4. Never Invest Money You Need

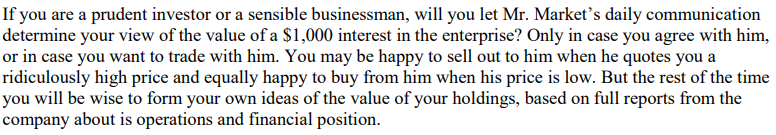

You can only use Mr. Market's mood swings to your advantage when you're not forced out of the market in bad times.

If you invest money that you suddenly need, you're forced to sell at his prices. However bad they may be.

You can only use Mr. Market's mood swings to your advantage when you're not forced out of the market in bad times.

If you invest money that you suddenly need, you're forced to sell at his prices. However bad they may be.

Tomorrow, a summary of Chapter 20 will follow, then Chapter 12 of Keynes' The General Theory.

If you don't want to wait, you can already read a detailed version of all 3 chapters here:

danielmnke.com

If you don't want to wait, you can already read a detailed version of all 3 chapters here:

danielmnke.com

That's it for today!

If you enjoyed it, please Like and Retweet this Thread so more people can see it!

Follow me @MnkeDaniel to learn more about Investing.

Have a great day!

If you enjoyed it, please Like and Retweet this Thread so more people can see it!

Follow me @MnkeDaniel to learn more about Investing.

Have a great day!

Loading suggestions...