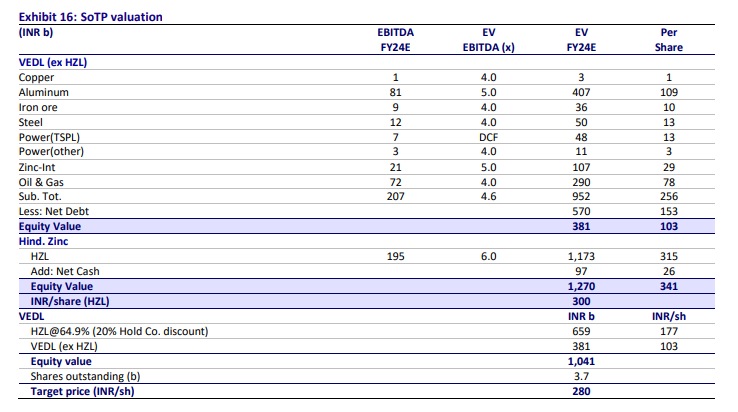

First, you do a SoTP valuation and if you find SoTP valuation quite higher than the current market cap; you buy the company before demerger.

Now, if you look at Vedanta, it comprises of so many businesses that valuing it now is really difficult.

2/n

Now, if you look at Vedanta, it comprises of so many businesses that valuing it now is really difficult.

2/n

Moreover you do not know how corporate office debt will be allocated to different businesses.

I was going through MOSL research reports of 2022 & 2023 and found drastic (over 50%) change in the value they assign to different individual businesses in these two reports.

3/n

I was going through MOSL research reports of 2022 & 2023 and found drastic (over 50%) change in the value they assign to different individual businesses in these two reports.

3/n

Basically no one knows the value of different businesses in this complicated structure.

The demerger process will take 12-18 months; based on sentiments, valuation may change drastically.

Hence it is important to have significant margin of safety if one buys pre-demerger.

4/n

The demerger process will take 12-18 months; based on sentiments, valuation may change drastically.

Hence it is important to have significant margin of safety if one buys pre-demerger.

4/n

One should also note that large part of the valuation is derived from #HZL, now in this demerger scheme, one company will hold stake in HZL along with new age businesses such as Semi conductor business & LCD screen business.

How much holding co discount someone should assign?

5/n

How much holding co discount someone should assign?

5/n

In short there are a lot of moving parts, there is a significant debt and entire holding of the promoters are pledged. Hence getting approval from the lenders may complicate the demerger process or at least may take longer time and Dynamics of individual business may change.

7/n

7/n

An outright sell of business post listing may definitely unlock value.

Hence, the better way to participate in this #specialsituation is to wait for demerger to complete and buy individual businesses which may get listed at lower valuation due to sell off or other reasons.

8/n

Hence, the better way to participate in this #specialsituation is to wait for demerger to complete and buy individual businesses which may get listed at lower valuation due to sell off or other reasons.

8/n

Note that institutional holding is not very high and hence there may not be significant sell off post demerger.

But, sell of a business will definitely give an opportunity where open offer may be launched giving minority investors good exit.

9/n

But, sell of a business will definitely give an opportunity where open offer may be launched giving minority investors good exit.

9/n

A few years back when #Adani group did a similar demerger, it resulted into a massive value unlocking.

But, Vedanta is largely into commodities. Only the time will tell how much value will be unlocked for both minority and for the promoter?

10/10

But, Vedanta is largely into commodities. Only the time will tell how much value will be unlocked for both minority and for the promoter?

10/10

Disc: Nil as of now. The tweet is just for educational purposes and it is not meant for any advice.

Loading suggestions...