1. To outperform, you need to do things differently

You can't outperform the market if you follow the crowd.

"If you want to be in the top 5% of money managers, you have to be willing to be in the bottom 5% too."

You can't outperform the market if you follow the crowd.

"If you want to be in the top 5% of money managers, you have to be willing to be in the bottom 5% too."

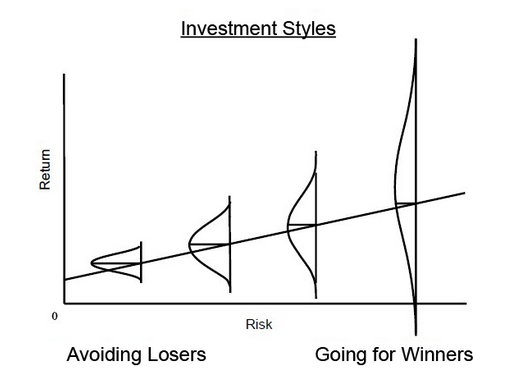

2. Focus on risk management

Great investing is focusing on risk management first and returns second.

If you can avoid losers, the winners will take care of themselves.

"Rule No 1: never lose money. Rule No 2: never forget rule No 1. " - Warren Buffett

Great investing is focusing on risk management first and returns second.

If you can avoid losers, the winners will take care of themselves.

"Rule No 1: never lose money. Rule No 2: never forget rule No 1. " - Warren Buffett

3. Risk control versus risk avoidance

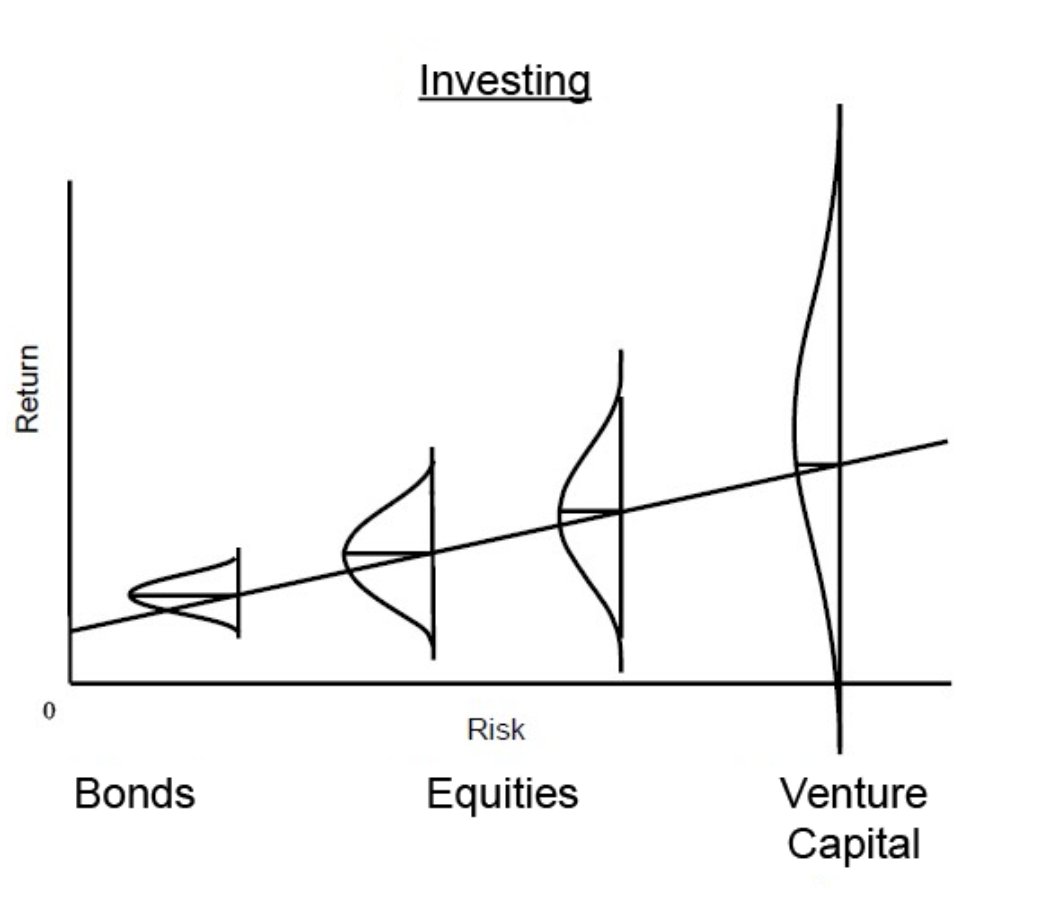

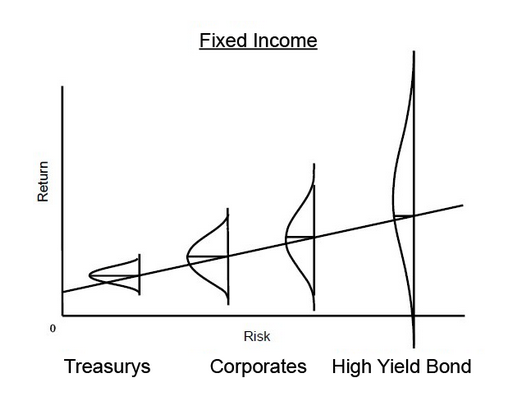

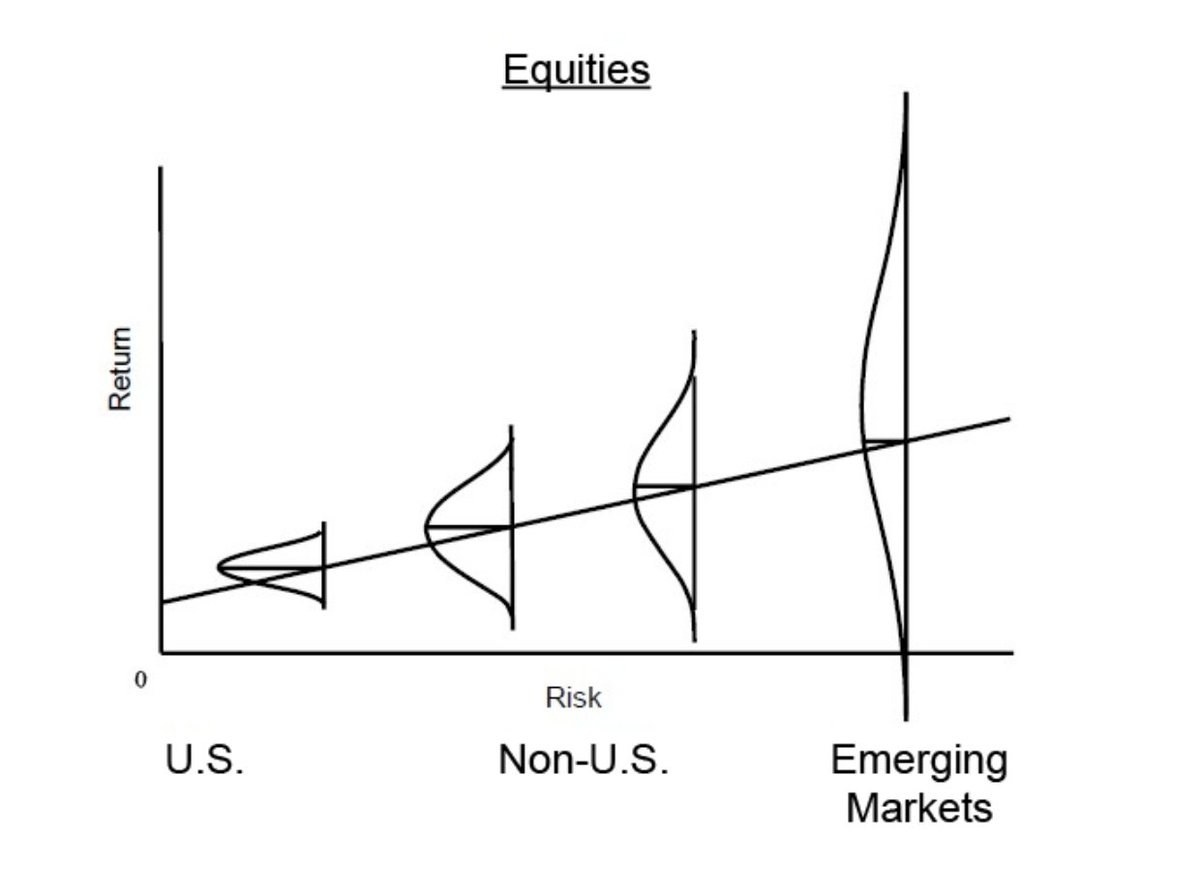

It's essential to understand the difference between risk control and risk avoidance.

Risk avoidance: not doing anything where the outcome is uncertain

Risk control: declining to take risks that you aren't rewarded for as an investor

It's essential to understand the difference between risk control and risk avoidance.

Risk avoidance: not doing anything where the outcome is uncertain

Risk control: declining to take risks that you aren't rewarded for as an investor

4. You will fail from time to time

For Marks, the question isn't whether you're going to have losers.

The question is how many losers you'll have and how bad they will be compared to your winners.

For Marks, the question isn't whether you're going to have losers.

The question is how many losers you'll have and how bad they will be compared to your winners.

5. The need for winning stocks

All you need in a successful investment career is a few very big winners.

People often say that you can't go broke from taking a profit.

That's true. But you probably won't become very rich either.

All you need in a successful investment career is a few very big winners.

People often say that you can't go broke from taking a profit.

That's true. But you probably won't become very rich either.

That's it for today.

If you liked this, you'll LOVE the compilation with all Memos of Howard Marks (> 1,600 pages).

Sign up here if you want to receive it for free: eepurl.com

If you liked this, you'll LOVE the compilation with all Memos of Howard Marks (> 1,600 pages).

Sign up here if you want to receive it for free: eepurl.com

Loading suggestions...