NEW FROM US: We Are Short Golden Heaven Group, Another Classic "China Hustle"

$GDHG

(1/n)

$GDHG

(1/n)

Our research shows:

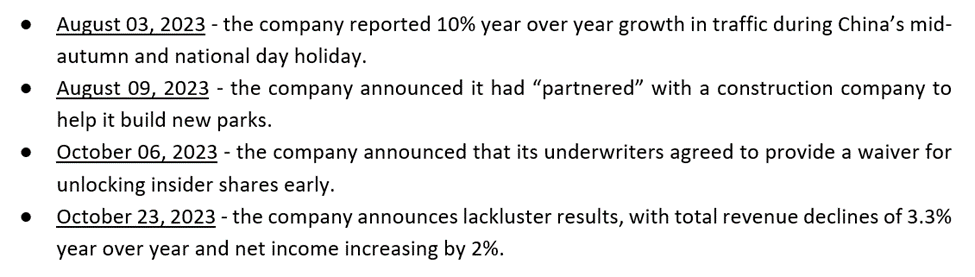

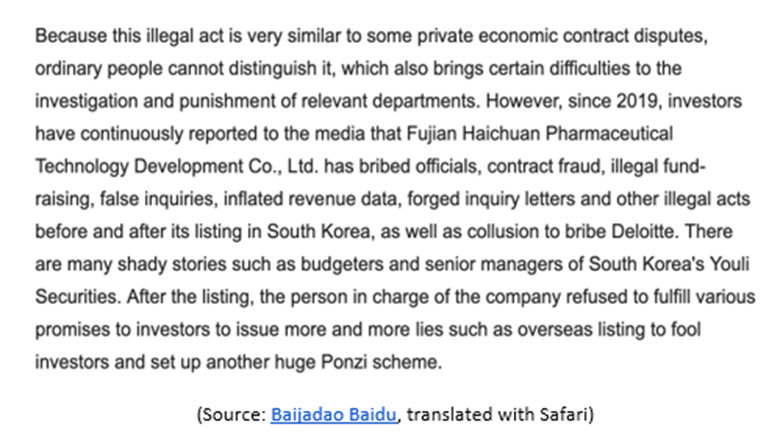

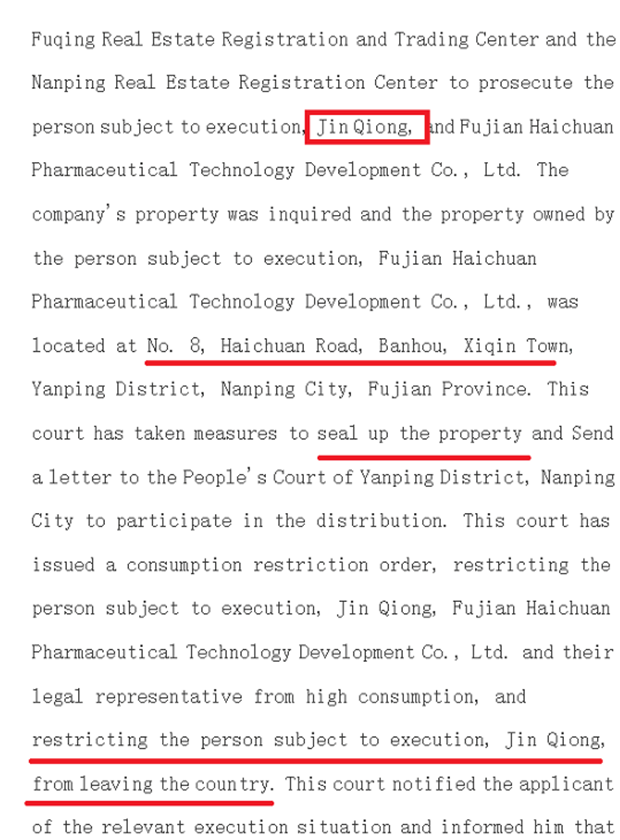

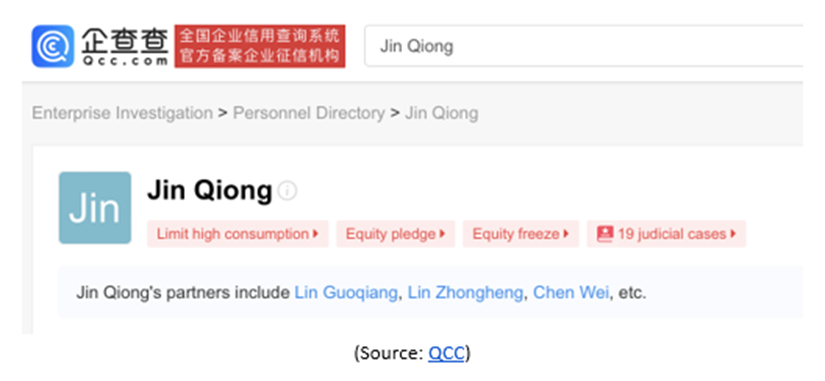

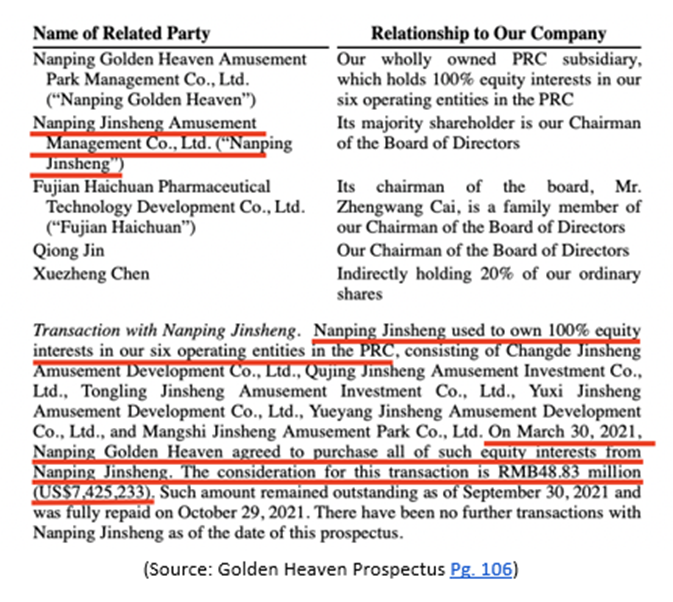

- $GDHG's CEO has a history of undisclosed fraud allegations and asset freezes in China.

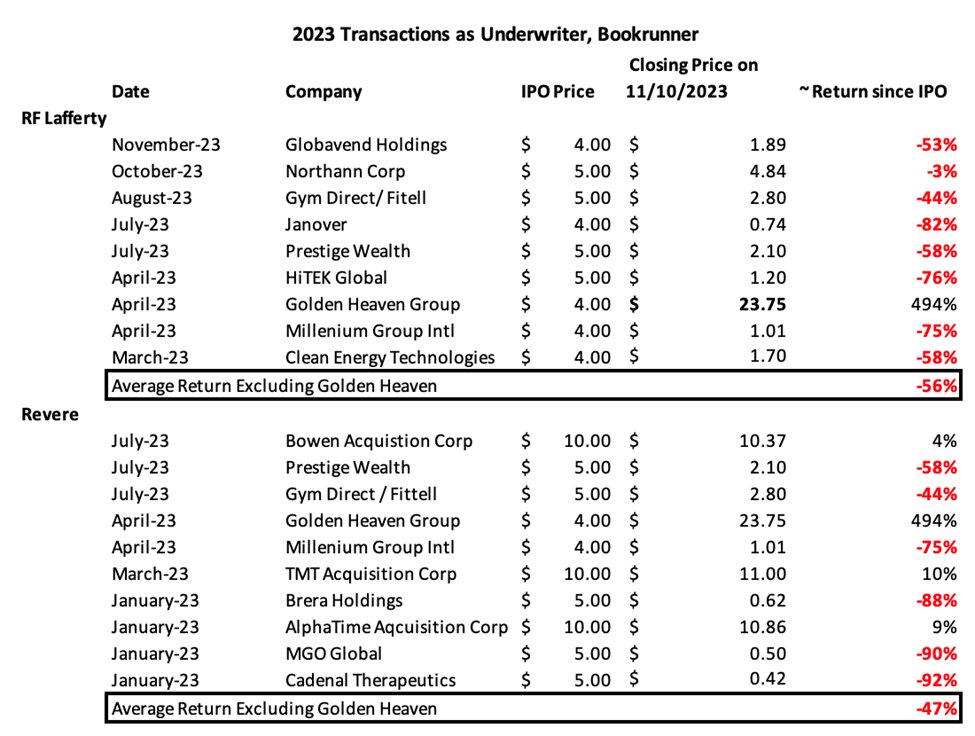

- The company was taken public by securities firms with multiple FINRA infractions.

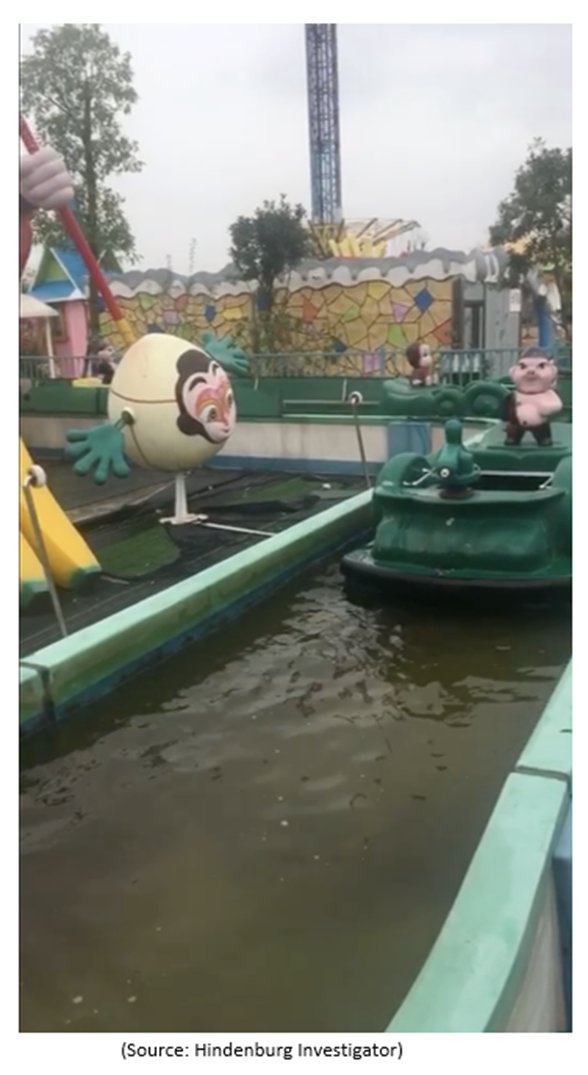

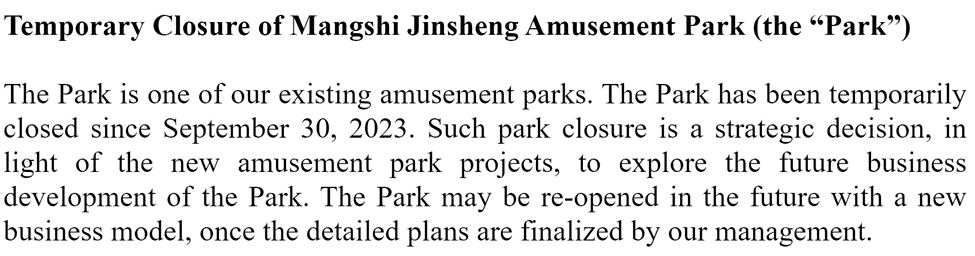

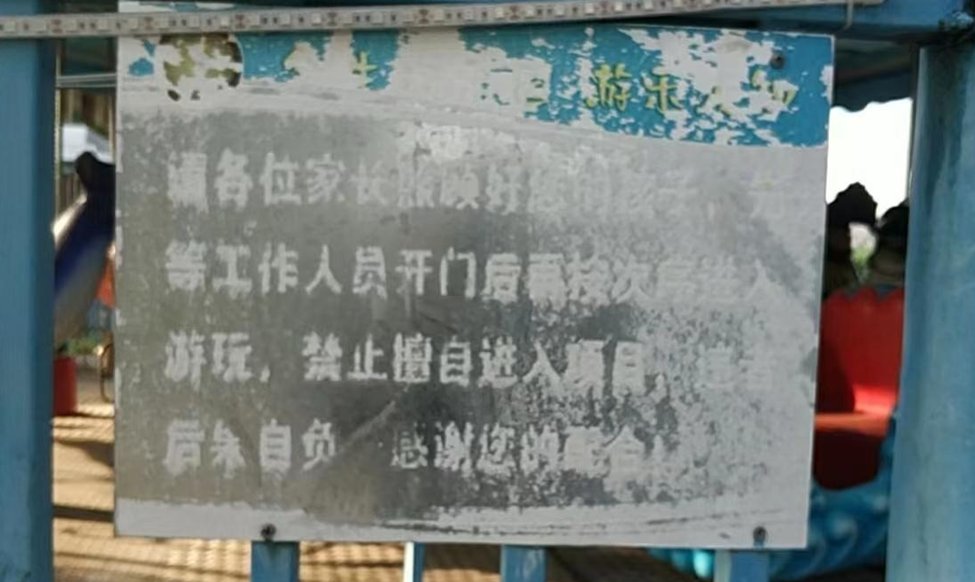

- GDHG’s claimed high-tech parks in China appear to be dystopian hellscapes.

(5/n)

- $GDHG's CEO has a history of undisclosed fraud allegations and asset freezes in China.

- The company was taken public by securities firms with multiple FINRA infractions.

- GDHG’s claimed high-tech parks in China appear to be dystopian hellscapes.

(5/n)

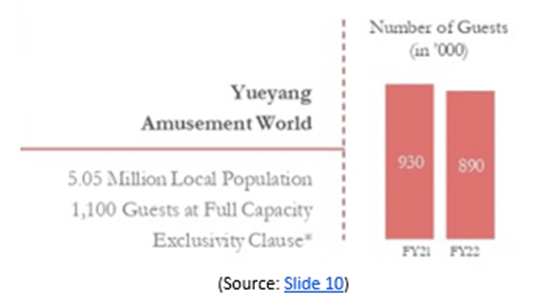

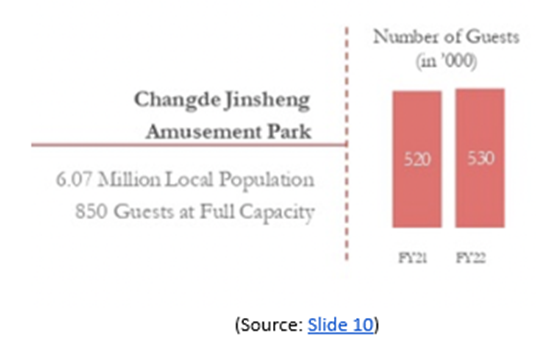

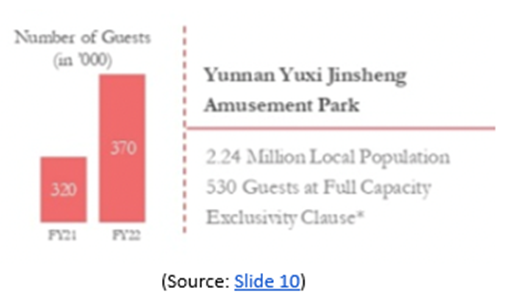

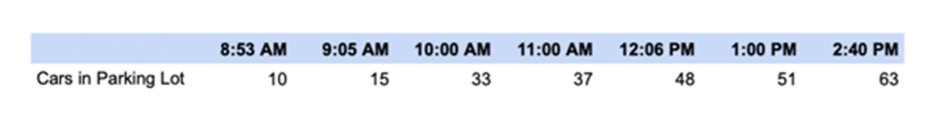

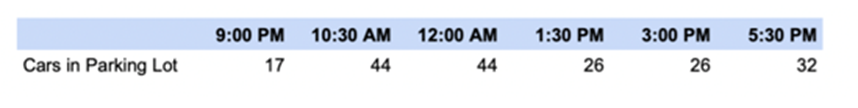

We visited each $GDHG park on the weekend, typically when amusement parks are busiest, expecting to find vibrant and heavily trafficked parks as suggested in the company's investor materials.

(13/n)

(13/n)

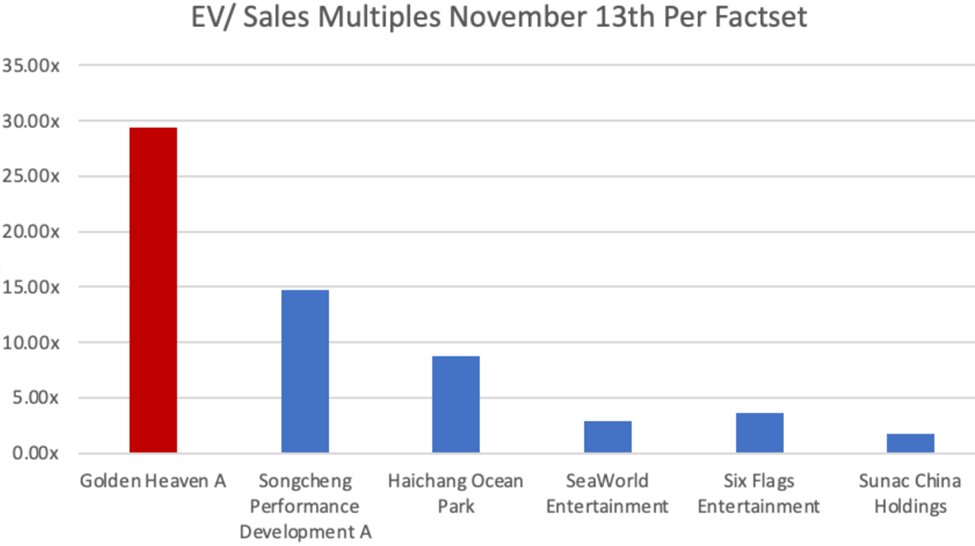

We have major doubts about $GDHG’s reported financials given the difference between its reported park activity and observable reality, and given the undisclosed fraud allegations & issues facing its Chairwoman & CEO.

(24/n)

(24/n)

The company switched auditors a week ago from one bucket shop auditor, BF Borgers, to another, Assentsure.

The latter has been registered with the PCAOB for only 2 years and has 11 microcap companies as clients.

(25/n)

The latter has been registered with the PCAOB for only 2 years and has 11 microcap companies as clients.

(25/n)

Two of Assentsure's partners were previously partners at RT LLP, another Singaporean auditor, which was fined and had its registration revoked by the PCAOB earlier this year.

(26/n)

(26/n)

Loading suggestions...