#fundamental Analysis

1. Business Overview

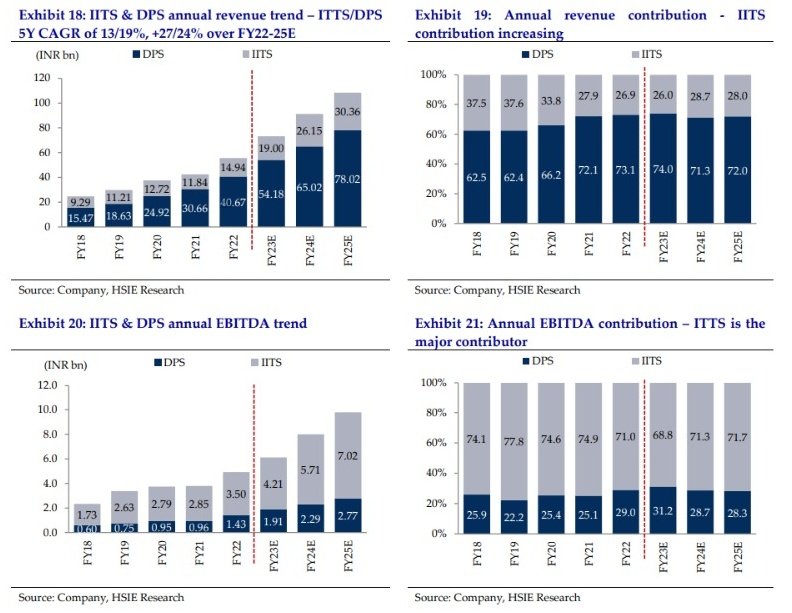

2. Vertical/Segmental Analysis

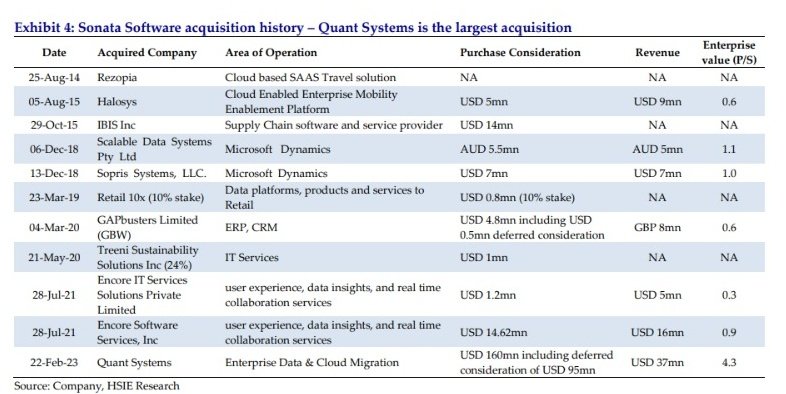

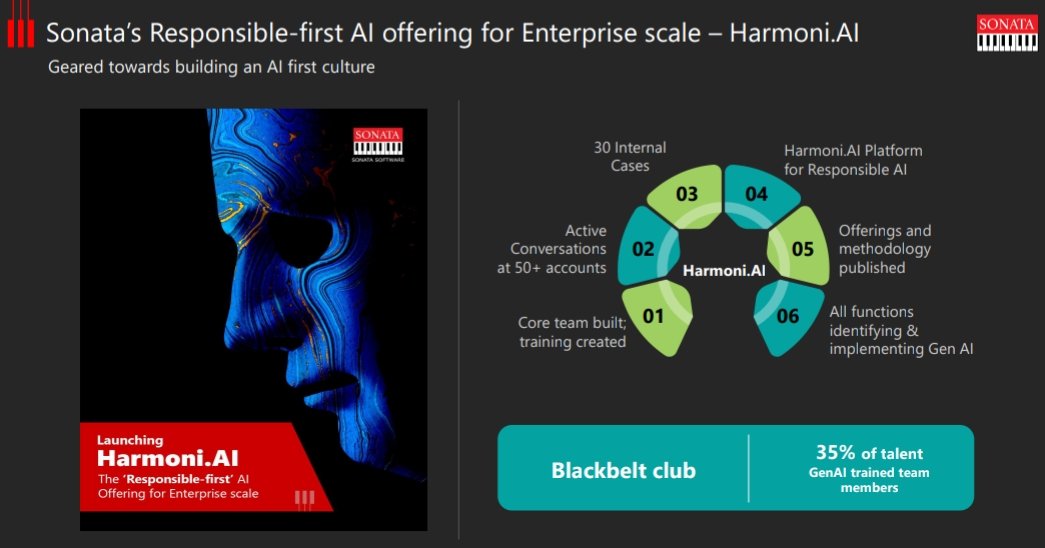

3. Acquisition History

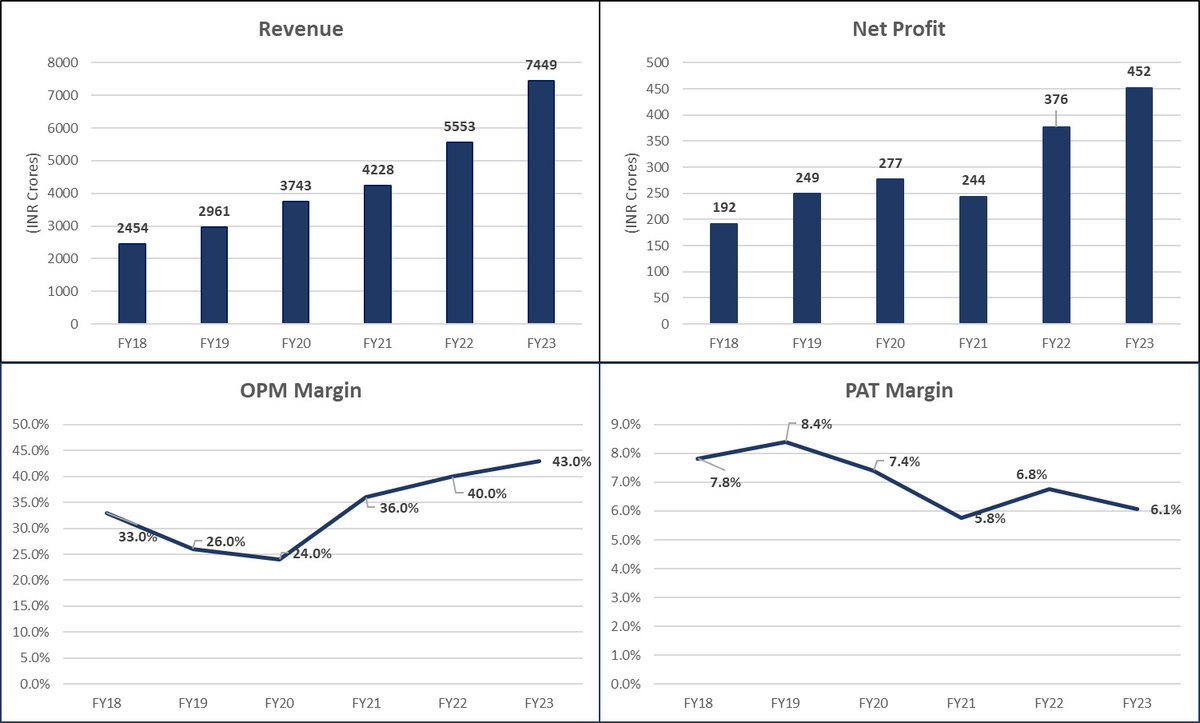

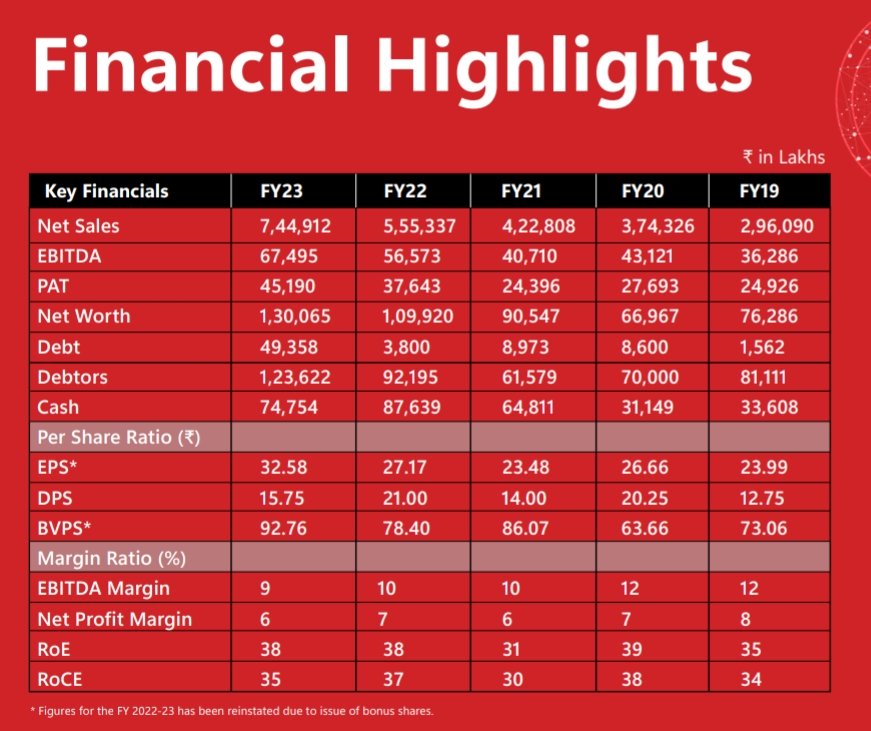

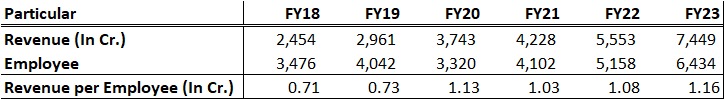

4. Financial Analysis

5. Opportunities

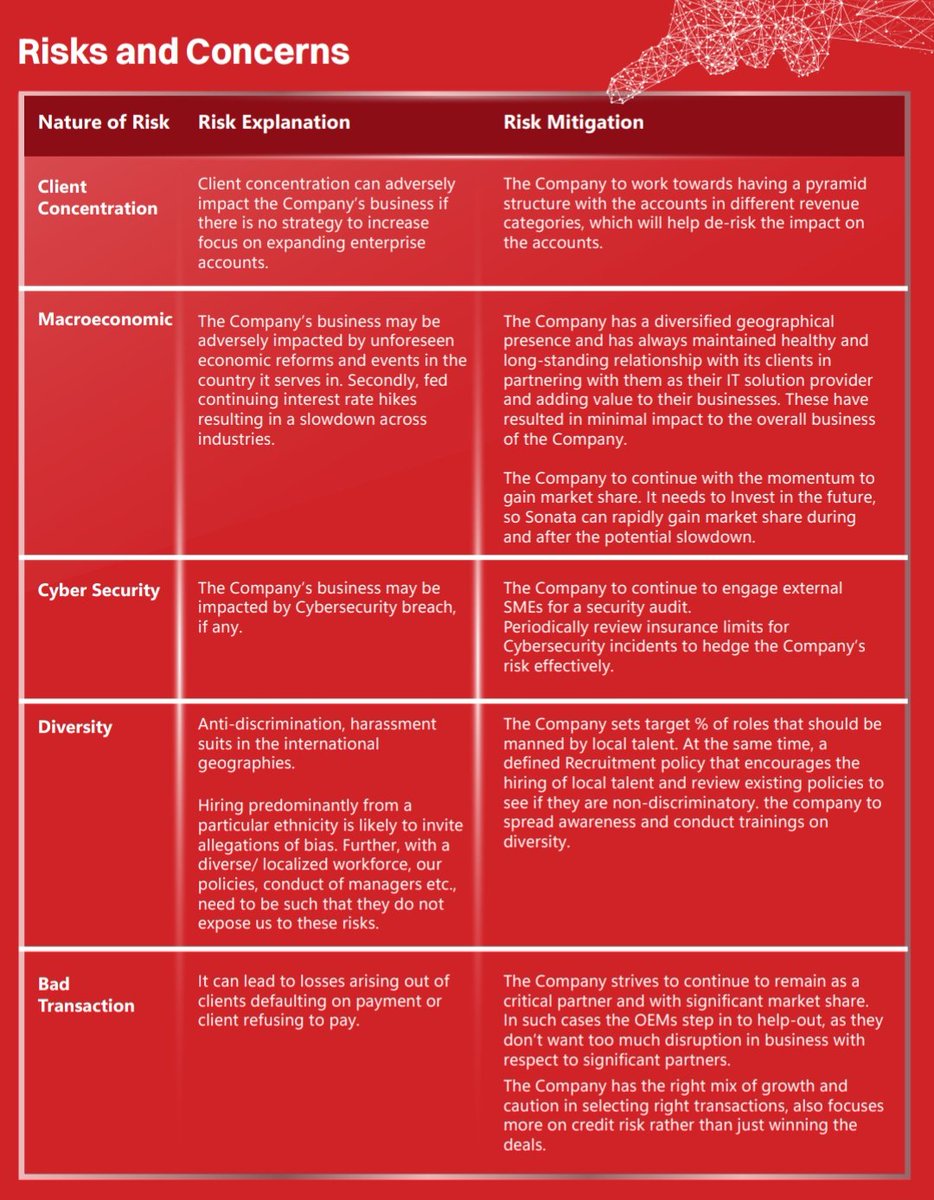

6. Risk

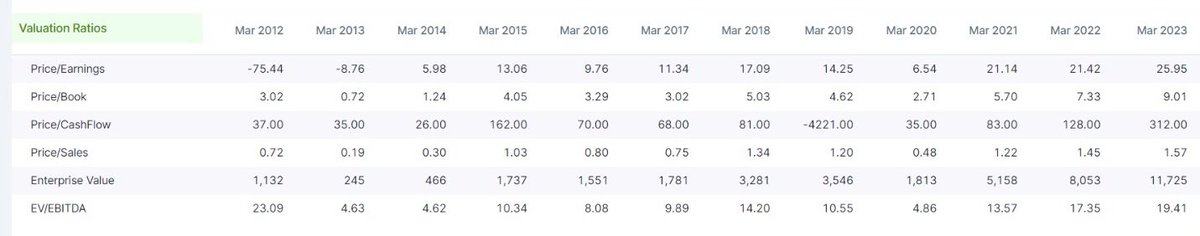

7. Valuation

8. Guidance

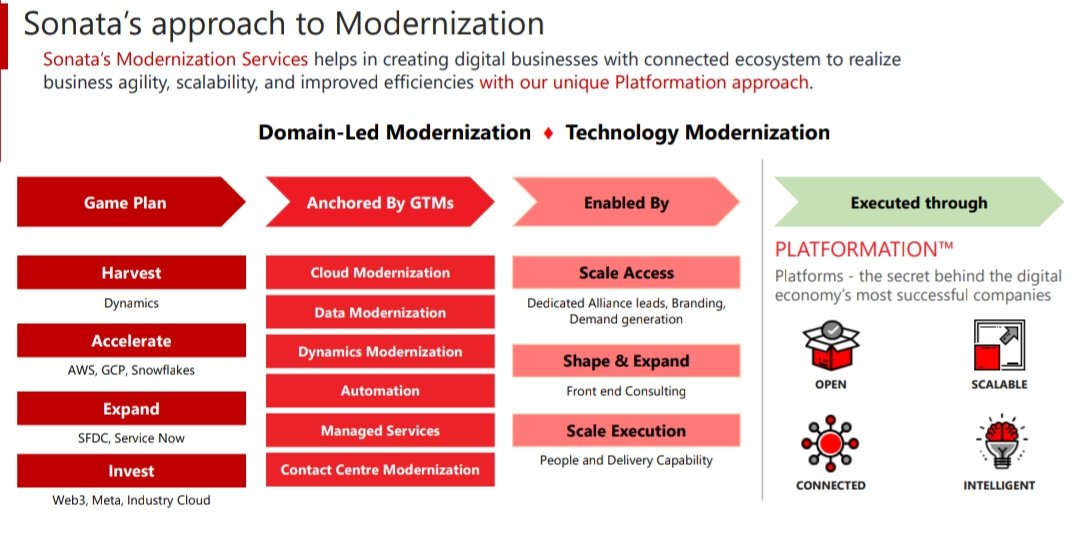

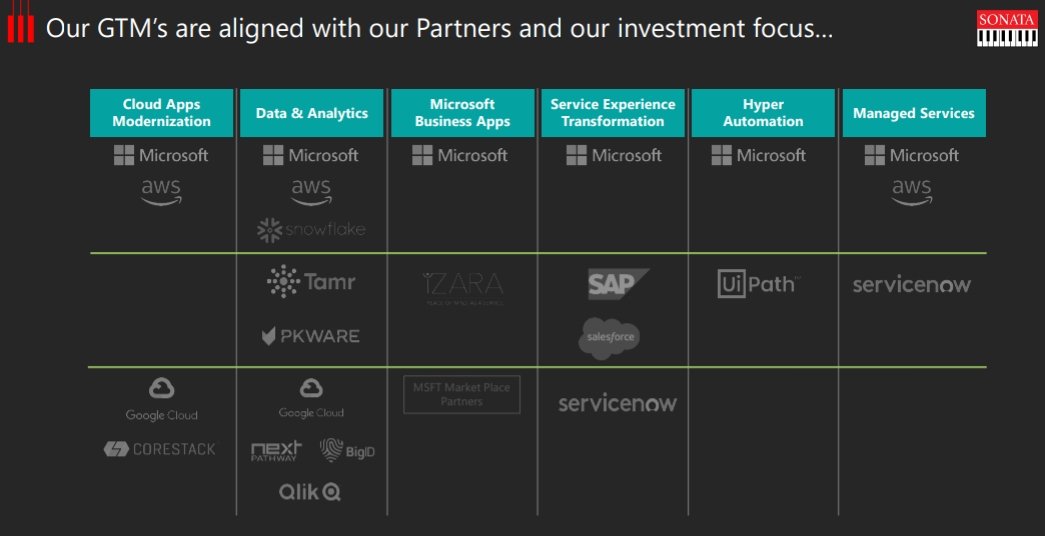

1. Business Overview

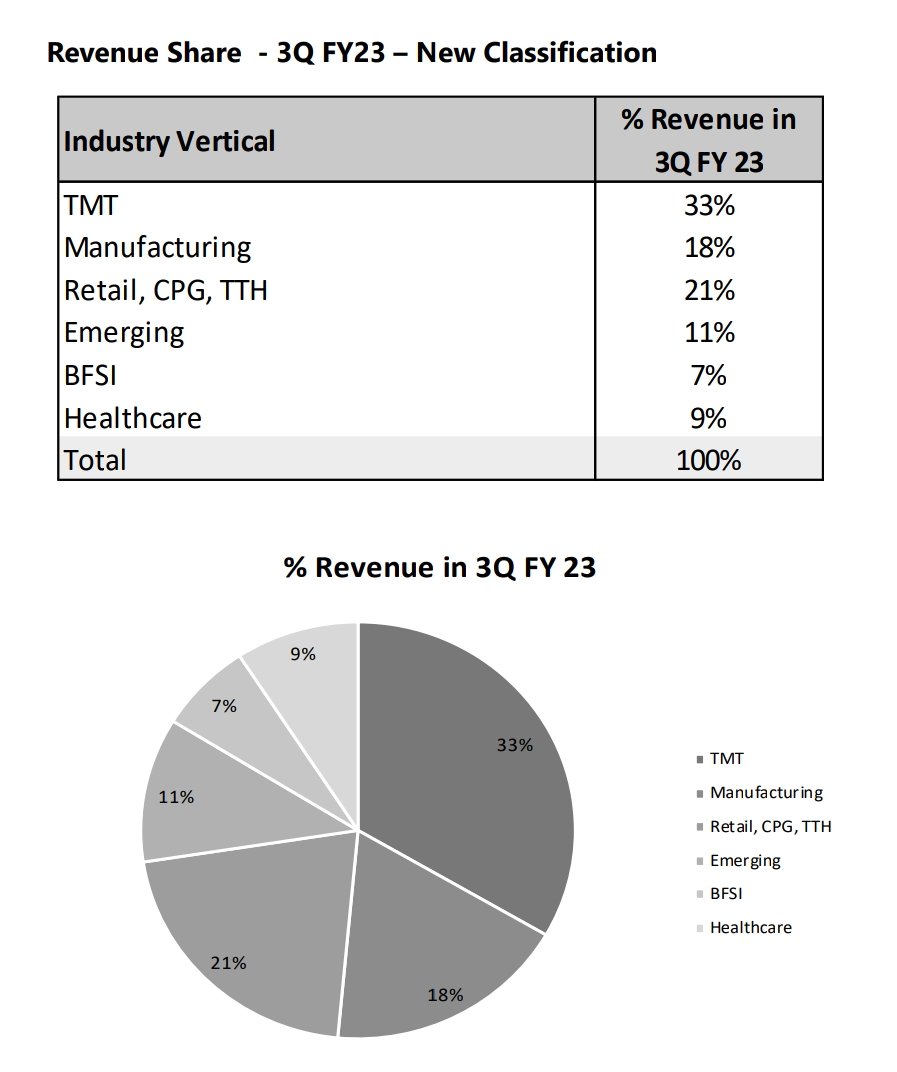

2. Vertical/Segmental Analysis

3. Acquisition History

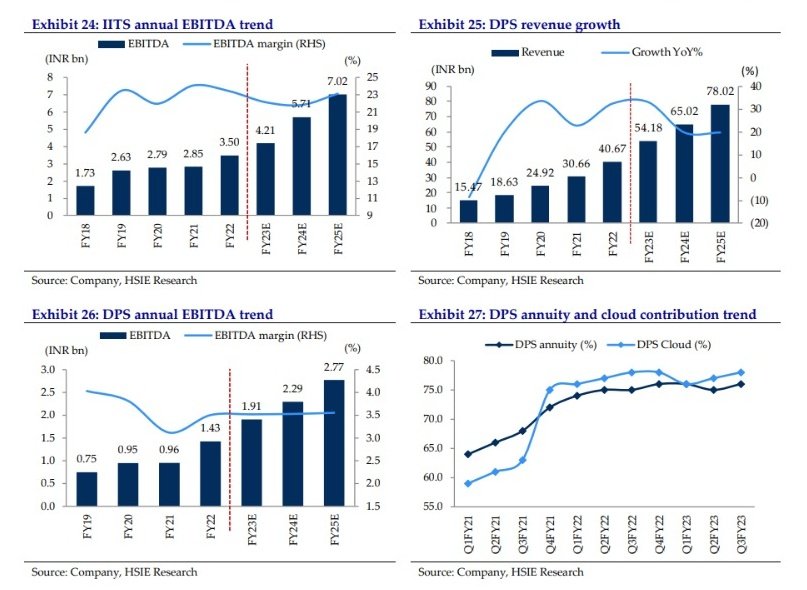

4. Financial Analysis

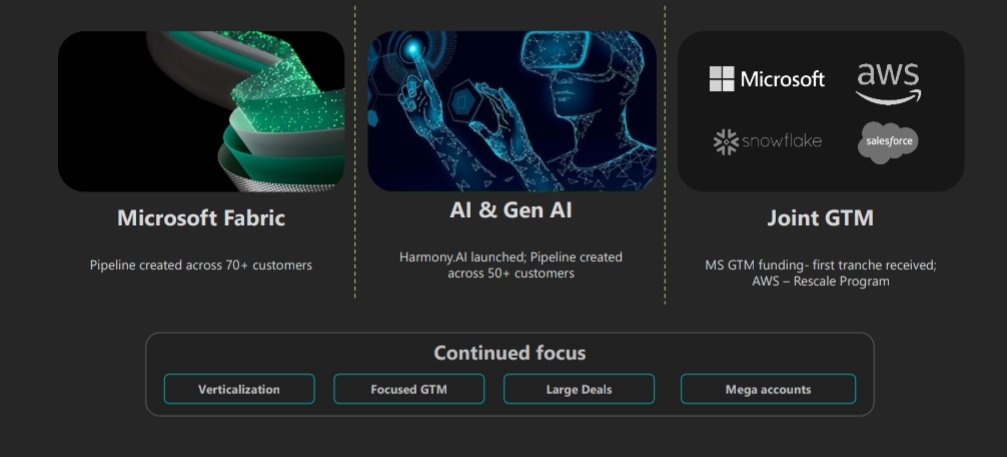

5. Opportunities

6. Risk

7. Valuation

8. Guidance

Guidance:

-Revenue Guidance of $1.5 BN by FY26

-Internation EBITDA will be in low 20s & Aim to have 50% Revenue contribution from IITS vertical

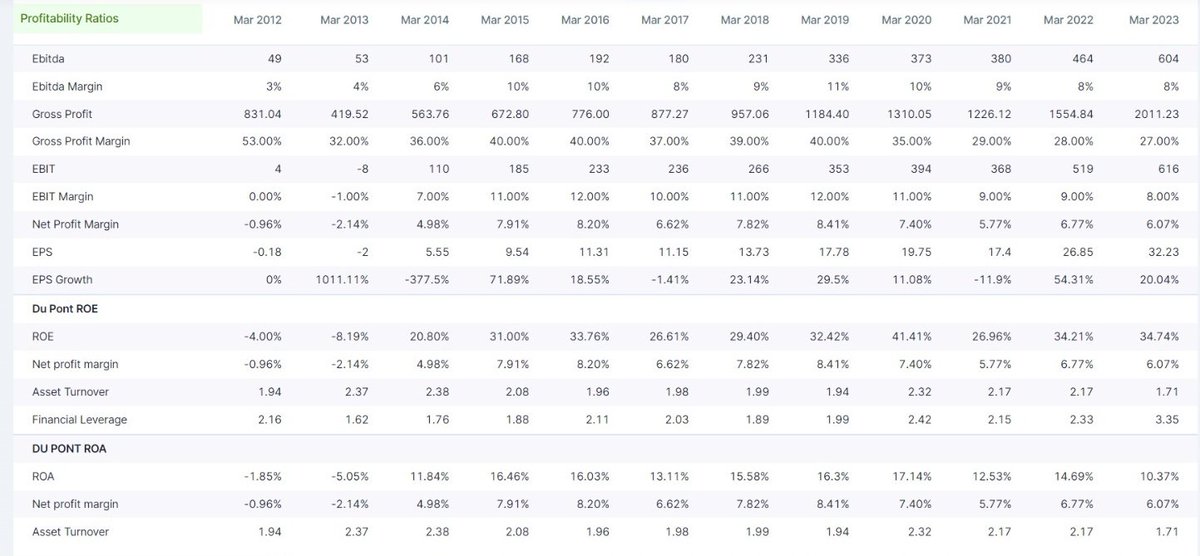

- Significant investment in Harmoni.AI platform, with a goal to have 25% of topline contribution from it in next 2-3 Yrs

-Revenue Guidance of $1.5 BN by FY26

-Internation EBITDA will be in low 20s & Aim to have 50% Revenue contribution from IITS vertical

- Significant investment in Harmoni.AI platform, with a goal to have 25% of topline contribution from it in next 2-3 Yrs

#Technical Analysis:

1. Point & Finger Chart

2. 3% x 3 Point & Finger Chart

3. Moving Avg. Observation

4. RSI Observation

5. Donchian Channel Observation

6. Bollinger Band Observation

7. Ichimoku Observation

1. Point & Finger Chart

2. 3% x 3 Point & Finger Chart

3. Moving Avg. Observation

4. RSI Observation

5. Donchian Channel Observation

6. Bollinger Band Observation

7. Ichimoku Observation

3. Moving Average Observations:

The 200-day moving average is still above the price.

Price above moving averages of 50, 100, and 200 days.

Alignment of the moving average is positive. It's a bullish situation with an upswing.

The 200-day moving average is still above the price.

Price above moving averages of 50, 100, and 200 days.

Alignment of the moving average is positive. It's a bullish situation with an upswing.

4. The Daily RSI indicator has continued to be above 60. This area is bullish. The Daily RSI is currently reading 69.93.

-The Weekly RSI has stayed over 70. The Weekly RSI is at 75.08.

-In the current session, the Monthly RSI indicator crossed over 80. The monthly RSI is at 87.44

-The Weekly RSI has stayed over 70. The Weekly RSI is at 75.08.

-In the current session, the Monthly RSI indicator crossed over 80. The monthly RSI is at 87.44

5. Donchian Channel Observations:

-Price is above the middle of the Donchian channel (Bullish).

-Difference between bands is 20.33%

6. Bollinger Band Observations:

-Price is above Uper band Bollinger band (Bullish to over-brought)

Difference between bands is 20.32%

-Price is above the middle of the Donchian channel (Bullish).

-Difference between bands is 20.33%

6. Bollinger Band Observations:

-Price is above Uper band Bollinger band (Bullish to over-brought)

Difference between bands is 20.32%

7. Ichimoku Observations:

-Price above Ichimoku clouds.

-Clouds are bullish.

-Tenkan line is above Kijun line. Ichimoku setup is bullish.

-Price above Ichimoku clouds.

-Clouds are bullish.

-Tenkan line is above Kijun line. Ichimoku setup is bullish.

No Recommendation

This post is purely for #educational purposes

Hope, you guys will like it!! ✨

For more such detailed Techno-Funda Analysis follow:

@Mr_Maurya16 & @BansalSwapan

This post is purely for #educational purposes

Hope, you guys will like it!! ✨

For more such detailed Techno-Funda Analysis follow:

@Mr_Maurya16 & @BansalSwapan

Loading suggestions...