#MintPlainFacts | As the world lurches from one crisis to another, the notion of what is a safe asset is shifting in subtle ways.

The dollar is not prepared to take on inflation, gold’s conventional relationship with interest rates is under challenge, and the yen has weakened since 2022. What lies ahead?

Read here: read.ht

The dollar is not prepared to take on inflation, gold’s conventional relationship with interest rates is under challenge, and the yen has weakened since 2022. What lies ahead?

Read here: read.ht

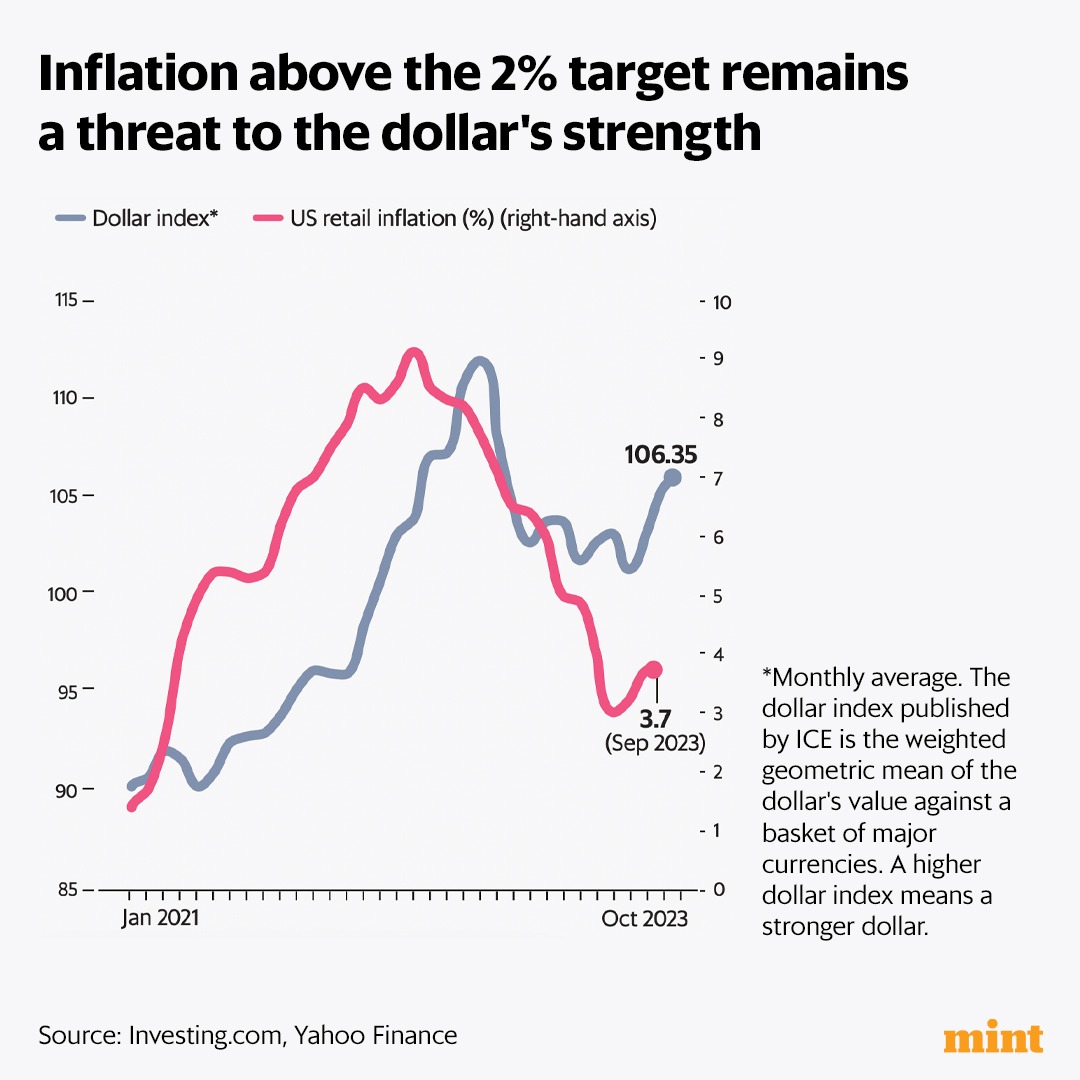

#MintPlainFacts | In September 2023, US retail inflation was at 3.7%, about half the 8.2% recorded a year ago, but still far from the 2% target rate.

The ongoing conflict in West Asia has re-introduced inflation risk by pushing up oil prices.

Read here: read.ht

The ongoing conflict in West Asia has re-introduced inflation risk by pushing up oil prices.

Read here: read.ht

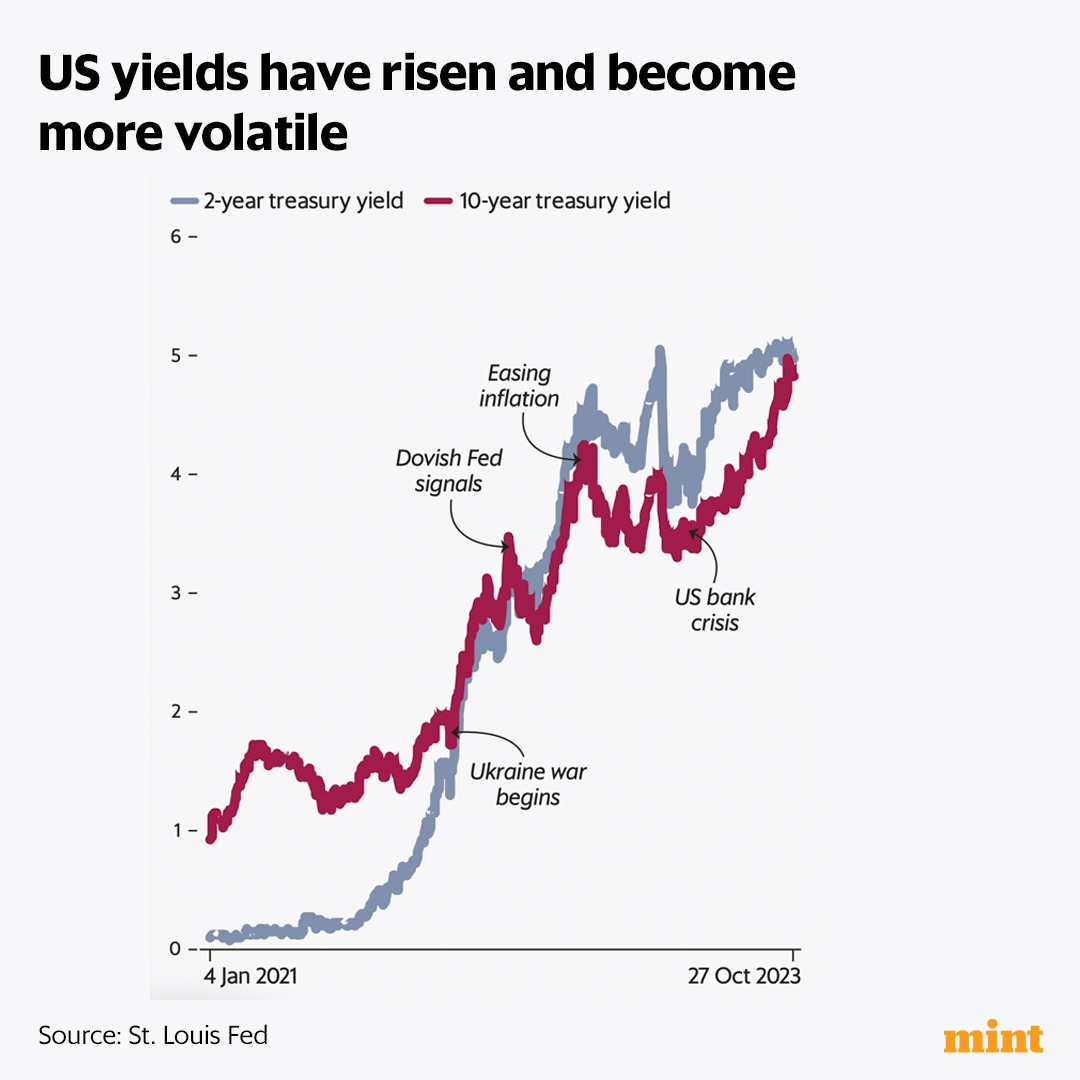

#MintPlainFacts | US government bonds are preferred in times of economic uncertainty or market volatility, but recently, Treasuries themselves have become unstable.

Read here: read.ht

Read here: read.ht

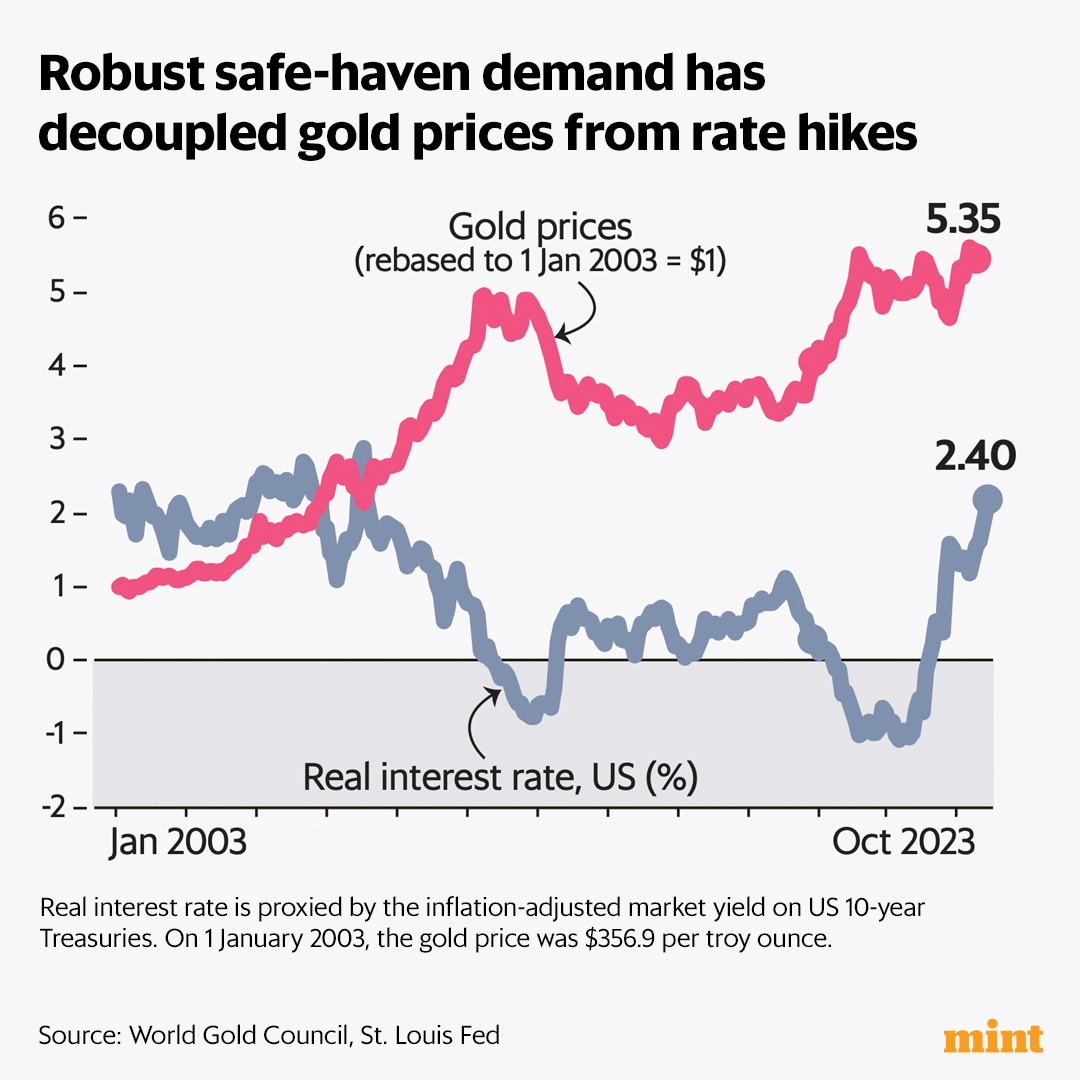

#MintPlainFacts | #Gold is a hedge against inflation as well as geopolitical risk. Not surprisingly, gold prices have been on a bullish trend.

Until May 2023, US rate hikes were a key price trigger, as higher interest rates increase the opportunity cost of holding gold. But this negative relationship has become less powerful in recent months.

Read here: read.ht

Until May 2023, US rate hikes were a key price trigger, as higher interest rates increase the opportunity cost of holding gold. But this negative relationship has become less powerful in recent months.

Read here: read.ht

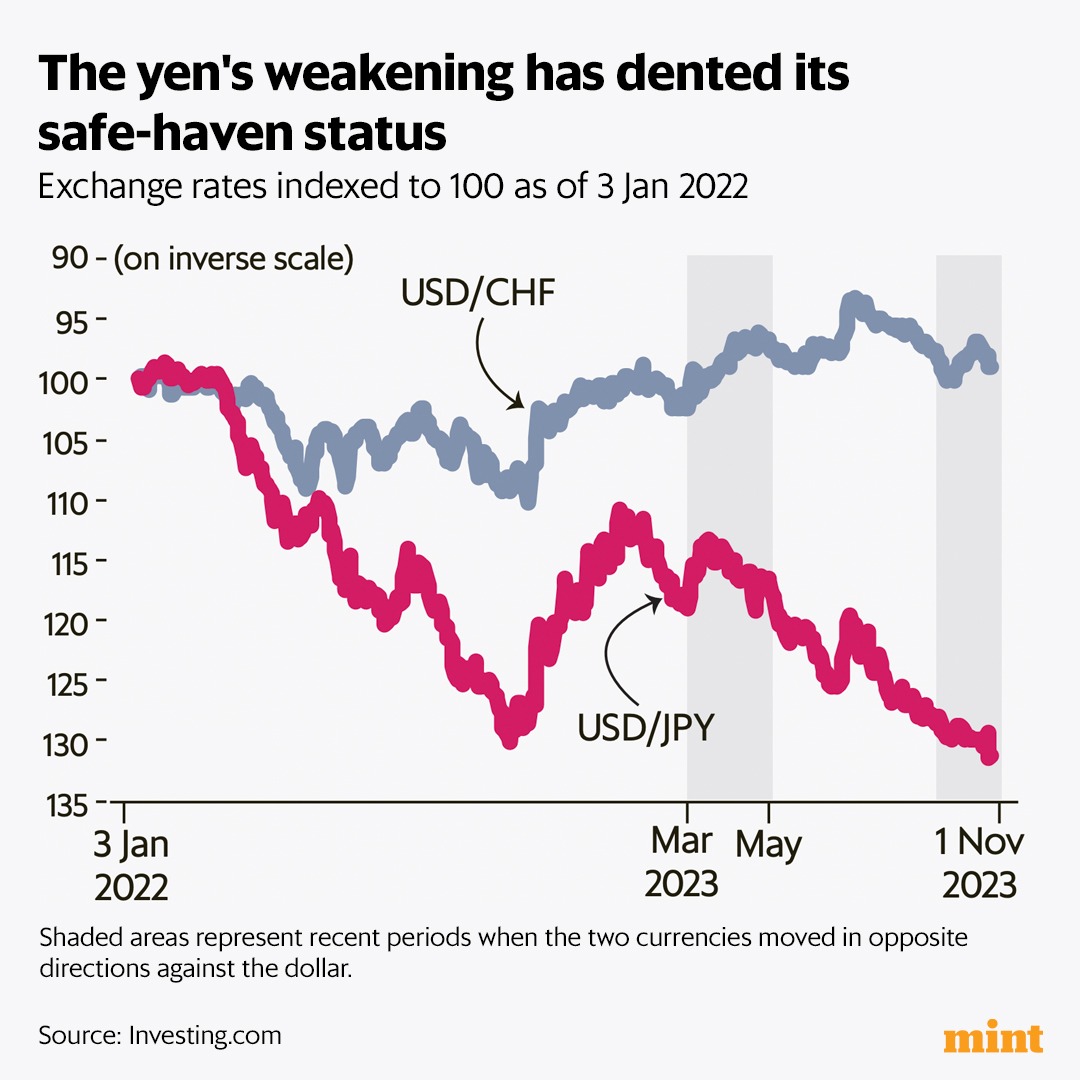

#MintPlainFacts | The yen and Swiss franc are popular safe haven currencies. The yen has weakened since 2022 mainly because of the Bank of Japan’s contrarian policy of low interest rates and yield-curve control.

A slow reversal of policy has already pushed up yields, and this in turn, is likely to attract capital inflows and strengthen the yen.

Read here: read.ht

A slow reversal of policy has already pushed up yields, and this in turn, is likely to attract capital inflows and strengthen the yen.

Read here: read.ht

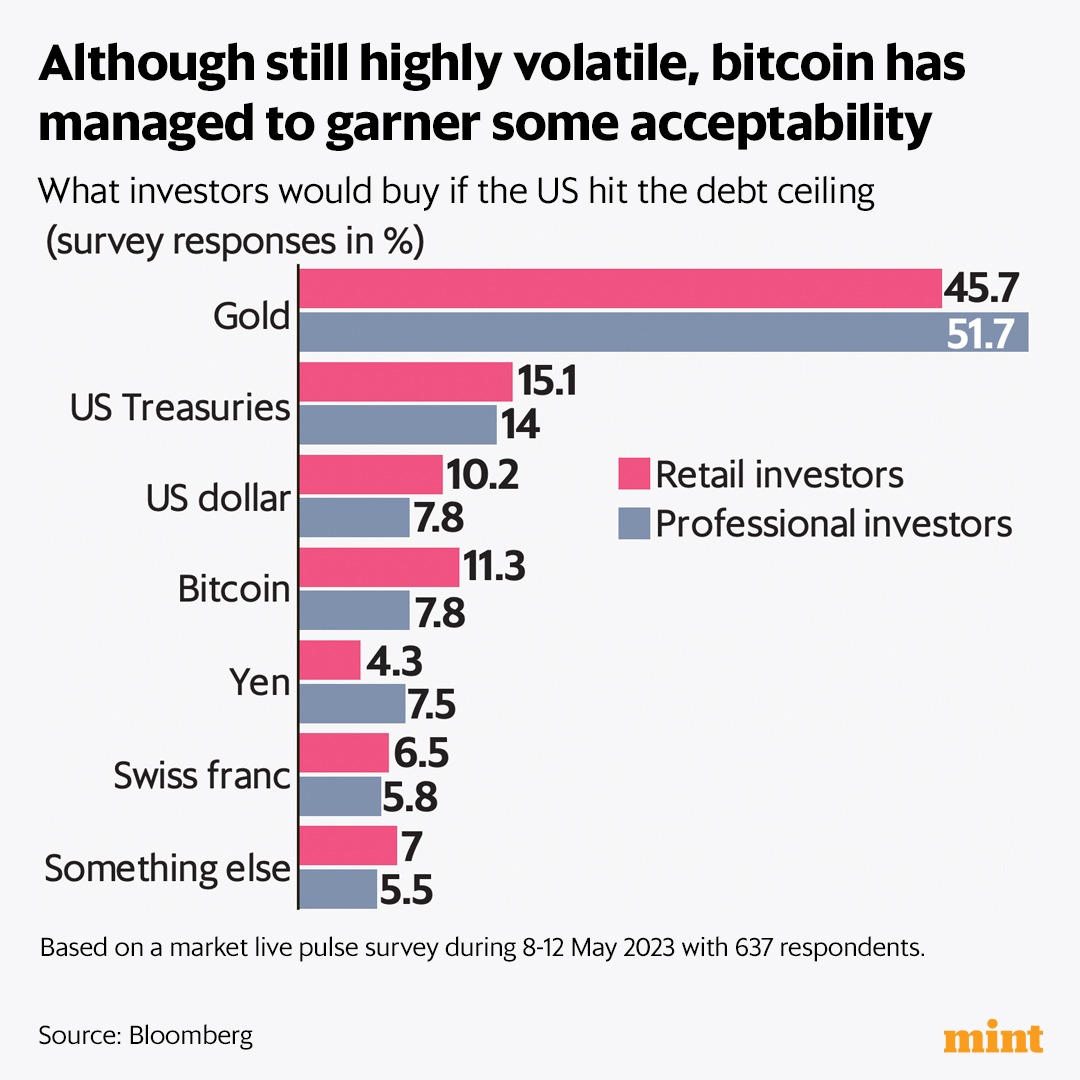

#MintPlainFacts | A May 2023 Bloomberg survey suggested that investors would favour bitcoin over the dollar, yen and Swiss franc in the event of a US debt default. #Crypto assets have become more widely acceptable for two reasons.

Read here: read.ht

Read here: read.ht

Loading suggestions...