Third-Largest Broker in #India: Angel One Techno-Funda Analysis

#Fundamentals by @BansalSwapan

#Technicals by @Mr_Maurya16

Market Cap ~ 18,750 Cr

CMP ~ 2,235

PE ~ 18.4x

1 Yr Return ~ 40%

Let's deep dive into it 👇

#Fundamentals by @BansalSwapan

#Technicals by @Mr_Maurya16

Market Cap ~ 18,750 Cr

CMP ~ 2,235

PE ~ 18.4x

1 Yr Return ~ 40%

Let's deep dive into it 👇

Technical analysis.

1.Point-and-Figure (P&F) Chart

2.Candlestick chart

1.Point-and-Figure (P&F) Chart

2.Candlestick chart

The 1% x 3 Point and Figure chart highlights the stock's considerable strength. The current DTB ( double top buy ) at 2517 is set to extend the

prior lengthy "X" anchor column & maintaining its position above the 10SMA and B/O of consolidation phase

prior lengthy "X" anchor column & maintaining its position above the 10SMA and B/O of consolidation phase

2.#Candlestick chart

The stock is now trading at its ATH. The long-term moving average (200EMA) and the short-term moving average (50EMA) have recently crossed above each other, creating a golden cross on the chart that indicates the continuation of the bullish trend.

Fundamental analysis:

Business Overview:

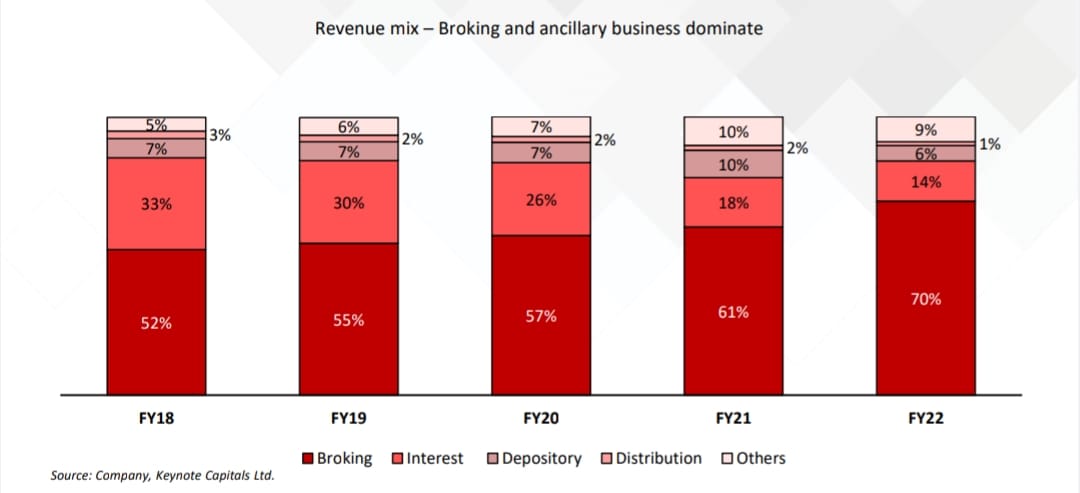

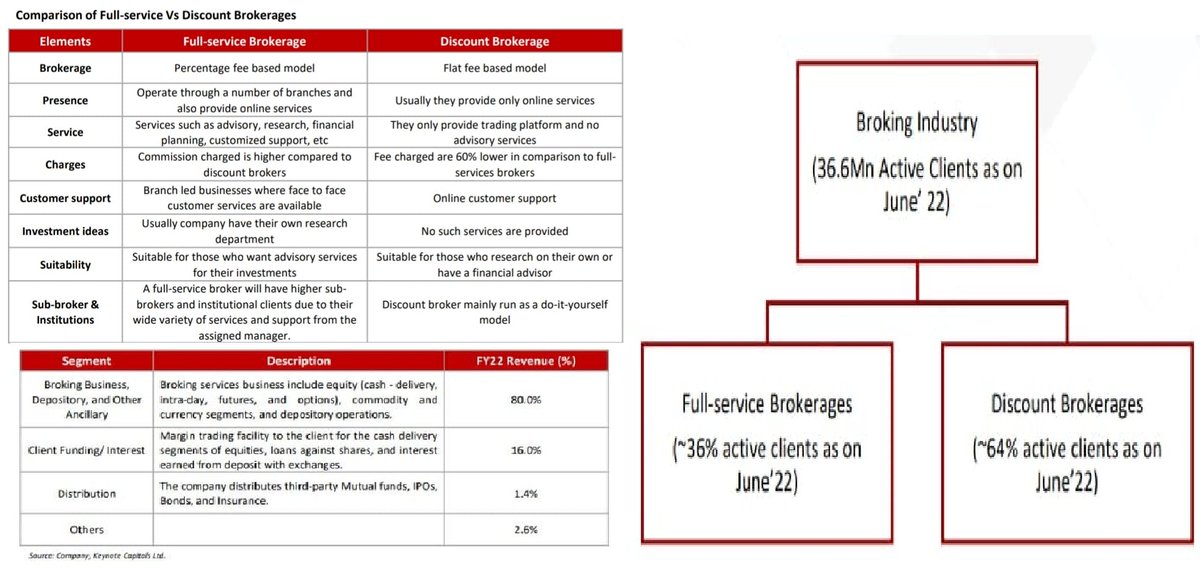

Started in 1996 as a #traditional stock #brokerage firm. Formally known as 'Angel Broking'. Operate in three segments i.e. broking & advisory, client funding & distribution. An all in one financial house with 10M+ Registered clients

Business Overview:

Started in 1996 as a #traditional stock #brokerage firm. Formally known as 'Angel Broking'. Operate in three segments i.e. broking & advisory, client funding & distribution. An all in one financial house with 10M+ Registered clients

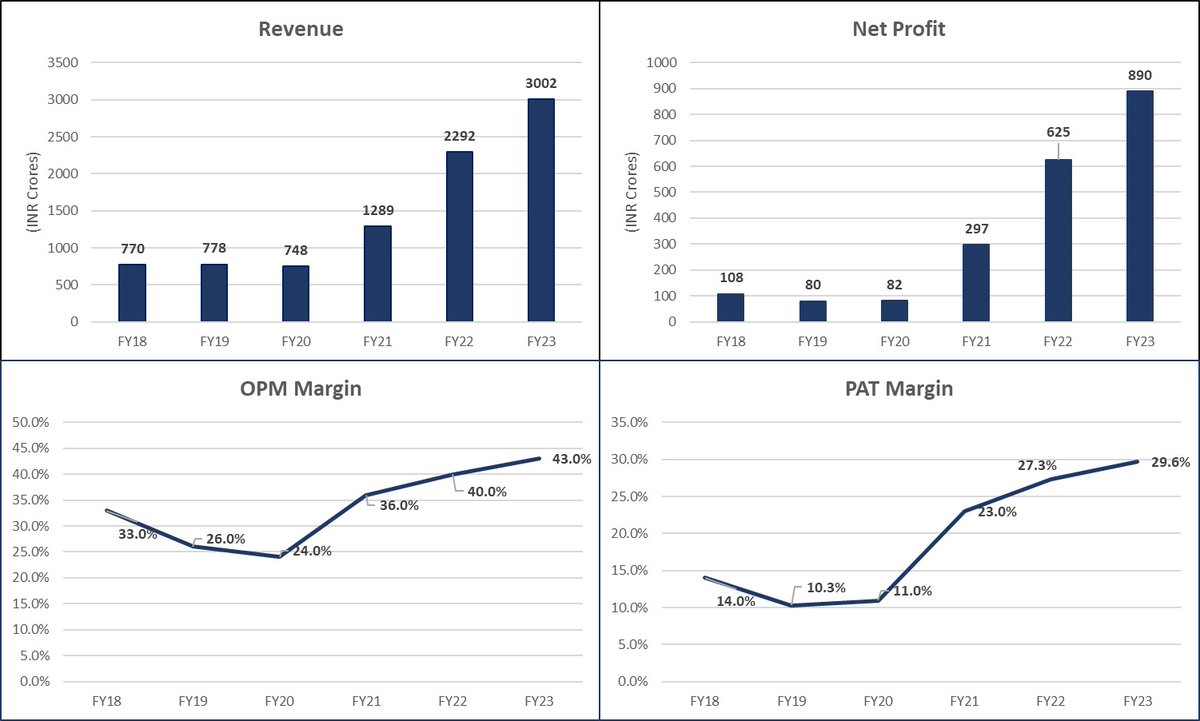

Financial analysis:

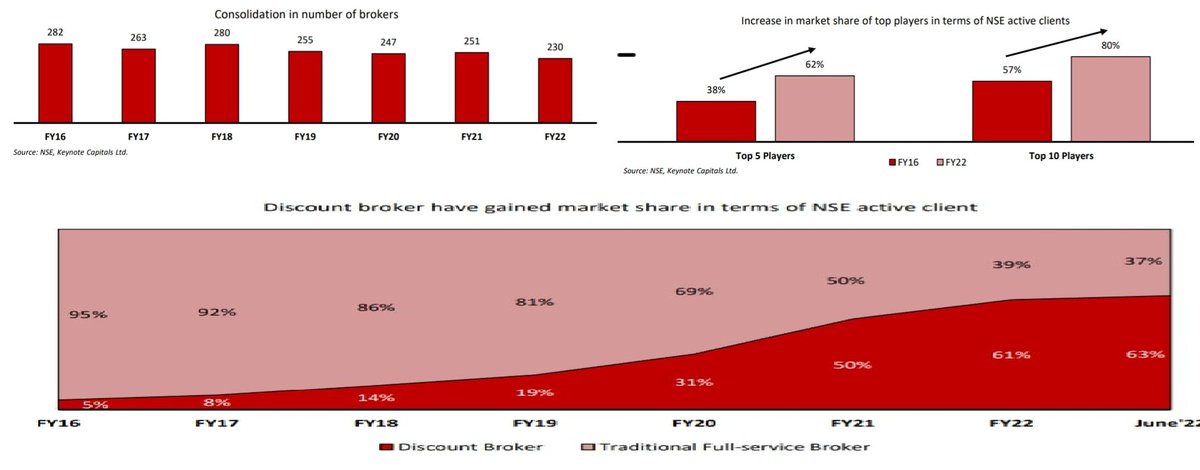

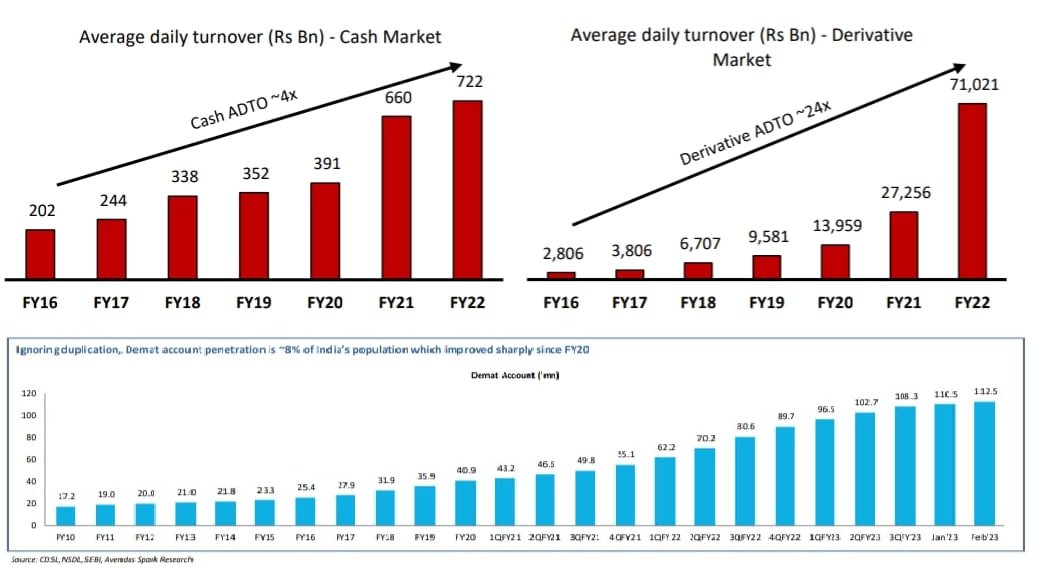

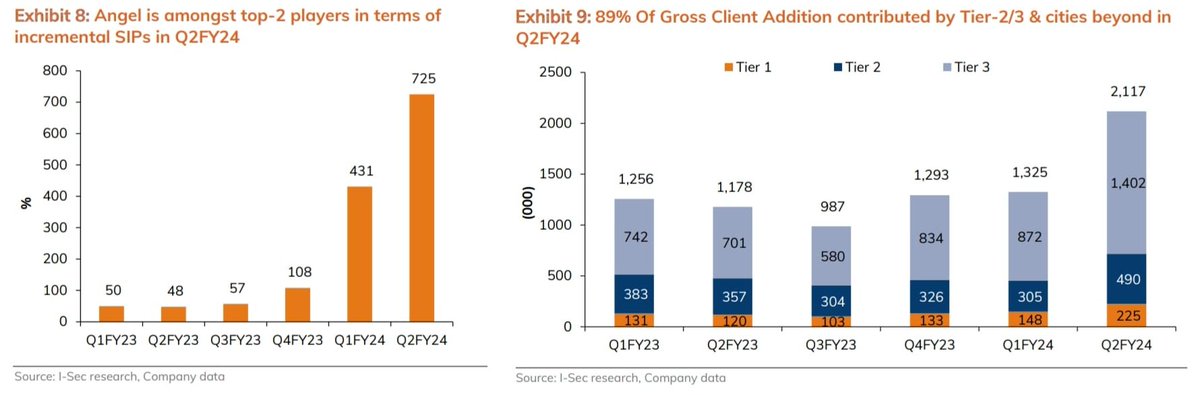

-#Sales has been grown at a CAGR of 31% in last 5 years (Industry tailwinds + move to flat fee model)

-PAT has been grown at a CAGR of 52% in last 5 years

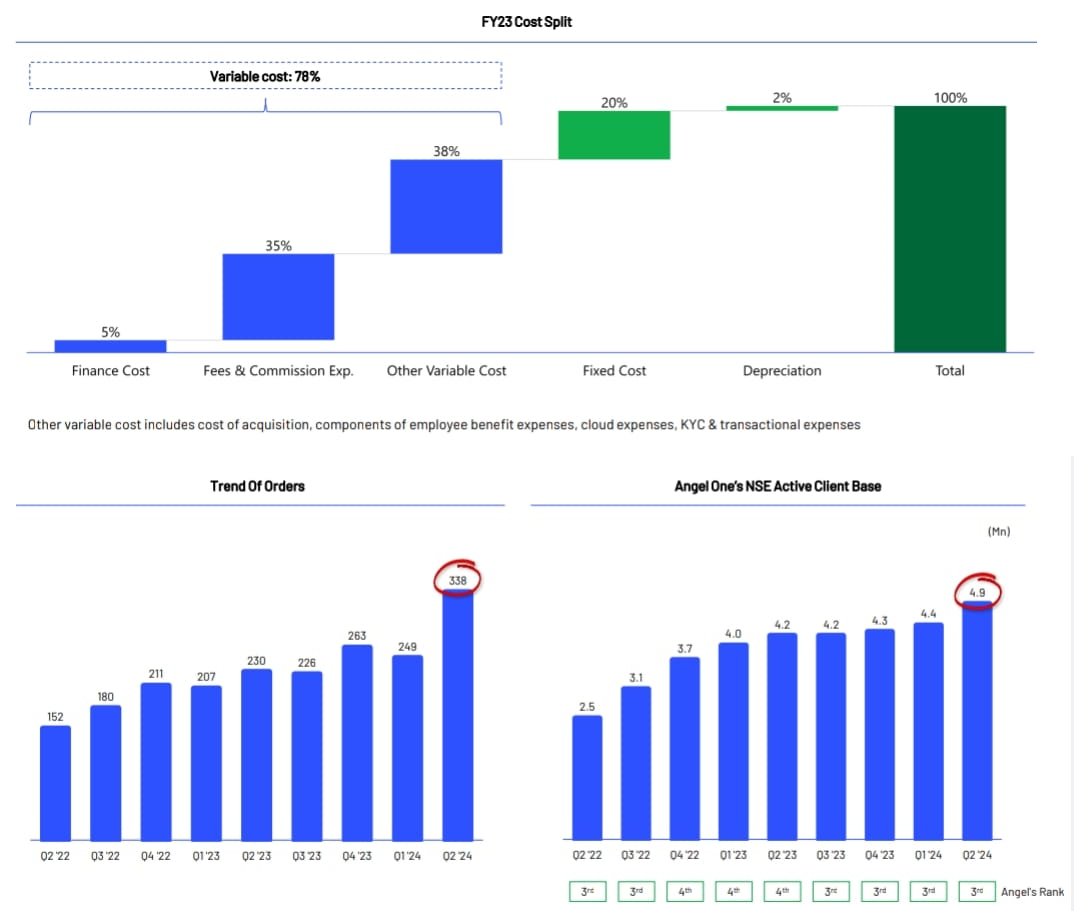

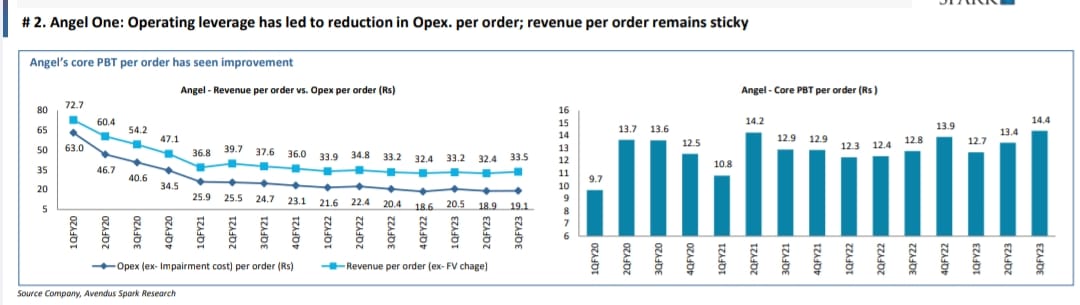

-OPM expanded to 43% from 33% in FY18 (Growth of Brokerage arm verticle + Operating Lvg)

-#Sales has been grown at a CAGR of 31% in last 5 years (Industry tailwinds + move to flat fee model)

-PAT has been grown at a CAGR of 52% in last 5 years

-OPM expanded to 43% from 33% in FY18 (Growth of Brokerage arm verticle + Operating Lvg)

Risks:

1. Highly Cyclical Industry with client addition depends upon Market sentiments (Poor sentiments fall in client addition & Vice versa)

2. IT/Software Disruption (led to loss to clients, which need to be compensated)

3. Only the broker arm is firing & rest are Laggard

1. Highly Cyclical Industry with client addition depends upon Market sentiments (Poor sentiments fall in client addition & Vice versa)

2. IT/Software Disruption (led to loss to clients, which need to be compensated)

3. Only the broker arm is firing & rest are Laggard

Valuations:

Trading at a PE of 18x

Median 3 year PE is of 20x

Peers like:

ISec trades at a PE of 17x

Industry is highly cyclical with regulator holding the key role

With things like Industry Trend, Growth & Risk in consideration Angel might be trading at fair to exp. Side

Trading at a PE of 18x

Median 3 year PE is of 20x

Peers like:

ISec trades at a PE of 17x

Industry is highly cyclical with regulator holding the key role

With things like Industry Trend, Growth & Risk in consideration Angel might be trading at fair to exp. Side

Note : No Recommendation

This post is for #educational purposes

For more such analysis follow:

@Mr_Maurya16 & @BansalSwapan

This post is for #educational purposes

For more such analysis follow:

@Mr_Maurya16 & @BansalSwapan

جاري تحميل الاقتراحات...