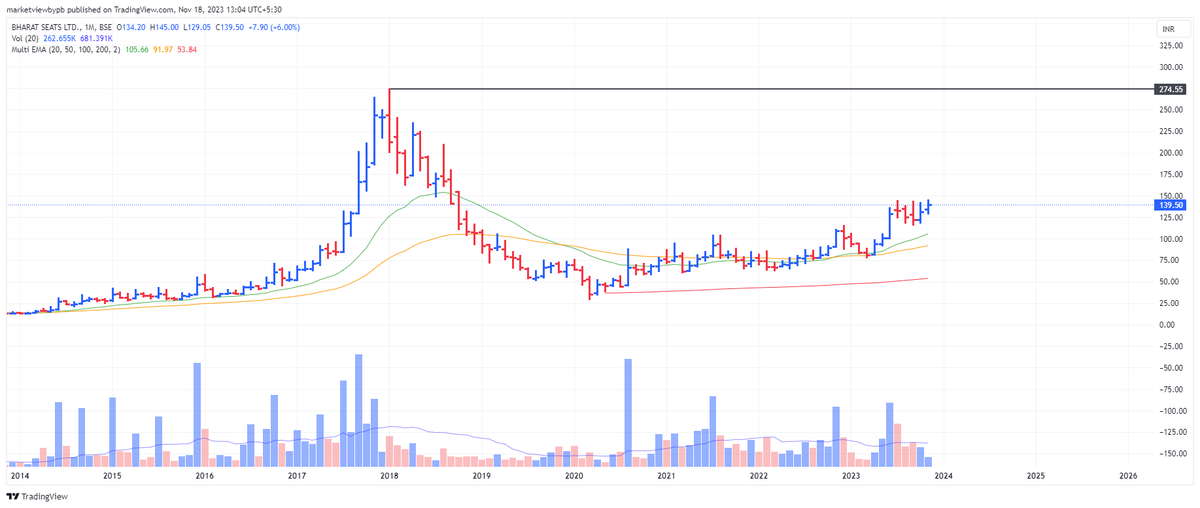

In this detailed🧵 I'll analyse Bharat Seats Ltd 💺 - Potential 2X Bagger 🪄

I'll look to analyse the fundamental aspects, product mix, current valuations, future growth plans, technical aspects, management commentary etc ✨

Like, Retweet & Boomark the Tweet 🔖

#BharatSeats

I'll look to analyse the fundamental aspects, product mix, current valuations, future growth plans, technical aspects, management commentary etc ✨

Like, Retweet & Boomark the Tweet 🔖

#BharatSeats

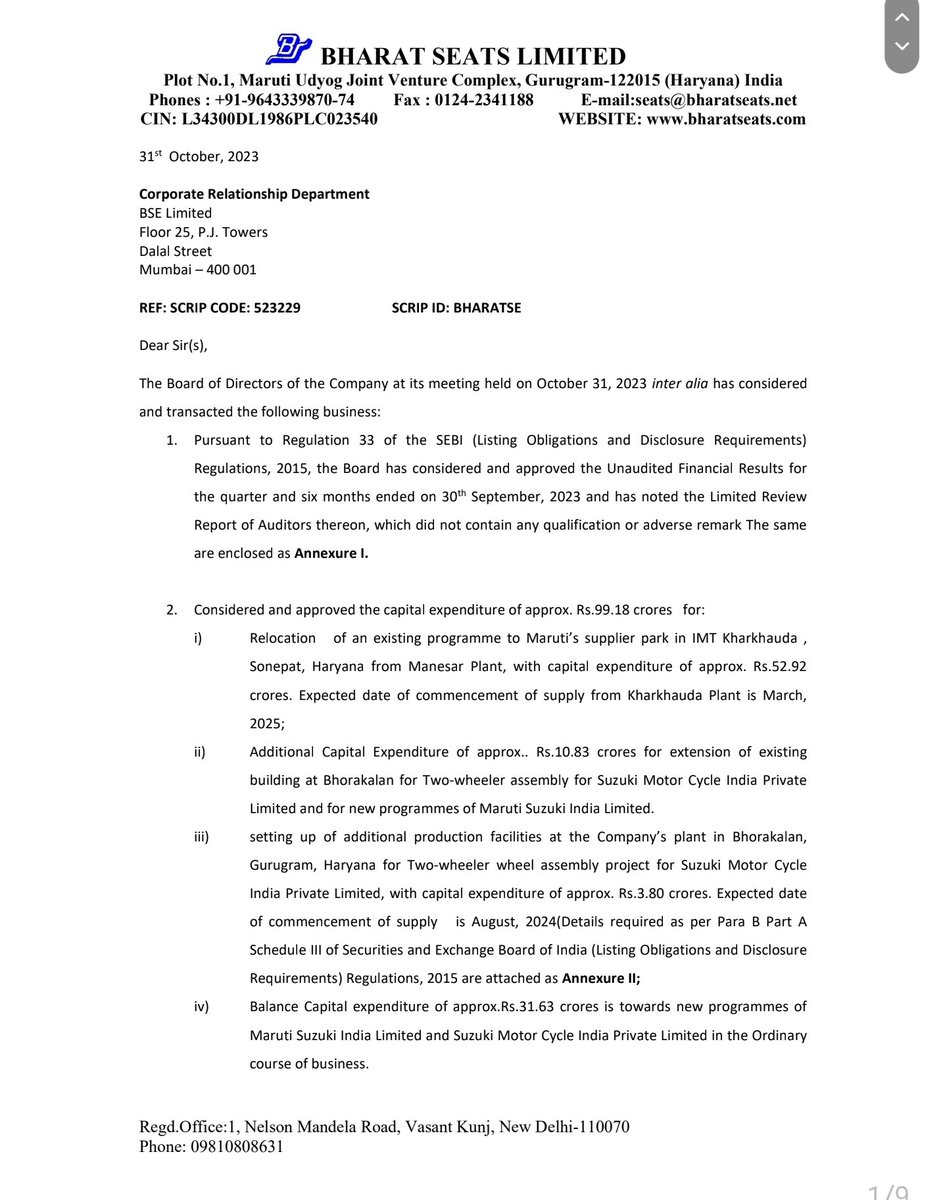

FY2023-FY2024. the new facility will lead to enhancement in the company's production capacity in line with the OEM’s requirements.

Client Concentration Risk 🎖️

✅MSIL and SMG together accounted for more than 85% of BSL’s revenue in FY2022. This exposes the company to high customer concentration risk with its revenue prospects primarily remaining linked to MSIL’s volumes.

✅MSIL and SMG together accounted for more than 85% of BSL’s revenue in FY2022. This exposes the company to high customer concentration risk with its revenue prospects primarily remaining linked to MSIL’s volumes.

R&D 🎖️

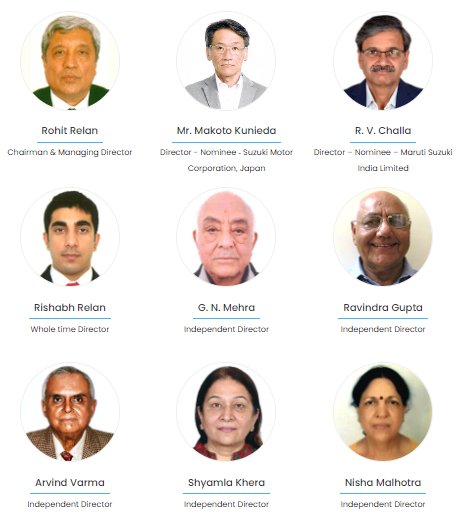

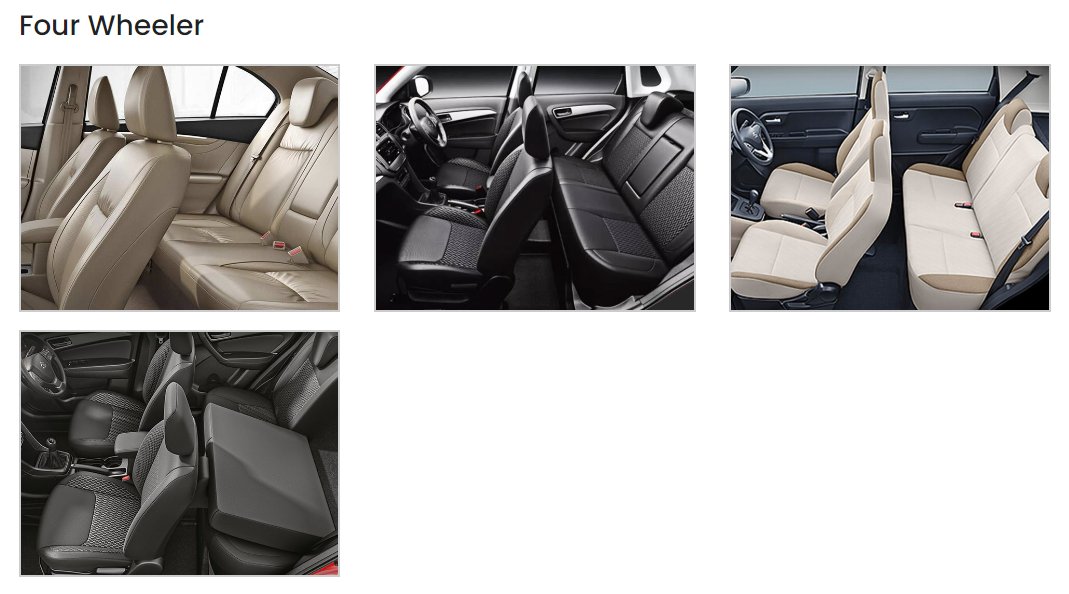

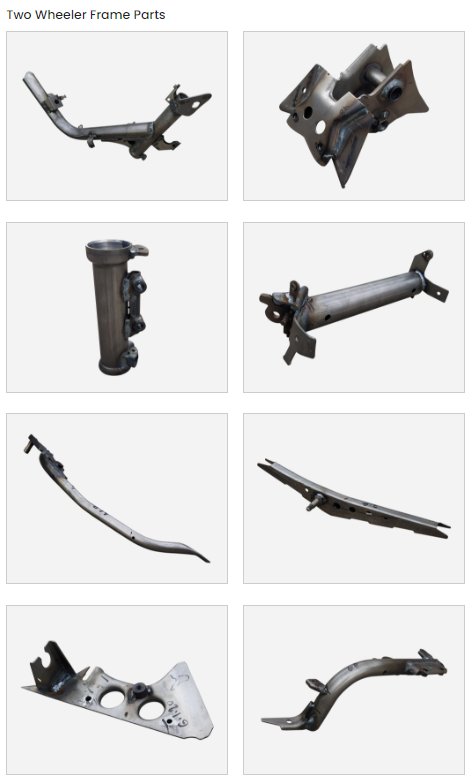

✅R&D work is carried out by the company in developing Seating Systems for Hatch-Backs, Sedans and SUV segment vehicles, Moulded floor carpets for 4-wheelers, Extrusion components for vehicle roof and windshield installation for Maruti Suzuki India Limited.

✅R&D work is carried out by the company in developing Seating Systems for Hatch-Backs, Sedans and SUV segment vehicles, Moulded floor carpets for 4-wheelers, Extrusion components for vehicle roof and windshield installation for Maruti Suzuki India Limited.

Focus 🎖️

✅It is planning to adopt new technologies and features for all verticals Seating System, NVH, Body Sealing Parts and 2W Seats, also it wants to build local capabilities in key areas Also the focus is on developing the capability for Trim testing in-house and plans to

✅It is planning to adopt new technologies and features for all verticals Seating System, NVH, Body Sealing Parts and 2W Seats, also it wants to build local capabilities in key areas Also the focus is on developing the capability for Trim testing in-house and plans to

establish and co-relate CAE test results for all Homologation tests.

ESM Rule and Its Effects 🎖️

What is ESM?

✅The regulator puts Companies below a Market Cap of 500Cr into 2 Categories ESM-1 and ESM-2.

✅A Stock has to Spent 90 Days in both these Categories.

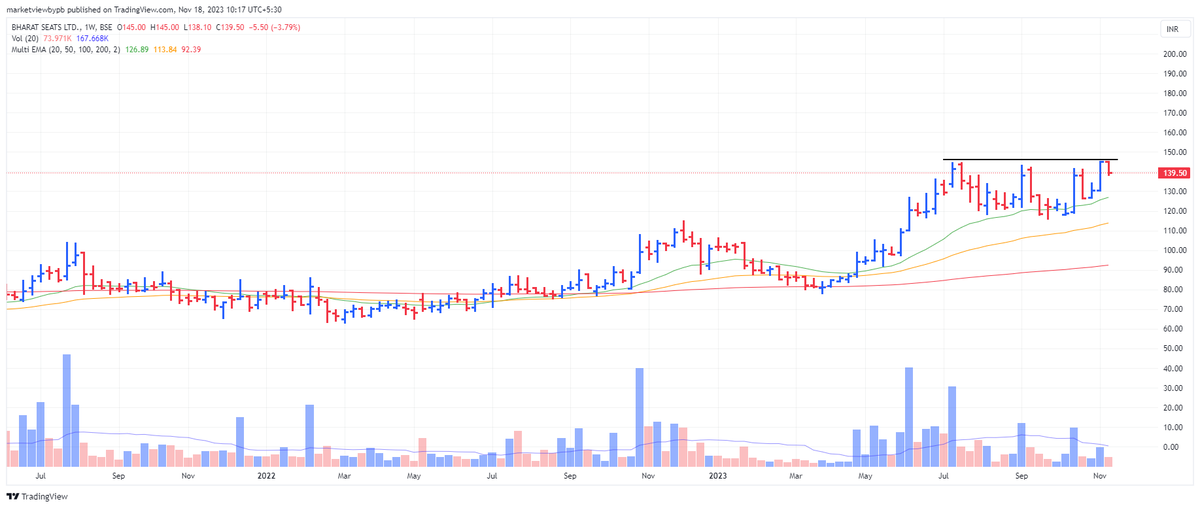

✅Bharat Seats will come out of ESM after 2 Weeks

What is ESM?

✅The regulator puts Companies below a Market Cap of 500Cr into 2 Categories ESM-1 and ESM-2.

✅A Stock has to Spent 90 Days in both these Categories.

✅Bharat Seats will come out of ESM after 2 Weeks

Imagine the Potential of this Company when it's Market Cap Moves above 500Cr 💎

Its Filter will Change to 20% and We May See it Finally Achieving its True Potential 🤗

That's the End of 🧵

Like, Retweet & Bookmark the 1st Tweet of the Thread 🤗🔖✅

#BharatSeats #StockMarket

Its Filter will Change to 20% and We May See it Finally Achieving its True Potential 🤗

That's the End of 🧵

Like, Retweet & Bookmark the 1st Tweet of the Thread 🤗🔖✅

#BharatSeats #StockMarket

Loading suggestions...