EV/EBITDA is a useful valuation metric as :

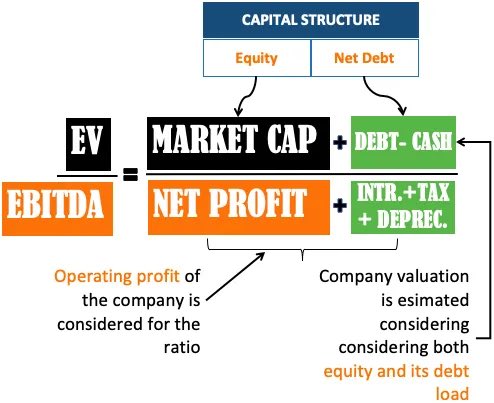

A) It takes into account the entire value of a company, including its debt and cash. This makes it a better valuation measure than the P/E ratio, which only considers the company's equity value.

A) It takes into account the entire value of a company, including its debt and cash. This makes it a better valuation measure than the P/E ratio, which only considers the company's equity value.

B) good measure of a company's profitability, as EBITDA strips out non-cash expenses such as depreciation and amortization.

C) less affected by accounting differences than other valuation metrics. This makes it a useful tool for comparing companies across industries and countries

C) less affected by accounting differences than other valuation metrics. This makes it a useful tool for comparing companies across industries and countries

D) EV/EBITDA takes into account the company's debt and cash, so it is better valuation metrics for comparing companies with different financial leverage

E) in cyclical industries. EV/EBITDA is less volatile than other metrics, such as P/E , so better suited through the cycle

E) in cyclical industries. EV/EBITDA is less volatile than other metrics, such as P/E , so better suited through the cycle

Loading suggestions...