Last year, Reliance Retail backed Dunzo in a $240 million round funding by investing $225 million and acquiring 25.8% of its stake.

This was a positive move, as a strategic partnership between Dunzo & Reliance Retail would be mutually beneficial.

This was a positive move, as a strategic partnership between Dunzo & Reliance Retail would be mutually beneficial.

These acquisitions are fueled by the aspiration of having Reliance Industries among the top 20 companies in the world.

And Reliance Retail plays a huge role in that.

And Reliance Retail plays a huge role in that.

You see, Reliance Retail owns brands across different segments like groceries, neighborhood convenience stores, electronic goods, clothes, jewelry, furniture, and medicines.

And Dunzo is a hyperlocal delivery startup that operates in all of these categories and more.

And Dunzo is a hyperlocal delivery startup that operates in all of these categories and more.

For Reliance Retail, there is an automatic fit with the JioMart business.

JioMart has given the ideal combination of technology and supply chain management in one single platform.

But quick commerce is still missing in the Reliance Retail business model.

JioMart has given the ideal combination of technology and supply chain management in one single platform.

But quick commerce is still missing in the Reliance Retail business model.

The acquisition of Dunzo will peg that gap as Dunzo will ensure rapid delivery across India as the front-end for Reliance Retail.

See, India’s retail market is growing at a staggering rate and is expected to grow over $800 billion by 2025.

See, India’s retail market is growing at a staggering rate and is expected to grow over $800 billion by 2025.

And that’s why Swiggy launched Instamart, YC continually back Zepto, TATA acquired BigBasket and Zomato acquired Blinkit.

In fact, even TATA and Zomato acquired BigBasket and Blinkit by first becoming the largest shareholder, just like Reliance Retail became to Dunzo.

In fact, even TATA and Zomato acquired BigBasket and Blinkit by first becoming the largest shareholder, just like Reliance Retail became to Dunzo.

And as for Dunzo, the partnership with Reliance Retail got them the means to spread across 250 cities and in future, it might have benefitted from Reliance Retail’s supply chain ecosystem.

So, it should have been a win-win situation for both. But now, 18 months later, this is not the case.

A series of events has led to Dunzo almost shutting down.

A series of events has led to Dunzo almost shutting down.

You see, when Reliance acquired 25.8% of Dunzo’s stake, it was not enough to completely acquire Dunzo, but it definitely acquired them a controlling stake.

Because as per law, any major decision in a company requires the support of 75% of the shareholders.

Because as per law, any major decision in a company requires the support of 75% of the shareholders.

So, with this deal, Reliance blocked Dunzo's ability to raise funds without their consent!

Because even if all other shareholders agreed, it would only amount to 74.2% shareholding — which is not enough for a go-ahead.

Because even if all other shareholders agreed, it would only amount to 74.2% shareholding — which is not enough for a go-ahead.

But even if Reliance got some controlling power, it doesn’t explain why Dunzo is in chaos.

What went so wrong that a startup that got Google’s first direct investment in India is about to shut down?

Dunzo failed to scale up.

What went so wrong that a startup that got Google’s first direct investment in India is about to shut down?

Dunzo failed to scale up.

In 2021, due to lockdown, quick commerce as a business model became so popular that every other company started quick delivery service.

• Ola started 15 min grocery delivery service

• Swiggy's InstaMart service started delivering in 15-30 minutes

• Dunzo promised to deliver in 19 minutes

• And BigBasket started BB Express

• Swiggy's InstaMart service started delivering in 15-30 minutes

• Dunzo promised to deliver in 19 minutes

• And BigBasket started BB Express

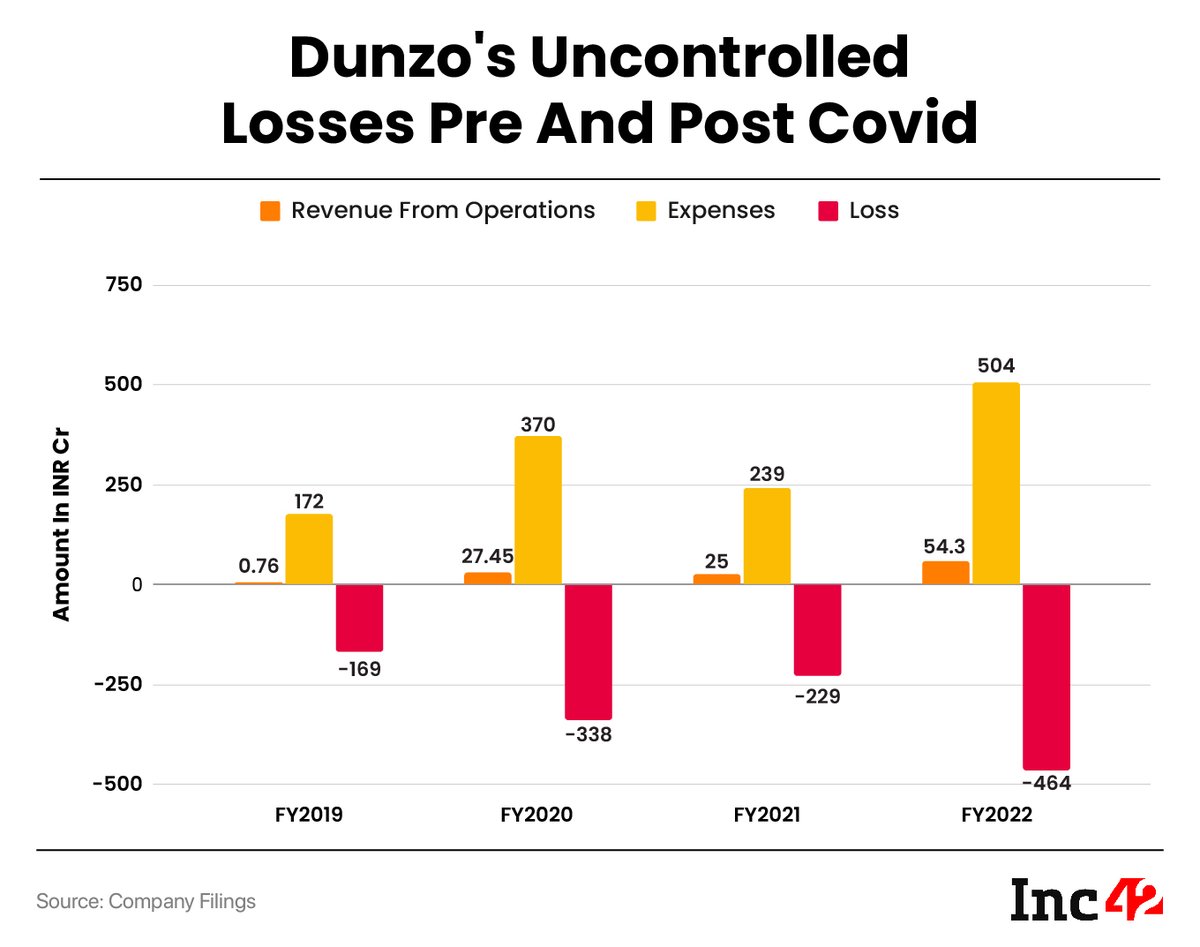

The business model which sets the foundation of quick commerce involves faster turnaround times (TAT) with low margins and higher delivery costs which leads to excessive cash burn for companies.

So to stay afloat in the quick commerce business, companies require deep pockets, and they must be capable of running on negative EBITDA for years.

Which doesn’t sound profitable at all.

Which doesn’t sound profitable at all.

Since Dunzo also jumped on the bandwagon of quick commerce through dark stores, it invested heavily in the Dunzo Daily product.

But once the lockdown got over, this business model started failing even more.

But once the lockdown got over, this business model started failing even more.

And Reliance ensured that no more investments came their way, forcing Dunzo to close their dark stores and shift to their previous B2B model, where they completed deliveries for other e-commerce brands on a revenue sharing basis.

Unsurprisingly, their biggest B2B client was none other than JioMart.

But even after Dunzo started offering B2B deliveries through Dunzo For Business (D4B) and B2C deliveries under two different models (hyperlocal and dark stores), they weren’t able to scale up Dunzo’s revenue.

But even after Dunzo started offering B2B deliveries through Dunzo For Business (D4B) and B2C deliveries under two different models (hyperlocal and dark stores), they weren’t able to scale up Dunzo’s revenue.

So this year in March, Dunzo tried to raise 100 million capital from existing investors. But they could only raise 75 million.

And then they had to ask Reliance for the extra 25 million. Which Reliance didn’t respond to.

And then they had to ask Reliance for the extra 25 million. Which Reliance didn’t respond to.

And Dunzo couldn’t raise funding from other investors, without the nod of Reliance.

This led to delayed salaries, missed repayment deadlines, lawsuits, mass layoff of over 300 employees and even 2 co-founders and the head of finance have made an exit.

This led to delayed salaries, missed repayment deadlines, lawsuits, mass layoff of over 300 employees and even 2 co-founders and the head of finance have made an exit.

And now the company that once was at the forefront of quick commerce business and was so valuable that Zomato and TATA wanted to acquire it at some point of time is in distress and on the verge of shutting down.

A potential distress sale could happen.

A potential distress sale could happen.

And if it does end up happening, any guesses on who’ll be the first in line to buy it?

If you liked this read do RePost🔄the 1st post

And follow us @FinFloww for such threads every Monday, Wednesday and Friday!

If you liked this read do RePost🔄the 1st post

And follow us @FinFloww for such threads every Monday, Wednesday and Friday!

Join the FinFloww channel on WhatsApp to receive such stories daily: whatsapp.com

Subscribe to WHAT THE FLOWW?, our weekly email newsletter where we dive deeper into such concepts:

finfloww.bio.link

finfloww.bio.link

Loading suggestions...