One of the best ways to learn about the Copper Industry is by studying the Top 10 Global Producers.

I read each of the Top 10 #Copper Producer Q2 2023 reports so you don't have to.

Here's a thread on the most important data and themes from the world's largest players ... 🧵

I read each of the Top 10 #Copper Producer Q2 2023 reports so you don't have to.

Here's a thread on the most important data and themes from the world's largest players ... 🧵

10/ Jiangxi Copper $JIAXF

Jiangxi has not reported Q2 2023 results as of this tweet.

Their latest report dates 04-28-2023.

Jiangxi has not reported Q2 2023 results as of this tweet.

Their latest report dates 04-28-2023.

11/ Recap: Key Takeaways From Top 10 #Copper Producers

There are a few key takeaways from these producers:

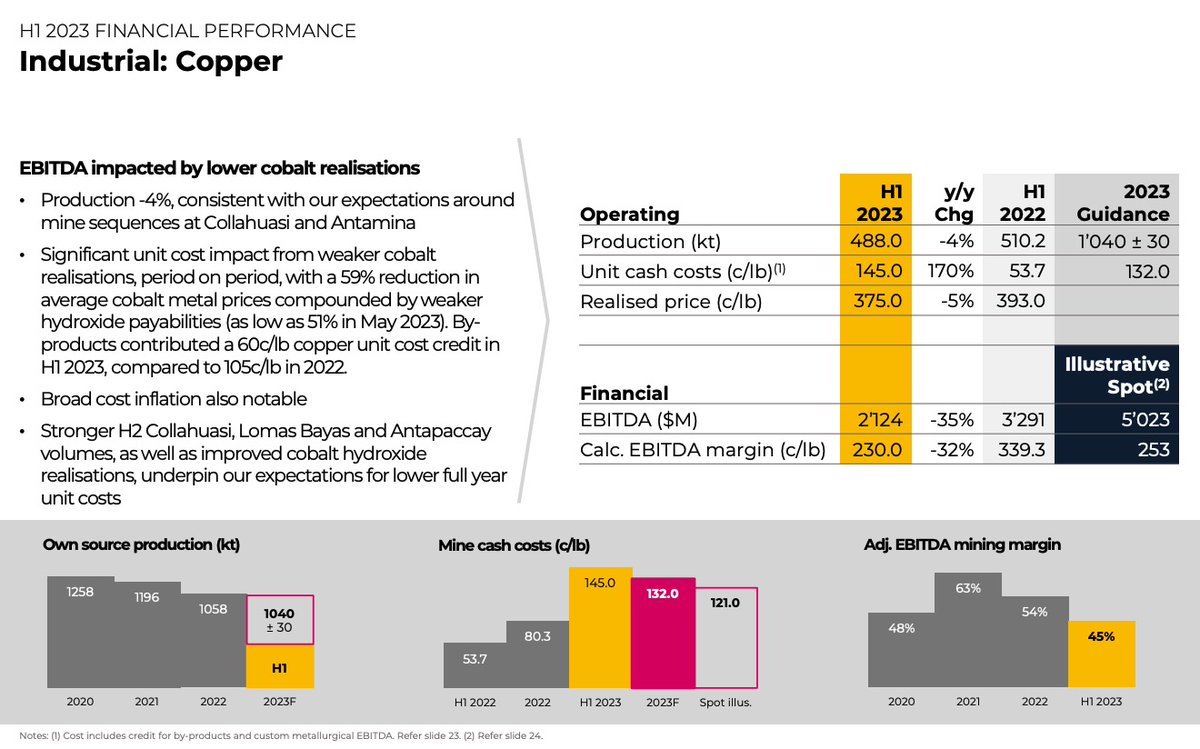

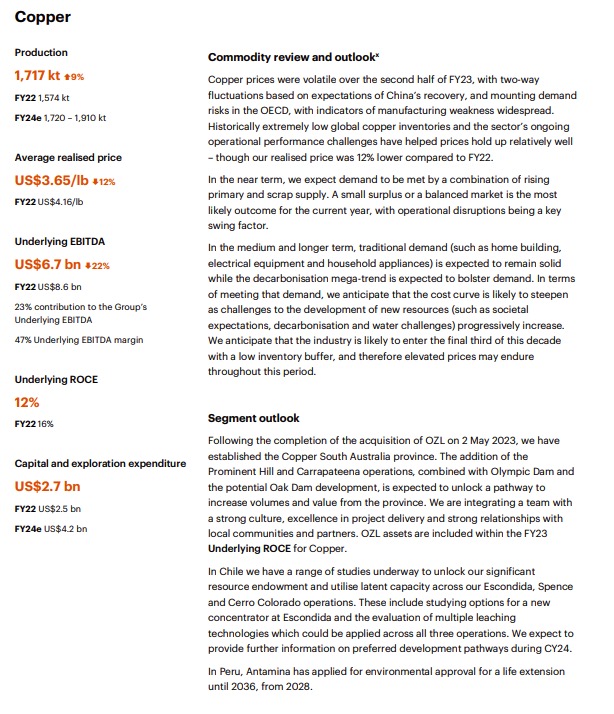

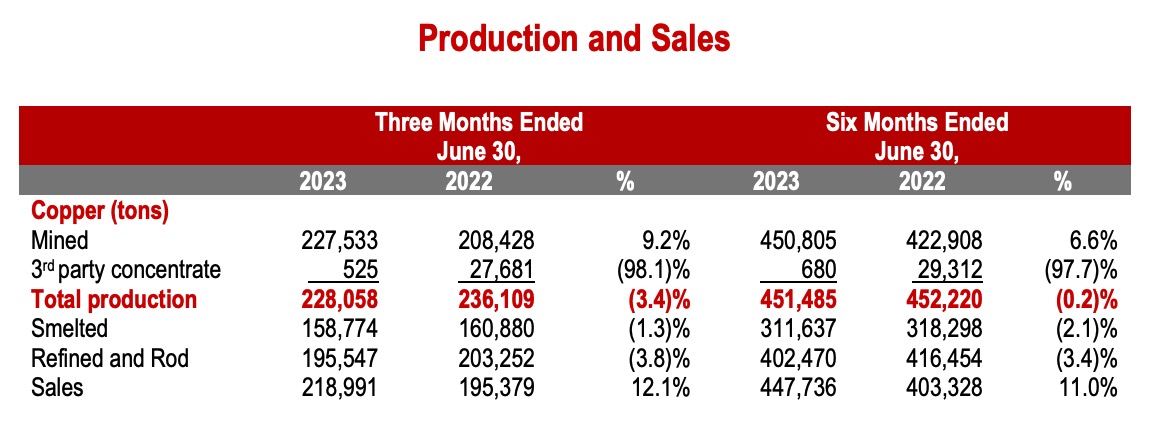

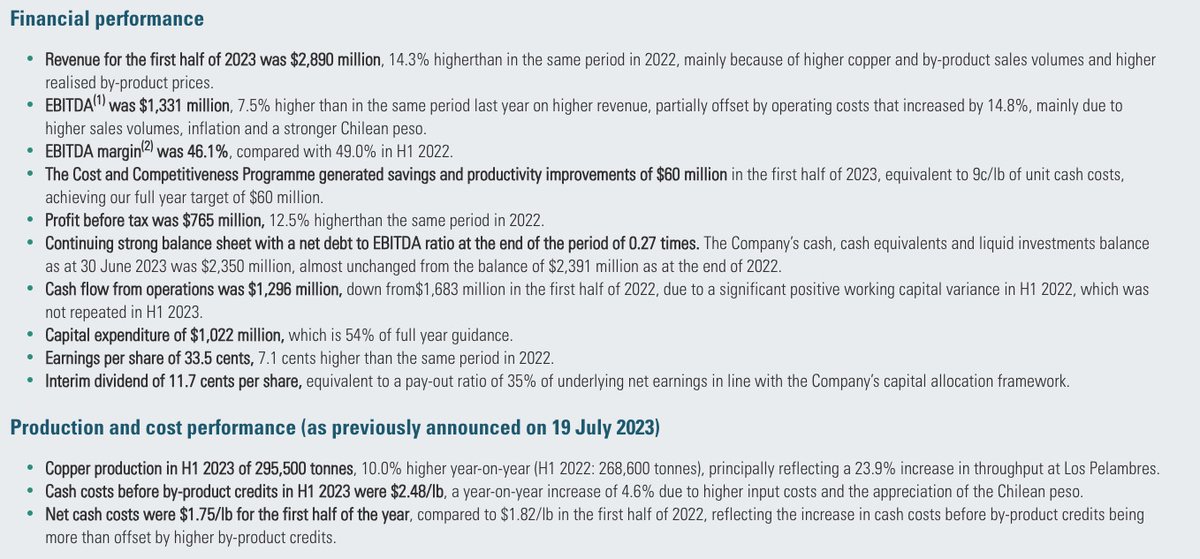

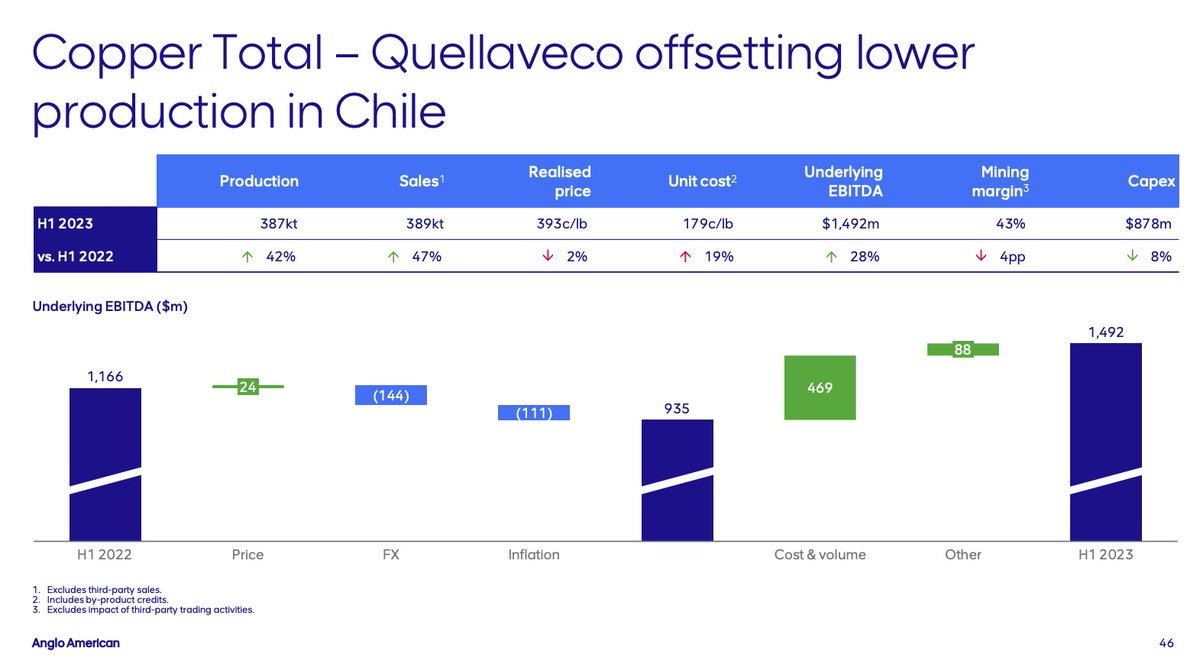

• Production is up across the board due to increased grades and mine ramp-ups

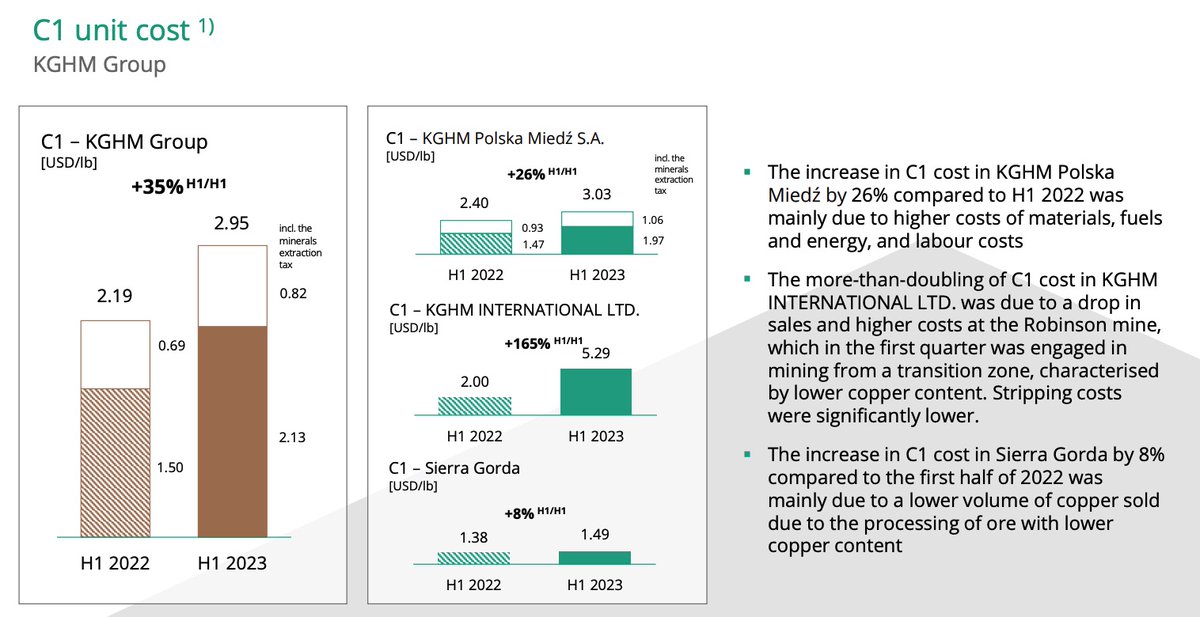

• Cost inflation is STILL here and impacting margins

• Odds are slight surplus into 2024

There are a few key takeaways from these producers:

• Production is up across the board due to increased grades and mine ramp-ups

• Cost inflation is STILL here and impacting margins

• Odds are slight surplus into 2024

12/ Conclusion

I hope you enjoyed this thread and learned something new!

Please consider liking, RT, and sharing with friends if you did.

We'll run this back at the end of Q3!

I hope you enjoyed this thread and learned something new!

Please consider liking, RT, and sharing with friends if you did.

We'll run this back at the end of Q3!

Loading suggestions...