That's it for today!

If you enjoyed it, please Like and Retweet this Thread so more people can see it!

Follow me @MnkeDaniel to learn more about Investing.

Have a great day!

If you enjoyed it, please Like and Retweet this Thread so more people can see it!

Follow me @MnkeDaniel to learn more about Investing.

Have a great day!

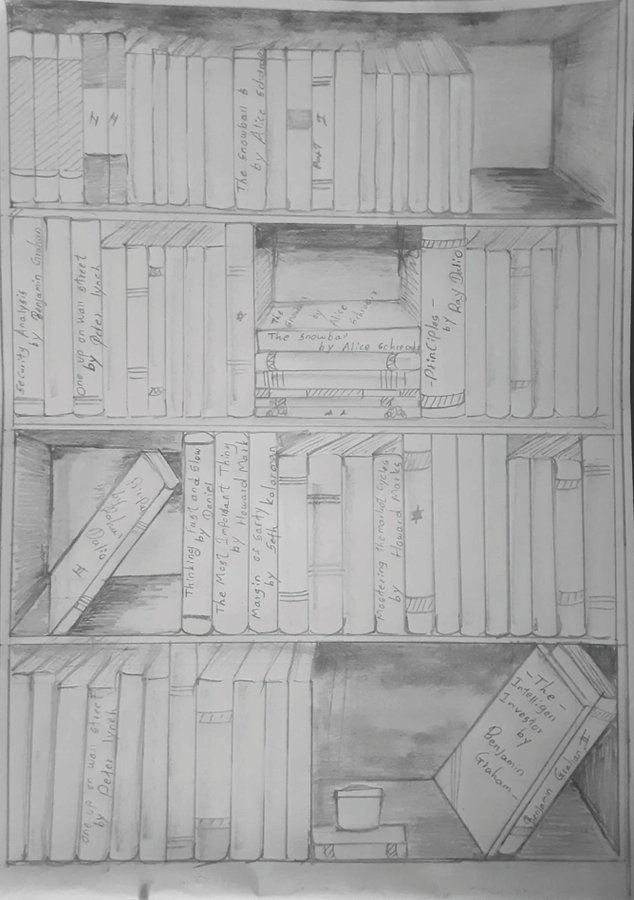

On my Website, I have over 70 Book Recommendations by Superinvestors, entrepreneurs, or scientists.

You’ll find Books on:

- Investing and Finance

- Psychology

- History

- Books on Superinvestors/Politicians/Entrepreneurs

danielmnke.com

You’ll find Books on:

- Investing and Finance

- Psychology

- History

- Books on Superinvestors/Politicians/Entrepreneurs

danielmnke.com

If you want to learn more about Investing, check out my Website!

You'll find:

- Investing Articles

- Free PDFs of Investment Letters, Speeches, and Investing Classes

- Book Recommendations on Investing, Valuation, Psychology, etc.

- A Thread Archive

danielmnke.com

You'll find:

- Investing Articles

- Free PDFs of Investment Letters, Speeches, and Investing Classes

- Book Recommendations on Investing, Valuation, Psychology, etc.

- A Thread Archive

danielmnke.com

Loading suggestions...