Ever been stopped out of a trade only to see the market reverse in your favor? 🔄

If you can relate, you're in the right place!

In this thread, we'll explore how to trade with institutions and use their strategies to your advantage

I hope this 🧵provides value to your journey!

If you can relate, you're in the right place!

In this thread, we'll explore how to trade with institutions and use their strategies to your advantage

I hope this 🧵provides value to your journey!

♟️ The world of trading is like a chess game, and think of institutional investors as seasoned grandmasters

They have immense resources, experience, and strategies at their disposal, but you can still be an opponent if you understand their moves 🤔

Let me explain...

They have immense resources, experience, and strategies at their disposal, but you can still be an opponent if you understand their moves 🤔

Let me explain...

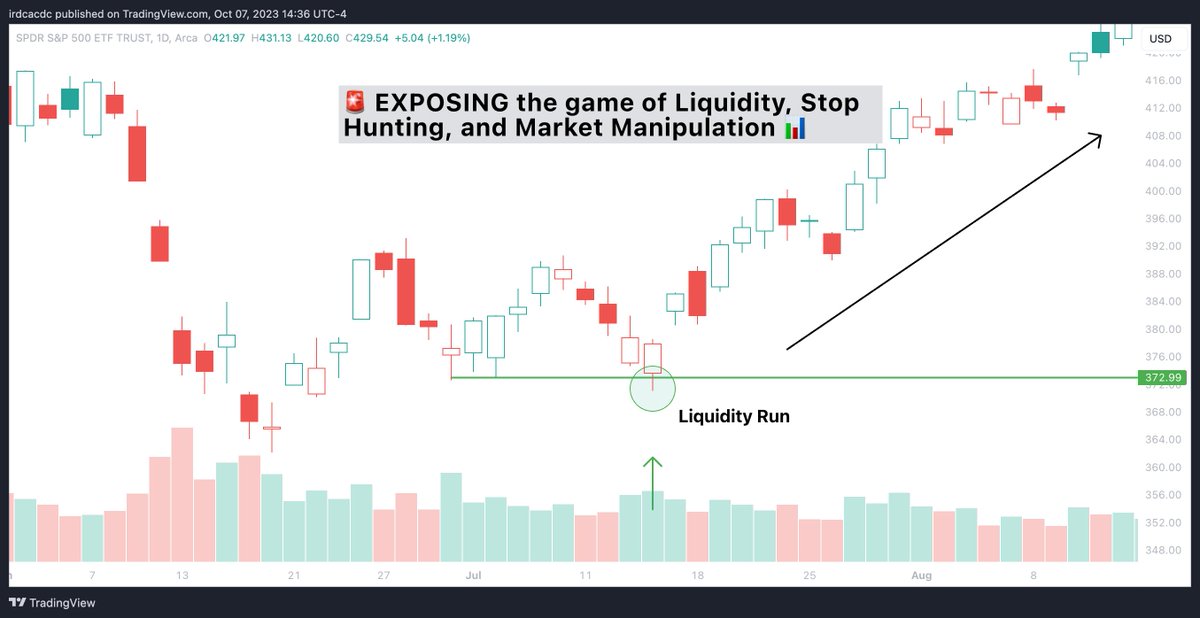

📊 Liquidity:

Institutional investors love it, and you should too!

Institutional investors often take advantage of liquidity to execute substantial trades without disturbing market prices

However, liquidity can also be used as a tool for manipulation 👇

Institutional investors love it, and you should too!

Institutional investors often take advantage of liquidity to execute substantial trades without disturbing market prices

However, liquidity can also be used as a tool for manipulation 👇

What Is Stop Hunting?

Stop hunting is a strategy that involves large traders pushing the market to trigger the stop-loss orders of other traders

The stop-loss orders force those traders out of their positions

Once those orders are cleared, the market reverses

(1/3) 👇

Stop hunting is a strategy that involves large traders pushing the market to trigger the stop-loss orders of other traders

The stop-loss orders force those traders out of their positions

Once those orders are cleared, the market reverses

(1/3) 👇

We can see price sweep below the previous day's low on Friday & held on to the 15 min, @notmrmanziel made the 15 min sweep popular within the community! 🧹

This shows buyers were still active at this level, & sellers got trapped causing big players to push the price higher 📈

This shows buyers were still active at this level, & sellers got trapped causing big players to push the price higher 📈

By positioning yourself strategically around these levels, you can take advantage of the resulting price movements!

✔️ Keep in mind that it's essential to have a thorough understanding of technical analysis and risk management to effectively implement such tactics

✔️ Keep in mind that it's essential to have a thorough understanding of technical analysis and risk management to effectively implement such tactics

Remember, knowledge is power 🧠

Educate yourself on these market dynamics, stay informed, and remain vigilant

While liquidity, stop hunting, and manipulation exist, being aware of their presence can help you make better trading decisions 🧐

Stay smart and adapt! 💪

Educate yourself on these market dynamics, stay informed, and remain vigilant

While liquidity, stop hunting, and manipulation exist, being aware of their presence can help you make better trading decisions 🧐

Stay smart and adapt! 💪

That's a wrap!

I hope you found value within this 🧵 on liquidity, stop hunting, and market manipulation in the stock market 👏

I hope this simple thread helped someone, RT or like if useful, it is much appreciated 😎

Please don't hesitate to ask questions 🙌

I hope you found value within this 🧵 on liquidity, stop hunting, and market manipulation in the stock market 👏

I hope this simple thread helped someone, RT or like if useful, it is much appreciated 😎

Please don't hesitate to ask questions 🙌

As always, to end this thread, I will leave you with a few follow suggestions: ✅

@DBookTrading: Volume

@fabiansoss: Volume

@notmrmanziel: Edu

@Jake__Wujastyk: Edu

@Strat_Trades: Edu

@RockyBTrades: Edu

@cs_tradess: Edu

@Braczyy: Edu

@TSDR_Trading: Edu

@SpencerParsons0: Charts

@DBookTrading: Volume

@fabiansoss: Volume

@notmrmanziel: Edu

@Jake__Wujastyk: Edu

@Strat_Trades: Edu

@RockyBTrades: Edu

@cs_tradess: Edu

@Braczyy: Edu

@TSDR_Trading: Edu

@SpencerParsons0: Charts

Loading suggestions...