#DefiLlama is rapidly becoming a crypto analytics hub.

The go-to platform for all analytics data...

Yet the only thing most people still use it for is to check TVLs.

Here are 7 other things you can do with @DefiLlama 🧵🧵

The go-to platform for all analytics data...

Yet the only thing most people still use it for is to check TVLs.

Here are 7 other things you can do with @DefiLlama 🧵🧵

@DefiLlama This thread might be everything you need to get ready for the upcoming bull market;

So,

• Bookmark

• Like & Repost

Done that? Good!

Let's just go straight into it 🌊🏊♀️

So,

• Bookmark

• Like & Repost

Done that? Good!

Let's just go straight into it 🌊🏊♀️

@DefiLlama 7. YIELD

• Go to Defillama's Website

• Click on Yield, then APY

This shows several pools across chains with crazy APYs.

One of the best ways to play this

• Do a quick research on the project

• How early are you?

• Risks involved, e.g., rug, IL, contract verification, etc

• Go to Defillama's Website

• Click on Yield, then APY

This shows several pools across chains with crazy APYs.

One of the best ways to play this

• Do a quick research on the project

• How early are you?

• Risks involved, e.g., rug, IL, contract verification, etc

@DefiLlama 6. RAISES

This is helpful to job hunters.

This tab shows the list of projects undergoing VC/Crowdfunding.

These projects are often in their early stages & potentially looking for people in different roles.

However, the roles can be competitive at times.

This is helpful to job hunters.

This tab shows the list of projects undergoing VC/Crowdfunding.

These projects are often in their early stages & potentially looking for people in different roles.

However, the roles can be competitive at times.

@DefiLlama 5. STABLECOIN INFLOW

One of the metrics to know which ecosystem is/will gain momentum is stablecoin inflow.

And vice versa when liquidity starts to flow out.

• Go to Stables > Chains

• Click on 7days change

You will see all the chains with the most recent stablecoin inflow.

One of the metrics to know which ecosystem is/will gain momentum is stablecoin inflow.

And vice versa when liquidity starts to flow out.

• Go to Stables > Chains

• Click on 7days change

You will see all the chains with the most recent stablecoin inflow.

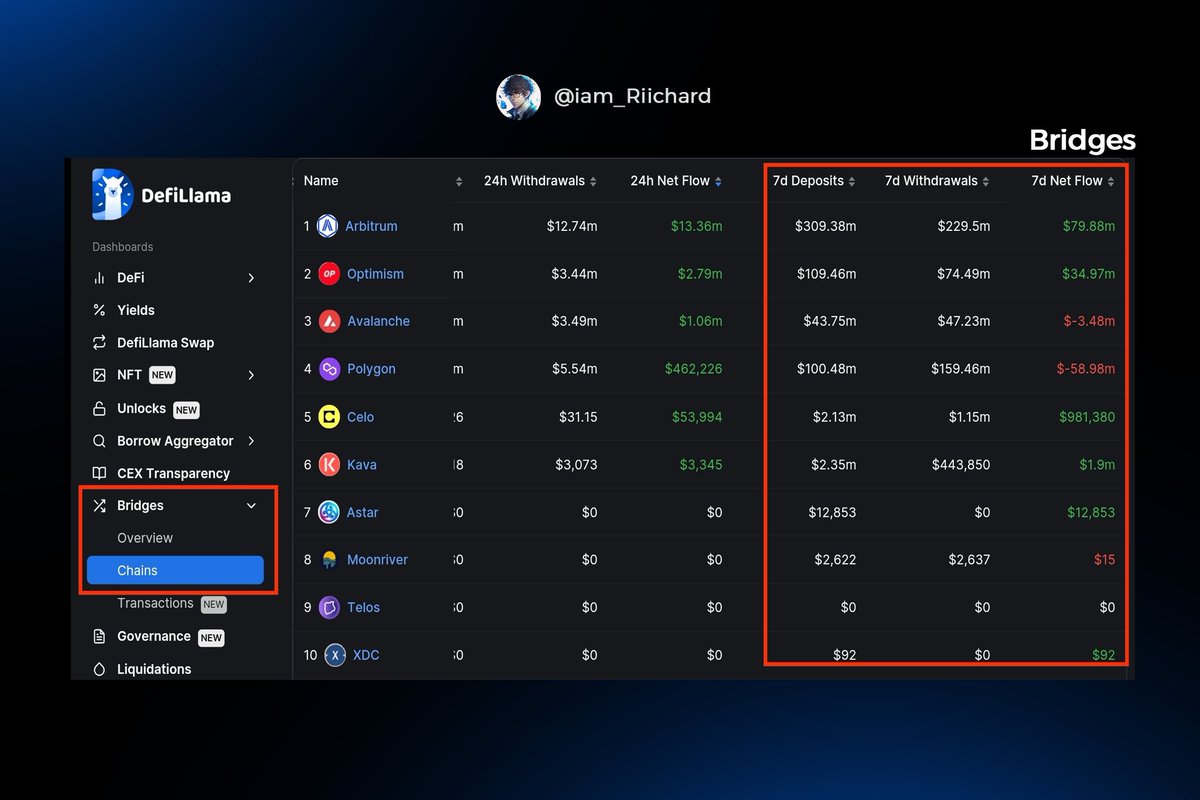

@DefiLlama 4. BRIDGES

This aggregates all the liquidity bridged into a particular ecos.

This is more effective than stablecoin inflow since it captures liquidities bridged through other tokens ($Eth, $BNB, etc.)

• Go to Bridges > Chains

• Click & compare 7days Net Flow & Deposits.

This aggregates all the liquidity bridged into a particular ecos.

This is more effective than stablecoin inflow since it captures liquidities bridged through other tokens ($Eth, $BNB, etc.)

• Go to Bridges > Chains

• Click & compare 7days Net Flow & Deposits.

@DefiLlama 3. TRENDING CONTRACTS

🚨Caution: Only proceed if you know what you're doing

There are several projects doing x50, x100, etc., daily, but you might not find them until after the pump.

You can find the next gem/narrative under trending contracts before it hits the whole CT.

🚨Caution: Only proceed if you know what you're doing

There are several projects doing x50, x100, etc., daily, but you might not find them until after the pump.

You can find the next gem/narrative under trending contracts before it hits the whole CT.

@DefiLlama • Go to Trending Contracts

• Set your preferred timeframe & Chain

e.g., Last 30 min > Ethereum

• Click Tx Growth (Shows highest transaction & wallet growth)

• Pick your preferred contract & it will redirect to Etherscan.

Your research & etherscan knowledge is needed here.

• Set your preferred timeframe & Chain

e.g., Last 30 min > Ethereum

• Click Tx Growth (Shows highest transaction & wallet growth)

• Pick your preferred contract & it will redirect to Etherscan.

Your research & etherscan knowledge is needed here.

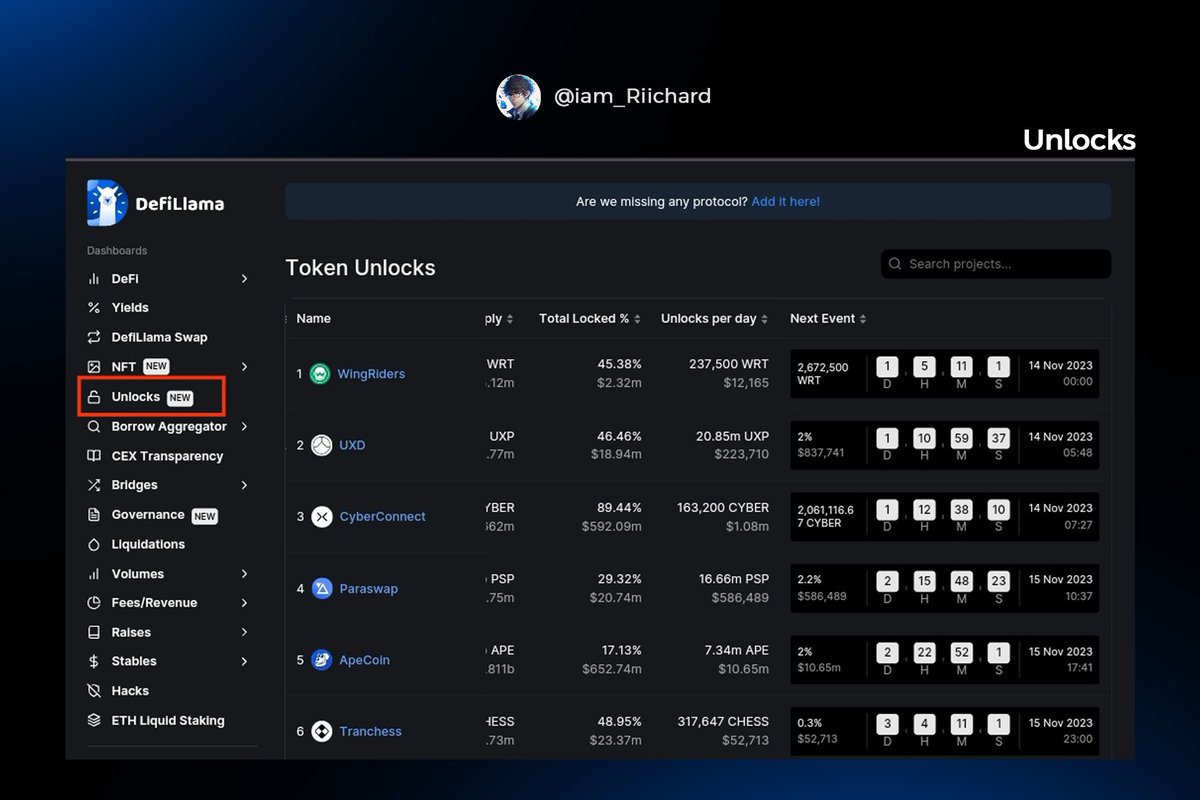

@DefiLlama 2. TOKEN UNLOCKS

Usually, token unlock awareness can save you from two things;

• Holding a token with high emissions for long term.

• Opportunity to short the token when unlock is close.

Mostly, tokens with upcoming unlocks announce bullish news close to the same date.

Usually, token unlock awareness can save you from two things;

• Holding a token with high emissions for long term.

• Opportunity to short the token when unlock is close.

Mostly, tokens with upcoming unlocks announce bullish news close to the same date.

@DefiLlama That's why some projects never pump.

And if it does, just a few percent, then start to dump.

Sincerely, each of these has its pros & cons.

Don't play a game you don't understand.

And if it does, just a few percent, then start to dump.

Sincerely, each of these has its pros & cons.

Don't play a game you don't understand.

@DefiLlama 1. AIRDROPS

This dashboard shows a list of tokenless protocols.

Note: Airdrop is not certain, except the protocol itself announces it.

You'll need to do some research here to ensure you're not wasting your time.

Some older protocols are worth interacting with.

This dashboard shows a list of tokenless protocols.

Note: Airdrop is not certain, except the protocol itself announces it.

You'll need to do some research here to ensure you're not wasting your time.

Some older protocols are worth interacting with.

@DefiLlama Apparently, you can also leverage ChatGPT alongside the Defillama plugin to improve your research.

Here's a detailed thread from @0xTindorr 👇

Here's a detailed thread from @0xTindorr 👇

Loading suggestions...