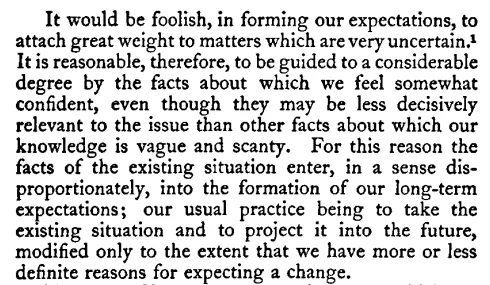

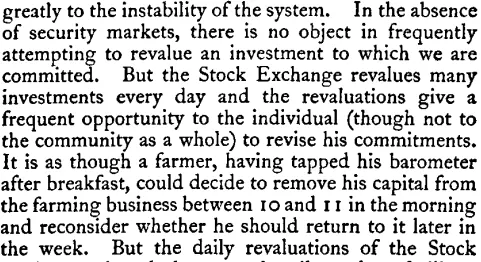

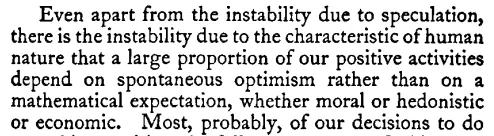

“If you understand chapters 8 and 20 of The Intelligent Investor and chapter 12 of The General Theory, you don’t need to read anything else."

- Warren Buffett

Here's a detailed article covering all three chapters:

danielmnke.com

- Warren Buffett

Here's a detailed article covering all three chapters:

danielmnke.com

That's it for today!

If you enjoyed it, please Like and Retweet this Thread so more people can see it!

Follow me @MnkeDaniel to learn more about Investing.

Have a great day!

If you enjoyed it, please Like and Retweet this Thread so more people can see it!

Follow me @MnkeDaniel to learn more about Investing.

Have a great day!

Loading suggestions...