Deep dive into Deep Industries Cashflow REDFLAGS!

Interesting accounting red flags in Deep Industries's Deep Troubles

#Redflags

Interesting accounting red flags in Deep Industries's Deep Troubles

#Redflags

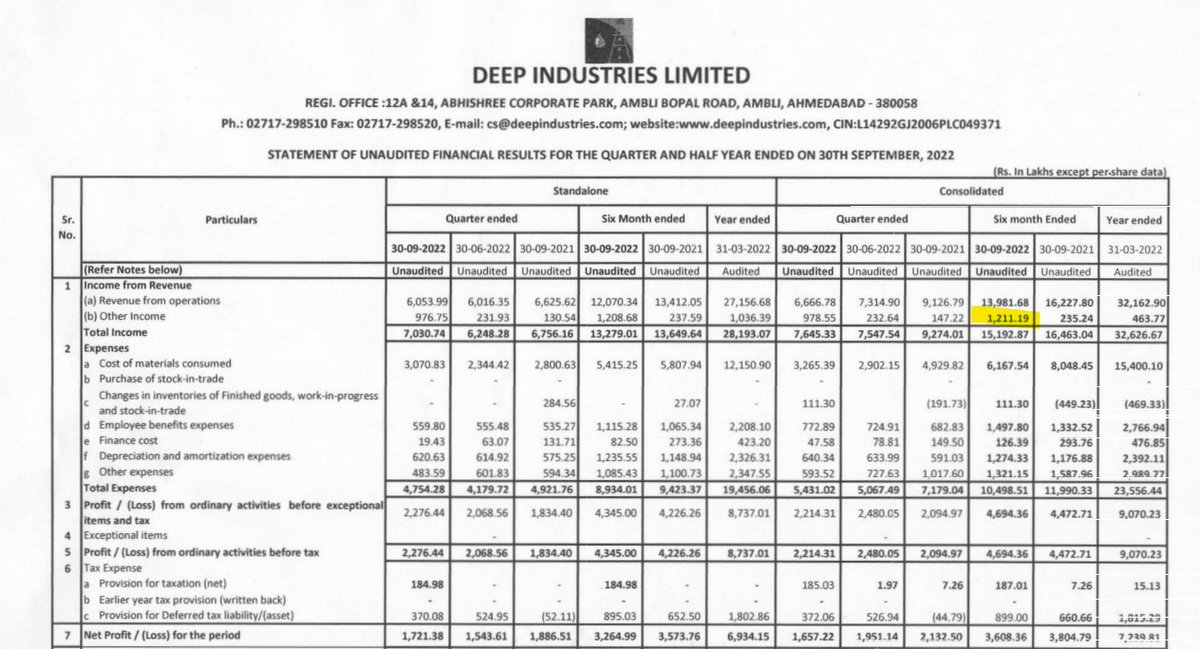

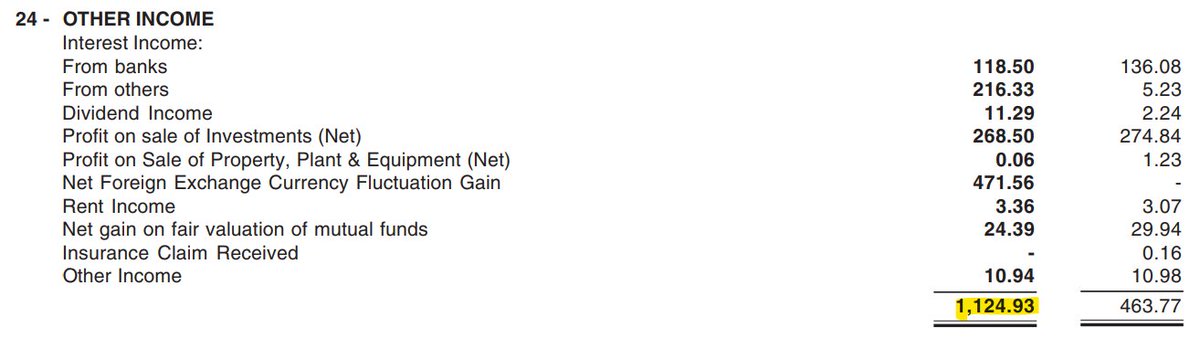

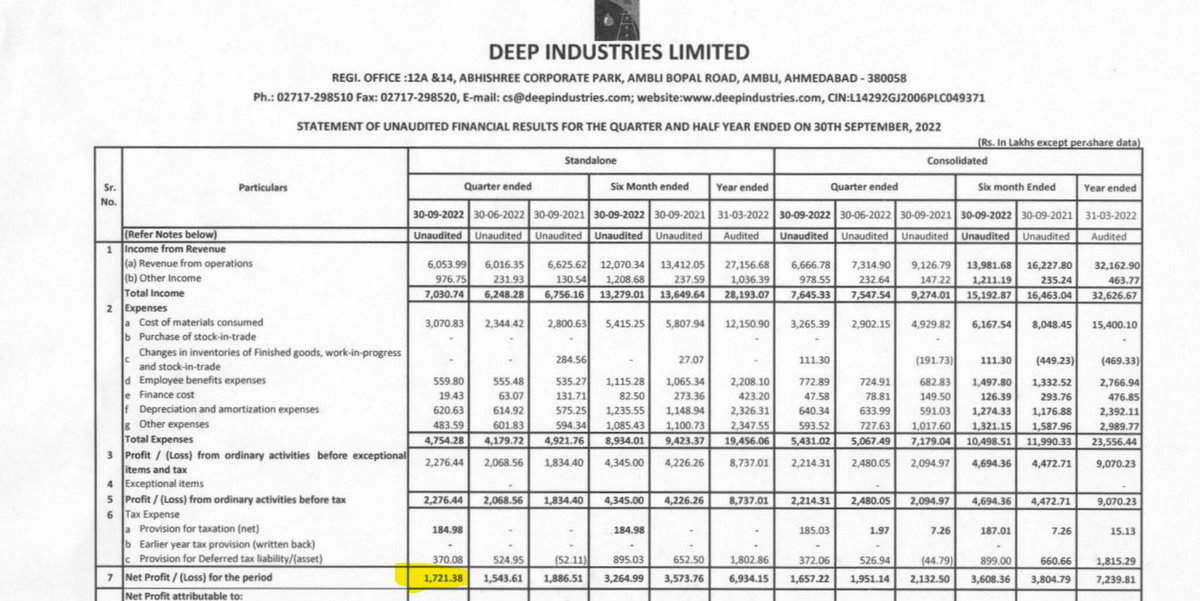

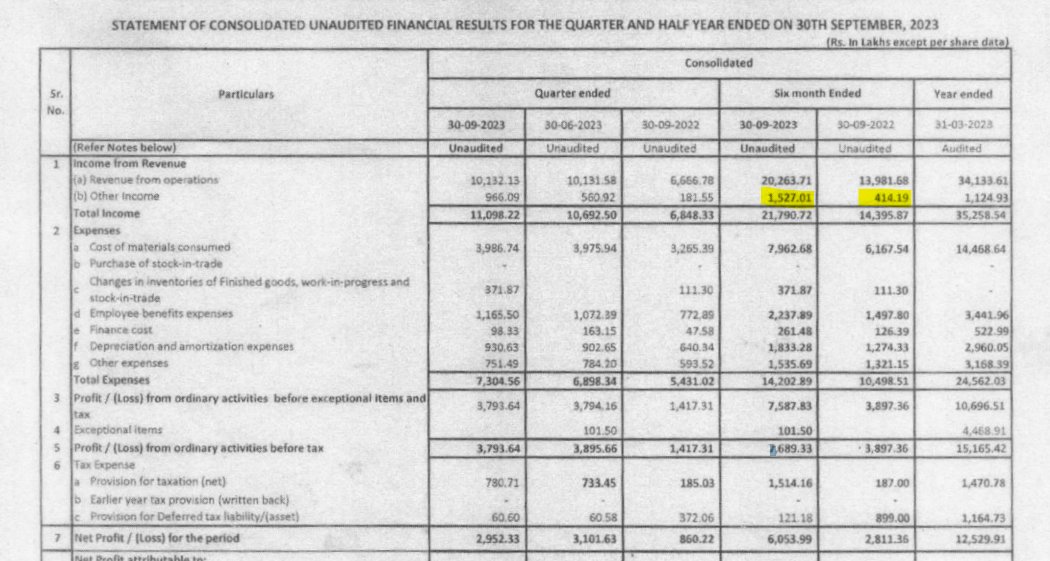

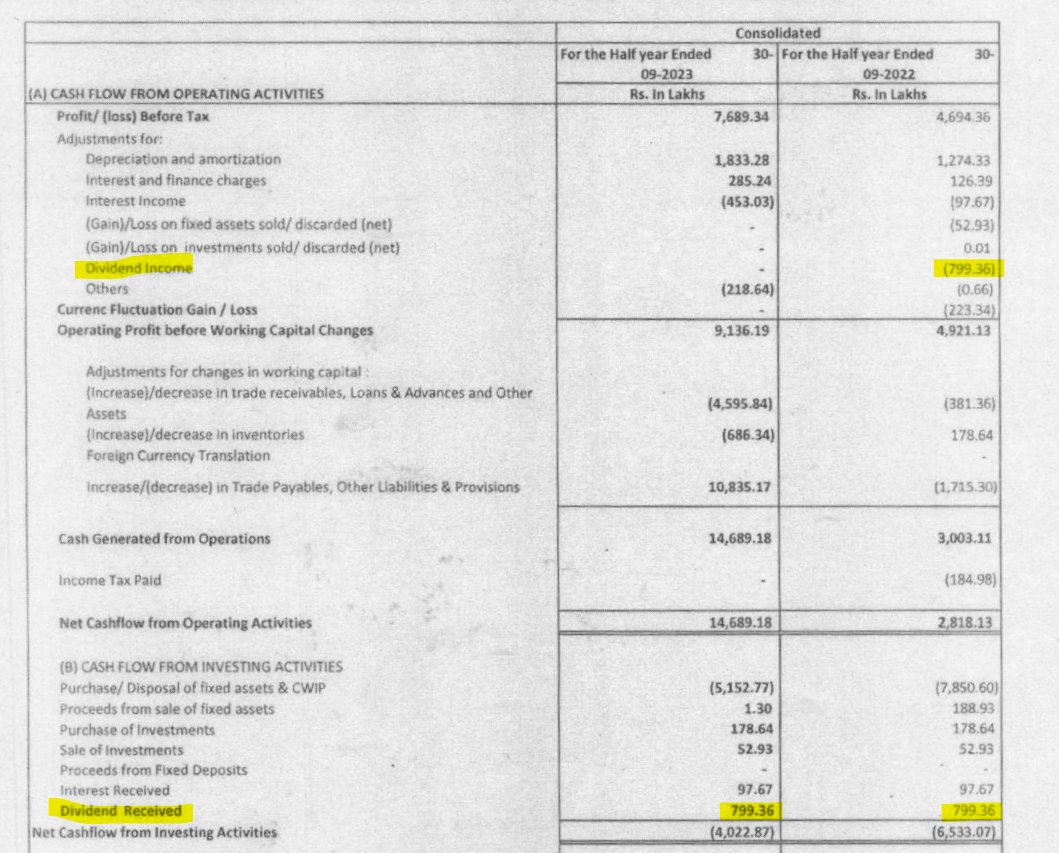

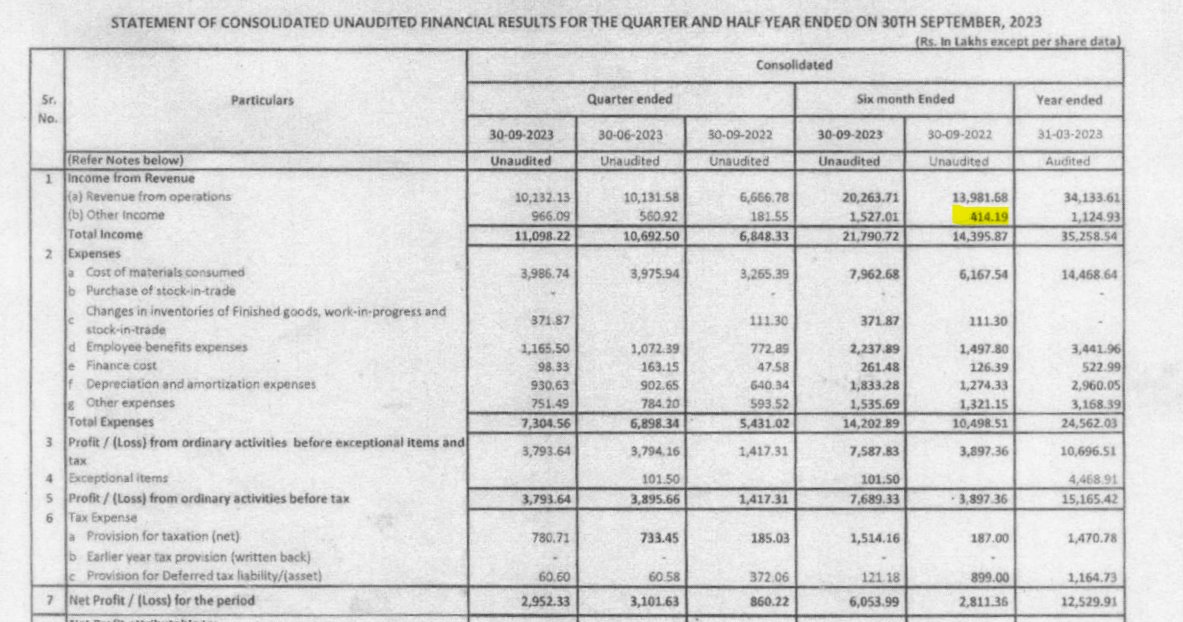

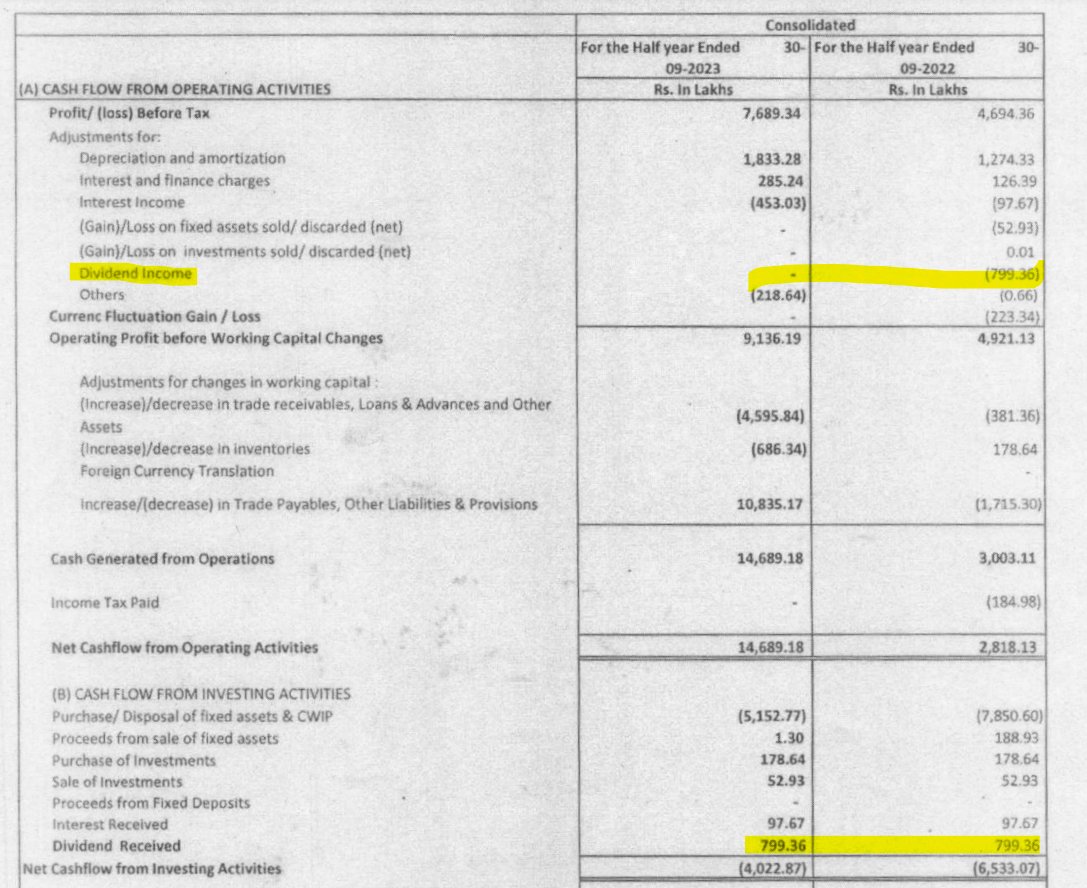

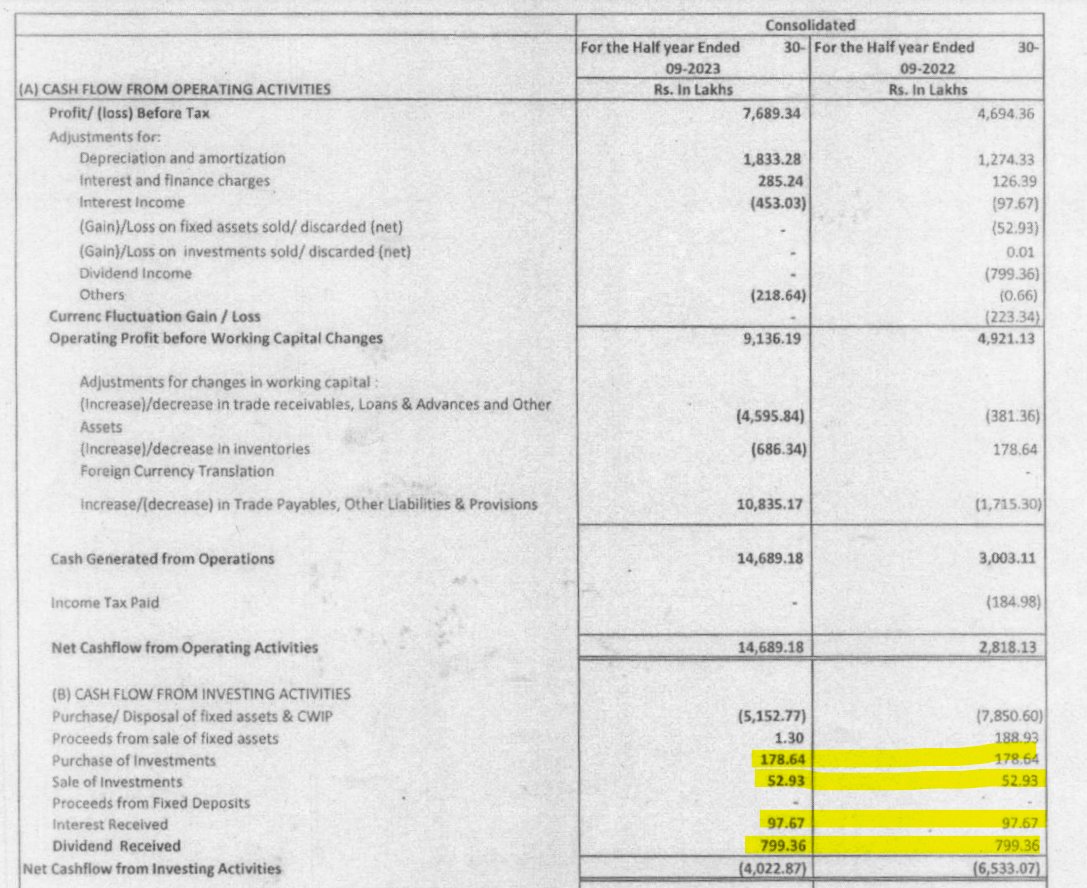

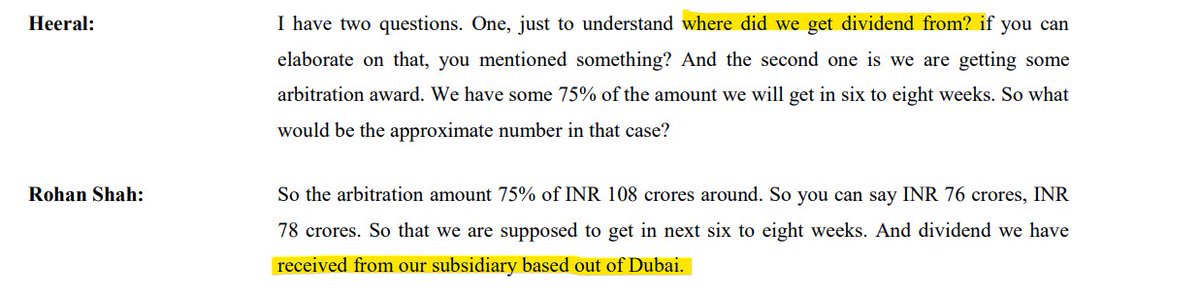

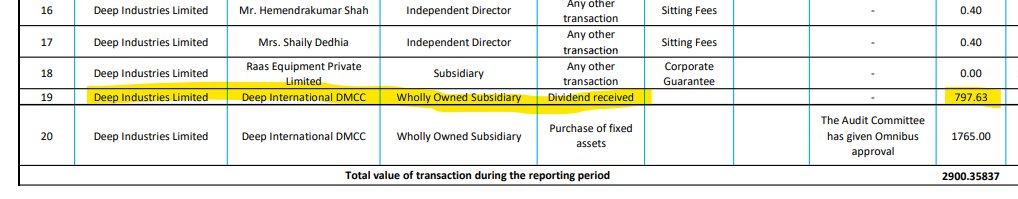

The story begins in Sep-22, when company recorded dividend from its dubai wholly owned subsidiary dividend in the consolidated FS, which should not be added in the Other income of Conso FS.

Let's understand it step by step.

Let's understand it step by step.

Other Income by Deep Industries

Q1 FY23 - 2.32 Cr

Q2 FY23- 9.78 Cr

Q3 FY23- 1.95 Cr

Q4 FY23- 5.15 Cr

YTD

Q1 - 2.32 Cr

Q2(6M) - 12.11 Cr

Q3(9M) - 14.06 Cr

Q4(Full Yr) - 11.24 Cr

For full yr, ideally it should be 19.2 Cr, but Other income reported as 11.24 Cr(difference of 7.96Cr)

Q1 FY23 - 2.32 Cr

Q2 FY23- 9.78 Cr

Q3 FY23- 1.95 Cr

Q4 FY23- 5.15 Cr

YTD

Q1 - 2.32 Cr

Q2(6M) - 12.11 Cr

Q3(9M) - 14.06 Cr

Q4(Full Yr) - 11.24 Cr

For full yr, ideally it should be 19.2 Cr, but Other income reported as 11.24 Cr(difference of 7.96Cr)

In the case of Consolidated FS, if you receive any dividend from the subsidiary, You do not need to show it as an additional "Other income".

It will be eliminated during the preparation of consolidated FS.

This also lead to whole Cash Flow Drama as well.

It will be eliminated during the preparation of consolidated FS.

This also lead to whole Cash Flow Drama as well.

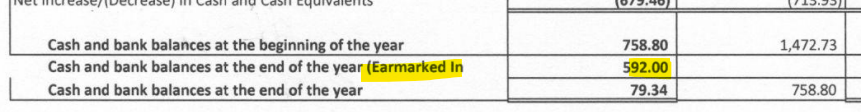

The company rectified the mistake from Mar-23 but did not mention it anywhere in the annual report.

Where as due to this, in Q2 alone there profit wiped out by 50%.

Where as due to this, in Q2 alone there profit wiped out by 50%.

Loading suggestions...