In Decentralized Finance, Protocol metric can be defined as a Structured framework of regulatory principles

This framework allows individuals engage in financial activities

Such as lending, borrowing, trading without relying on financial entities or your traditional banks

This framework allows individuals engage in financial activities

Such as lending, borrowing, trading without relying on financial entities or your traditional banks

The vending machine follows a protocol to make this happen smoothly.

• Trading :- trade your money for snacks

• No middle men :- there are no banks or financial middle men

• Transparency:- transactions are publicly recorded to ensure transparency & security

• Trading :- trade your money for snacks

• No middle men :- there are no banks or financial middle men

• Transparency:- transactions are publicly recorded to ensure transparency & security

I hope you catch my drift, let’s keep going

Q:

“Alright I get it Za, what defi protocol can we earn from? and how?

A:

I’ve got one in store, with your understanding of what protocols are, we can move on to an emerging protocol :)

Introducing @Linq_group 💎

Q:

“Alright I get it Za, what defi protocol can we earn from? and how?

A:

I’ve got one in store, with your understanding of what protocols are, we can move on to an emerging protocol :)

Introducing @Linq_group 💎

How does Linq work and what makes it different ?

The LINQ Protocol utilizes the LP token creation method from Uniswap V2 to redistribute tokens to holders

So Instead of having liquidity in one place,

The LINQ Protocol utilizes the LP token creation method from Uniswap V2 to redistribute tokens to holders

So Instead of having liquidity in one place,

these LP tokens are dispersed among all $LINQ token holders, this concept is referred to as "Linquidity”

Yes “linquid” 🔥

This idea ensures that LP tokens - which are created from swap fees,

are shared fairly among people who have $LINQ tokens.

Yes “linquid” 🔥

This idea ensures that LP tokens - which are created from swap fees,

are shared fairly among people who have $LINQ tokens.

From this, there is fairness and also control , which is different from a usual defi protocol

In decentralizing liquidity

• There is zero monopoly; governance is distributed across the pool

• Earnings for Token holders

In decentralizing liquidity

• There is zero monopoly; governance is distributed across the pool

• Earnings for Token holders

The wider distribution of LP tokens, the lesser a single entity have an impact on price

Also with a more diverse group of stakeholders holding LP tokens, there is less likelihood of sell-offs during market downturns

Also with a more diverse group of stakeholders holding LP tokens, there is less likelihood of sell-offs during market downturns

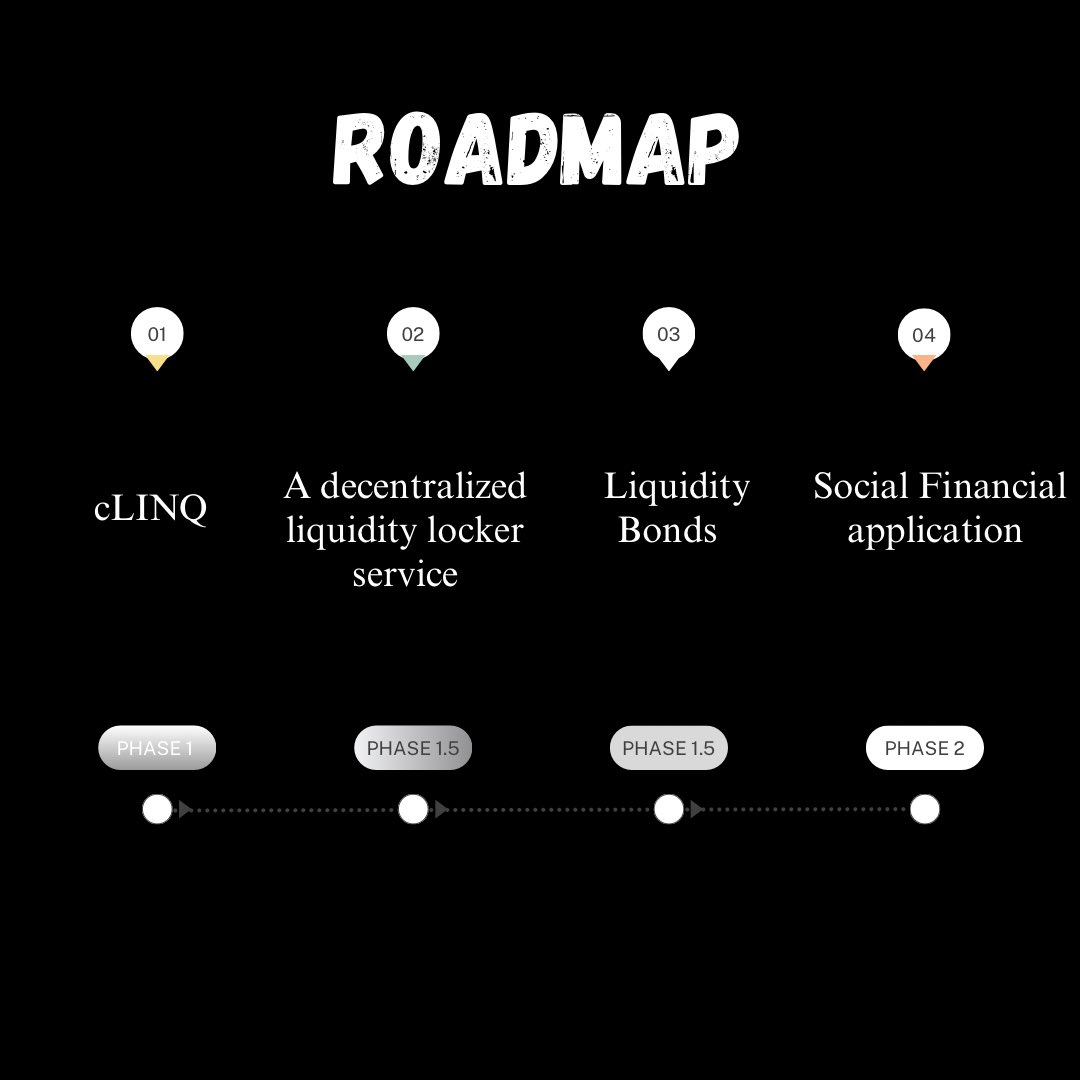

ROADMAP

—> Current Features

Linq Protocol has already implemented innovative mechanisms to address challenges related to liquidity provision and distribution in decentralized protocols.

One key feature is the fair distribution of LP tokens to holders

—> Current Features

Linq Protocol has already implemented innovative mechanisms to address challenges related to liquidity provision and distribution in decentralized protocols.

One key feature is the fair distribution of LP tokens to holders

—> Time-Locked Staking of LP Tokens:

In this phase, Linq Protocol introduces an incentive system for users to lock their LP tokens for specific durations.

This helps maintain a stable and long-term liquidity pool, benefiting the entire ecosystem.

Staking is currently Live 🔥

In this phase, Linq Protocol introduces an incentive system for users to lock their LP tokens for specific durations.

This helps maintain a stable and long-term liquidity pool, benefiting the entire ecosystem.

Staking is currently Live 🔥

You can check out this thread by @SamuelXeus

LINQNOMICS - LING TOKENOMICS

$LINQ Token

Type: ERC-20

Total Supply: 100,000,000 tokens

Token Distribution: 3% of every transaction goes to the LP community claims

Another 3% is allocated for LP staking in Ethereum (ETH) rewards and development.

$LINQ Token

Type: ERC-20

Total Supply: 100,000,000 tokens

Token Distribution: 3% of every transaction goes to the LP community claims

Another 3% is allocated for LP staking in Ethereum (ETH) rewards and development.

LP Staking and Development: The 3% tax from each transaction is designated for LP staking and development.

-> There's no fixed amount set aside for development; instead, this tax is utilized to maintain the APR for LP staking ETH rewards 💎

-> There's no fixed amount set aside for development; instead, this tax is utilized to maintain the APR for LP staking ETH rewards 💎

I hope you enjoyed this thread as much as I enjoyed writing it

Tagging Admirable Chads in the space:

@SamuelXeus

@VanessaDefi

@izu_crypt

@PrudentSammy

@DOLAK1NG

@CryptoGideon_

@Deebs_Defi

@0xJok9r

@Stoiiic

@TheDefiSaint

@MercyDeGreat

Tagging Admirable Chads in the space:

@SamuelXeus

@VanessaDefi

@izu_crypt

@PrudentSammy

@DOLAK1NG

@CryptoGideon_

@Deebs_Defi

@0xJok9r

@Stoiiic

@TheDefiSaint

@MercyDeGreat

Loading suggestions...