1/ We all ignored the most important parts of trading when we were learning the forex market, we were taught market moves either upward, downward or sidewards. The BIG question is do you know how to capitalize on it.

JOIN the biggest active discord server for Forex traders, kindly join and don’t miss out on love trade calls.

shorturl.at

shorturl.at

2/ In a bullish market we more interested in buys right and same for bearish market where we focused on sells right, then what would you DO in a side movement ?

Ensure you are following @pipscityins & @trayyon_dmn

3/ A side movement is considered a RANGE, in this thread I will show you how you can capitalize on RANGE and that what the RIMC concept is all about.

4/ A ranging market, also known as a sideways or consolidating market, is a market condition in which the price of a financial instrument, such as a stock, currency pair, or commodity, moves within a relatively narrow range with no clear upward or downward trend. In a ranging market:

5/ Horizontal Movement: Prices tend to move horizontally or sideways rather than in a clear, sustained uptrend or downtrend.

UNRELATED

Every trader has issues with technical analysis, in this short course I delve deep into how to analyze the market, technical concept explained with real chart examples, this course will change your view on TRADING. —- Click to purchase 👇

selar.co

Every trader has issues with technical analysis, in this short course I delve deep into how to analyze the market, technical concept explained with real chart examples, this course will change your view on TRADING. —- Click to purchase 👇

selar.co

6/ Support and Resistance: Price levels of support (the lower boundary of the range) and resistance (the upper boundary of the range) are established. These levels often act as barriers that the price repeatedly tests but does not significantly breach.

7/ Volatility Decreases: Volatility, or the magnitude of price swings, is typically lower during ranging markets compared to trending markets.

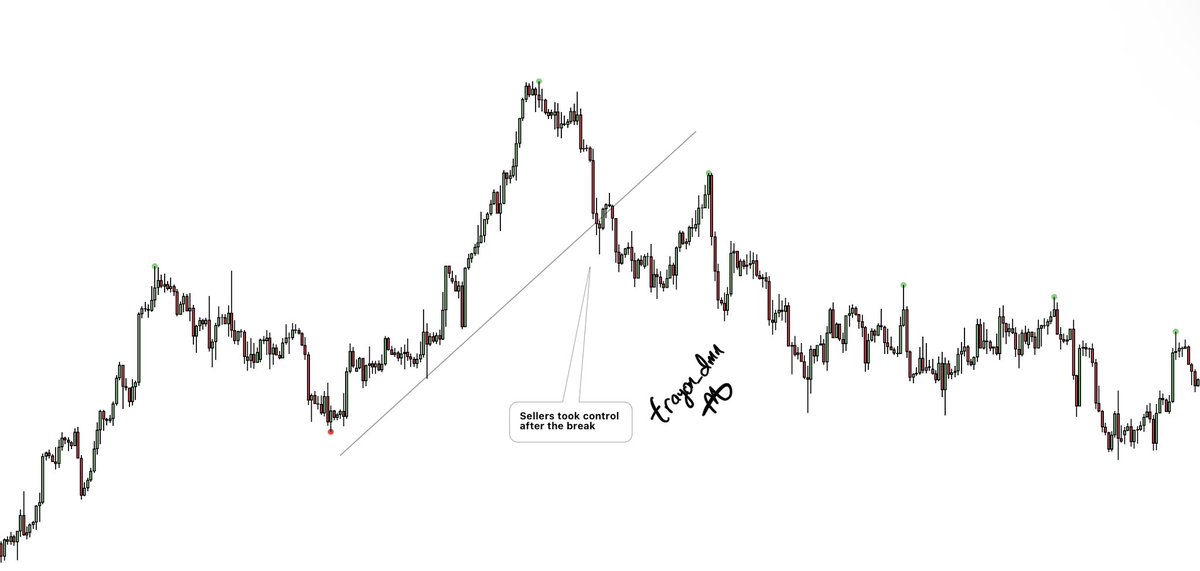

8/ Consolidation: Traders and investors may perceive the market as consolidating or taking a breather after a previous trend, and they often anticipate a breakout in one direction once the range is broken.

All free forex education are posted regularly on our youtube channel, kindly subscribe to get notified when we post new contents.

@Pipscity?si=kCgOdYusO_YK9Z6l" target="_blank" rel="noopener" onclick="event.stopPropagation()">youtube.com

@Pipscity?si=kCgOdYusO_YK9Z6l" target="_blank" rel="noopener" onclick="event.stopPropagation()">youtube.com

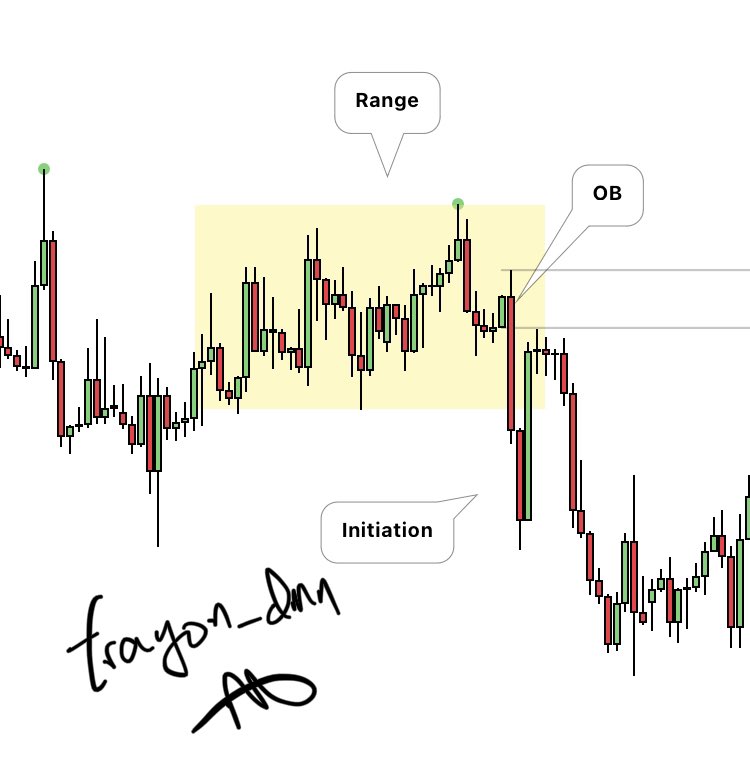

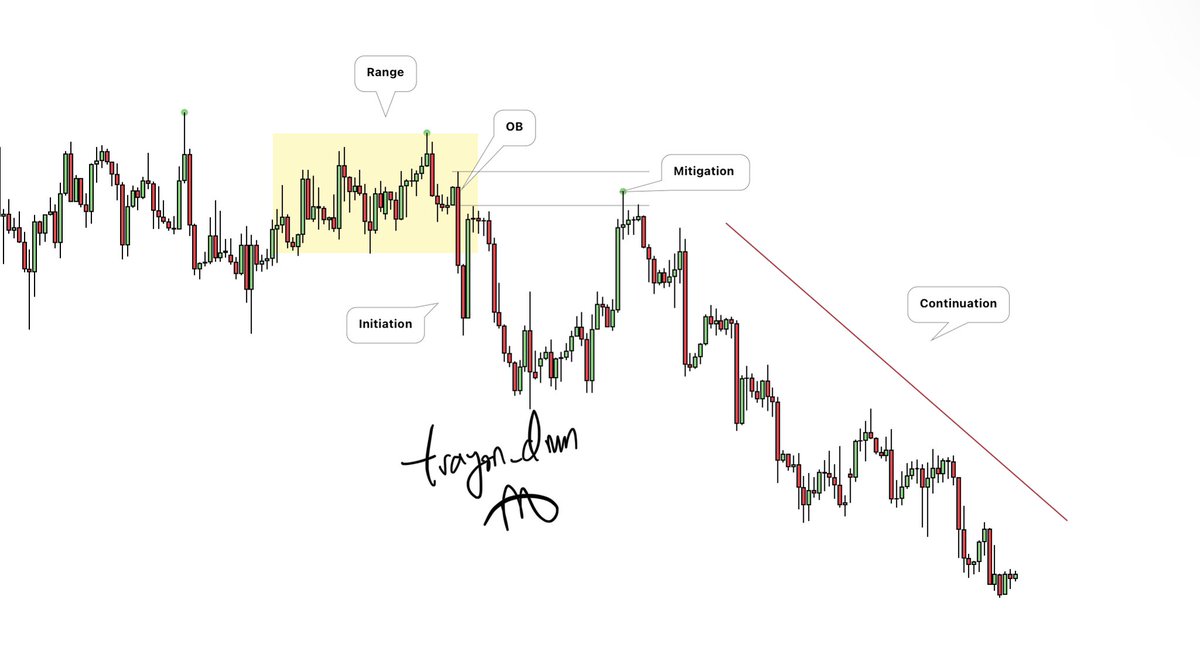

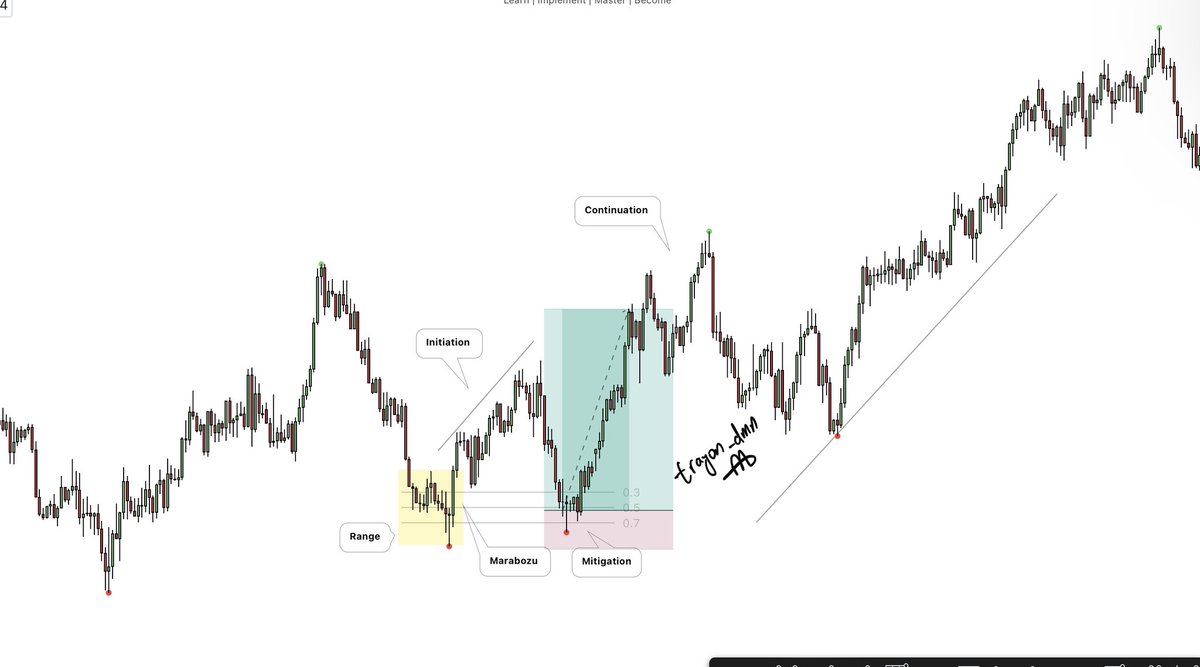

9/ what then is RIMC concept? It simply means Range Initiation Mitigation Continuation, the concept is fully based off ranges and also certain candlestick patterns.

10/ For candlestick patterns we want to focus on Engulfing, Inside Bars, marabozu. The reason for this is cause these candlestick patterns represent momentum when it appears on charts especially at critical areas such as Support or Resistance

Before we PROCEED, join our forex community

t.me to stay connected with trading education, updates and major announcements.

t.me to stay connected with trading education, updates and major announcements.

12/ let’s have some major chart examples of major RIMC and also note this strategy isn’t 100% and it’s not the holy grail. But the win rate is above 70% which is very fair. We also use Gann box focusing on 30%, 50%, & 70% for actual range mitigation.

14/ in the image above we see that the trend became bearish, so with this we will be more focused on shorts than longs.

15/ where then is our RIMC after understanding the market TREND? In the image below, the range is marked with yellow and within this range we do see a momentum candlestick pattern which in this example is the bearish engulfing ( known for short as our SELLING OB ). #lessismore

To understand the FULL concept: kindly watch this video

x.com

x.com

Loading suggestions...