This is my 3rd year in the Web3 space.

I have one rule :

"Question everything but don't fade anything"

I seize every opportunity, refusing to let them slip away.

Just like you, I once navigated Web3 with limited to no knowledge.

But then . . . .

I have one rule :

"Question everything but don't fade anything"

I seize every opportunity, refusing to let them slip away.

Just like you, I once navigated Web3 with limited to no knowledge.

But then . . . .

If there's one big problem we all experience in DeFi, it is LP.

Liquidity provision and distribution have always been problematic in DEFI due to the centralized nature of traditional models.

This centralized approach poses risks and inefficiencies.

Introducing: @linq_group

Liquidity provision and distribution have always been problematic in DEFI due to the centralized nature of traditional models.

This centralized approach poses risks and inefficiencies.

Introducing: @linq_group

Here is the solution: @linq_group

Why?

They decentralize the liquidity pool and make the token holders a part of this.

Here is where it gets interesting:

@linq_group is introducing this amazing system that allows you and I to interact with DEFI world differently.

Here 👇

Why?

They decentralize the liquidity pool and make the token holders a part of this.

Here is where it gets interesting:

@linq_group is introducing this amazing system that allows you and I to interact with DEFI world differently.

Here 👇

Here's what they do differently :

→ Merging DEFI with SOCIAL MEDIA.

This approach will blow your mind.

Stay with me

It is mainly for :

Token distribution to top token owners this approach makes use of chain process to decentralize and secure the liquidity pool.

→ Merging DEFI with SOCIAL MEDIA.

This approach will blow your mind.

Stay with me

It is mainly for :

Token distribution to top token owners this approach makes use of chain process to decentralize and secure the liquidity pool.

This includes creating liquidity provider token.

under the uniswap frame work under the v2 uniswap frame work and implementing a scheme for the time locked staking.

Now instead of keeping liquidity centralized here's what they did.

under the uniswap frame work under the v2 uniswap frame work and implementing a scheme for the time locked staking.

Now instead of keeping liquidity centralized here's what they did.

The team taught of how else they could go about it . . .

and viola they said they will distribute the LP token to all the $linq token holders now they call this LINQUIDITY get that!

This strategies enhances the utility and stability for Ling token

and viola they said they will distribute the LP token to all the $linq token holders now they call this LINQUIDITY get that!

This strategies enhances the utility and stability for Ling token

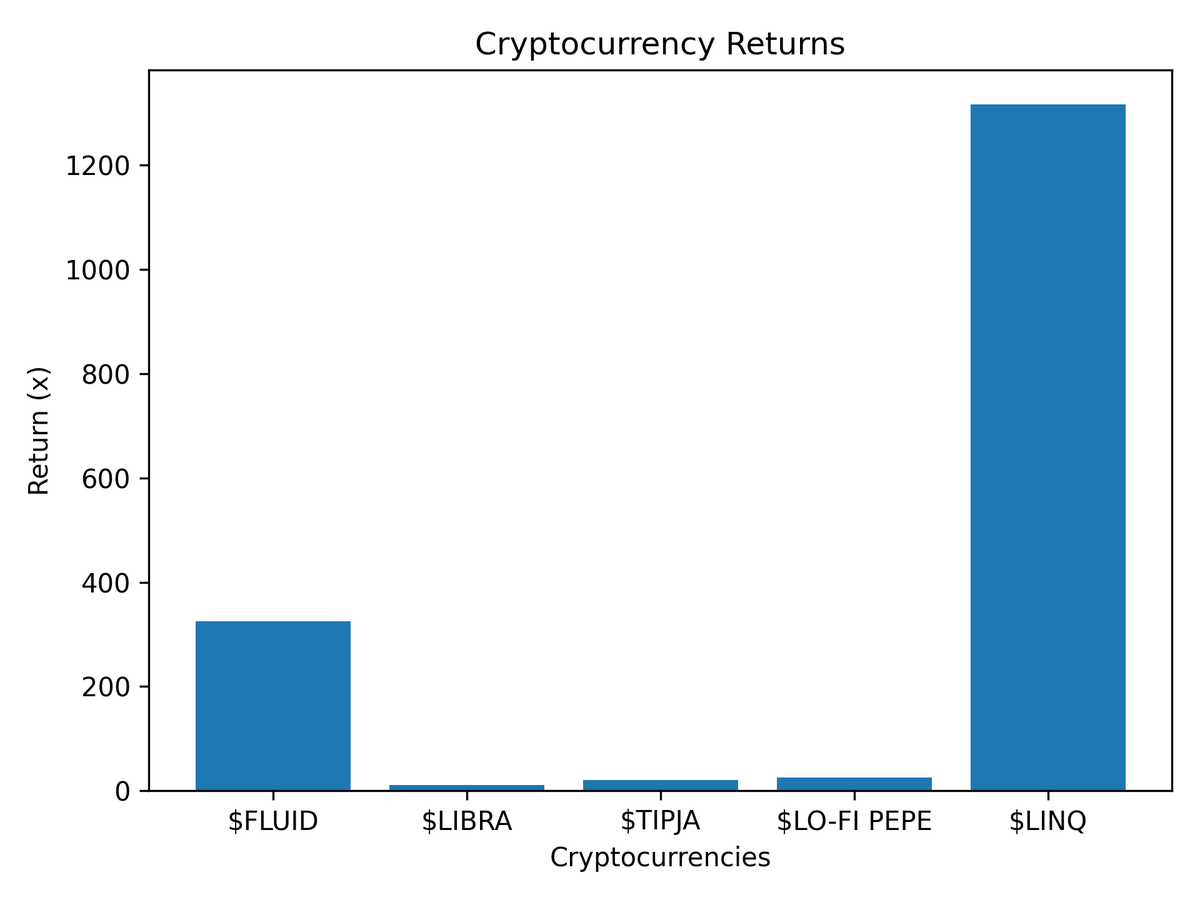

You know why Linq is different ?

It's really all about giving everyone a piece of the liquidity pie.

The Linq group was founded in 2023 by three super visionary minds who belive in the power of collaboration and decentralization.

It's really all about giving everyone a piece of the liquidity pie.

The Linq group was founded in 2023 by three super visionary minds who belive in the power of collaboration and decentralization.

Linq is all about using blockchain to create a super smooth system where you can make meaningful connection be part of communities & find endless opportunities.

Now we can take a look at the lingonomics.

Lol.

Yeah tokenomics of Ling.

Now we can take a look at the lingonomics.

Lol.

Yeah tokenomics of Ling.

There is a 6% transaction tax and 3% of every transactions is auto-generated liquidity

That is claimable by linq token holders in proportion to what they are holding.

3% of every Transaction generates eth to maintain a sustainable staking APR and development.

That is claimable by linq token holders in proportion to what they are holding.

3% of every Transaction generates eth to maintain a sustainable staking APR and development.

The linq liquidity pool token. More features that are coming includes revenue from holding linq and earning liquidity pool.

Revenue from linq token staking and Linq LP staking

For more information : check them out @linq_group

Revenue from linq token staking and Linq LP staking

For more information : check them out @linq_group

Tagging @SamuelXeus and @linq_group to check this out.

Loading suggestions...