Note:

This thread might be long because I want include all details to make sure you perfectly understand it.

So make sure you read till the end!

• But before begin:

Kindly retweet the first tweet up there to help other traders learn too.

Done? Thank you!

Now let's dive ⤵️

This thread might be long because I want include all details to make sure you perfectly understand it.

So make sure you read till the end!

• But before begin:

Kindly retweet the first tweet up there to help other traders learn too.

Done? Thank you!

Now let's dive ⤵️

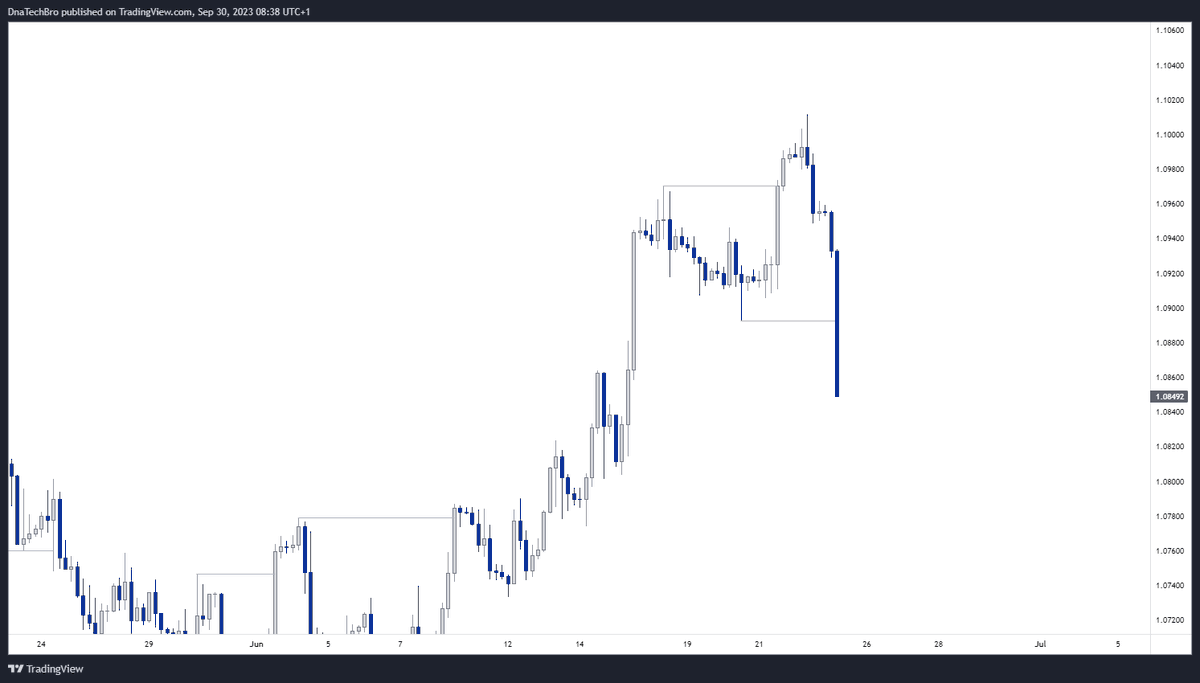

As you should know by know... Supply and demand zones are everywhere, on every timeframe.

But not all of them are tradable.

If you try to trade all of them, you're setting yourself up for failure.

Here's what to do instead:

Trade only valid ones.

How? ⤵️

But not all of them are tradable.

If you try to trade all of them, you're setting yourself up for failure.

Here's what to do instead:

Trade only valid ones.

How? ⤵️

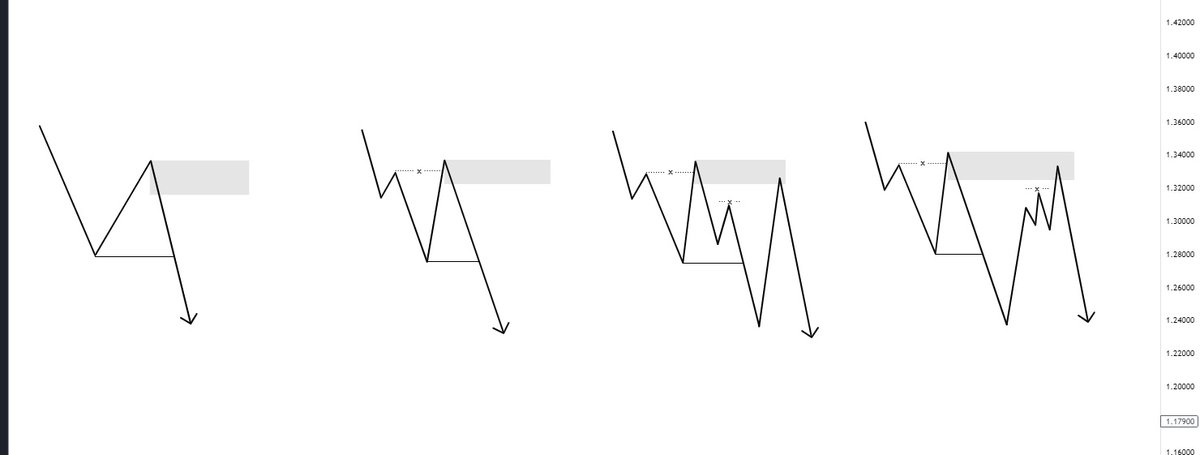

The first question you want to ask yourself when picking you zones and area of interest is...

"What did this zone achieve?"

The first way to validate a zone is by checking to see if that zone breaks some structure.

But why is this so important? ⤵️

"What did this zone achieve?"

The first way to validate a zone is by checking to see if that zone breaks some structure.

But why is this so important? ⤵️

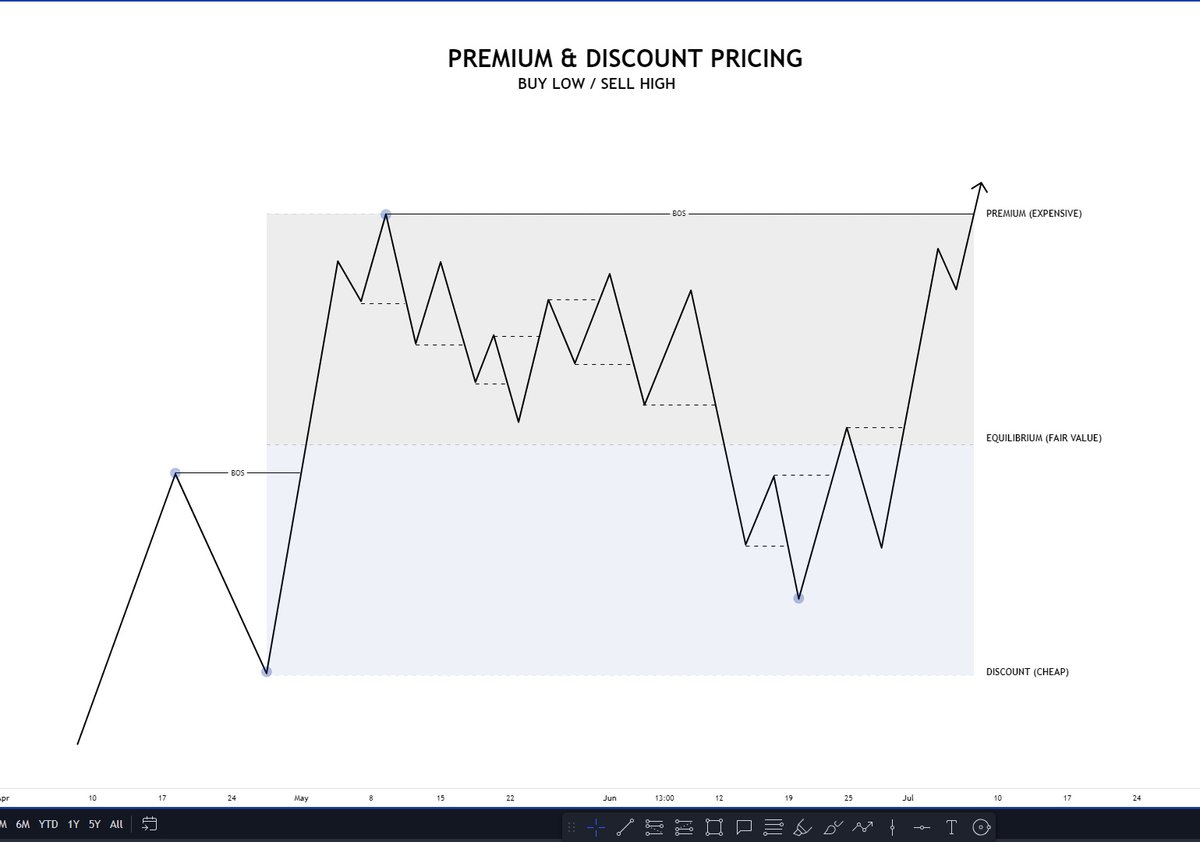

Now we have 3 types of structure...

Swing structure

Internal structure

& Fractal structure

The more significant the structure that a zone manages to break, then the more significant that zone should be.

A zone that breaks swing structure is stronger and holds more weight.

Swing structure

Internal structure

& Fractal structure

The more significant the structure that a zone manages to break, then the more significant that zone should be.

A zone that breaks swing structure is stronger and holds more weight.

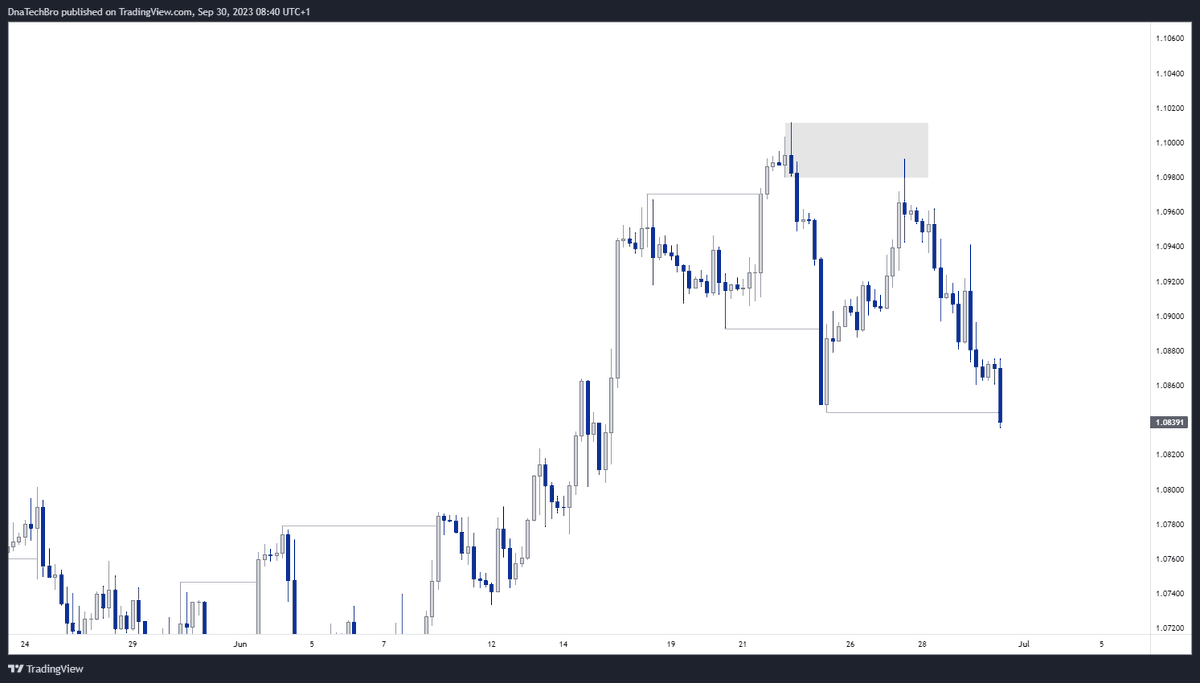

Next step from there is to look at other confluences like:

➢ Pricing

➢ Flip Zone

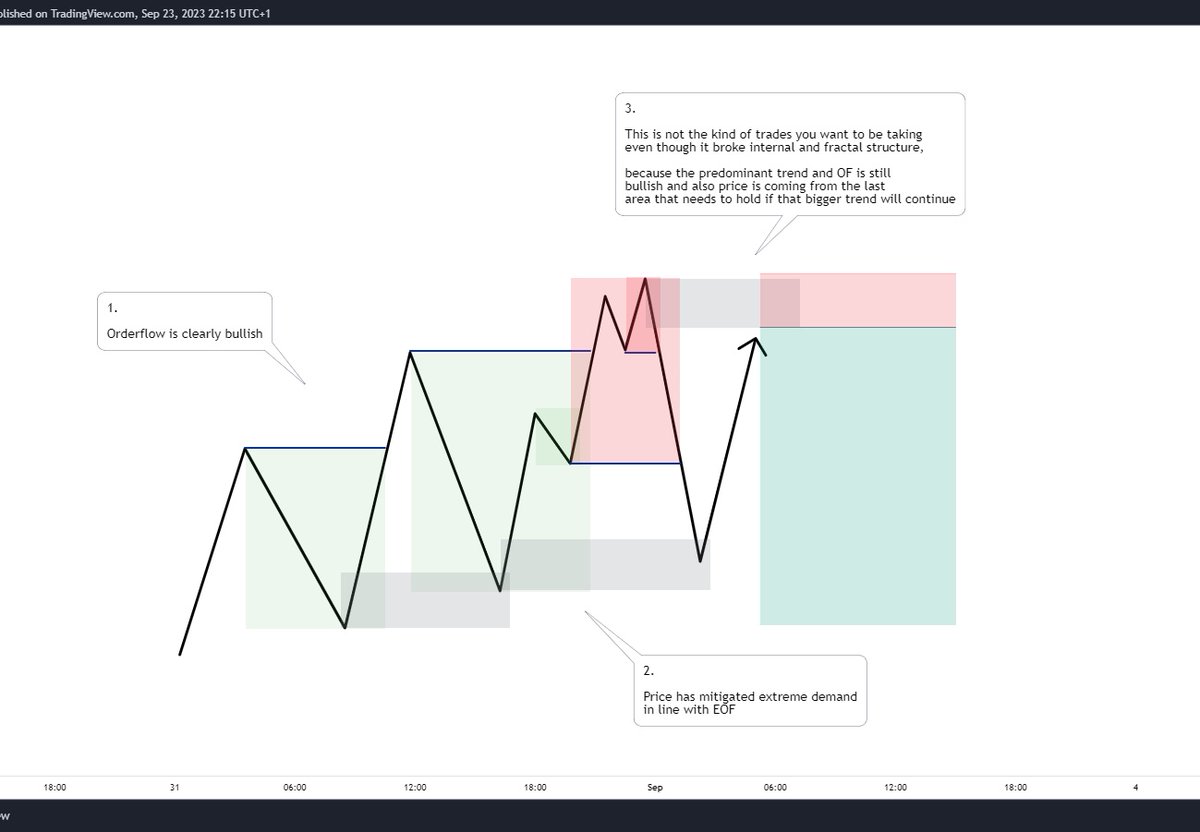

➢ Orderflow

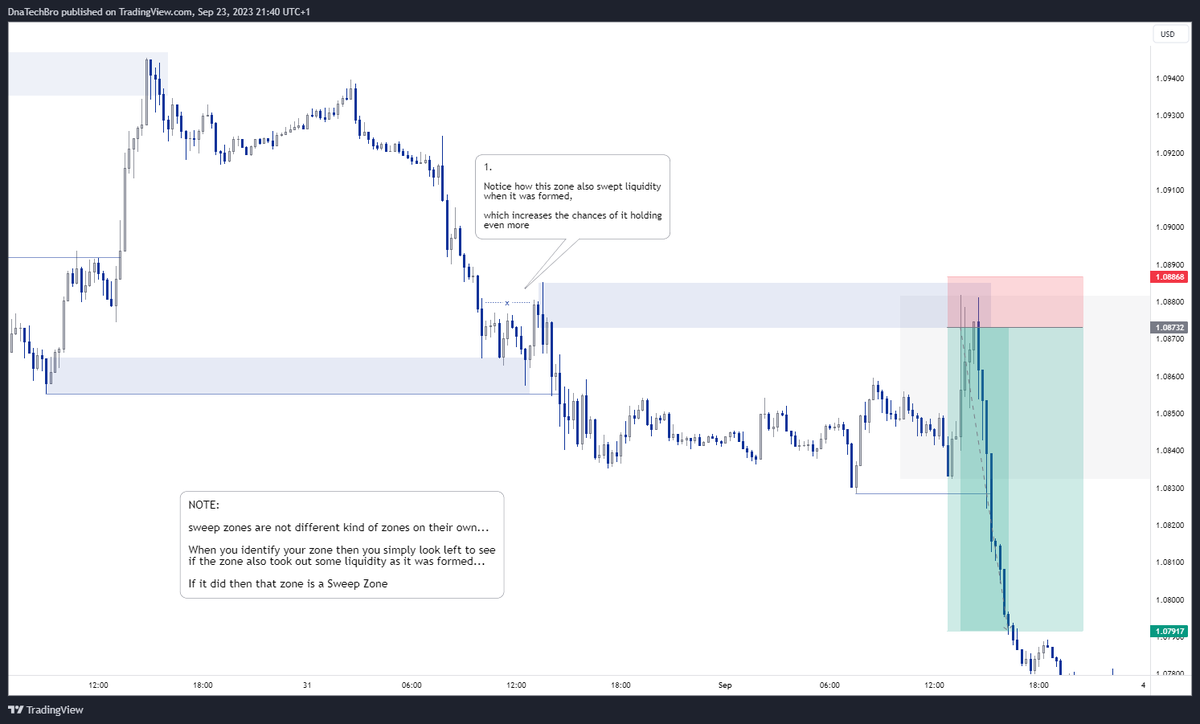

➢ Liq. Sweep

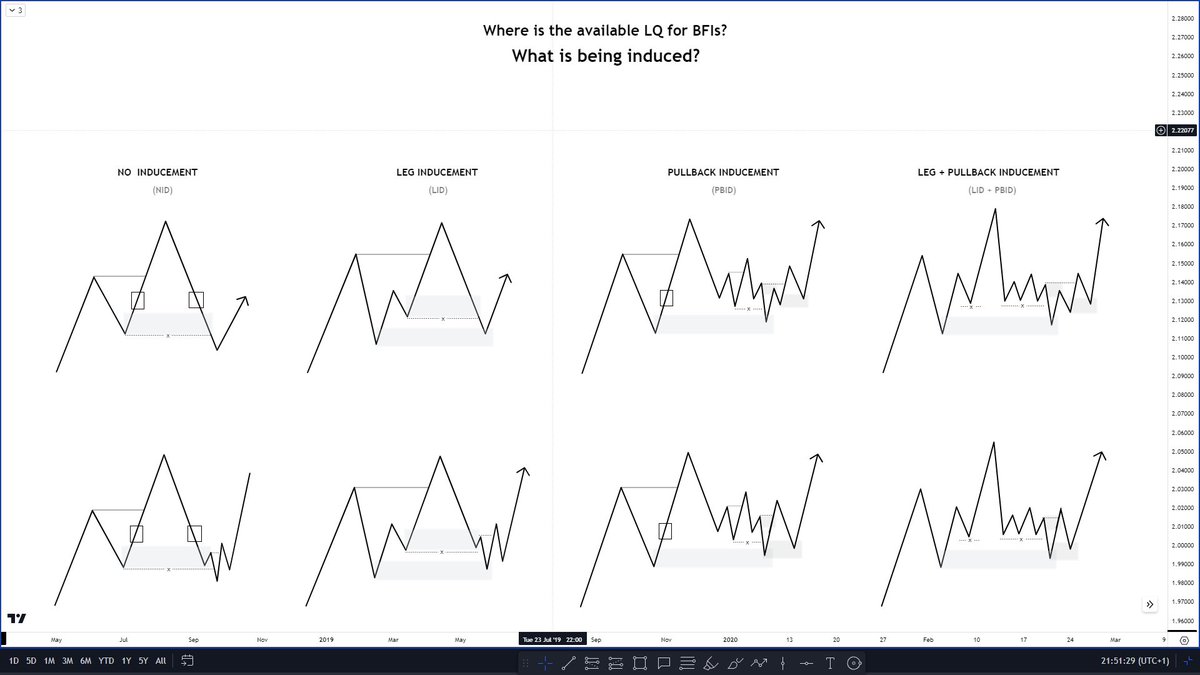

➢ Inducement

➢ Visible on HTF

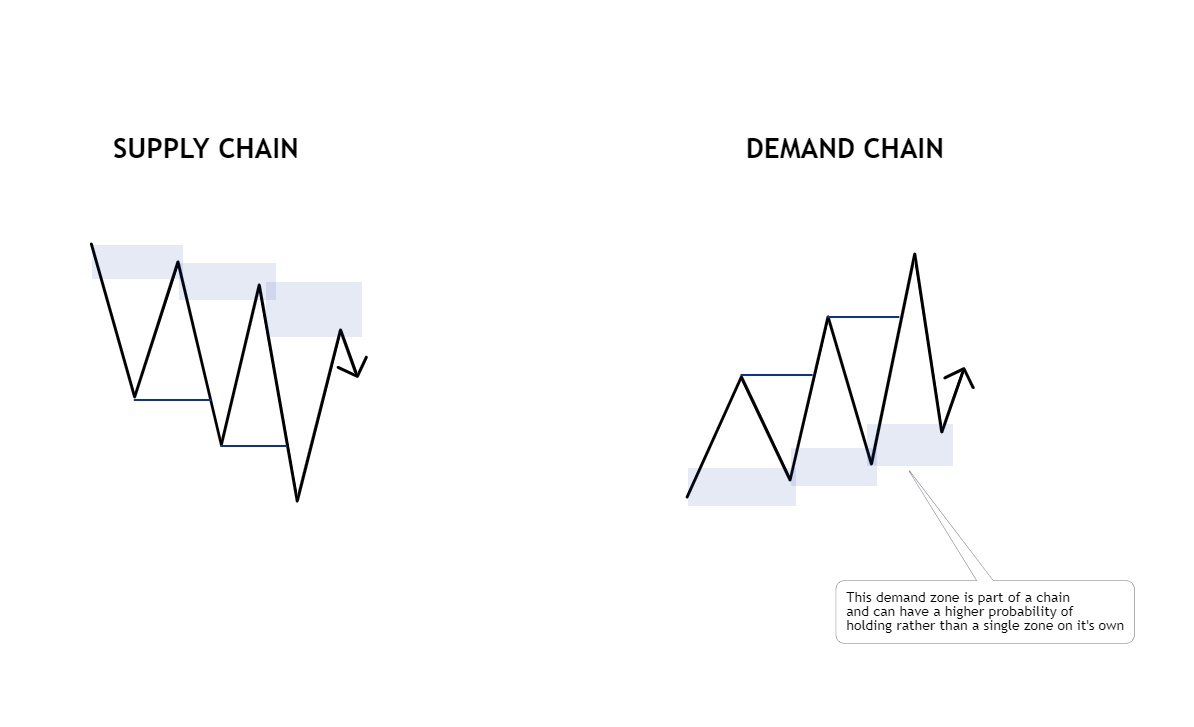

➢ Part of a price Chain, etc

Let's take them one after the other ⤵️

➢ Pricing

➢ Flip Zone

➢ Orderflow

➢ Liq. Sweep

➢ Inducement

➢ Visible on HTF

➢ Part of a price Chain, etc

Let's take them one after the other ⤵️

VISIBLE ON HTF?

Most people don't pay attention to this one...

But a high timeframe zone will hold more weight than a low timeframe zone.

So it's important to also pay attention to higher timeframe structure, objective and narratives...

Most people don't pay attention to this one...

But a high timeframe zone will hold more weight than a low timeframe zone.

So it's important to also pay attention to higher timeframe structure, objective and narratives...

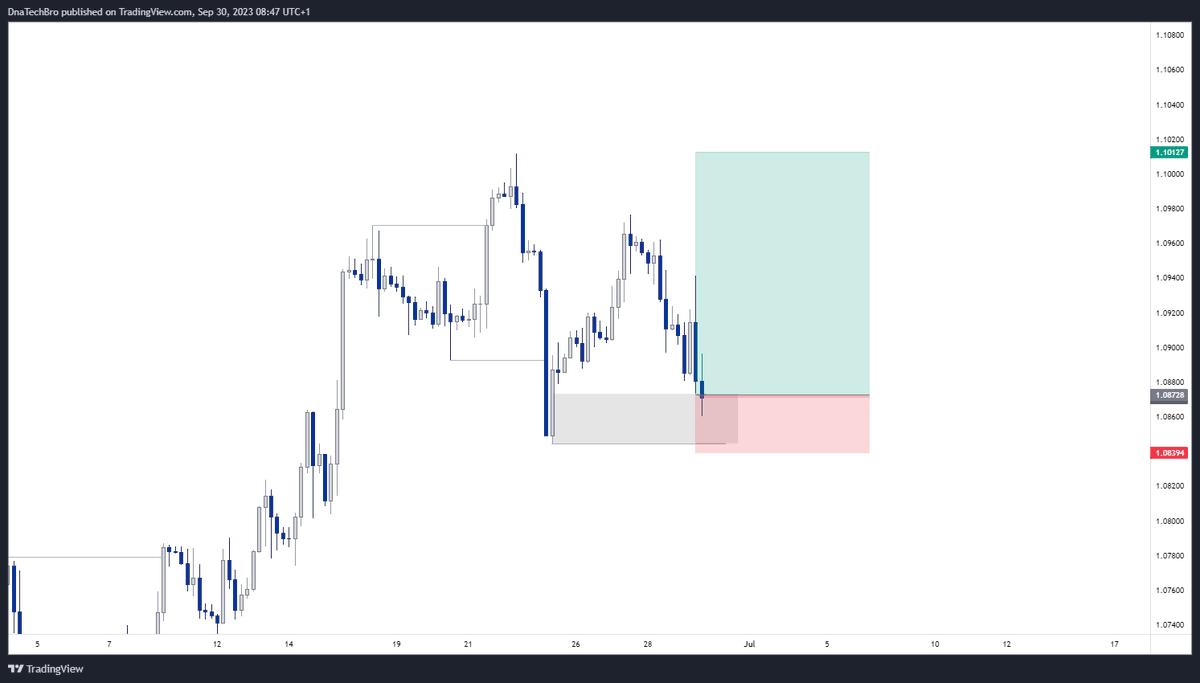

But the most important one of them all and 'a must have' for me before I consider trading that zone...

Is that it must at least break a structure.

And ideally be visible on my medium timeframe.

After that I can then look to see if there are other confluences or not.

Is that it must at least break a structure.

And ideally be visible on my medium timeframe.

After that I can then look to see if there are other confluences or not.

Also note that we don't trade them in isolation...

You don't just see a sweep zone and decide to trade it like that.

You have to consider other things like market structure, currently orderflow, what has been mitigated, current and next objective, Etc.

They work hand in hand.

You don't just see a sweep zone and decide to trade it like that.

You have to consider other things like market structure, currently orderflow, what has been mitigated, current and next objective, Etc.

They work hand in hand.

And that's a wrap for now!

If you found this helpful;

1. Consider following me (@dnatechbro) for more

2. Also repost the first tweet for other traders to see and learn from too.

Happy trading 🥂

If you found this helpful;

1. Consider following me (@dnatechbro) for more

2. Also repost the first tweet for other traders to see and learn from too.

Happy trading 🥂

PS:

If you're looking for Funding to elevate your trading...

I recommend you check out my previous thread about FundingPips.

It contain everything you need to know about the fastest growing prop firm ⤵️

If you're looking for Funding to elevate your trading...

I recommend you check out my previous thread about FundingPips.

It contain everything you need to know about the fastest growing prop firm ⤵️

Loading suggestions...