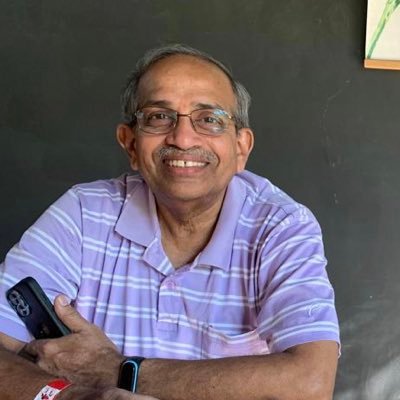

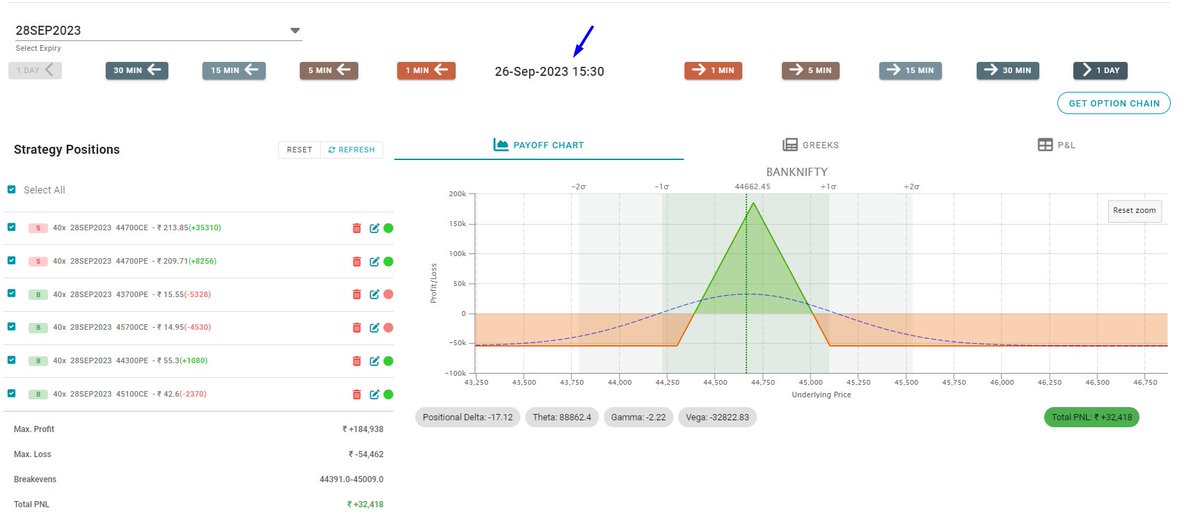

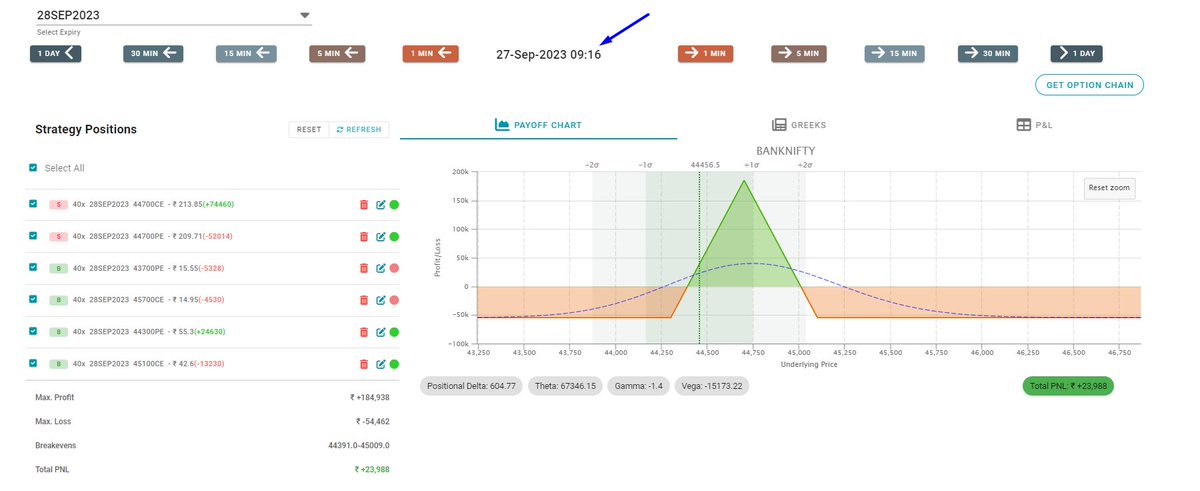

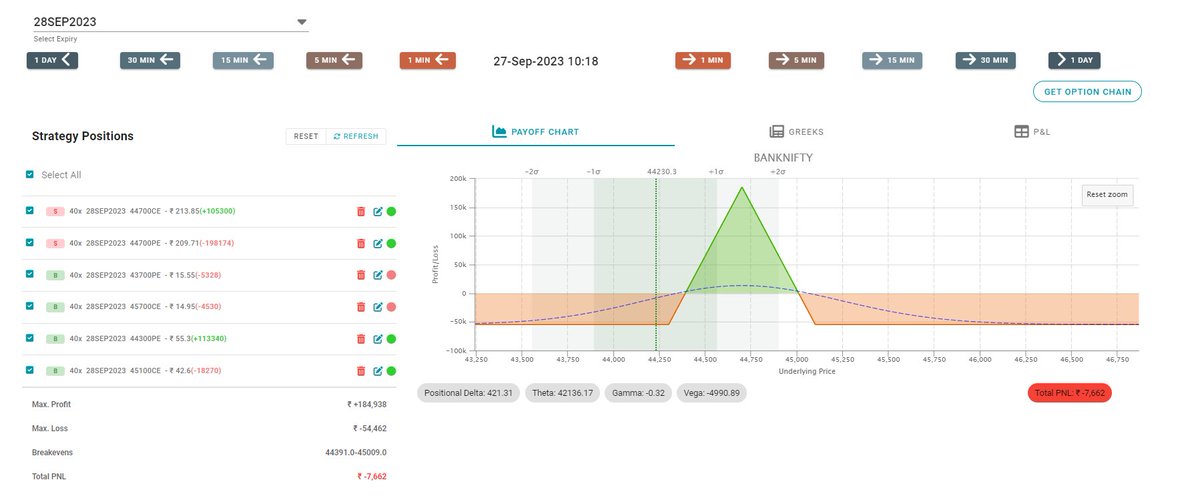

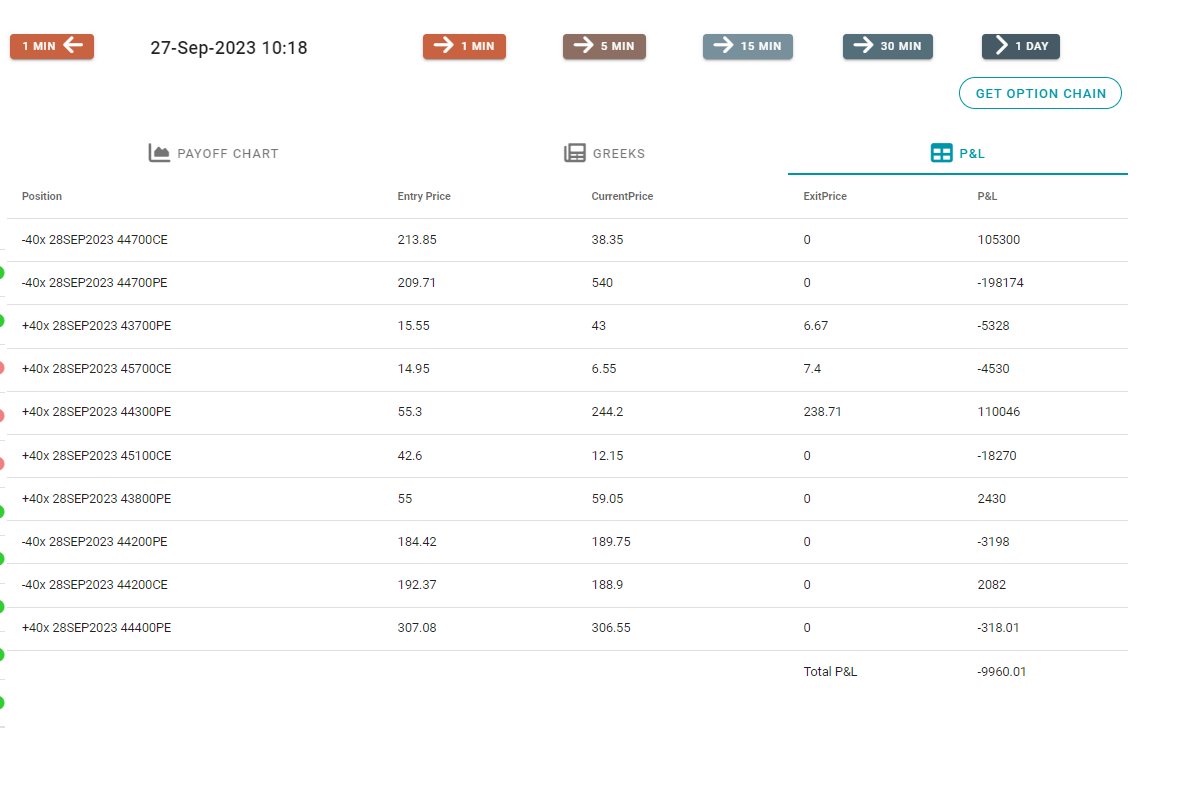

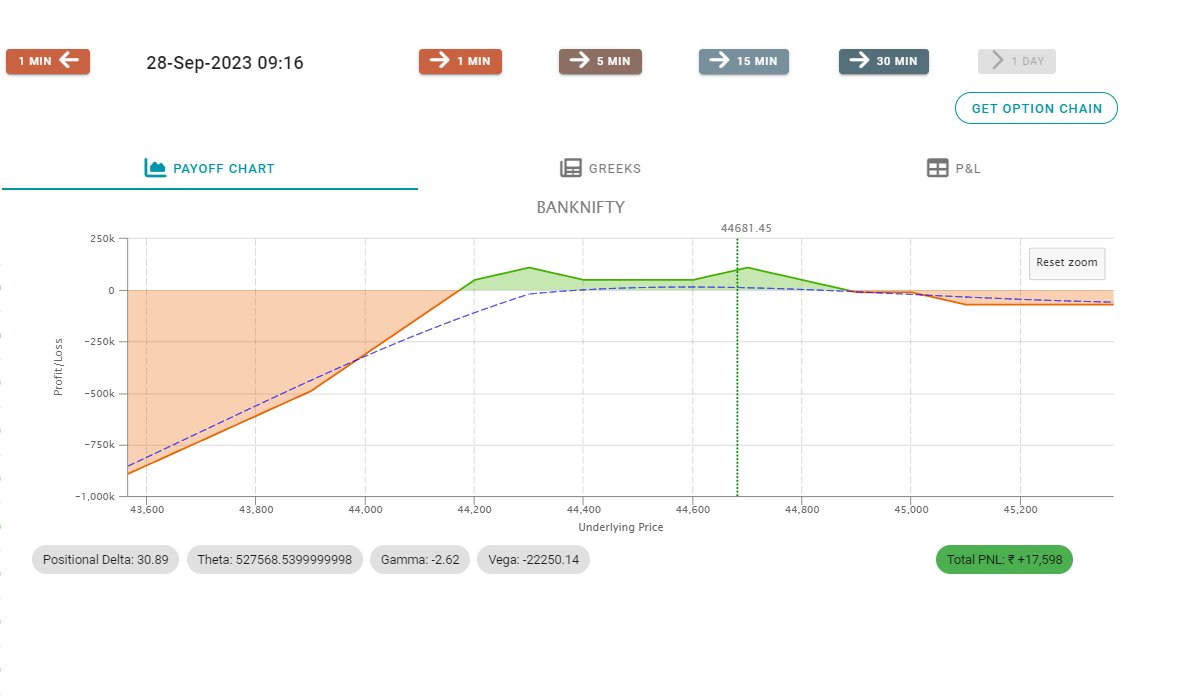

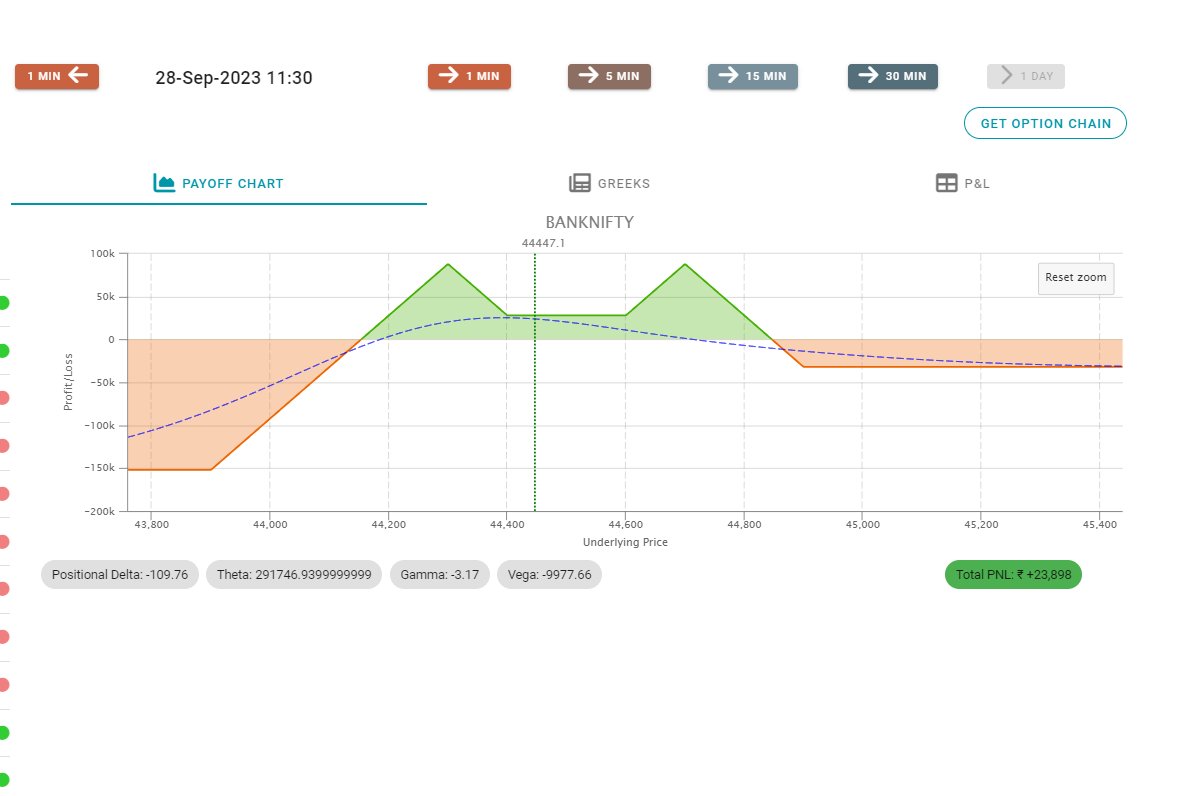

#BankNifty IronFly initiated on 26Sep23 at round 09:40 at 44700 strike with 1000 points away wings

Reason for 1000 points away wings -

* Since it is only 3 DTE the plan was to gain maximum theta decay in straddle intraday and bring the wings inside by EOD.

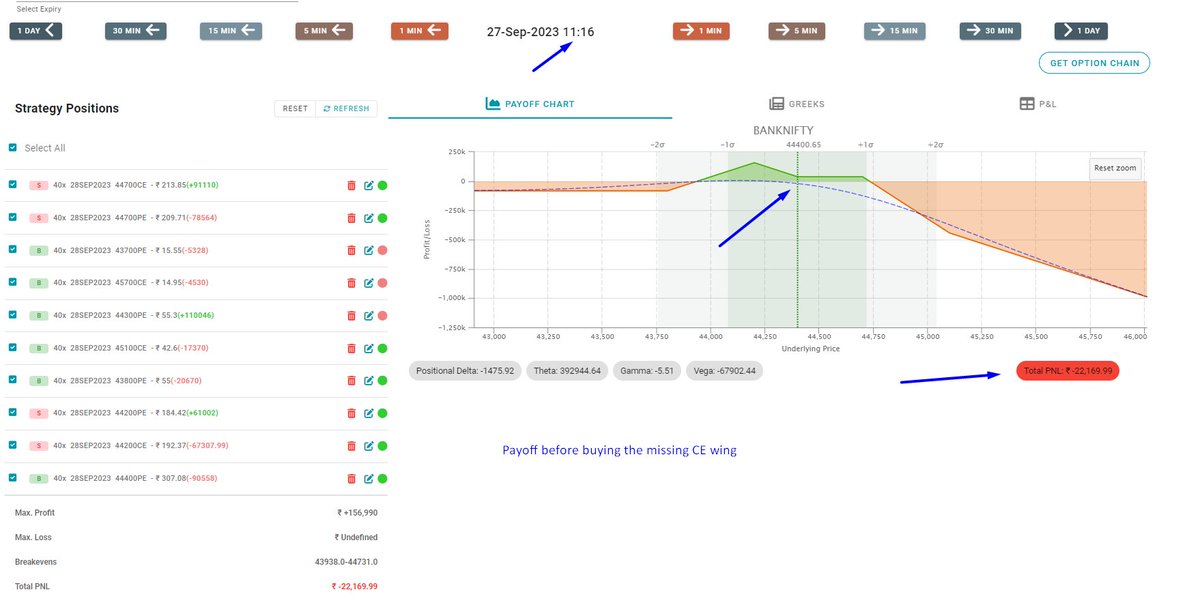

Reason for 1000 points away wings -

* Since it is only 3 DTE the plan was to gain maximum theta decay in straddle intraday and bring the wings inside by EOD.

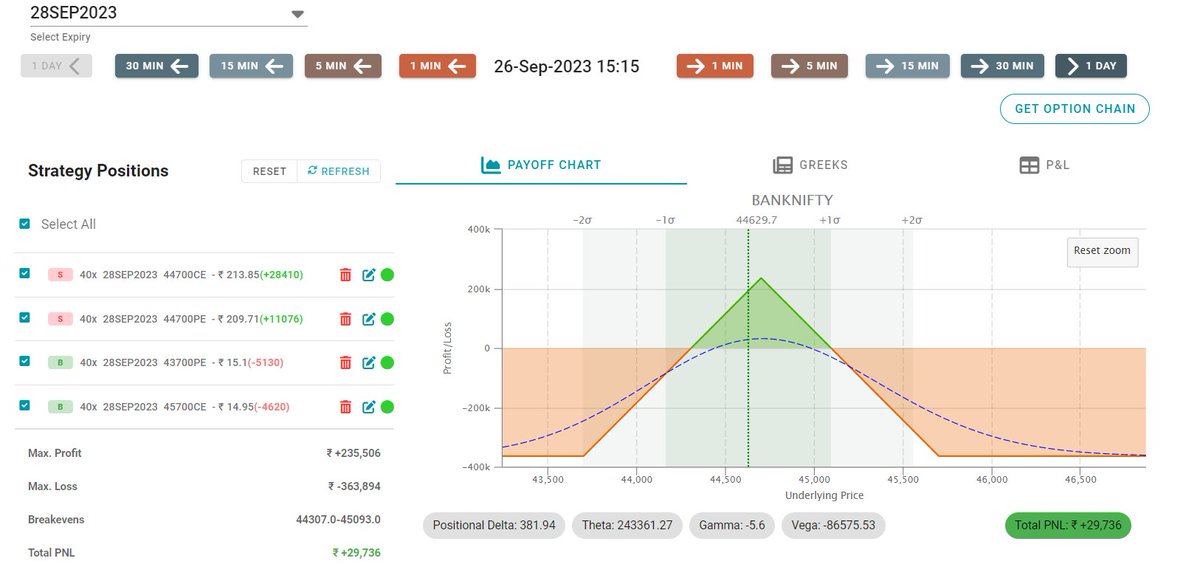

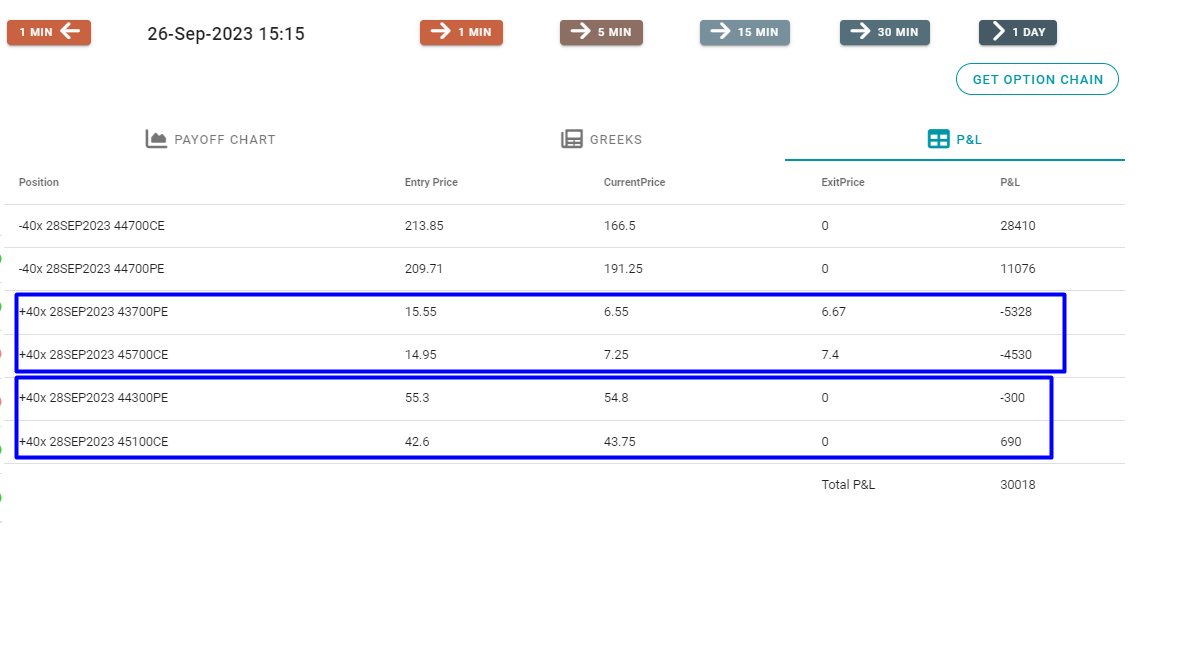

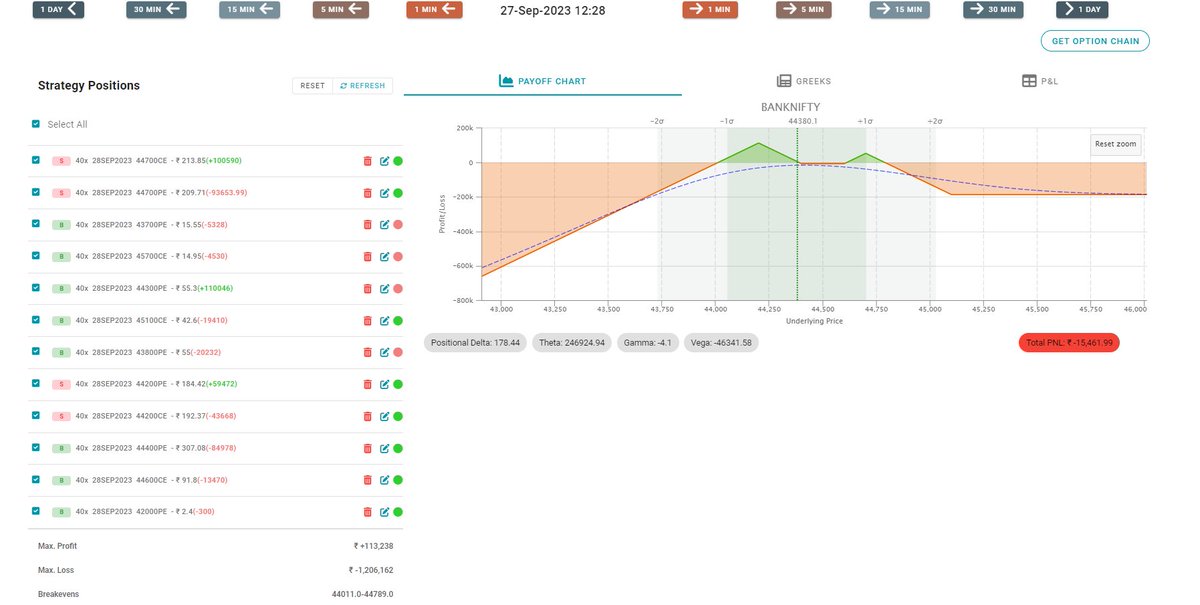

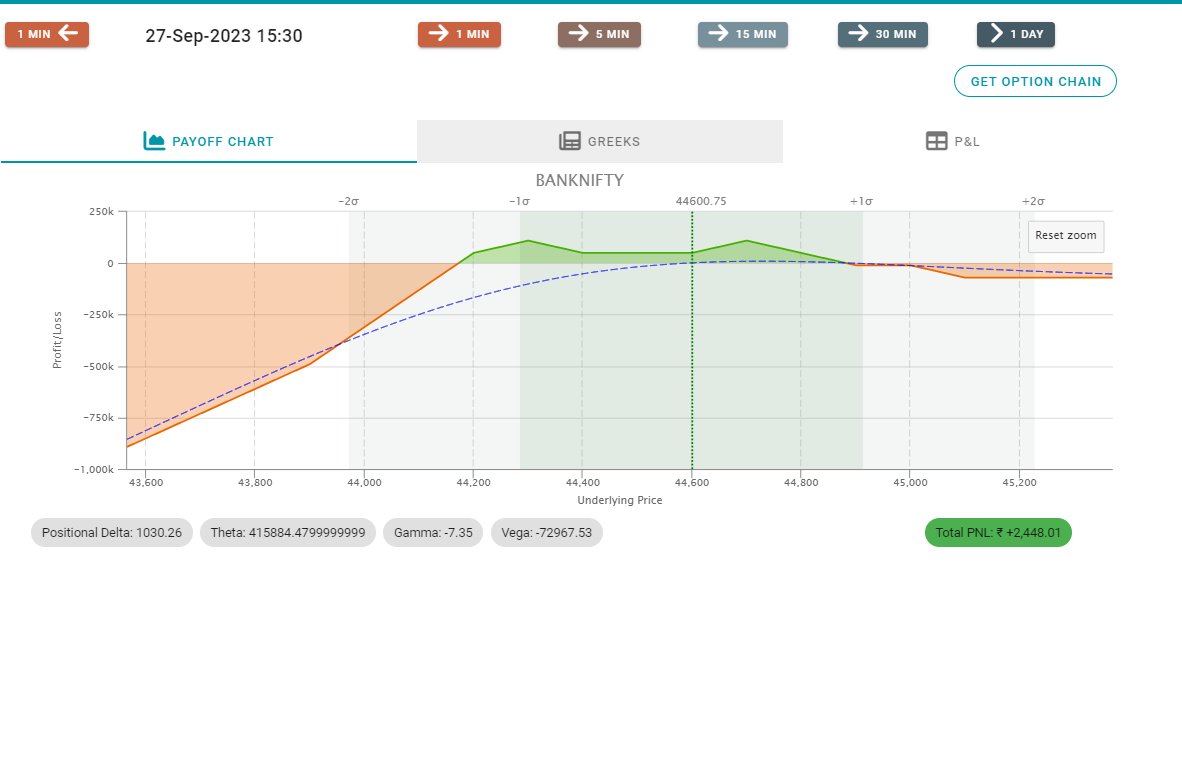

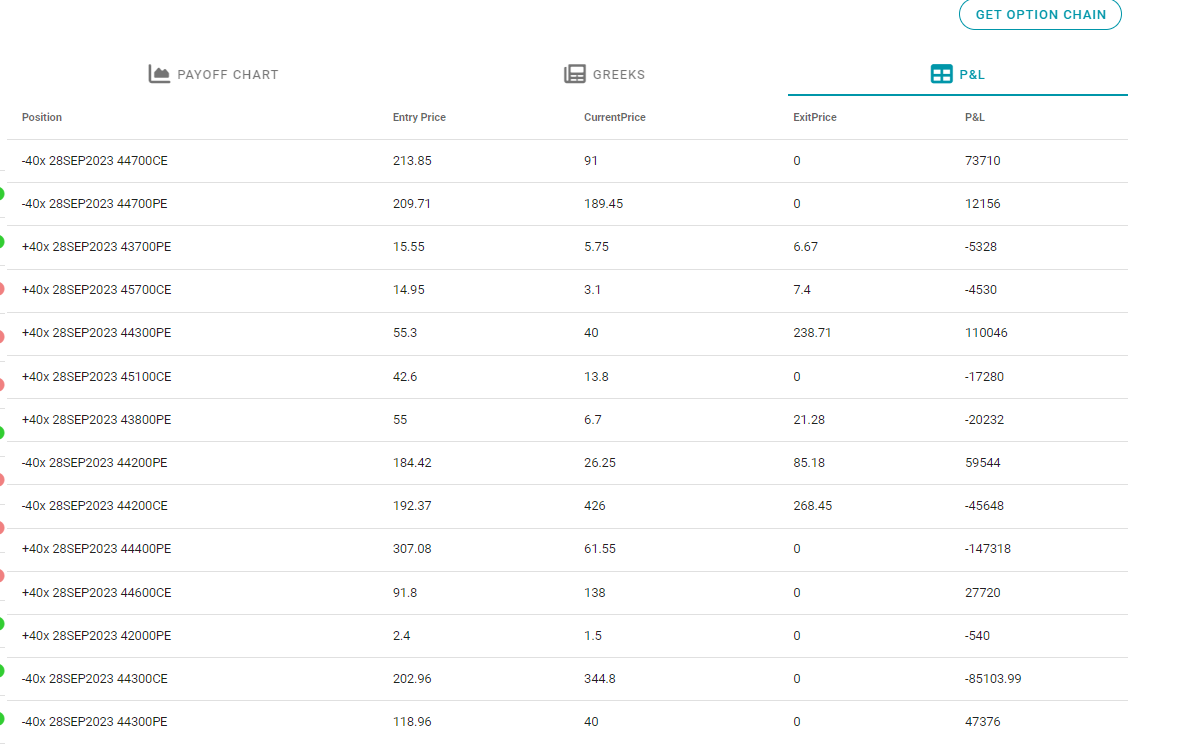

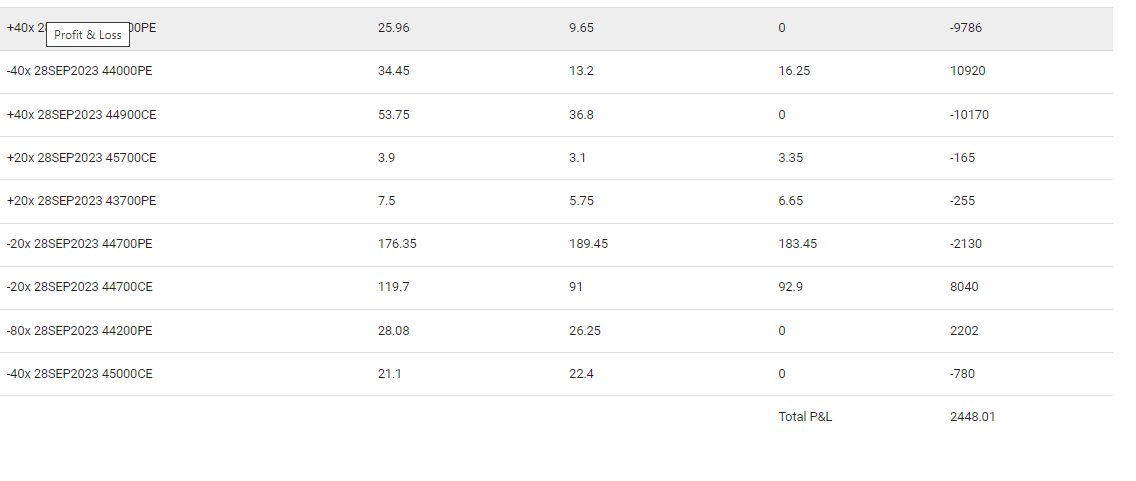

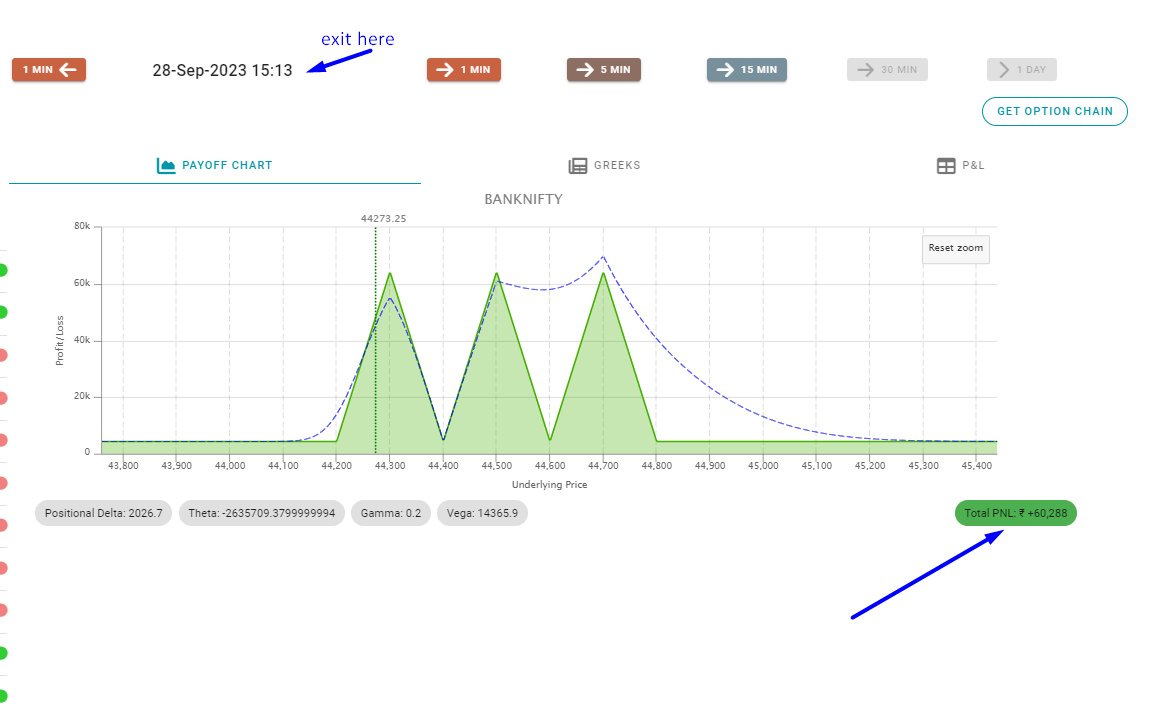

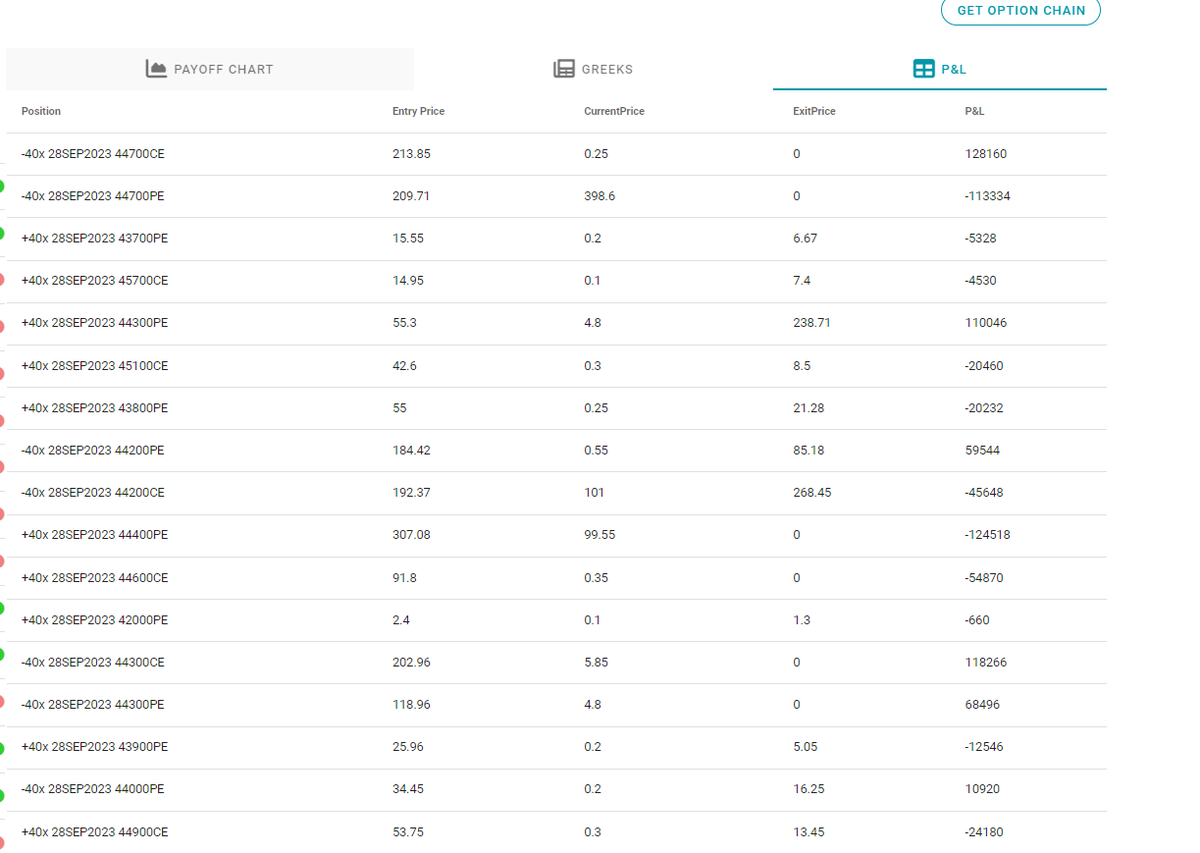

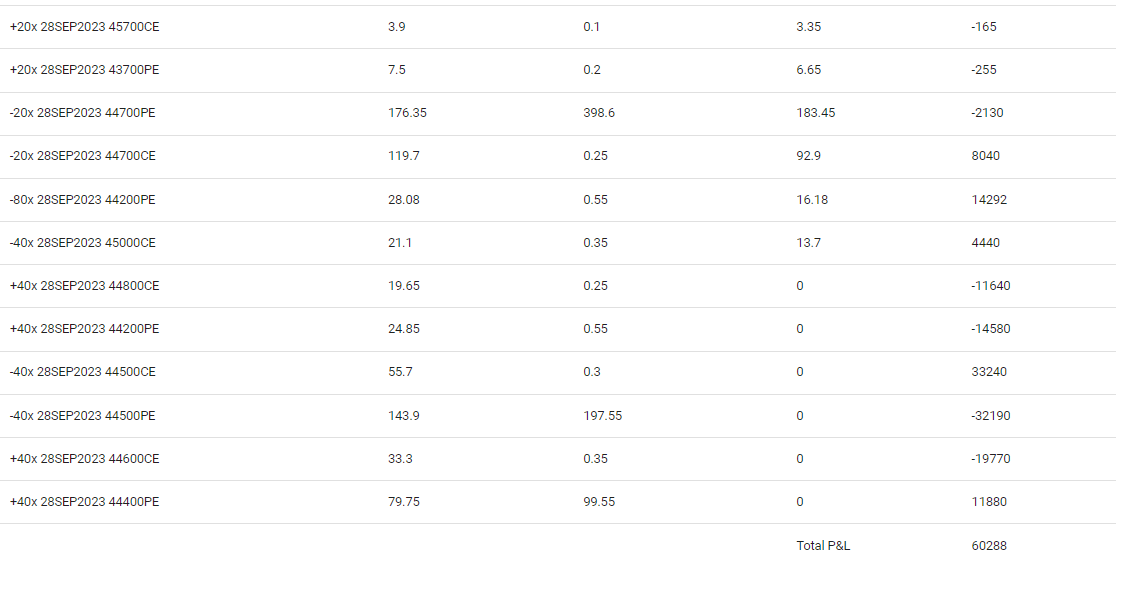

#Crown strategy payoff at 15:13 was like this. Decided to exit here

جاري تحميل الاقتراحات...