1. The Concept of a Margin of Safety

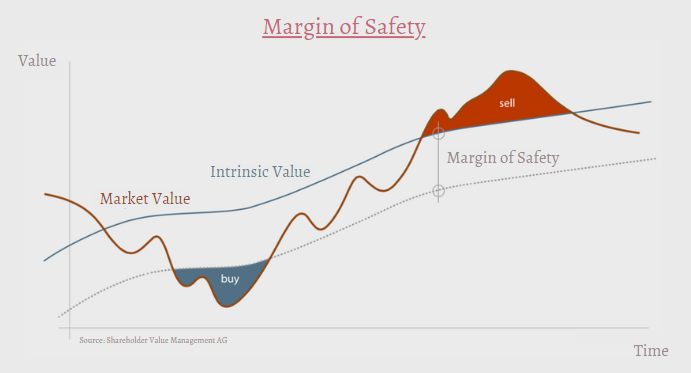

A stock has a fair (intrinsic) value based on the underlying company.

This fair value often deviates from the stock price by a wide margin.

No Margin of Safety: Stock Price > Fair Value

Margin of Safety: Stock Price < Fair Value

A stock has a fair (intrinsic) value based on the underlying company.

This fair value often deviates from the stock price by a wide margin.

No Margin of Safety: Stock Price > Fair Value

Margin of Safety: Stock Price < Fair Value

2. Benefits

Buying something for less than it's worth is always a good deal.

In investing, its importance is even greater because you never know the exact fair value.

You can only guess a range.

A Margin of safety is self-defense against a wrong estimate of fair value.

Buying something for less than it's worth is always a good deal.

In investing, its importance is even greater because you never know the exact fair value.

You can only guess a range.

A Margin of safety is self-defense against a wrong estimate of fair value.

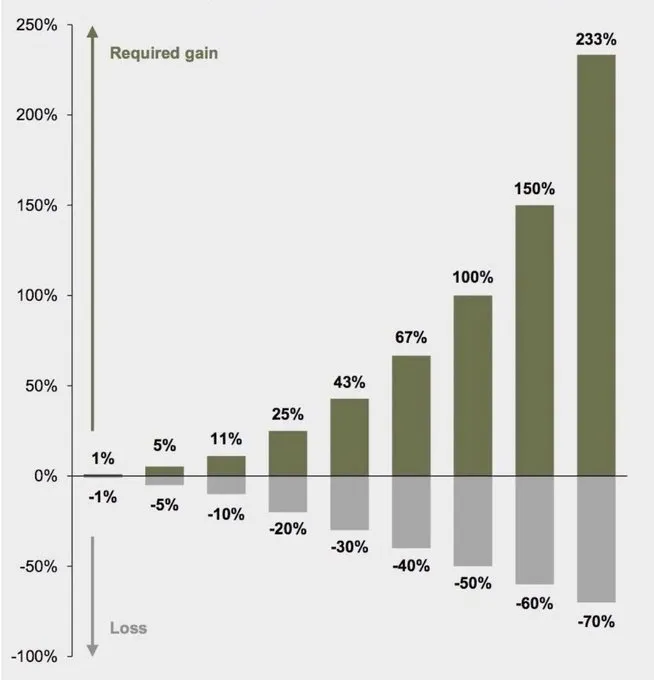

Second, exponential returns.

Stock A is worth (fair value) $10 but is selling for $8. Upside=25%

Now, if that same stock weren’t selling for $8 but for $5, the upside potential would suddenly become 100%.

So, a MoS prevents unrecoverable losses and exponential returns.

Stock A is worth (fair value) $10 but is selling for $8. Upside=25%

Now, if that same stock weren’t selling for $8 but for $5, the upside potential would suddenly become 100%.

So, a MoS prevents unrecoverable losses and exponential returns.

“If you understand chapters 8 and 20 of The Intelligent Investor and chapter 12 of The General Theory, you don’t need to read anything else."

- Warren Buffett

Here's a detailed article covering all three chapters:danielmnke.com

- Warren Buffett

Here's a detailed article covering all three chapters:danielmnke.com

That's it for today!

If you enjoyed it, please Like and Retweet this Thread so more people can see it!

Follow me @MnkeDaniel to learn more about Investing.

Have a great day!

If you enjoyed it, please Like and Retweet this Thread so more people can see it!

Follow me @MnkeDaniel to learn more about Investing.

Have a great day!

Loading suggestions...