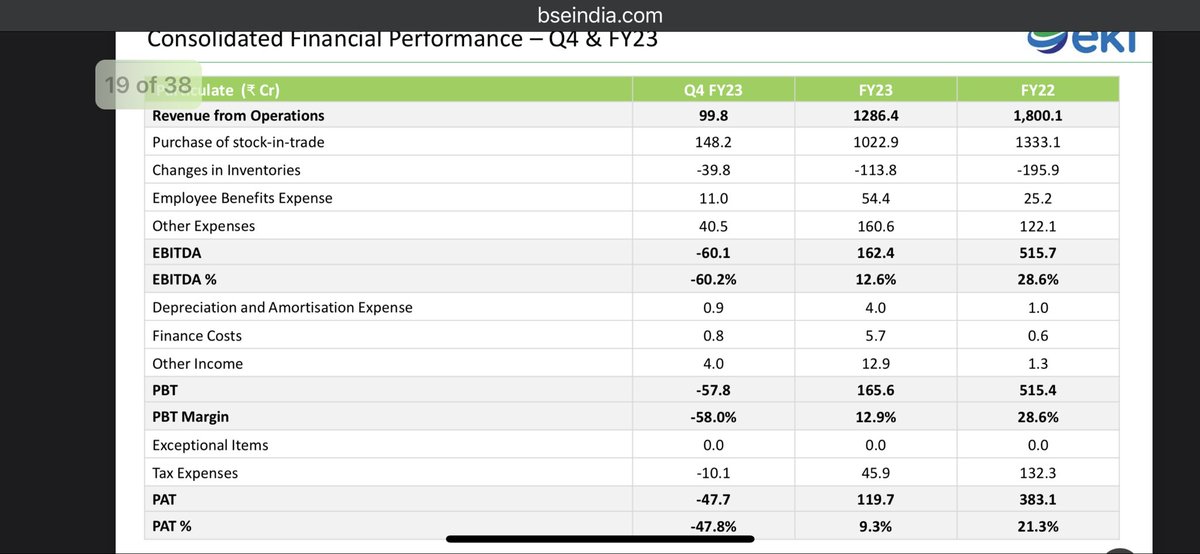

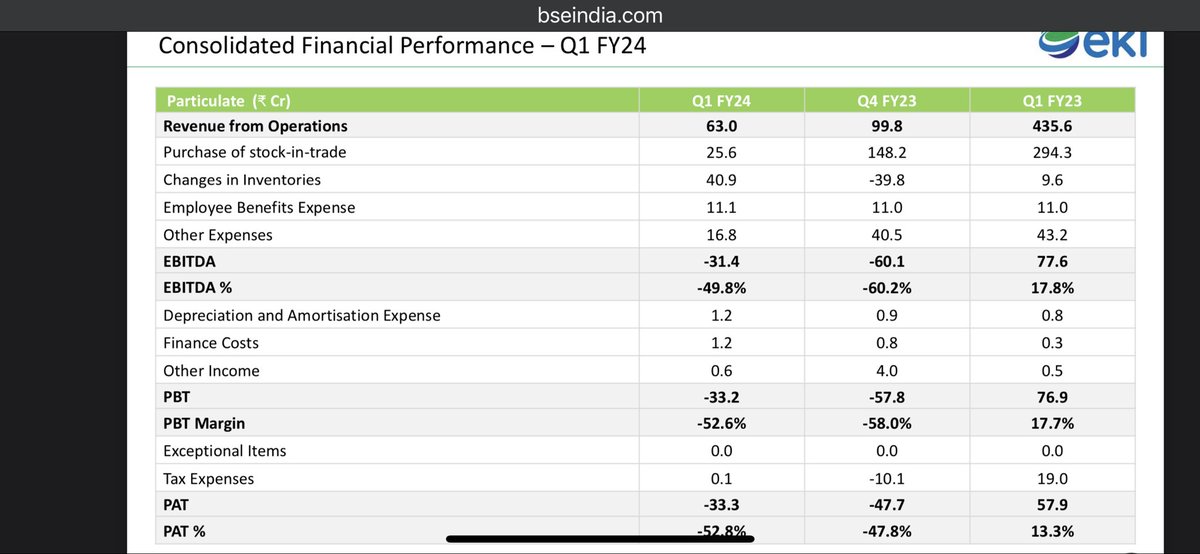

Eki energy Q4’23 PAT ~47cr loss, Q1’24 PAT ~33 cr loss. No new audit related qualifications/issues highlighted in the report. Annual FY23 PAT 119 cr profit #ekienergy

🧵 #1. The performance translates the overall pressure witnessed in the sector. Let’s focus on few more points.

🧵 #1. The performance translates the overall pressure witnessed in the sector. Let’s focus on few more points.

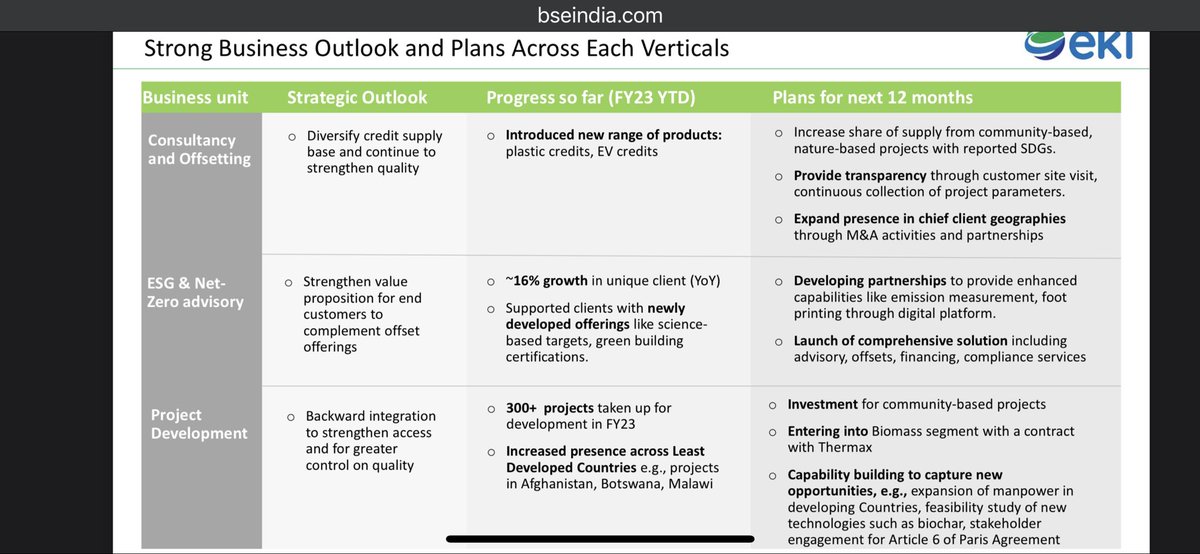

#3. Years The performance is linked to the carbon credit prices. Unless the cc prices goes up, there will be continued pressure in the industry. Price depends on how the laws, policies are created which will attract new investments. Govt and Intl. org have to play a vital role.

#5. They will have cost pressure as they have opened many new branches across the globe. They should be more frugal in their investments now with new officers or locations. There is an increase in borrowing also seen in their balance sheet.

#6. On an annual basis though the profit percentage has decreased massively, they still posted a small profit for FY23 (still positive EPS. ). We have to see how the upcoming quarters are performed and where the sector is heading to. Current PE is ~14 based on the new result.

#7. Market to decide if 14 PE for the stock is at lower side or higher side. This is a commodity sector, it is ought to be cyclical for the learners to keep in mind.

All the points are my personal opinion and no way a buy or sell recommendation.

Enjoy your investing journey.

All the points are my personal opinion and no way a buy or sell recommendation.

Enjoy your investing journey.

Loading suggestions...