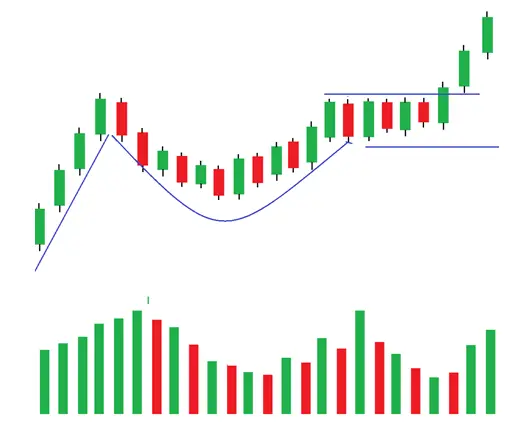

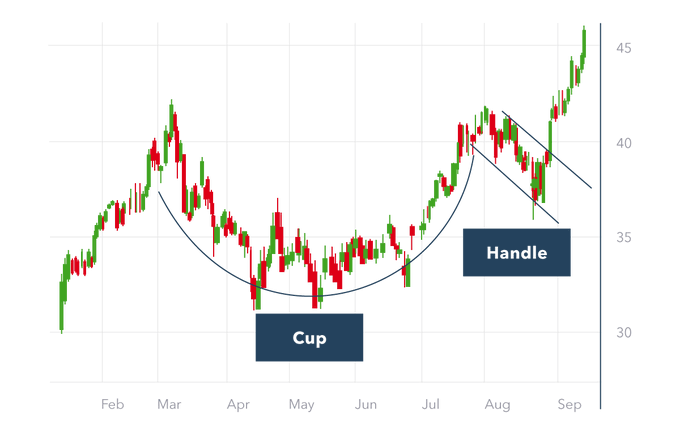

Cup and handle:

The cup and handle is a well-known continuation stock chart pattern that signals a bullish market trend. The cup appears similar to a rounding bottom chart pattern, and the handle is similar to a wedge pattern

@mystock_myview

@GarvModi70

@cakunalshah1983

The cup and handle is a well-known continuation stock chart pattern that signals a bullish market trend. The cup appears similar to a rounding bottom chart pattern, and the handle is similar to a wedge pattern

@mystock_myview

@GarvModi70

@cakunalshah1983

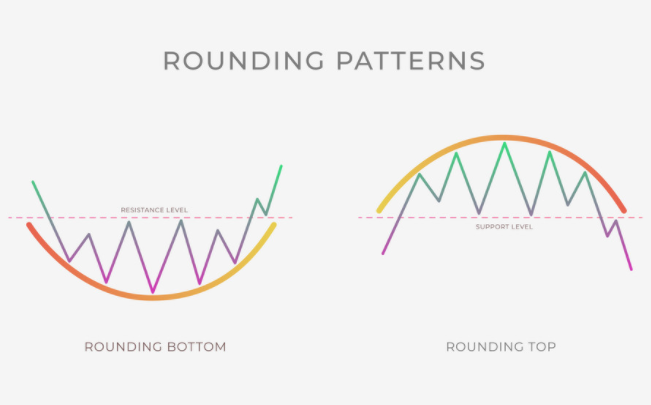

Rounding top/bottom:

The rounded top and bottom are reversal patterns designed to catch the end of a trend and signal a potential reversal point on a price chart.

@MeghaTrader_MT

@Breakoutrade94

@STOCKBAGGER1

@BakuSarman

The rounded top and bottom are reversal patterns designed to catch the end of a trend and signal a potential reversal point on a price chart.

@MeghaTrader_MT

@Breakoutrade94

@STOCKBAGGER1

@BakuSarman

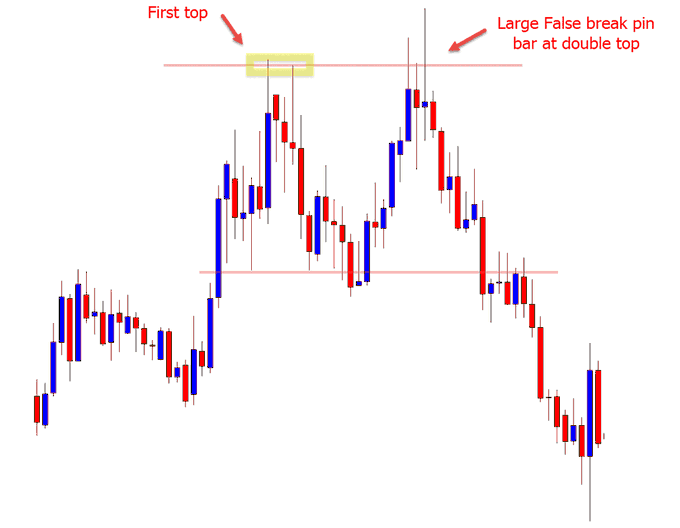

Double top:

A double top looks much like the letter M. An asset’s price will experience a peak, before retracing back to a level of support. It will then climb up once more before reversing back more permanently against the prevailing trend.

@WaveFinancial

@Ishan_Narayan_

A double top looks much like the letter M. An asset’s price will experience a peak, before retracing back to a level of support. It will then climb up once more before reversing back more permanently against the prevailing trend.

@WaveFinancial

@Ishan_Narayan_

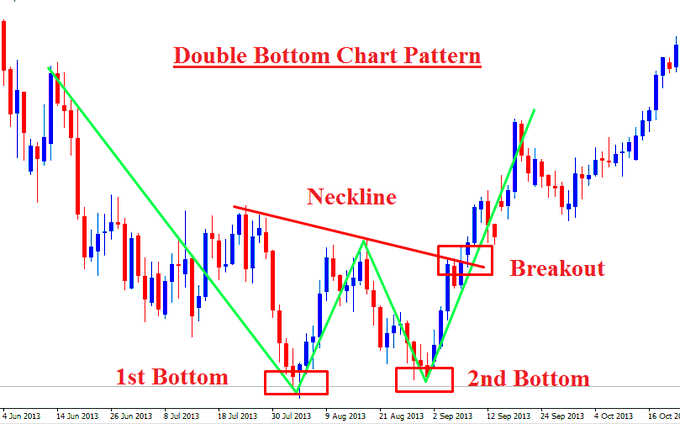

Double bottom:

A double bottom looks similar to the letter W and indicates when the price has made two unsuccessful attempts at breaking through the support level. It is a reversal chart pattern as it highlights a trend reversal.

@GirishAnchanWMA

@me__kaushik

@RICHADICT

A double bottom looks similar to the letter W and indicates when the price has made two unsuccessful attempts at breaking through the support level. It is a reversal chart pattern as it highlights a trend reversal.

@GirishAnchanWMA

@me__kaushik

@RICHADICT

Wedge:

A wedge pattern represents a tightening price movement between the support and resistance lines. There are two types of wedge: rising and falling.

@TechnoChartist

@Addition_Singh

@Niteish_14

A wedge pattern represents a tightening price movement between the support and resistance lines. There are two types of wedge: rising and falling.

@TechnoChartist

@Addition_Singh

@Niteish_14

Flag stock chart pattern:

A flag chart pattern is formed when the market consolidates in a narrow range after a sharp move.

@Earner_Sanjeev

@sonaliktalreja

@ent_wala

A flag chart pattern is formed when the market consolidates in a narrow range after a sharp move.

@Earner_Sanjeev

@sonaliktalreja

@ent_wala

Loading suggestions...