-Pyramiding in trading is a strategy where you add to your position in a winning trade to Increase your Overall Profits and keeping the Risk in control.

When done correctly It can maximize the Profits

When done correctly It can maximize the Profits

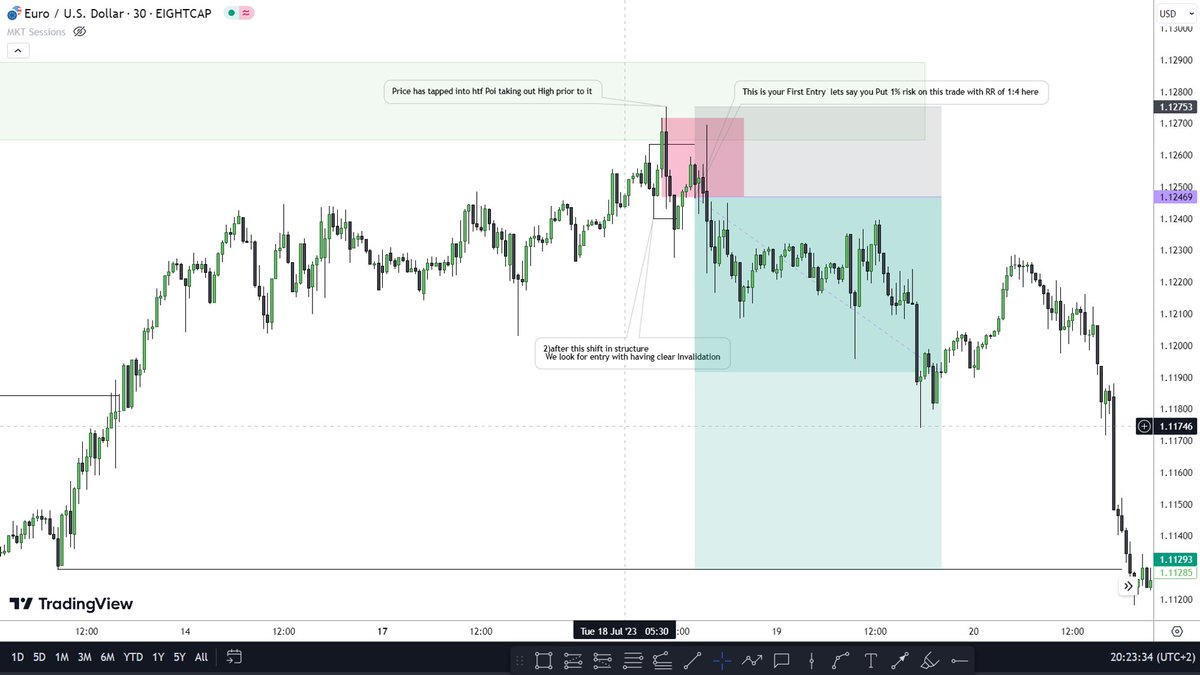

1)Establish a Clear Trading Plan: Before you start pyramiding, have a well-defined trading plan that includes entry ,Your invalidation and Draw on liquidity ,risk and and criteria for identifying potential pyramiding opportunities

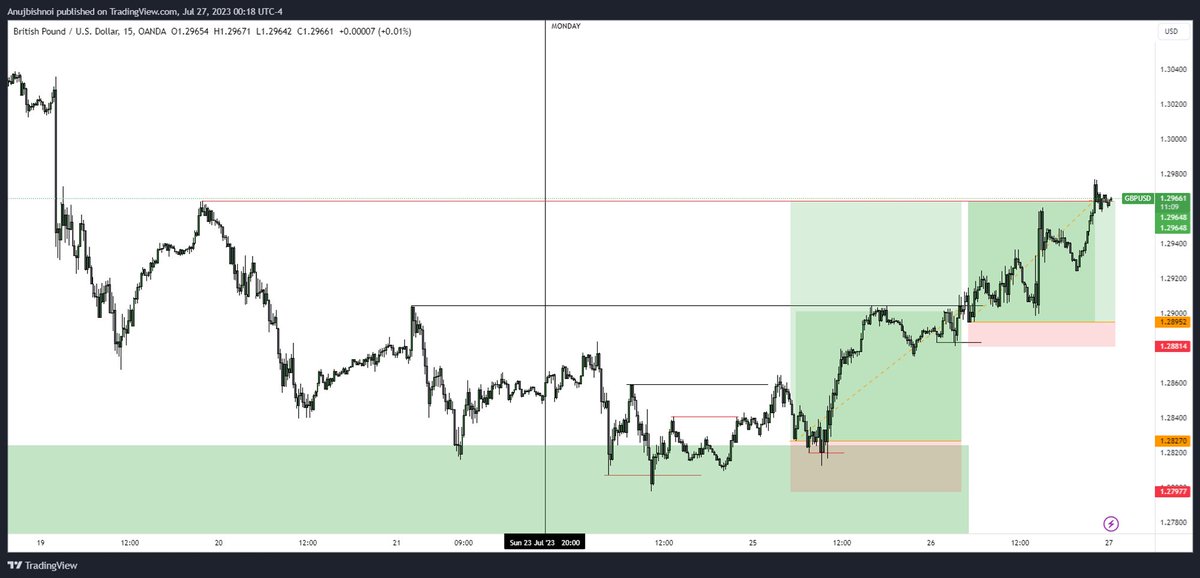

3)Monitor the Trade: Watch your trade closely to identify signs of strength or weakness. If Price starts to move in your favour Fast and we look for new Invalidation to Trim our Stops So that we have More available risk to work with

4)Add to the Position:

When the trade is moving as expected and meets your pyramiding criteria, add to your position. This can be done by buying more of the same asset at the current market price or entering a new trade with the same asset.

When the trade is moving as expected and meets your pyramiding criteria, add to your position. This can be done by buying more of the same asset at the current market price or entering a new trade with the same asset.

5)Risk Management:

Determine how much additional risk you're willing to take with each pyramided position..Your overall risk should lie under what you decided to Put in the first Have clear stop-loss levels for each segment.

Determine how much additional risk you're willing to take with each pyramided position..Your overall risk should lie under what you decided to Put in the first Have clear stop-loss levels for each segment.

Remember that pyramiding can amplify both profits and losses. It's essential to have a solid understanding of the markets, a clear trading plan, and effective risk management strategies in place before attempting to pyramid trades.

Loading suggestions...