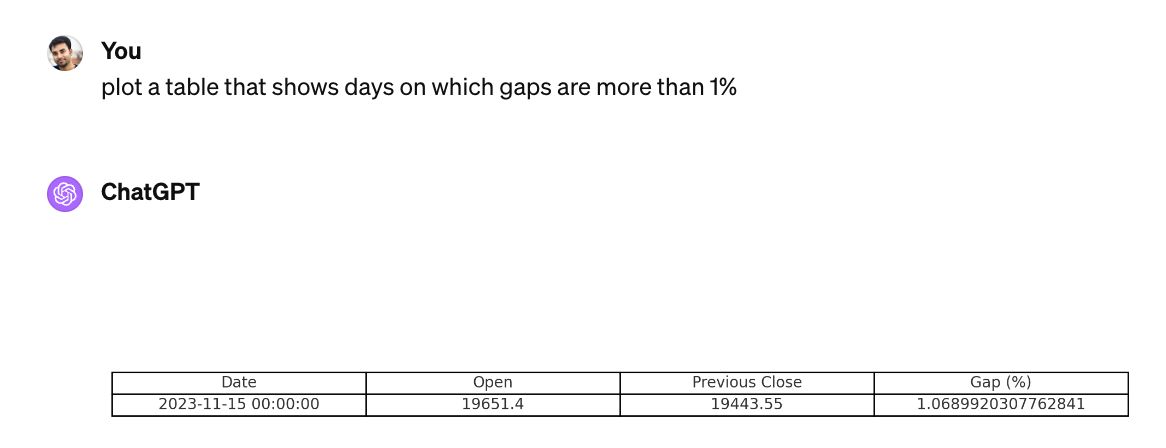

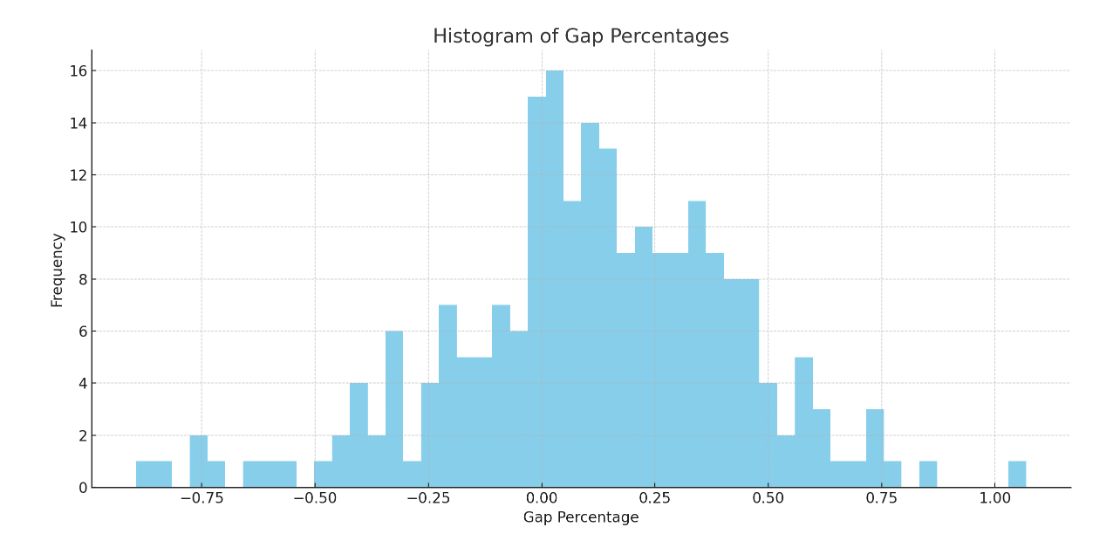

There are 72 instances of downward gaps with an average gap of -44.03 points and a mean percentage gap of -0.23%.

There are 150 instances of upward gaps with an average gap of 51.92 points and a mean percentage gap of 0.28%.

There are 72 instances of downward gaps with an average gap of -44.03 points and a mean percentage gap of -0.23%.

There are 150 instances of upward gaps with an average gap of 51.92 points and a mean percentage gap of 0.28%.

The data reveals that small upward gaps are the most frequent, while large downward gaps are the least frequent.

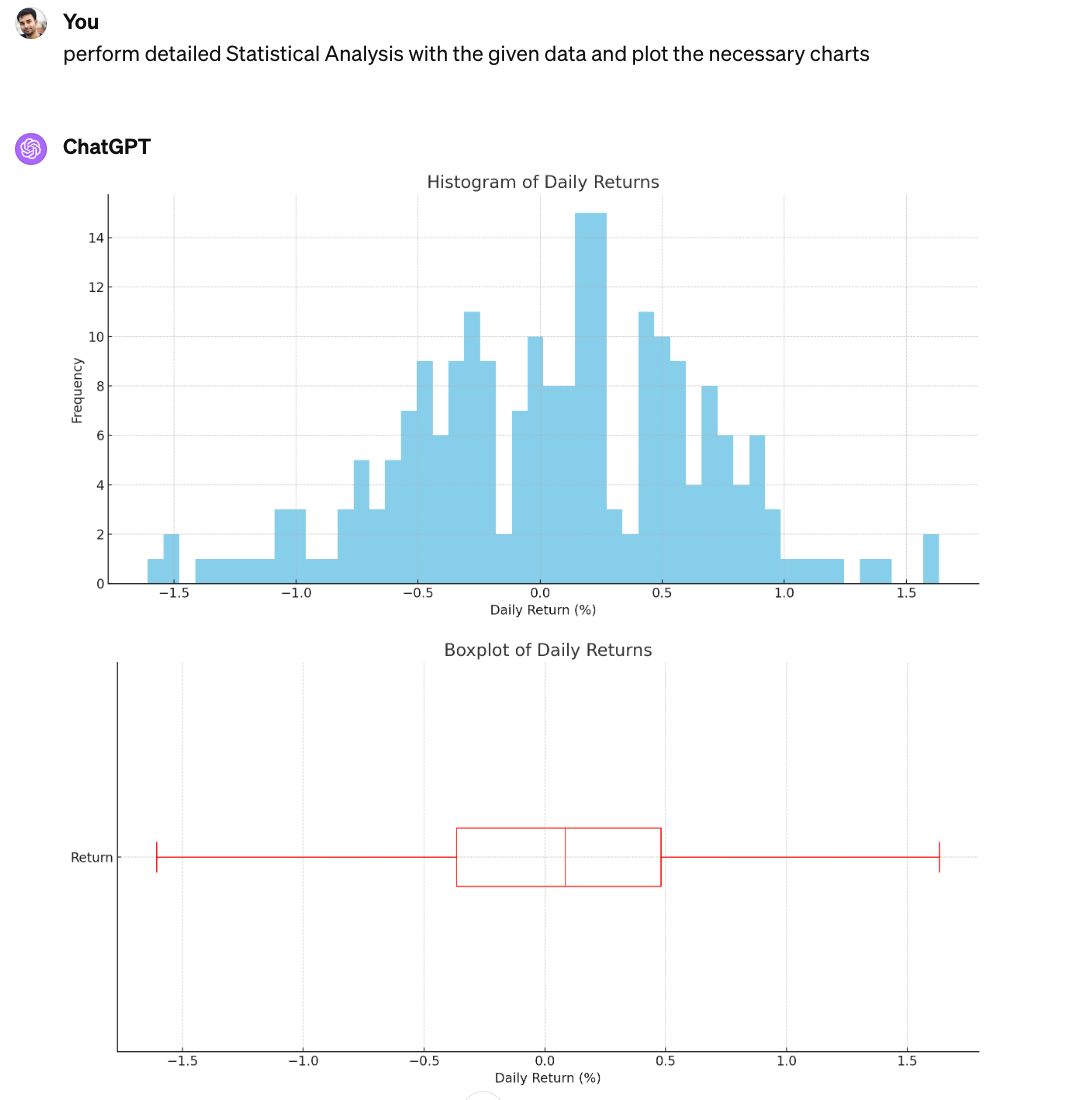

This is the major advantage with ChatGPT along with the analysis, it provides you with detailed interpretation as well. So decision making for traders becomes easier.

This is the major advantage with ChatGPT along with the analysis, it provides you with detailed interpretation as well. So decision making for traders becomes easier.

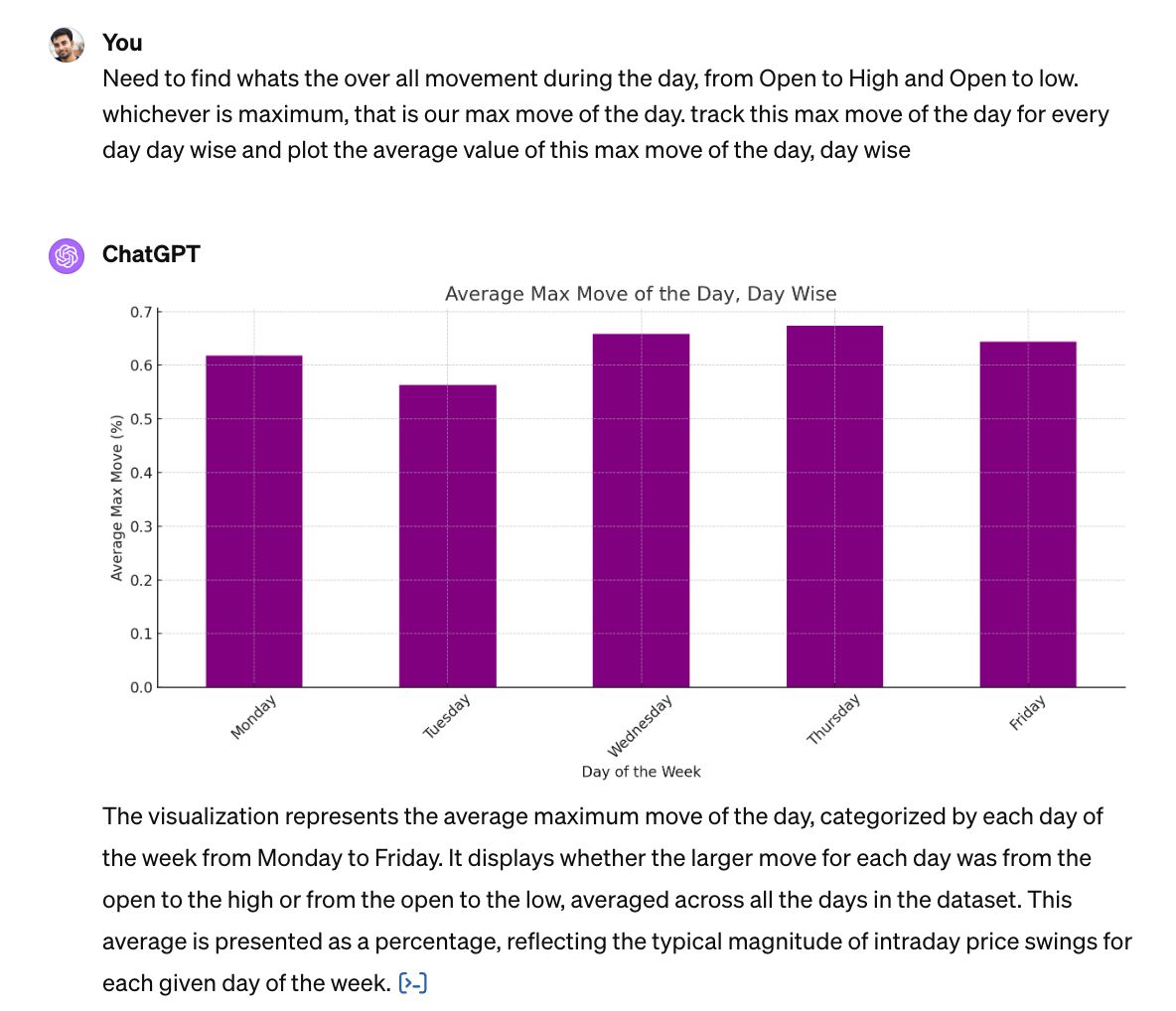

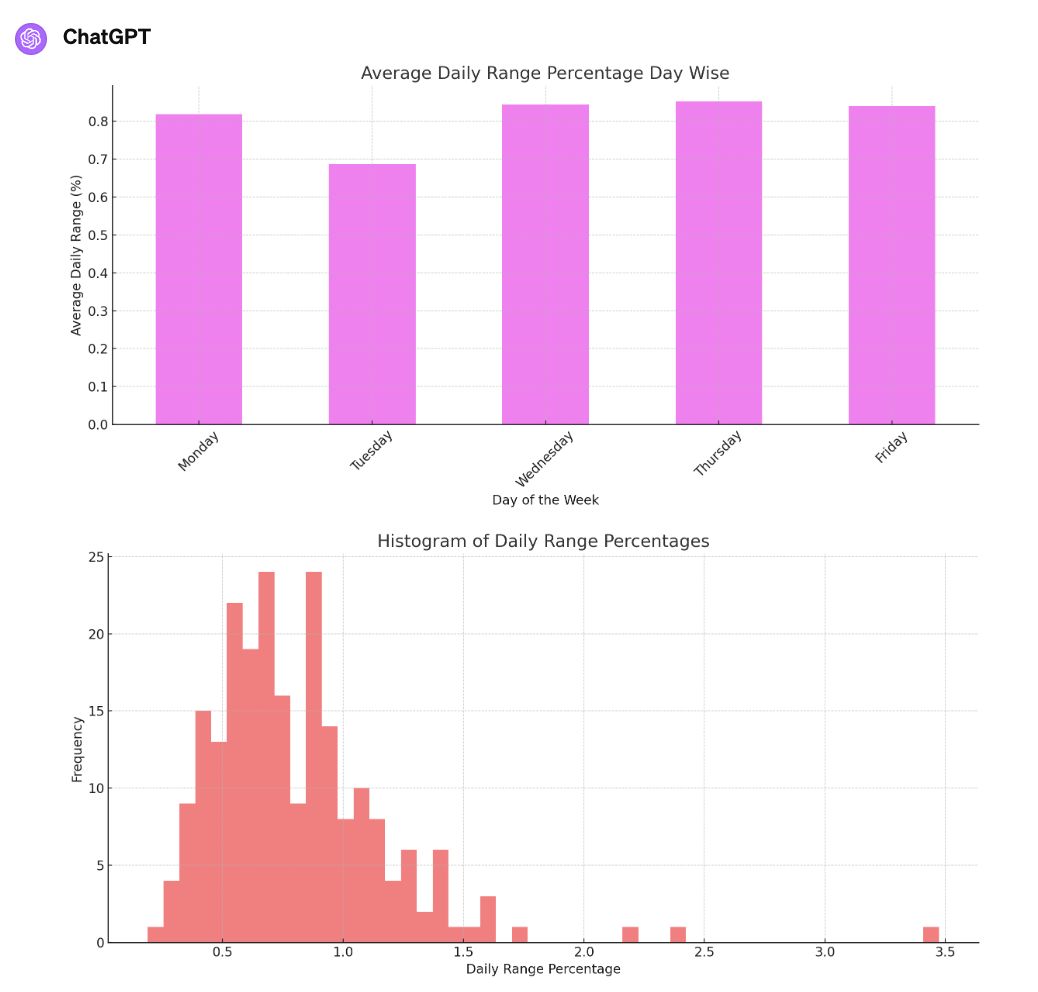

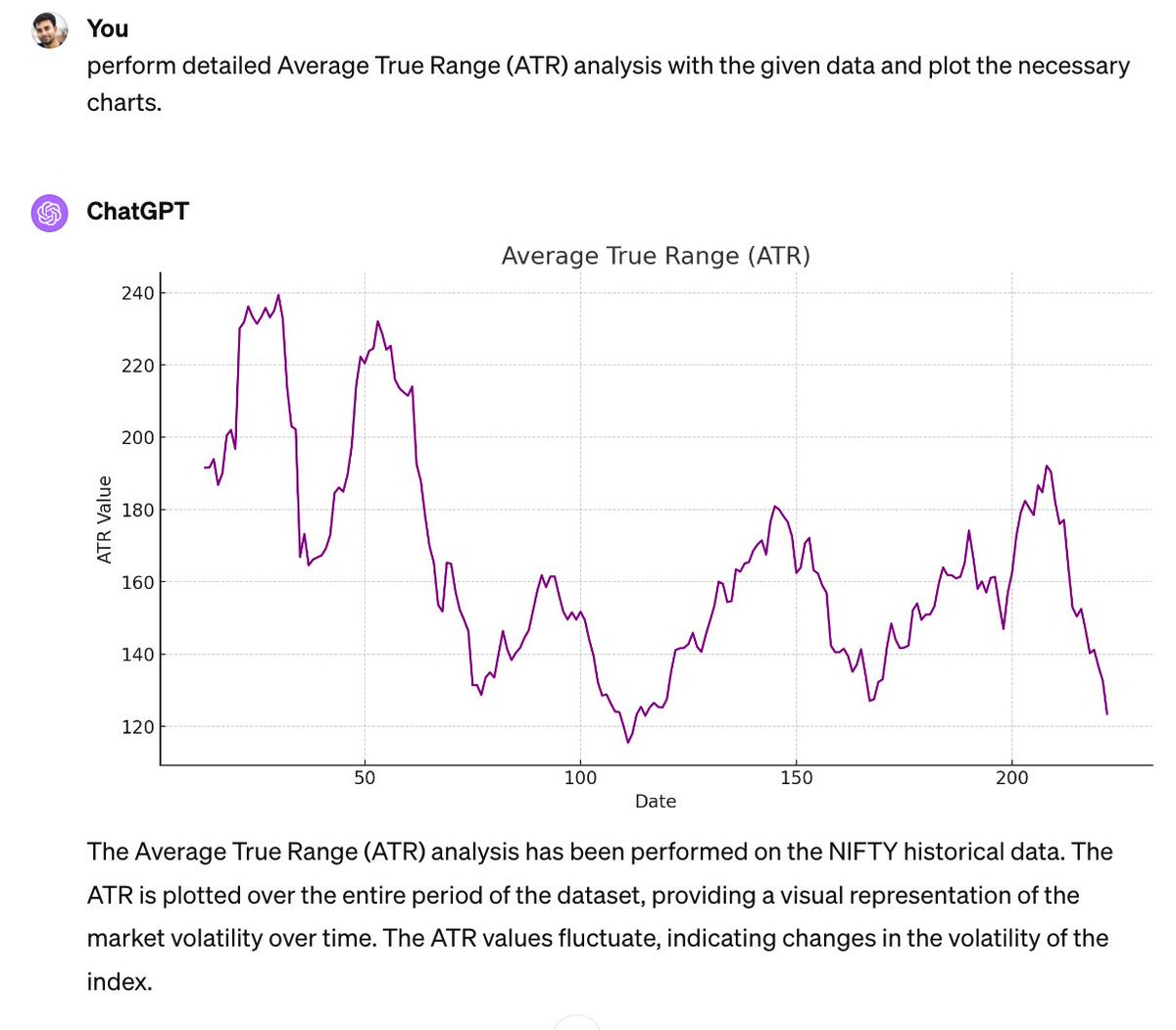

The minimum recorded daily range is 37 points, and the maximum is 618.8 points.

The average daily range percentage is 0.81%, with a standard deviation of 0.38%.

The minimum percentage range is 0.19%, and the maximum is 3.47%.

The average daily range percentage is 0.81%, with a standard deviation of 0.38%.

The minimum percentage range is 0.19%, and the maximum is 3.47%.

ChatGPT has drastically reduced my time I spend with Excel. ChatGPT can swiftly execute statistical analysIs, calculate technical indicators like ATR for volatility assessment, and provide chart visualisations for better decision-making. If you haven't tried it yet,give it a try

Loading suggestions...