The invocation Prayer and Welcome address is done.

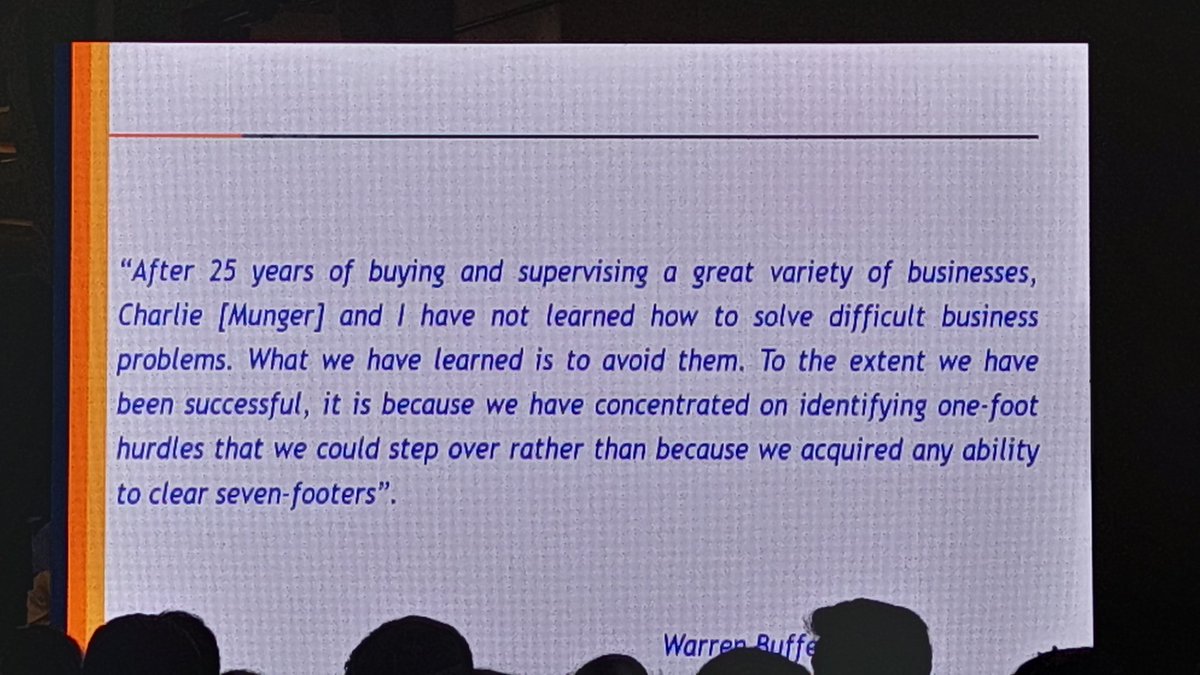

The first speaker, Mr. Rajeev Thakkar, @PPFAS is on stage now.

The first speaker, Mr. Rajeev Thakkar, @PPFAS is on stage now.

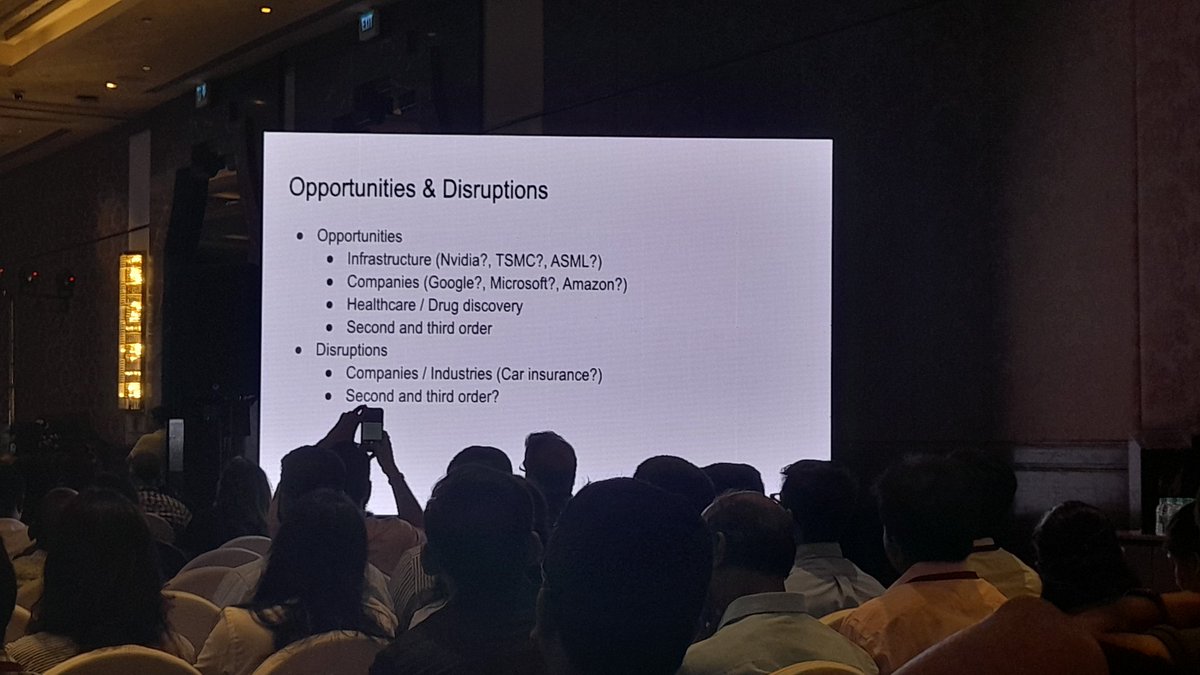

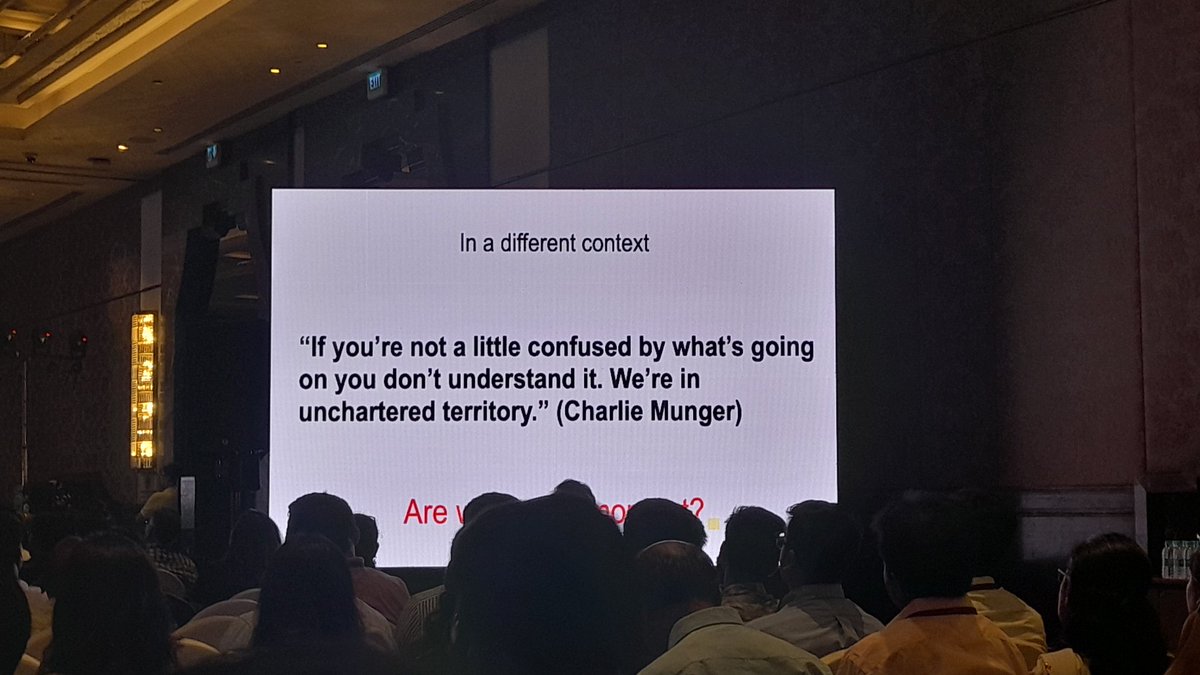

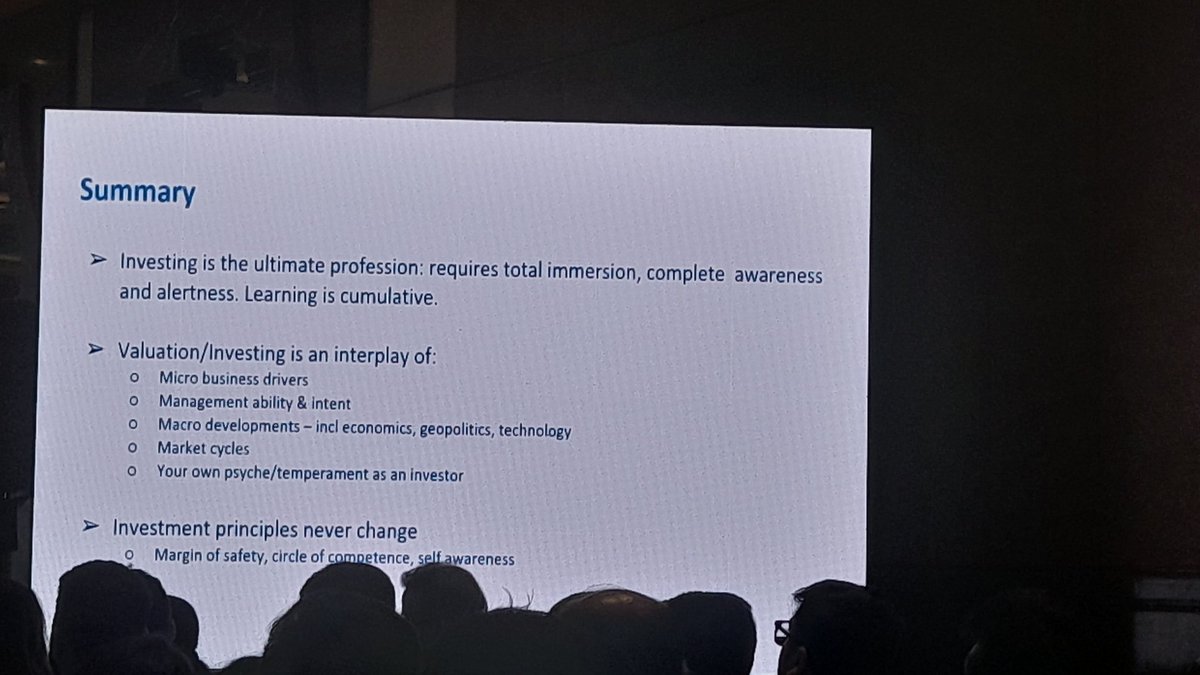

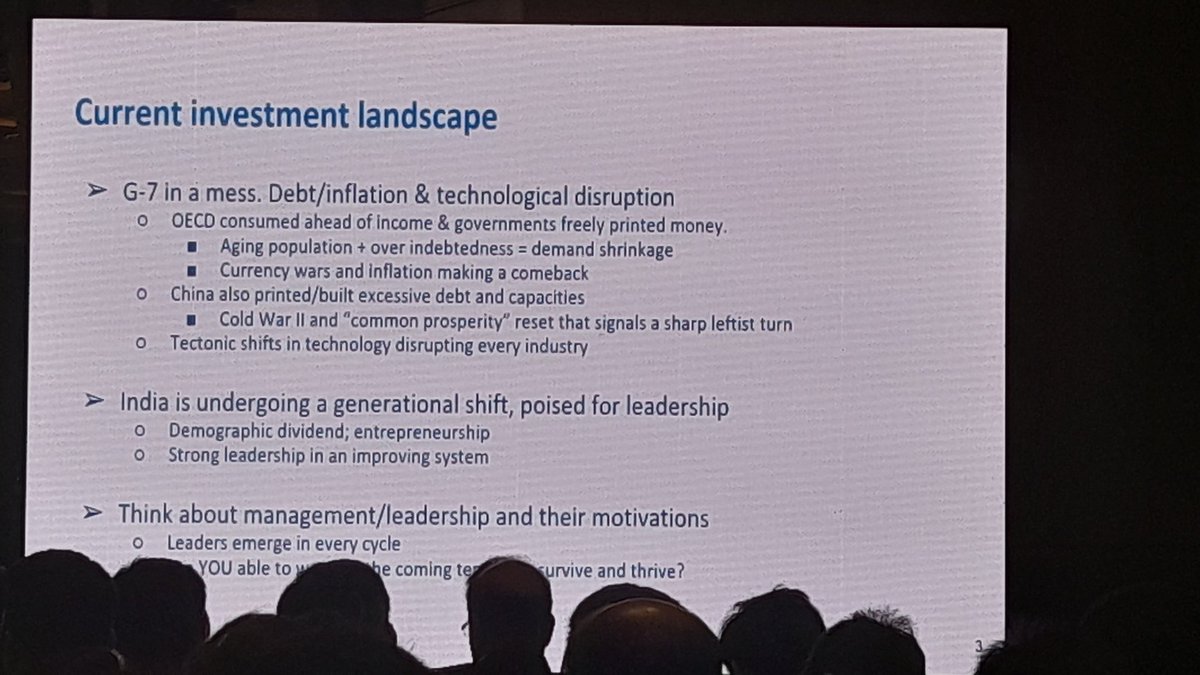

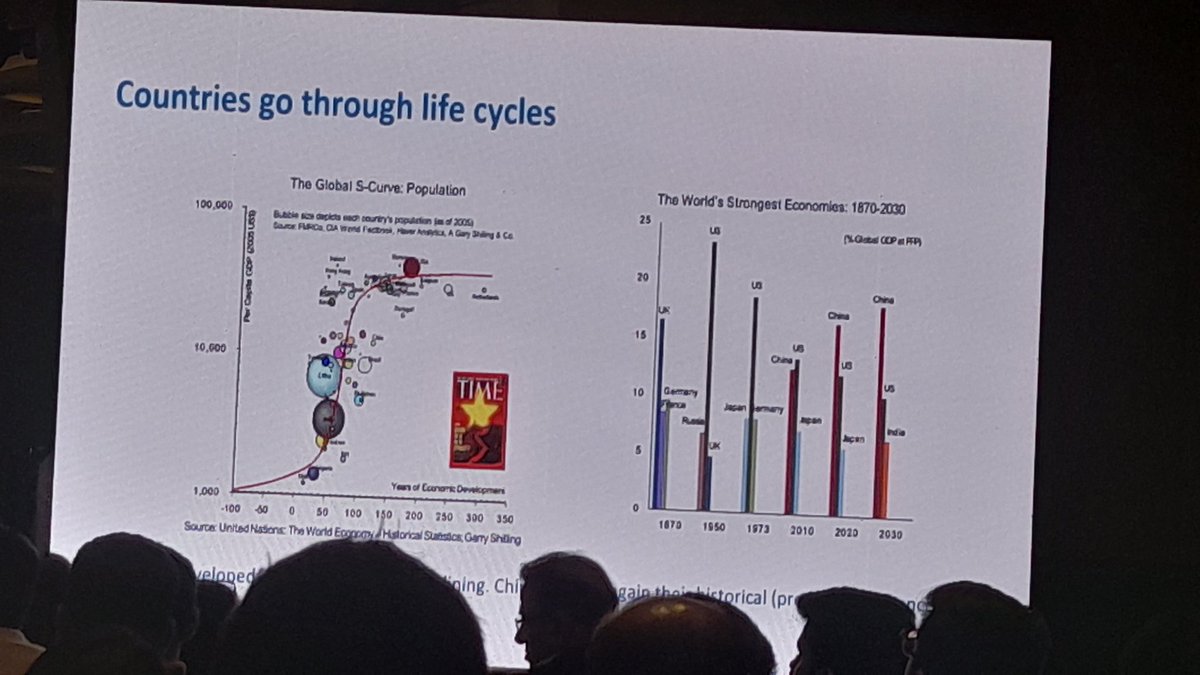

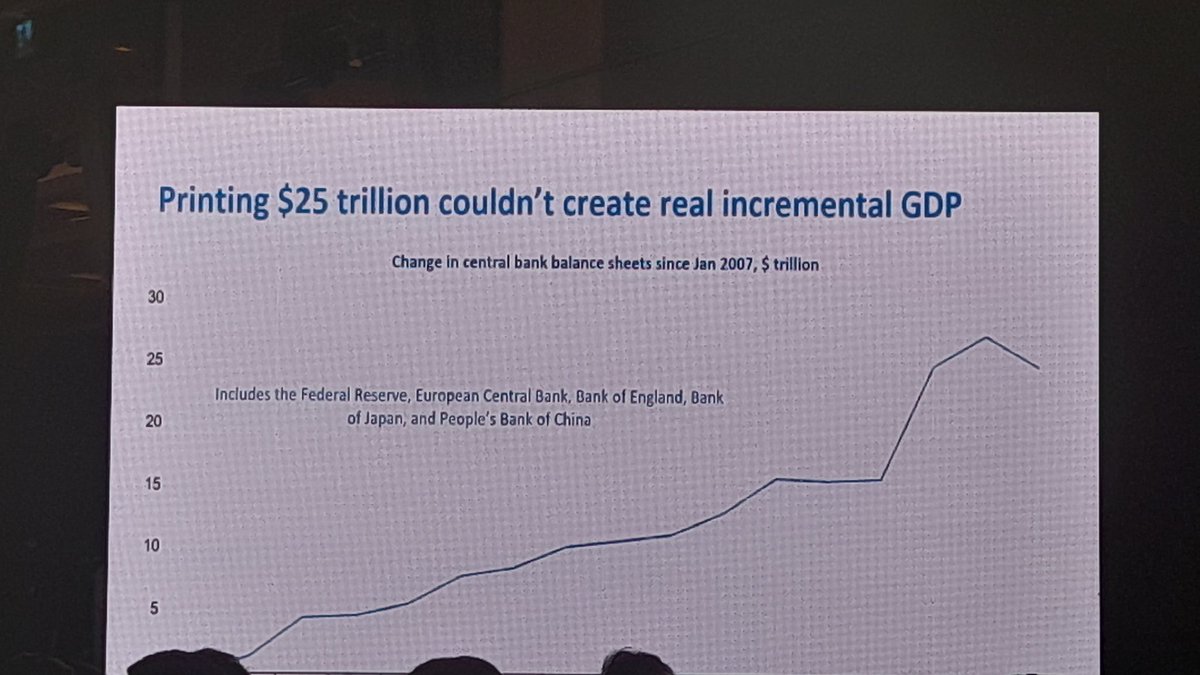

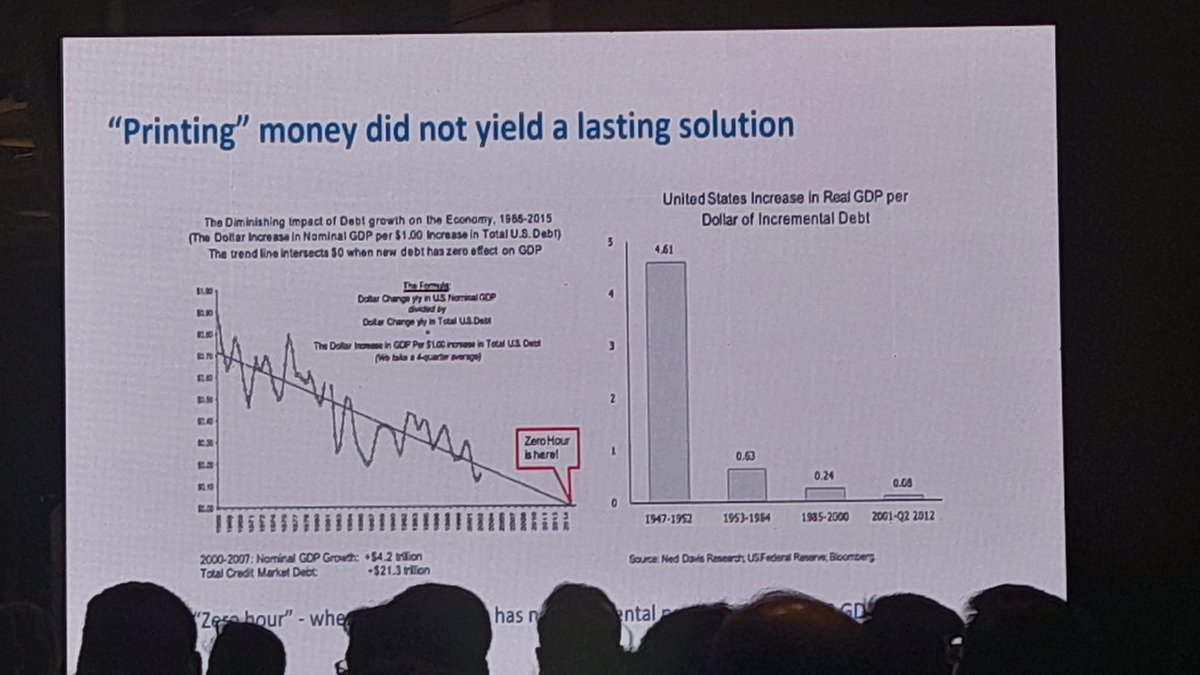

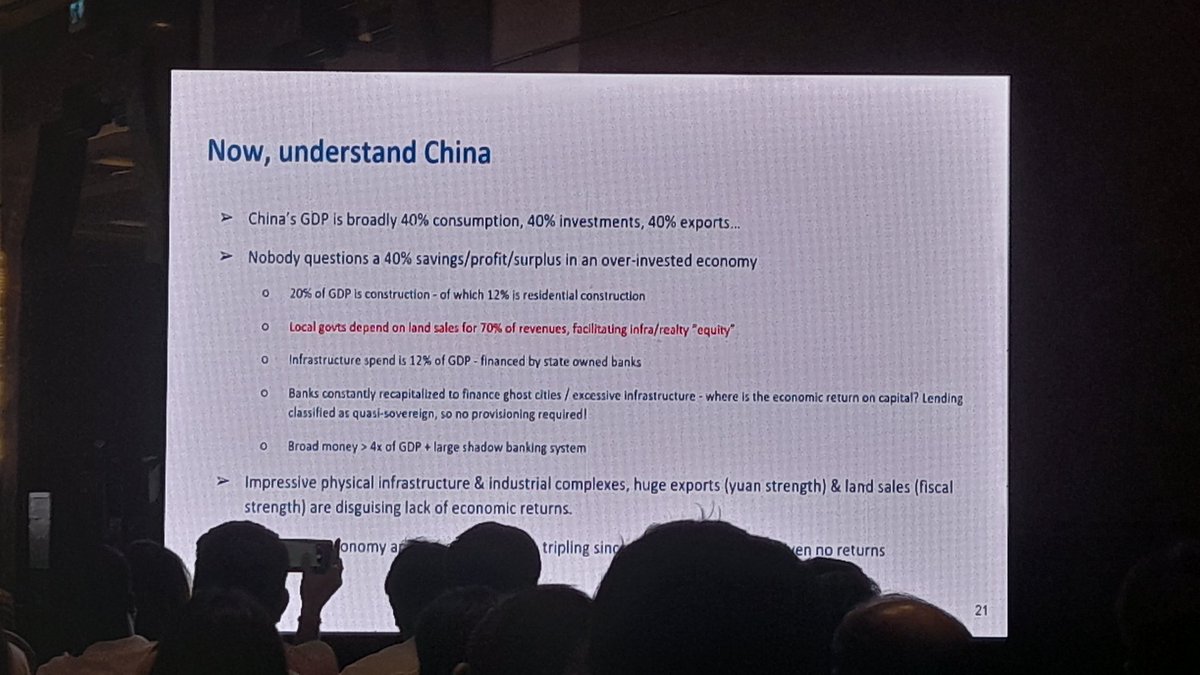

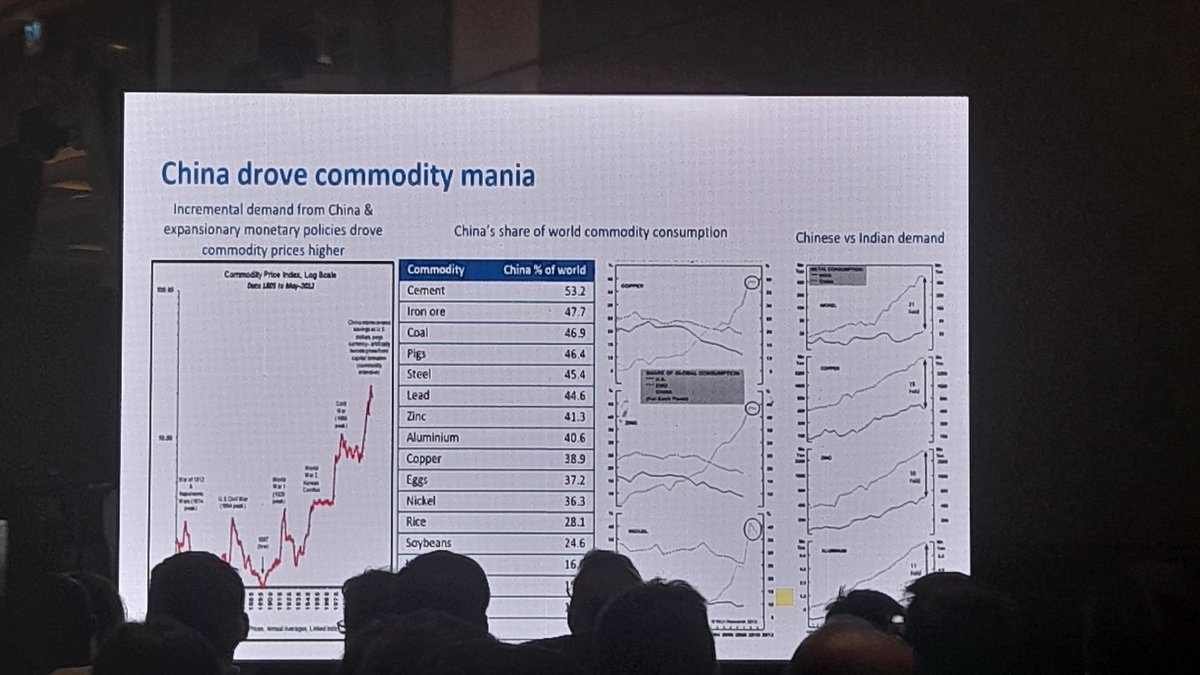

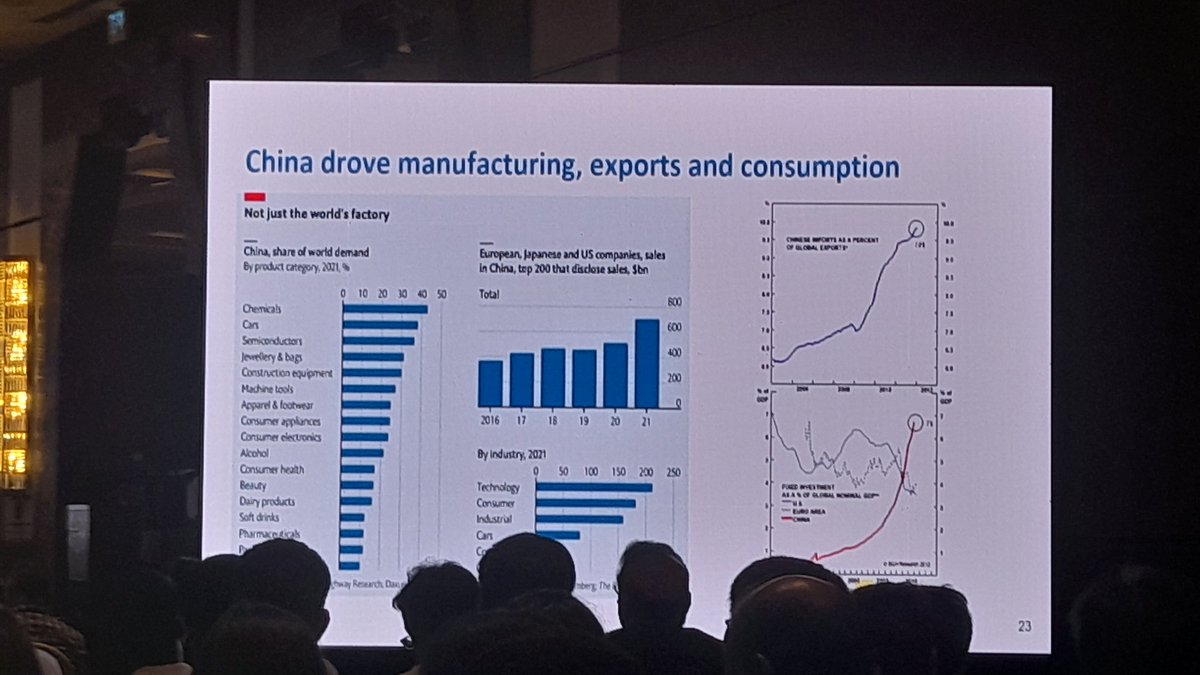

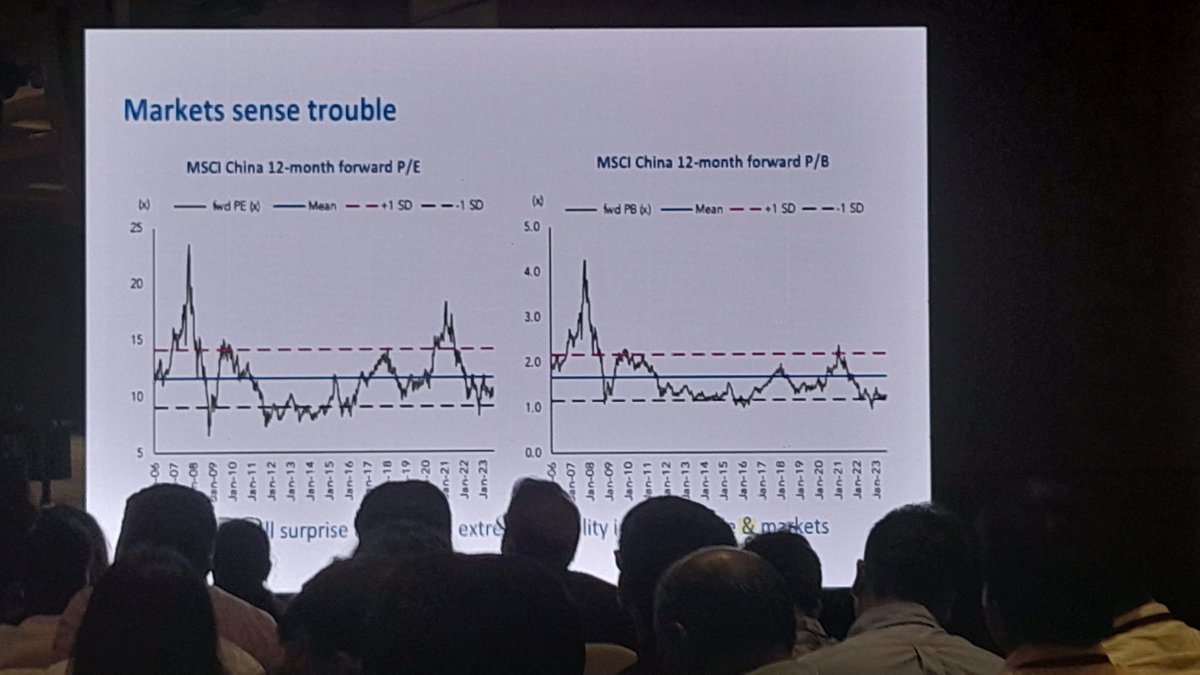

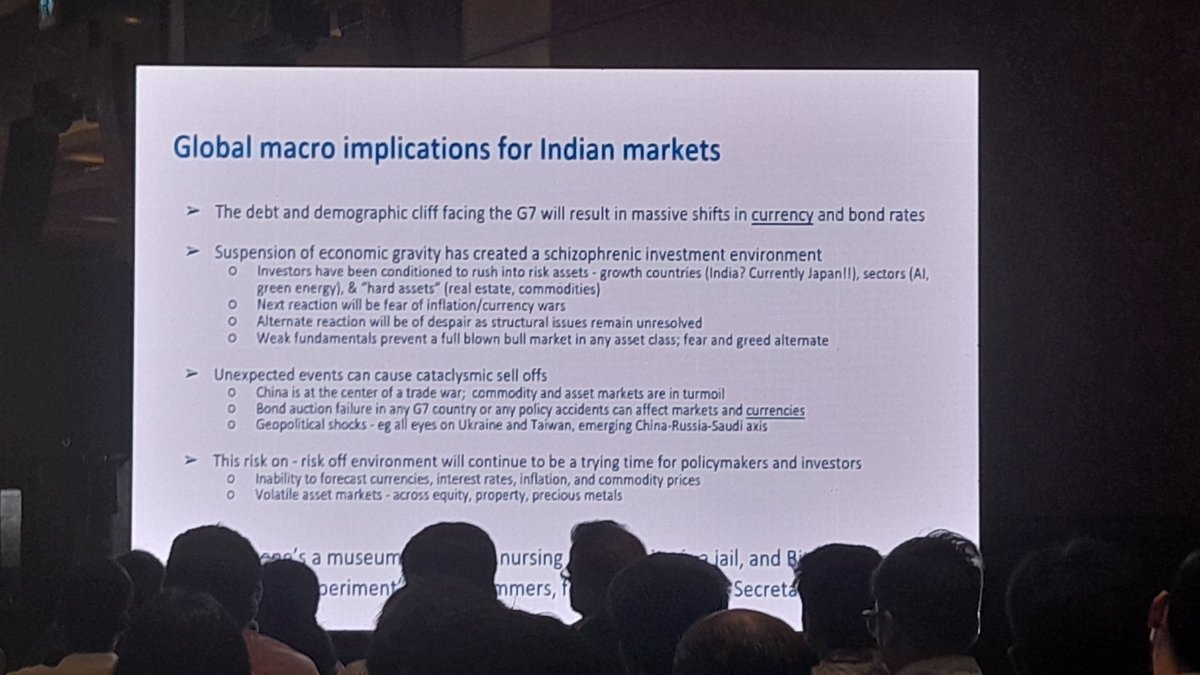

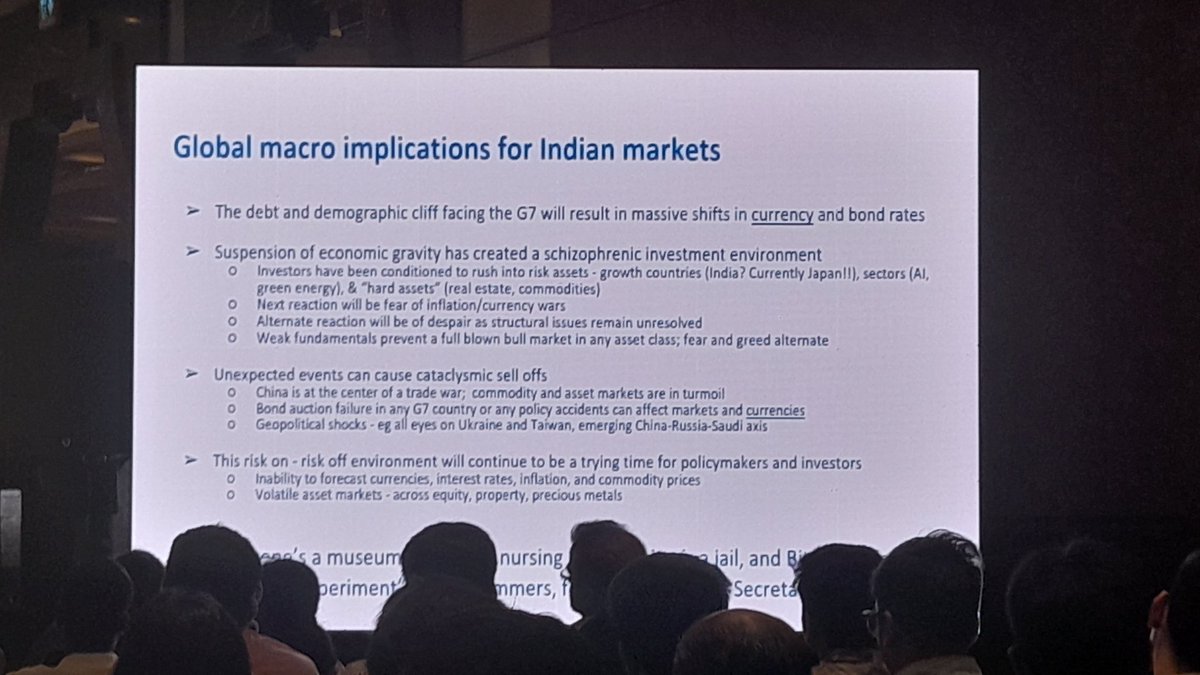

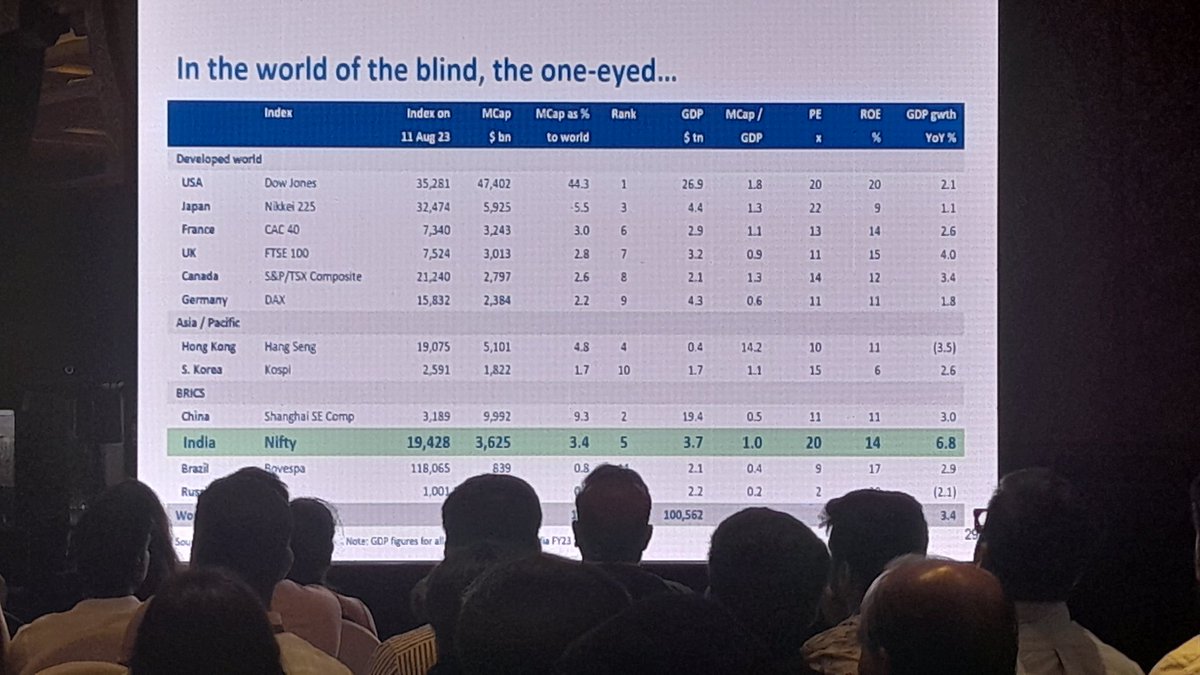

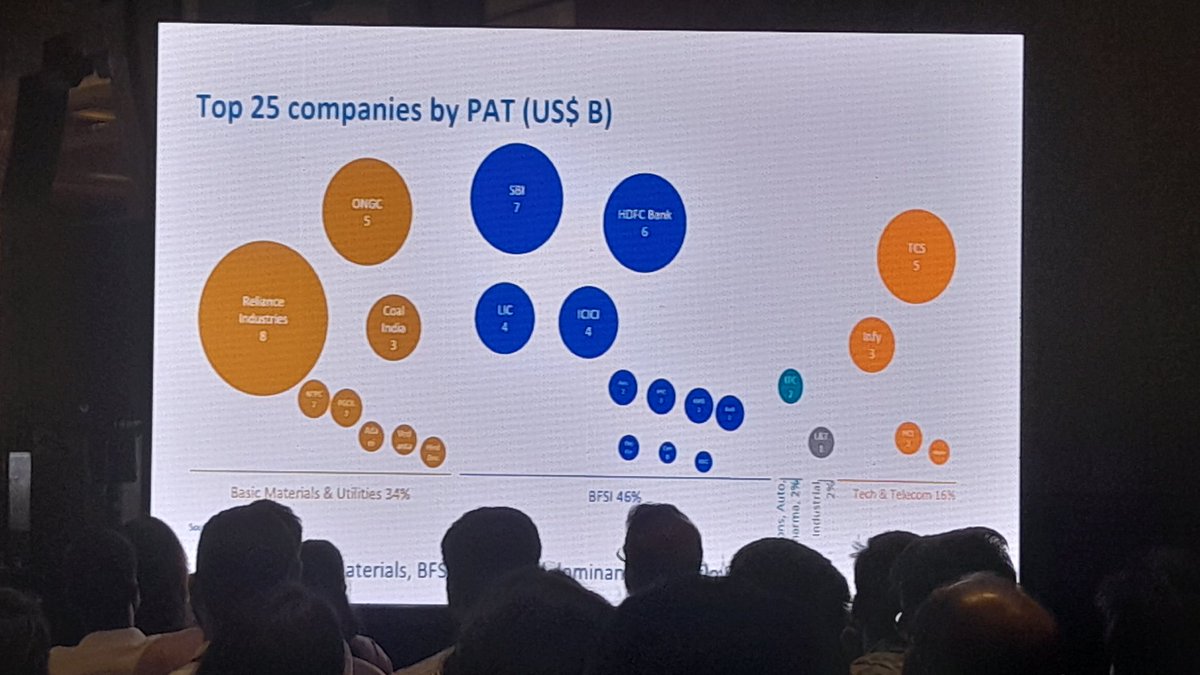

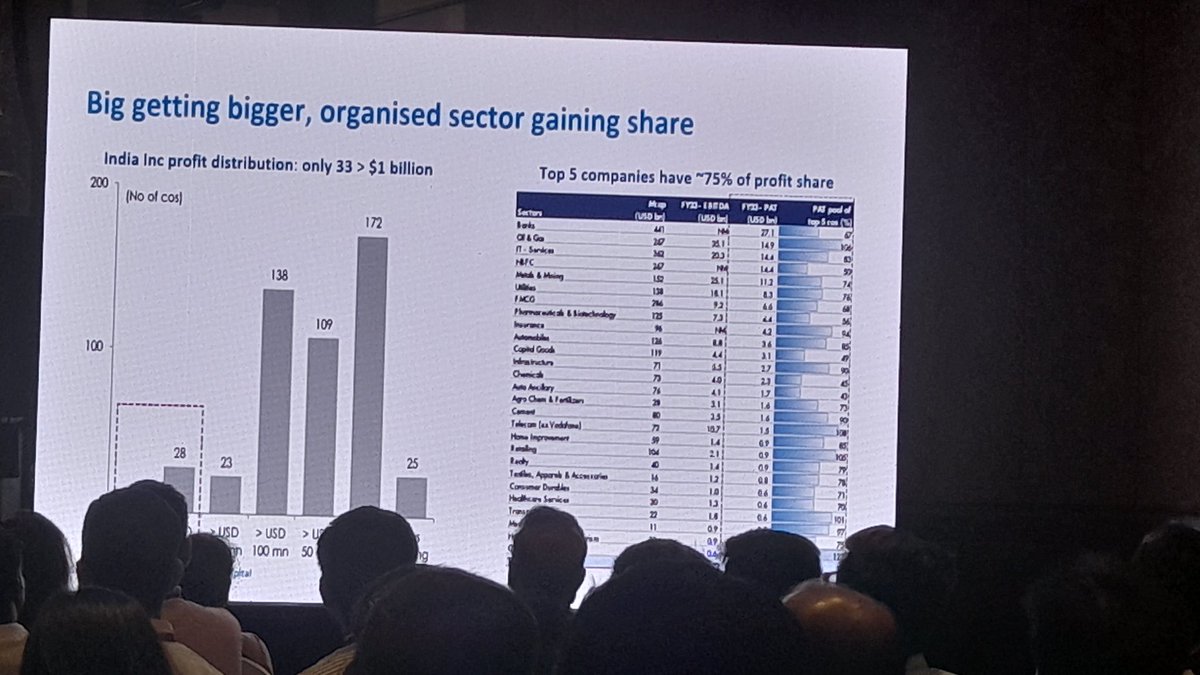

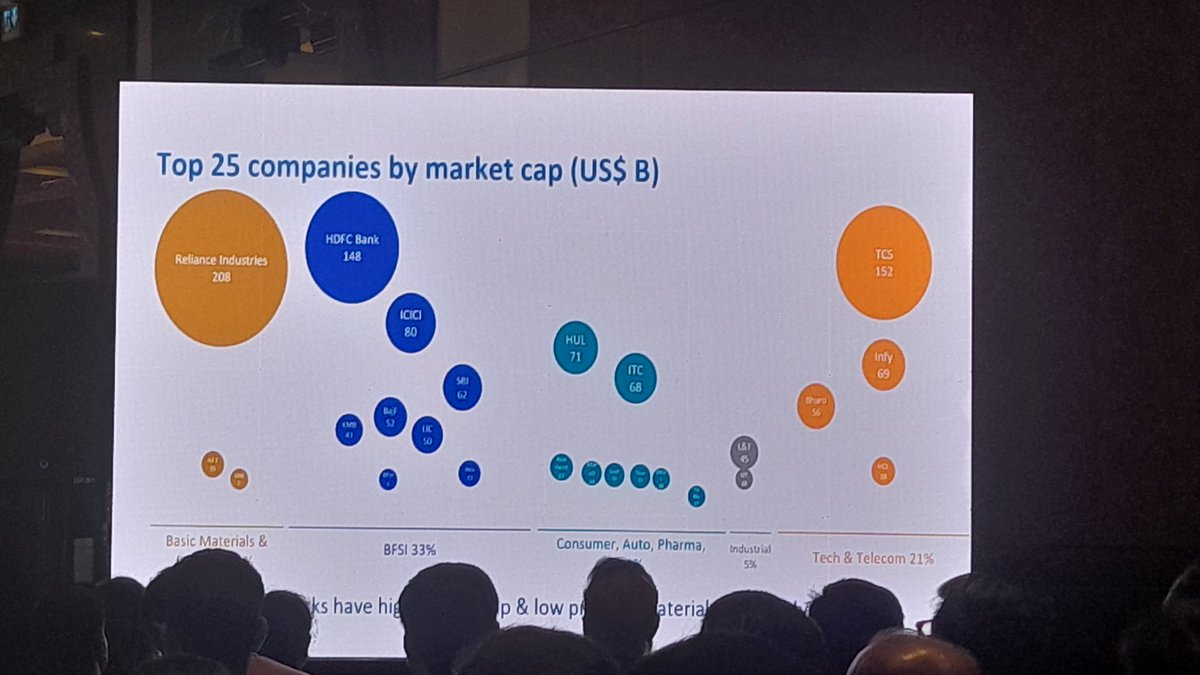

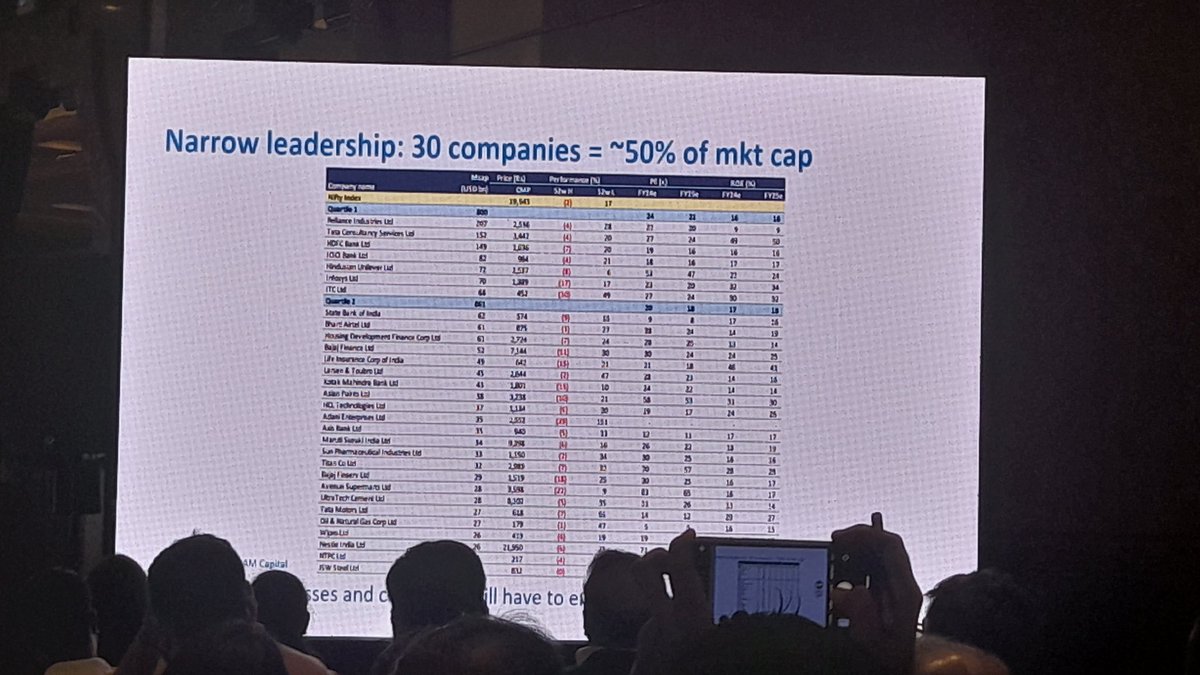

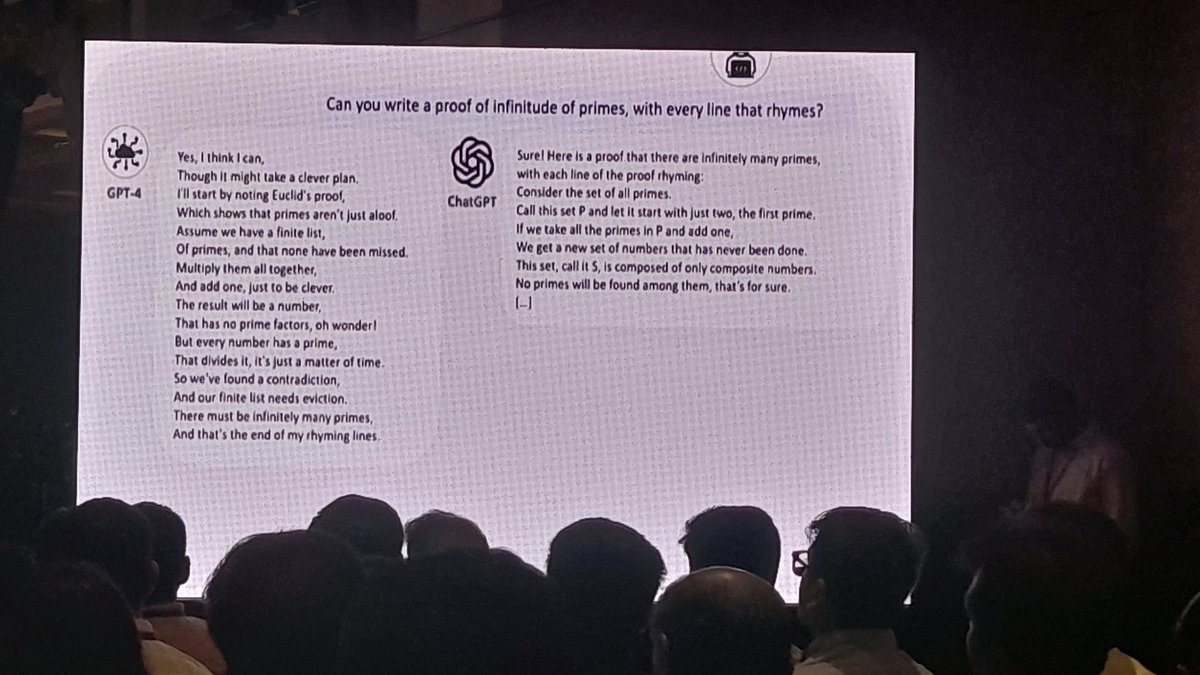

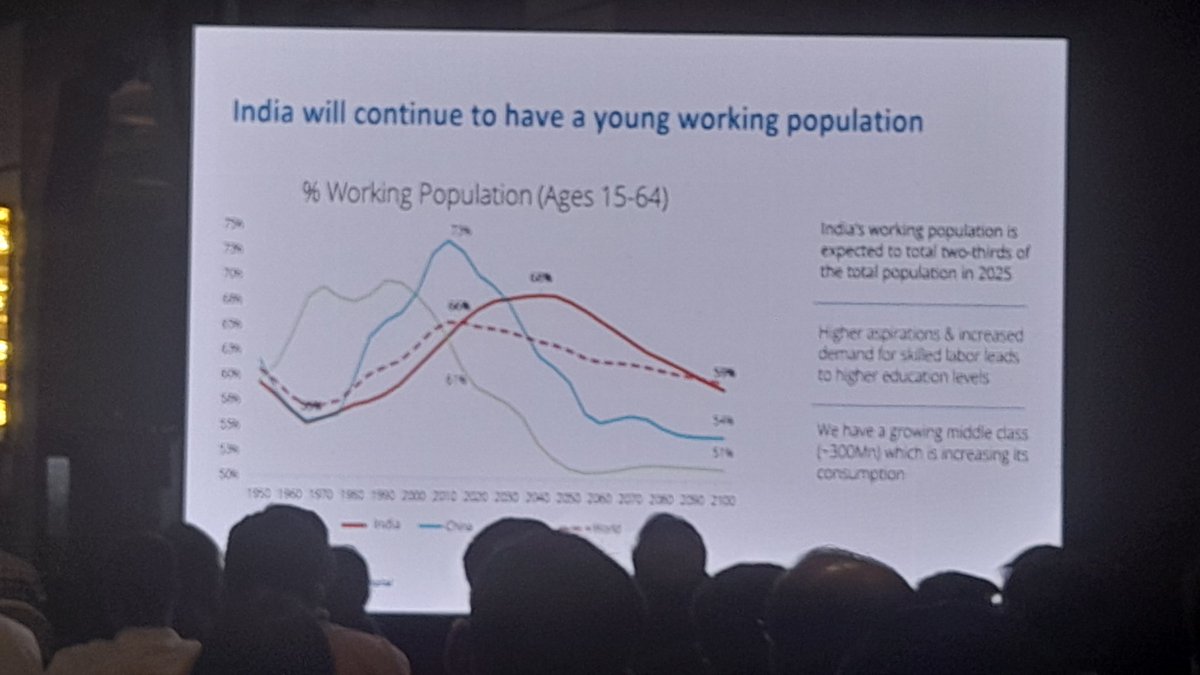

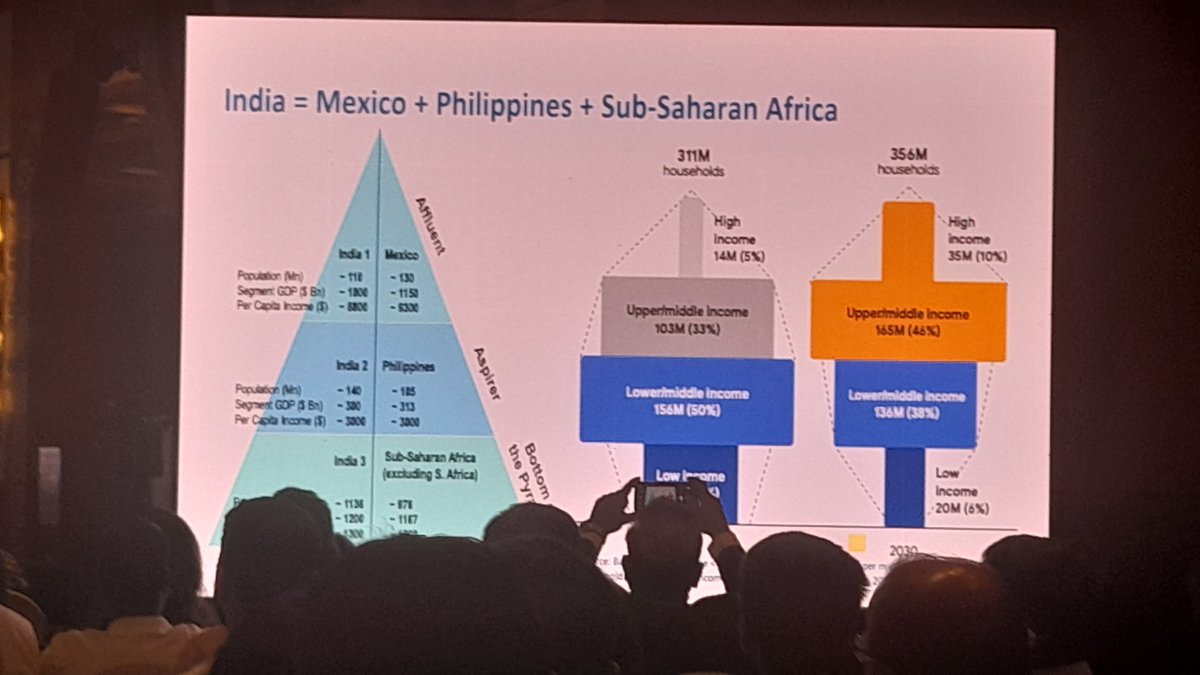

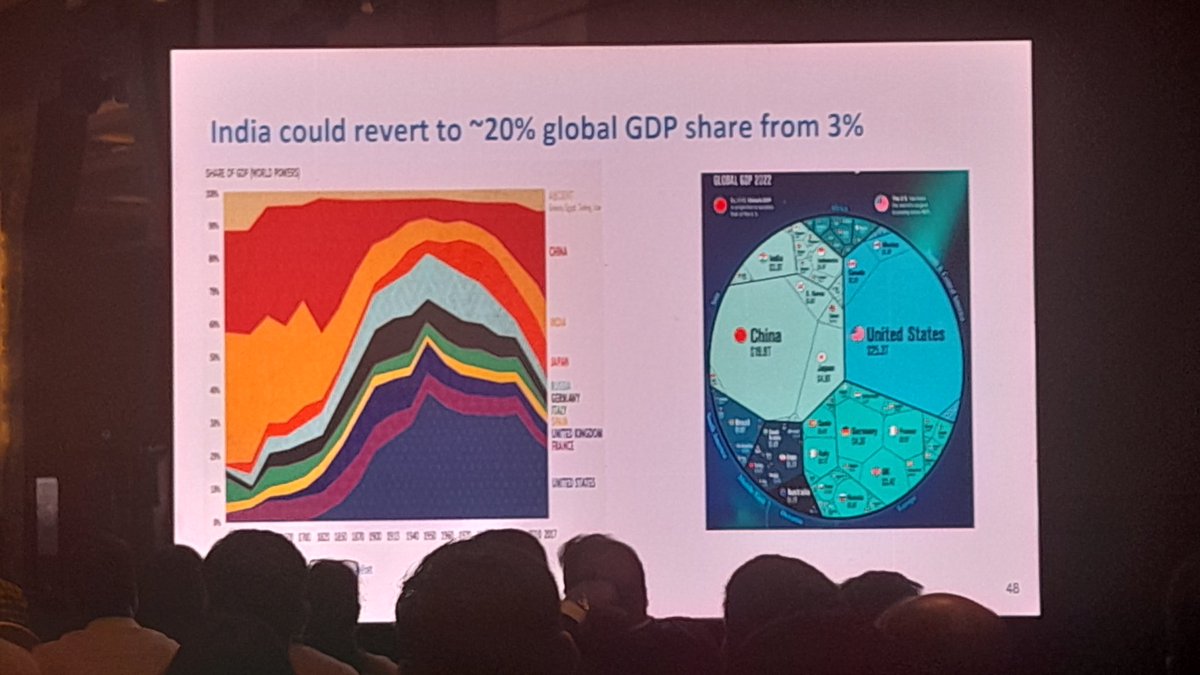

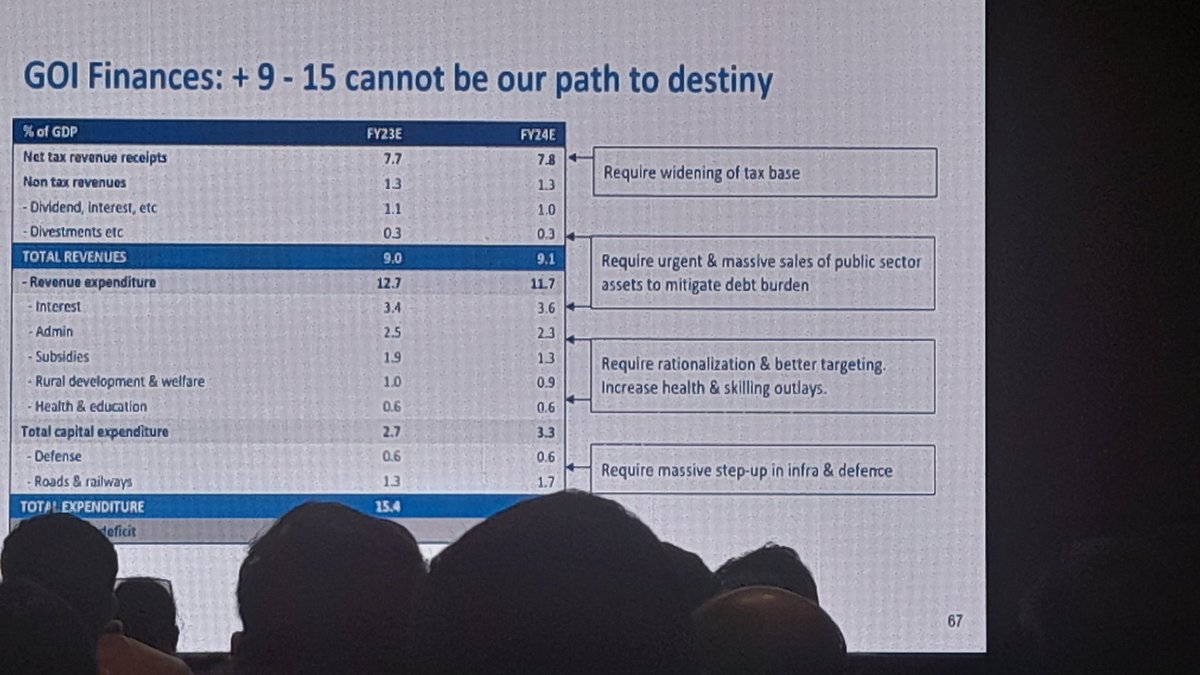

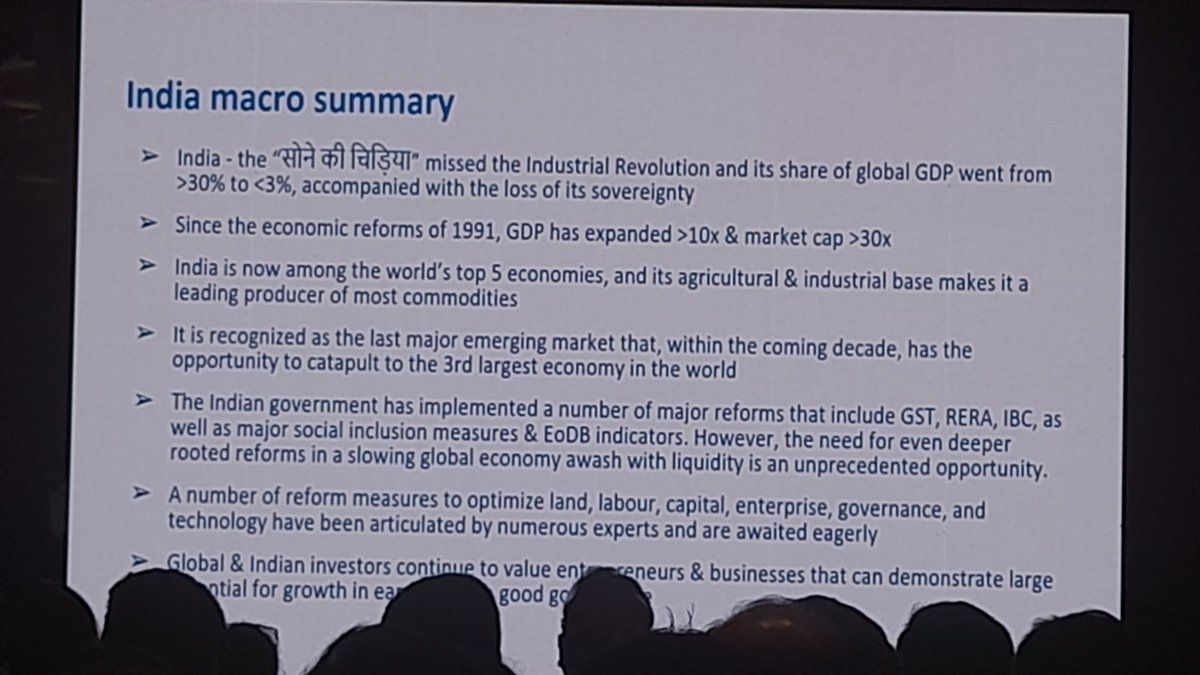

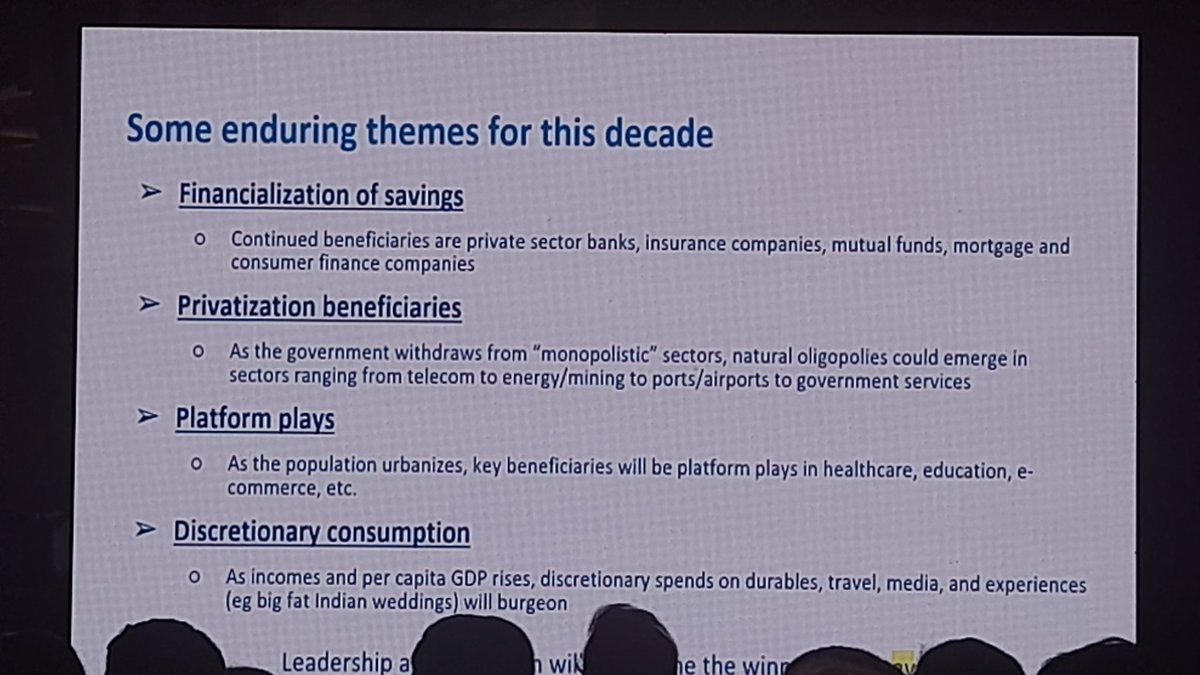

@benedictevans Rajeev Thakkar ends his brilliant talk and now comes Mr. Manish Chokhani (@chokhani_manish)

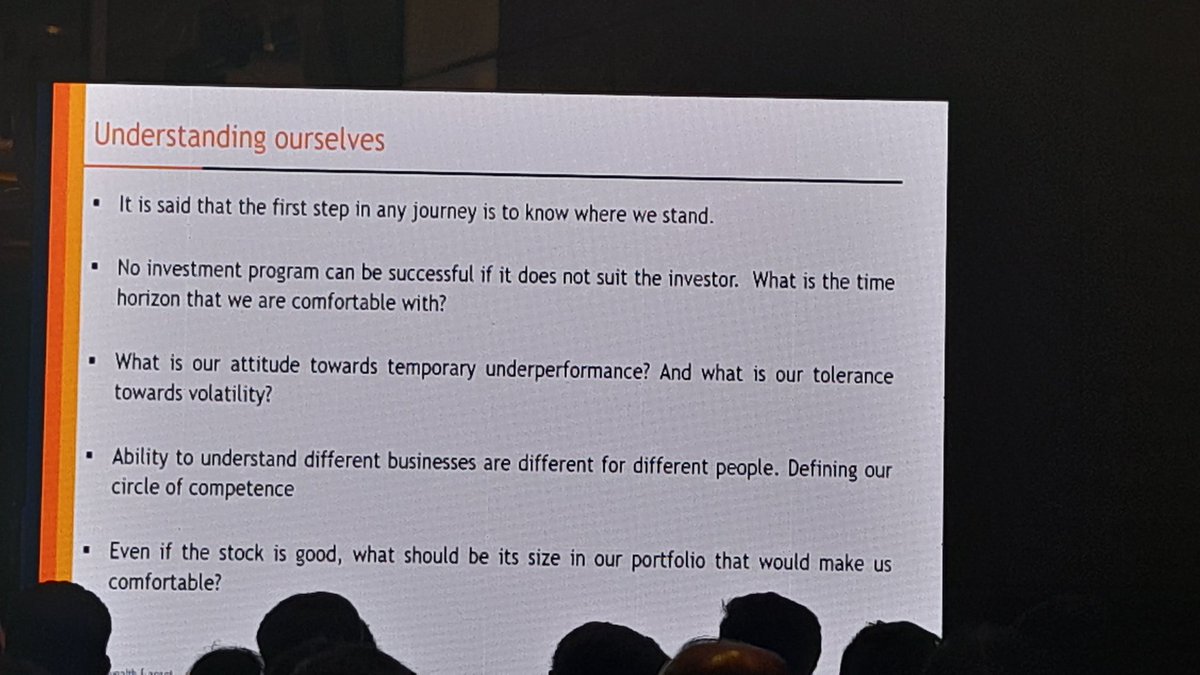

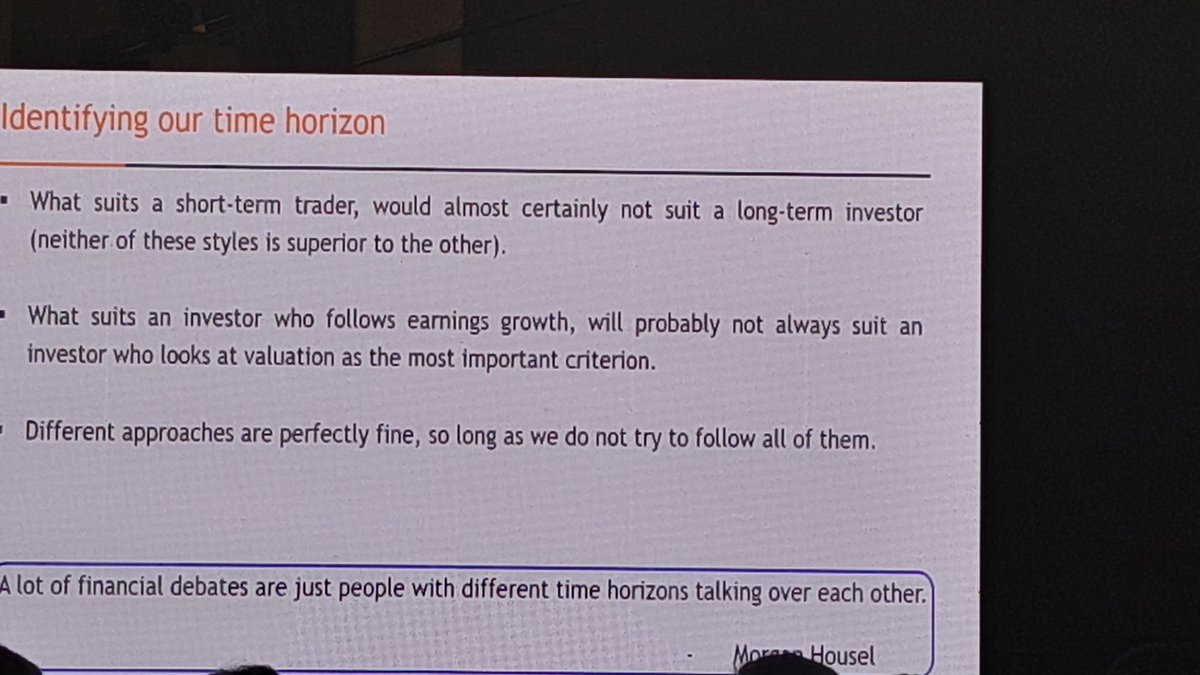

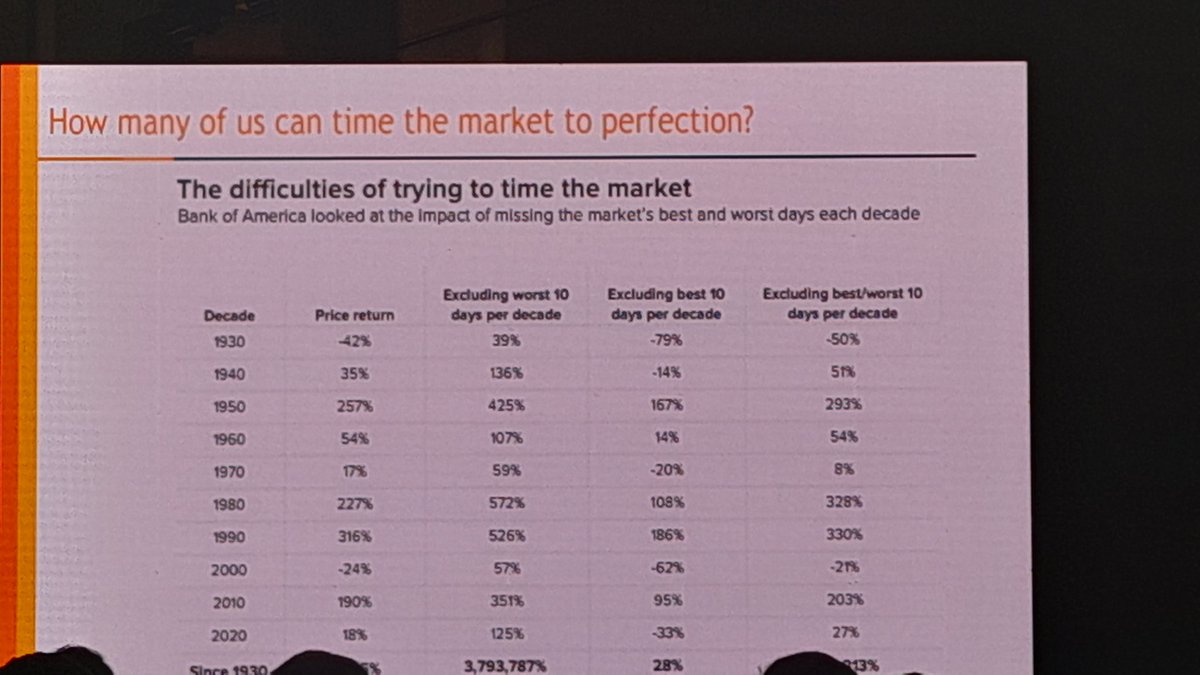

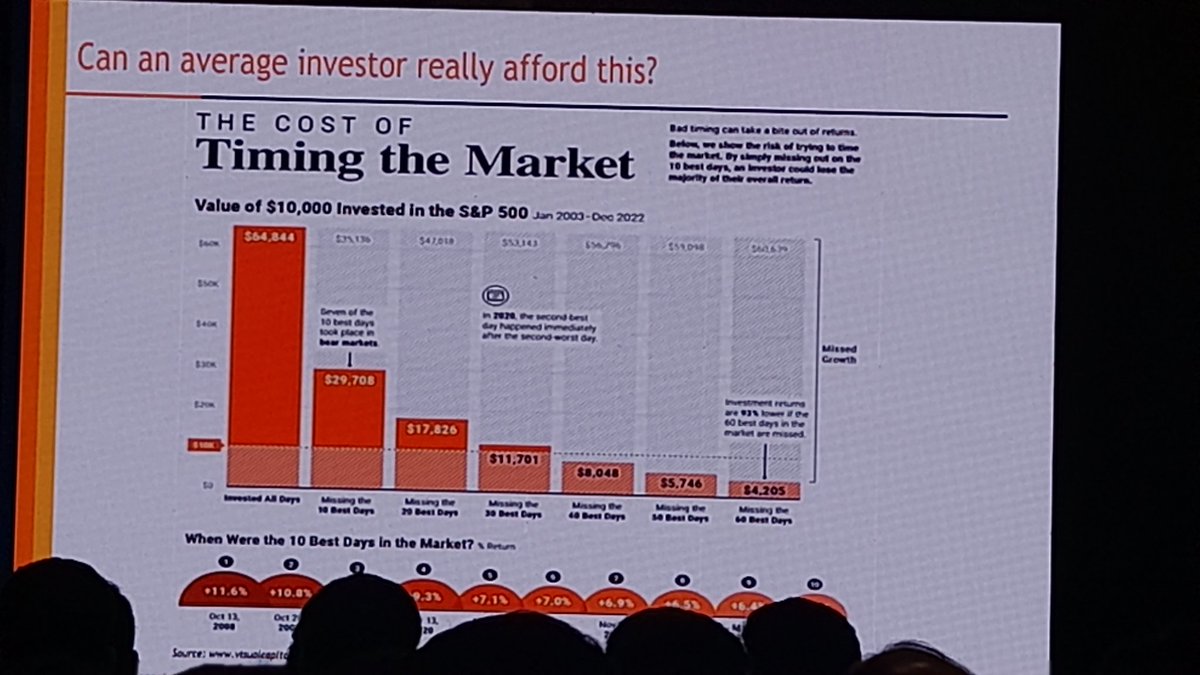

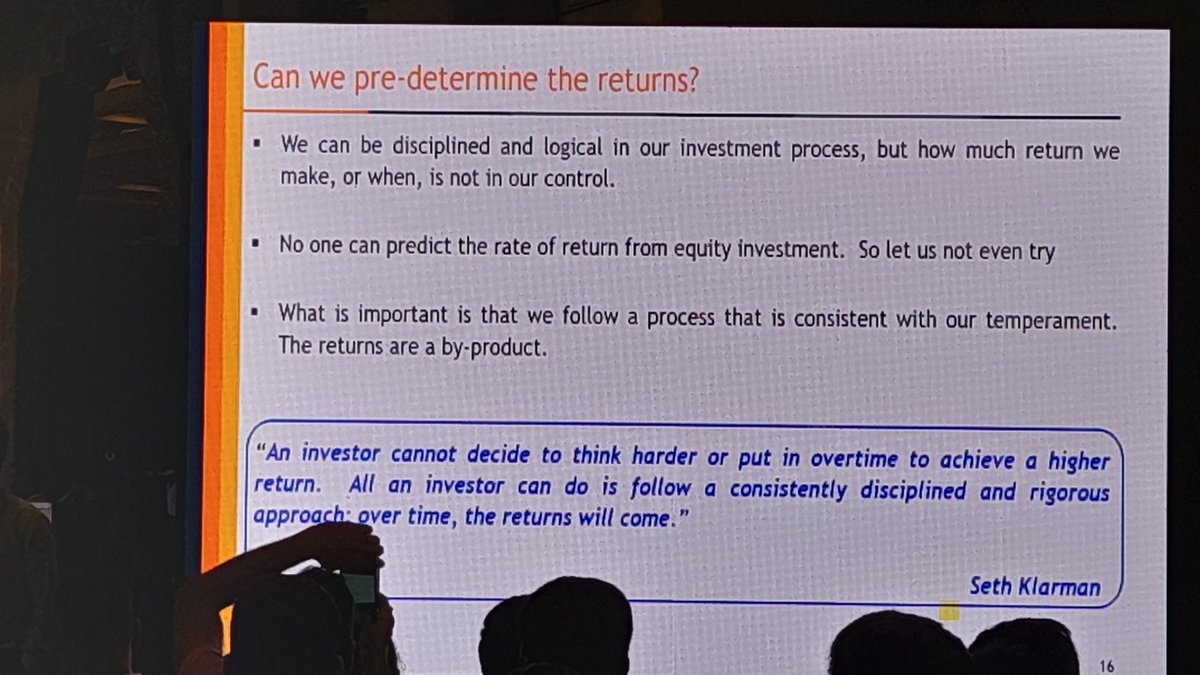

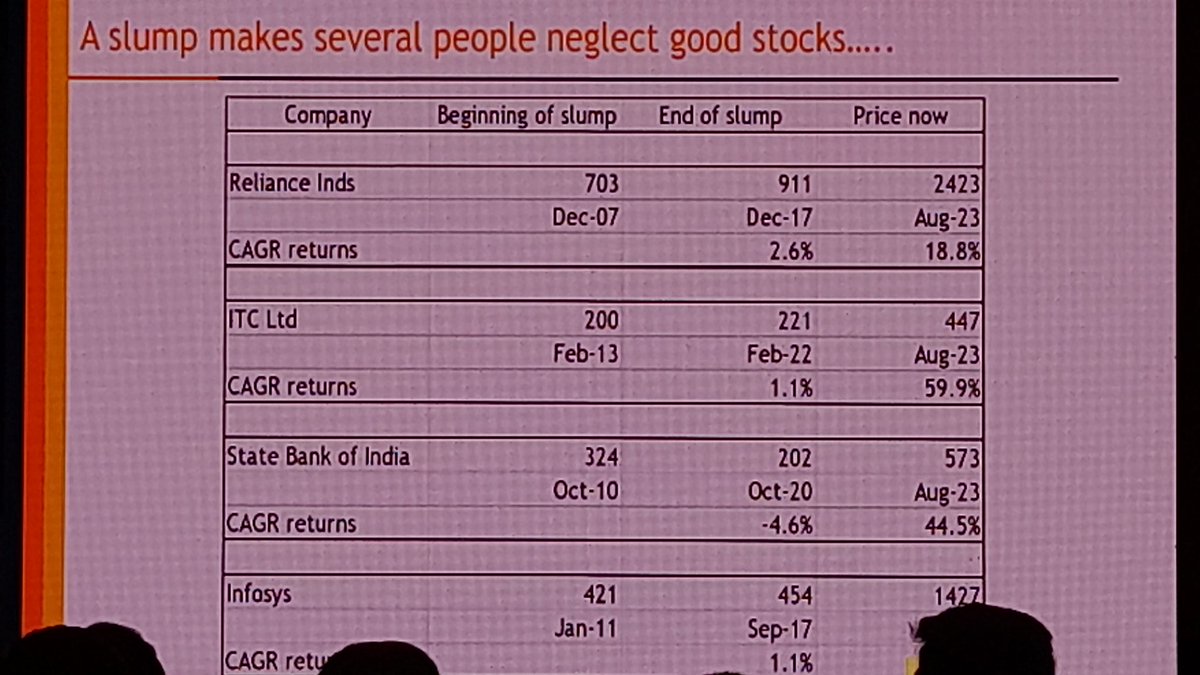

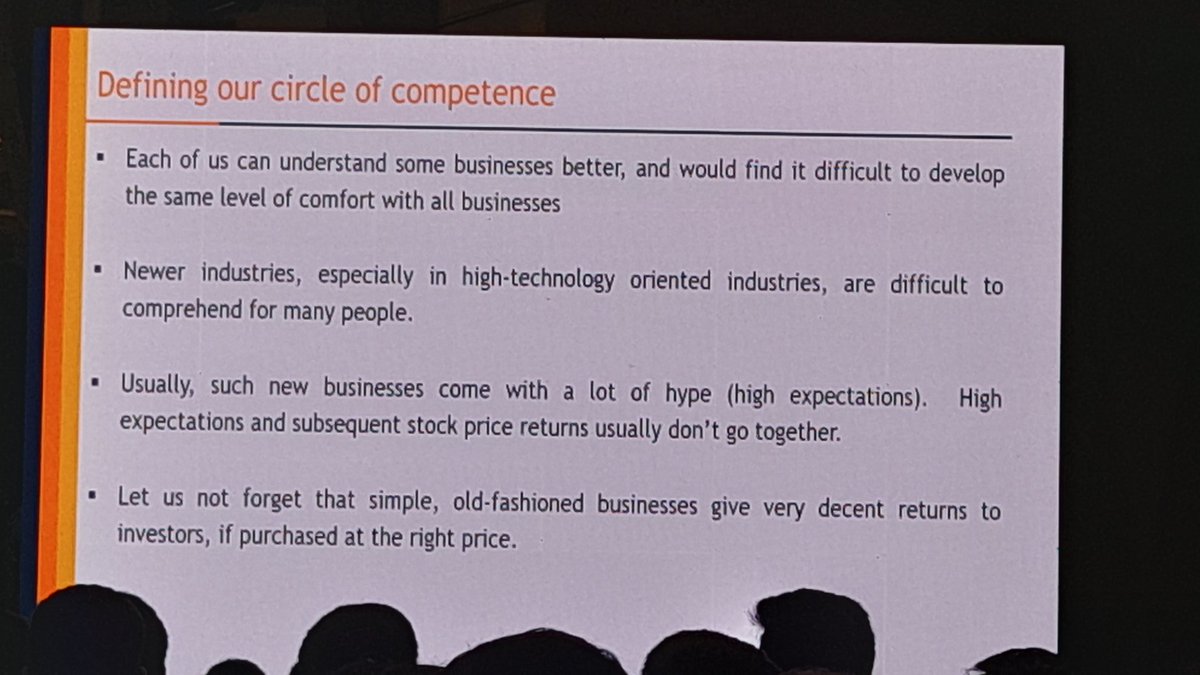

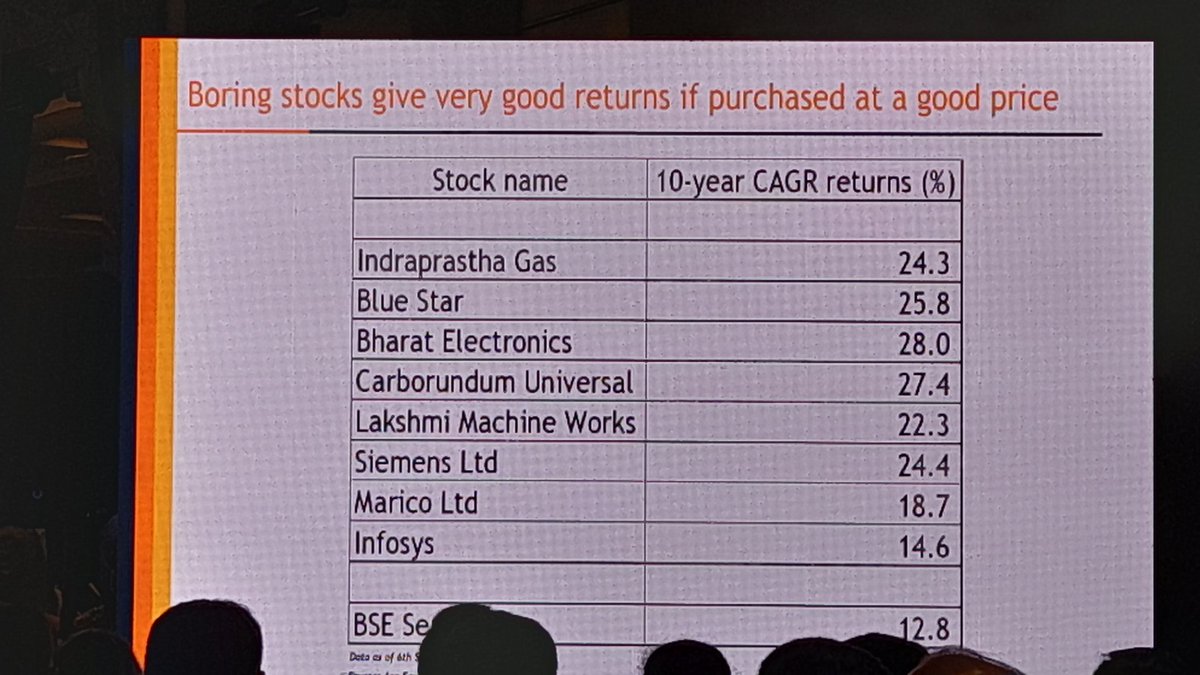

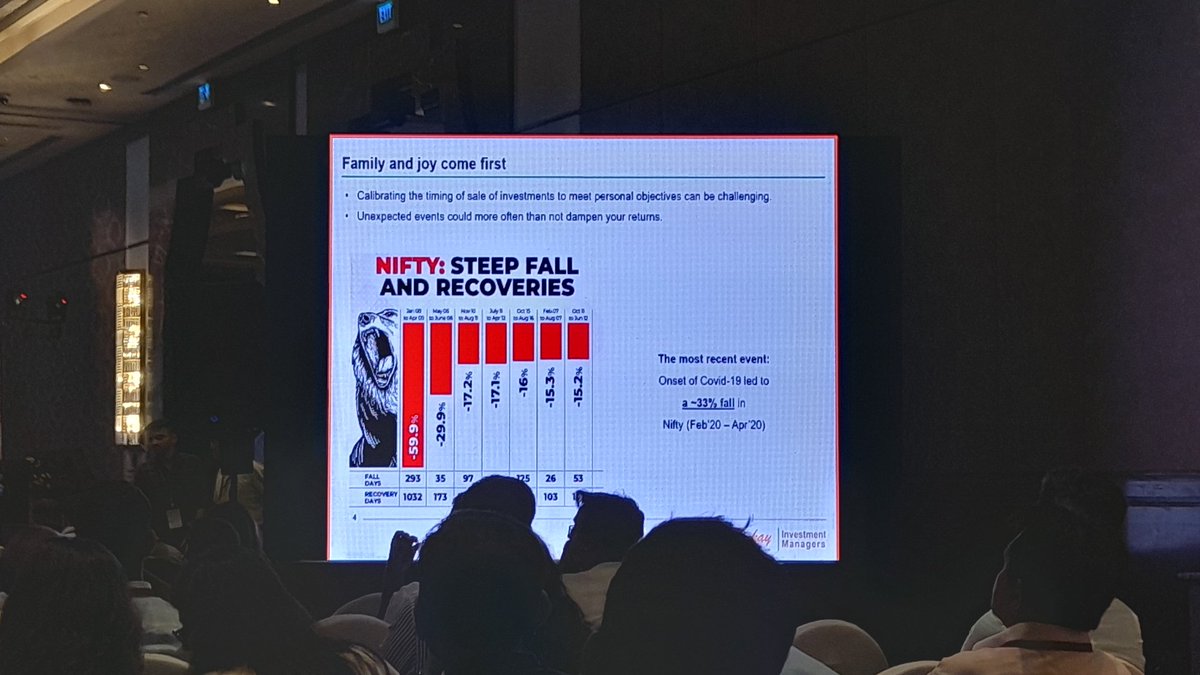

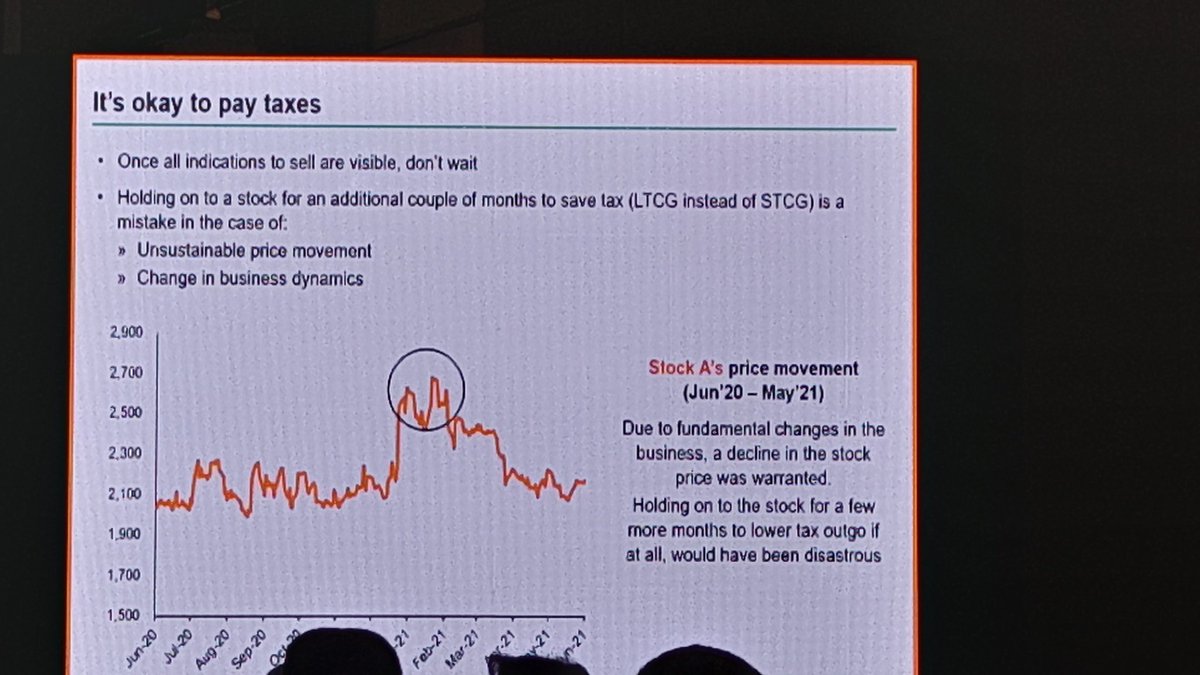

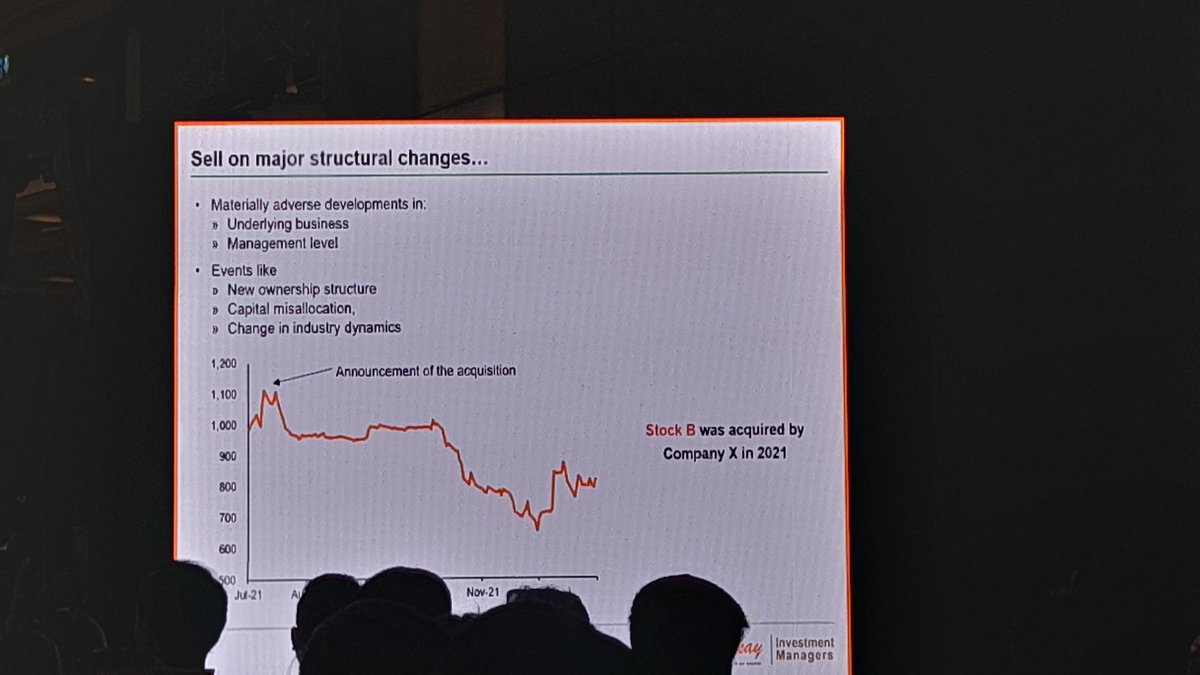

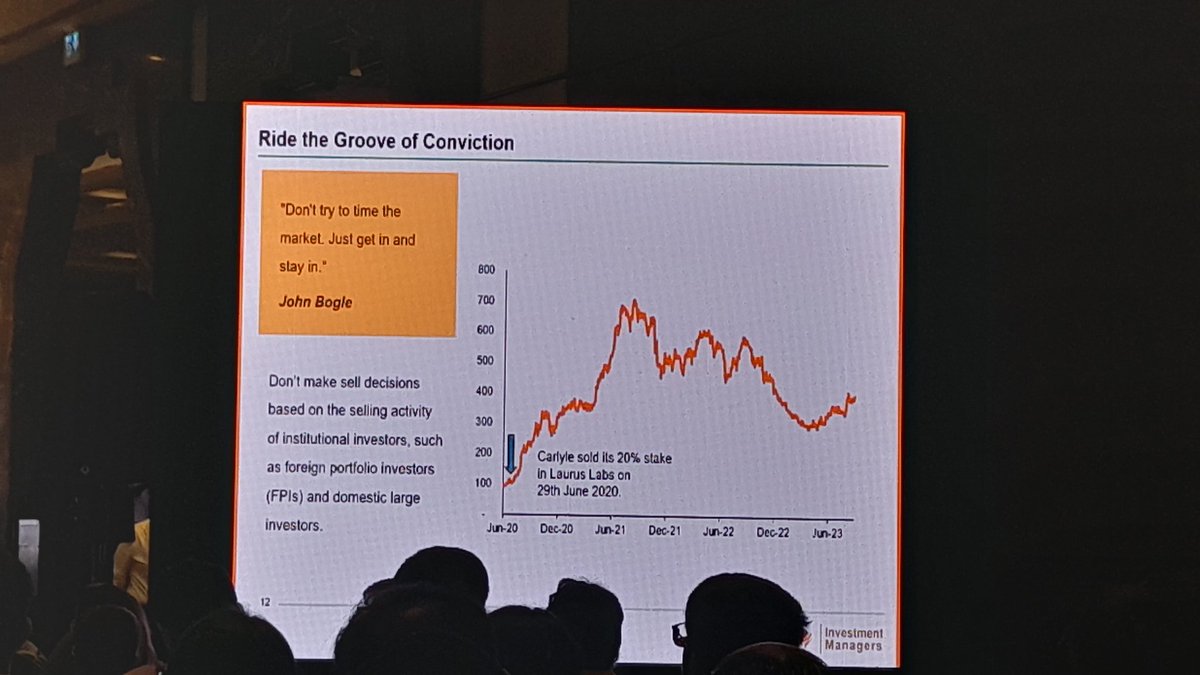

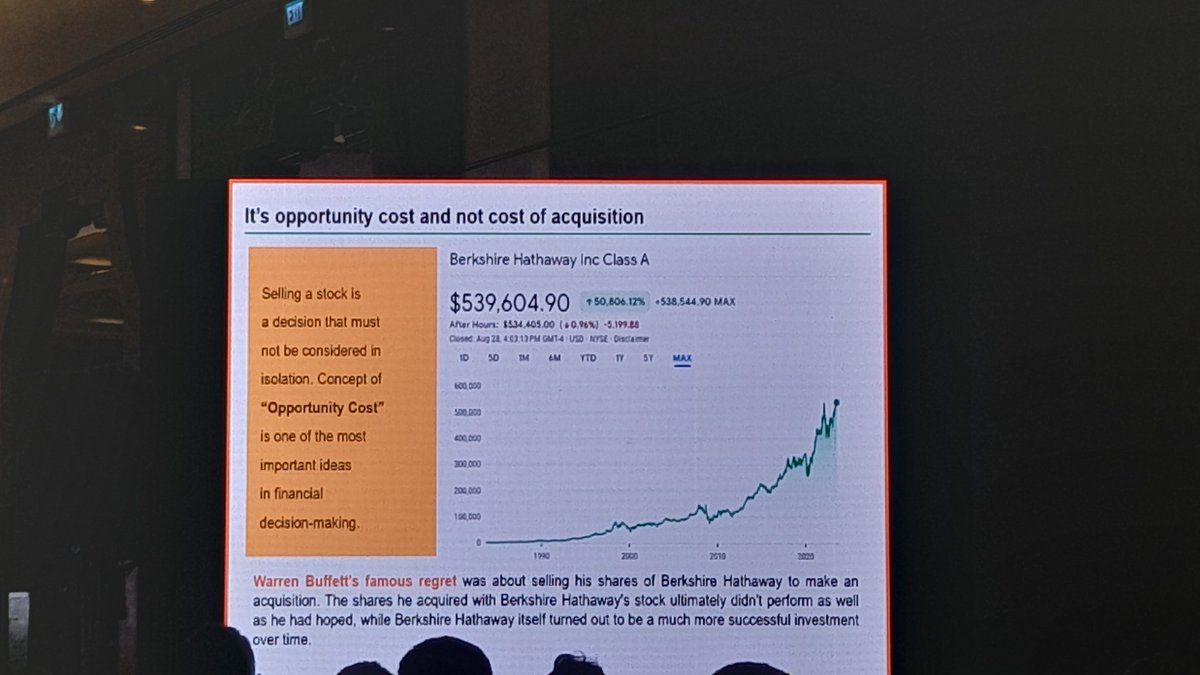

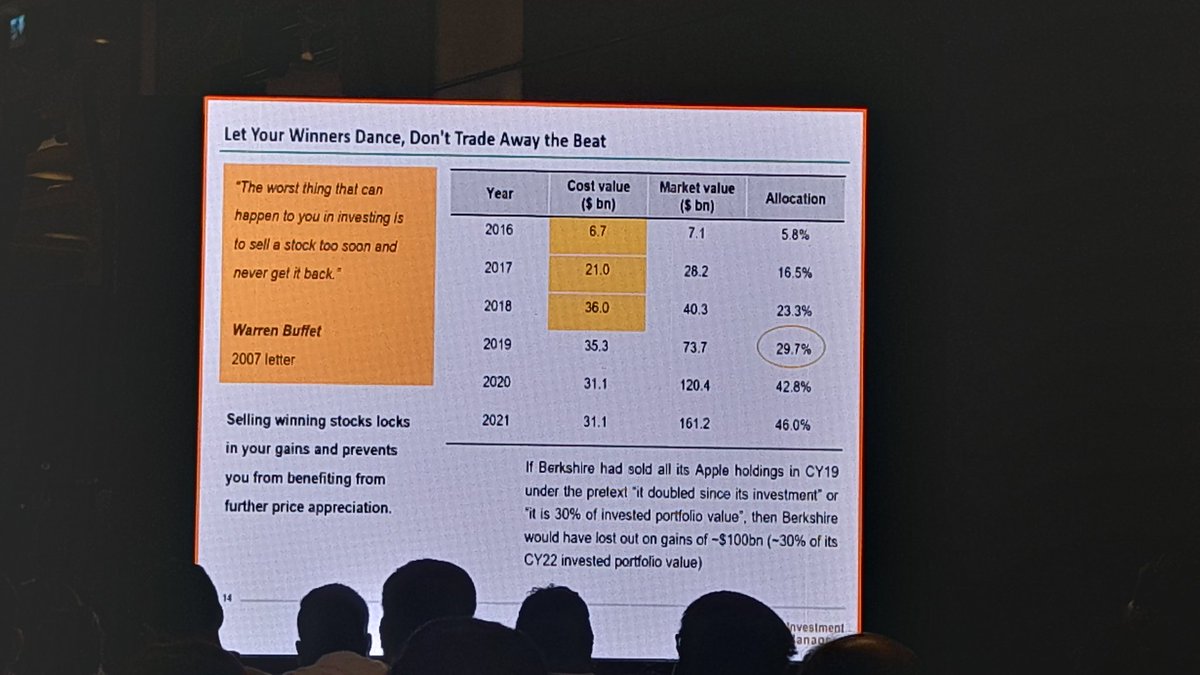

An Investor Manual

An Investor Manual

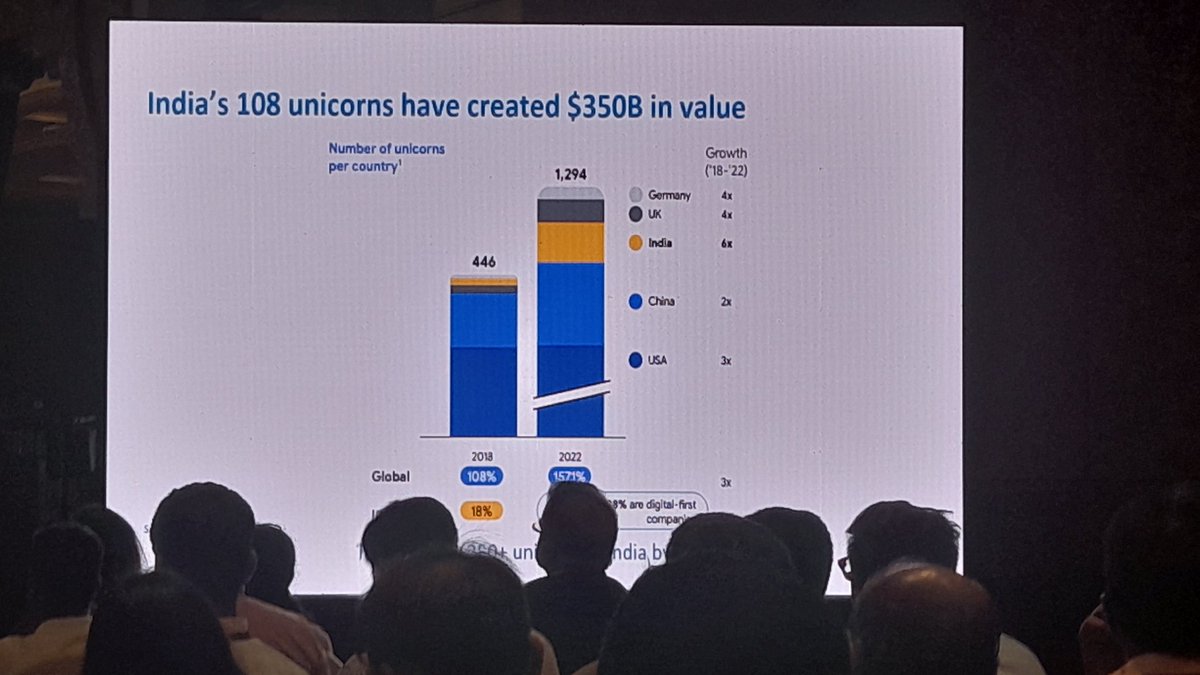

Gave the examples of Lenskart.

From 100 million to 8 billion in 6 years.

From 100 million to 8 billion in 6 years.

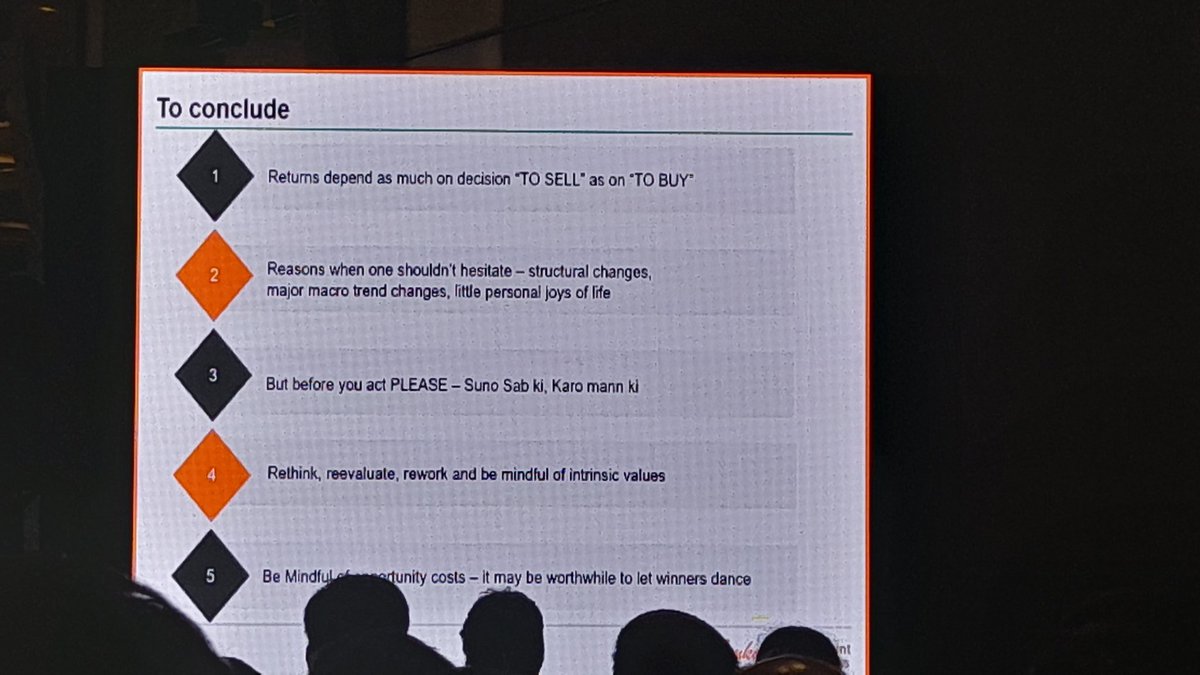

And the presentation of Mr. Manish Chokhani (@chokhani_manish ) ends.

Q&A begins.

Q&A begins.

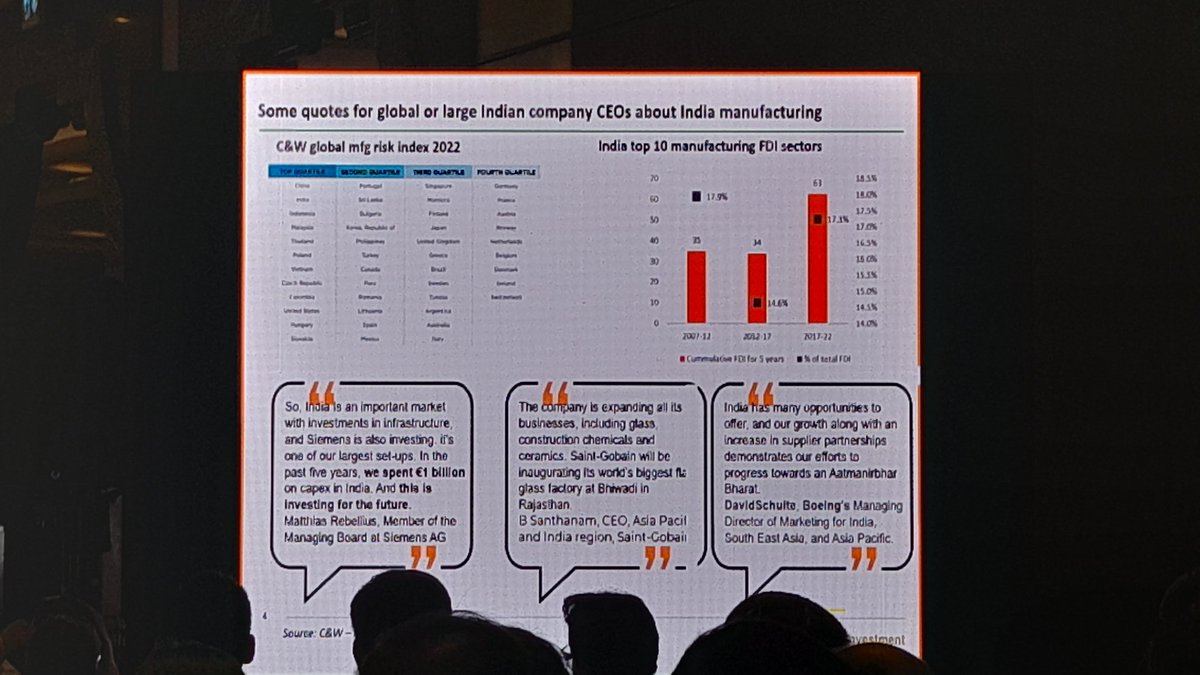

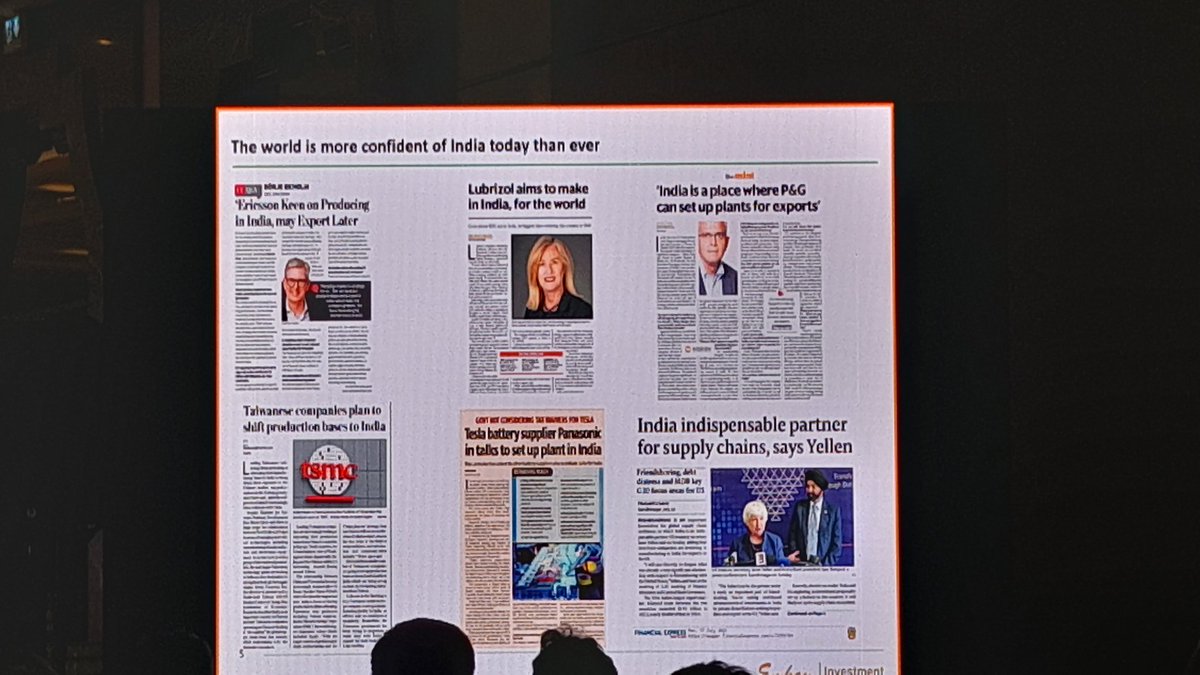

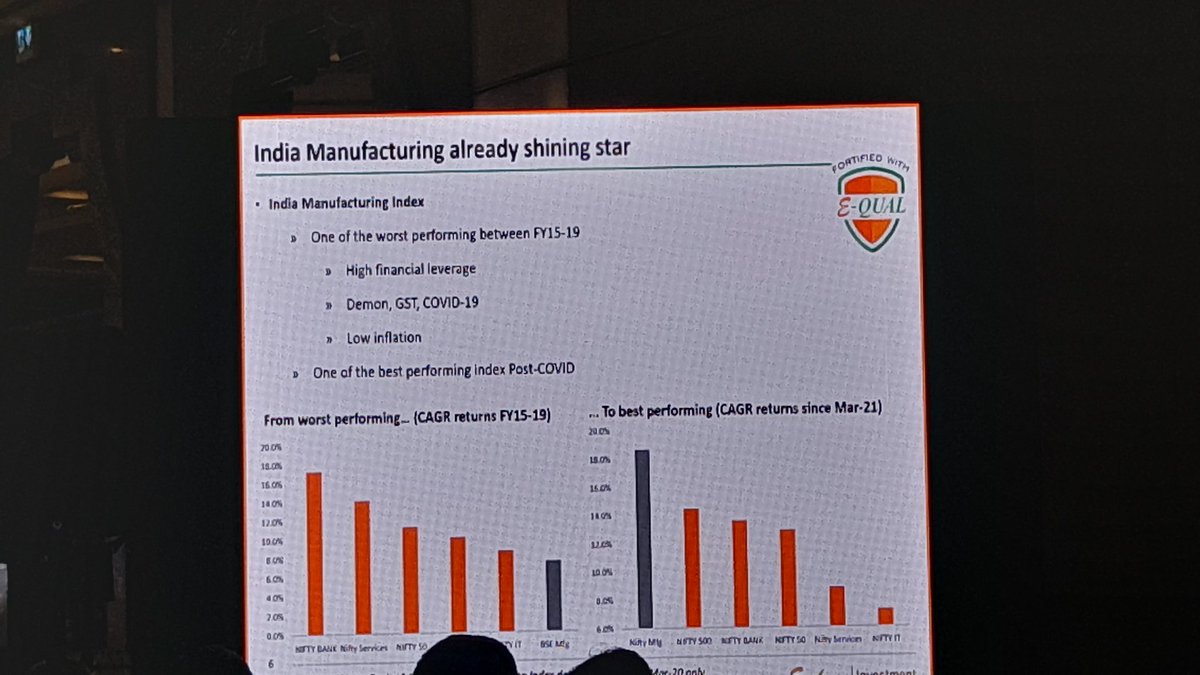

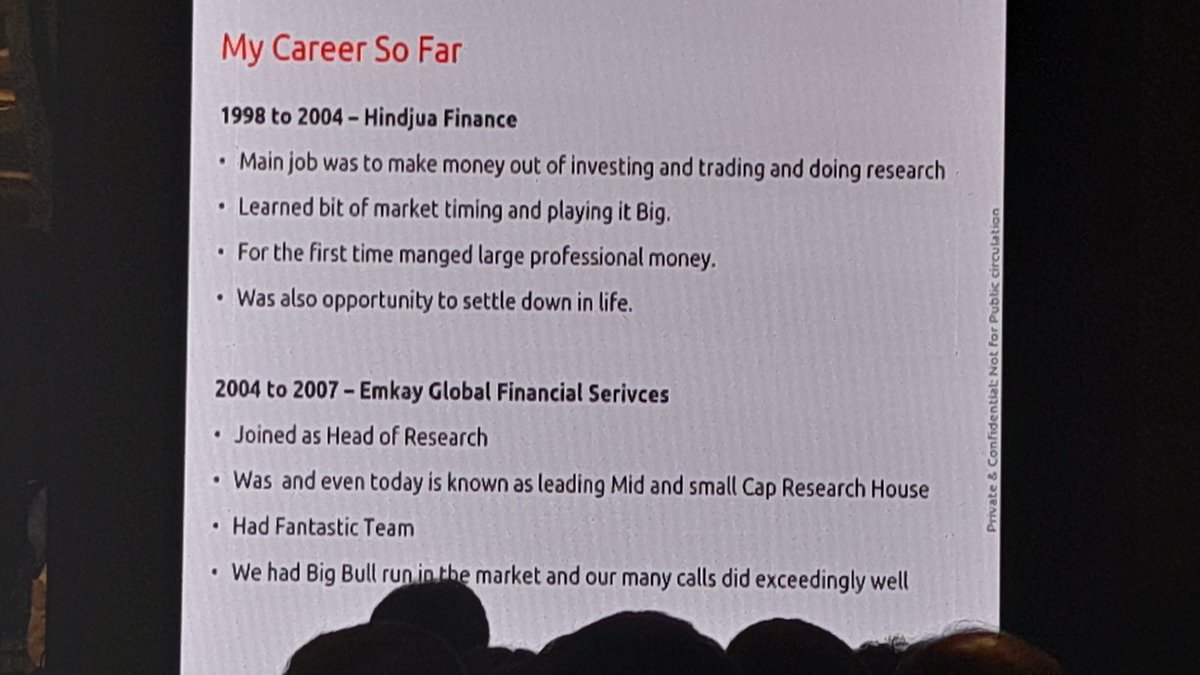

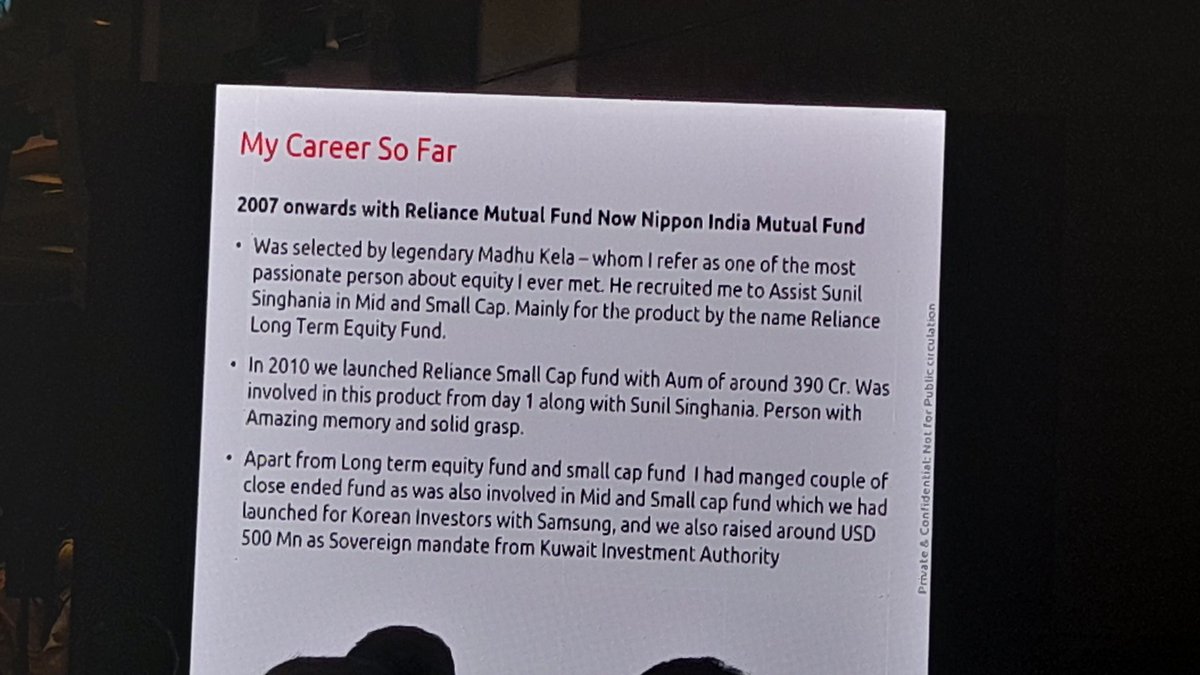

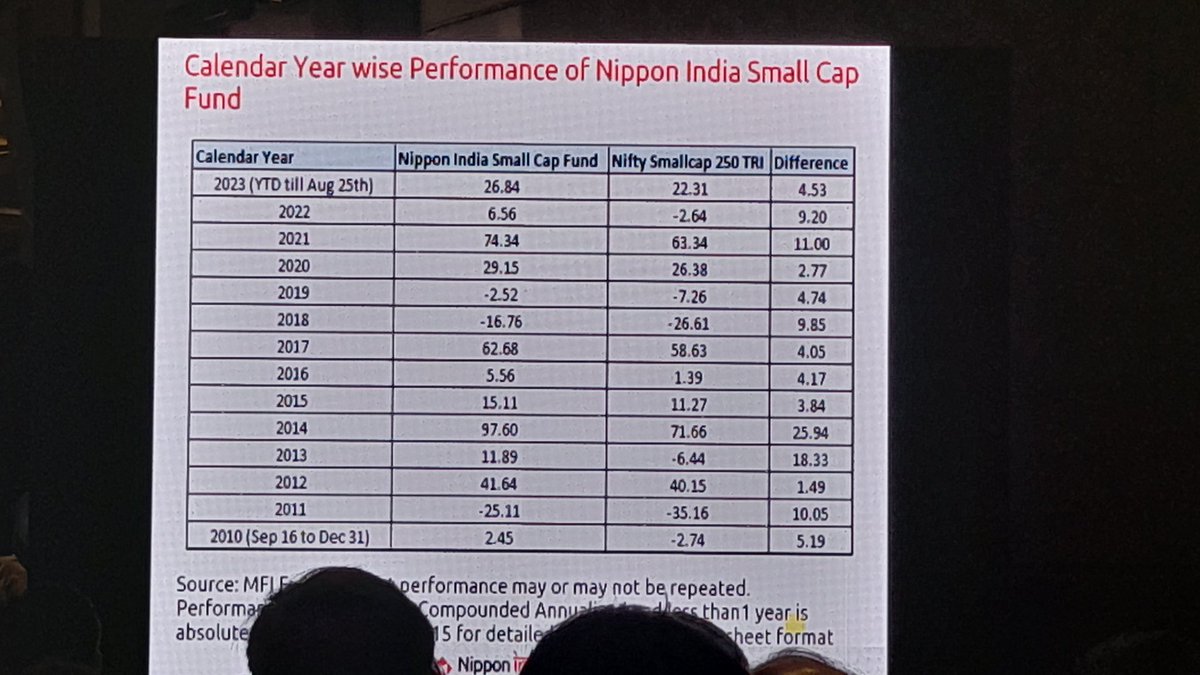

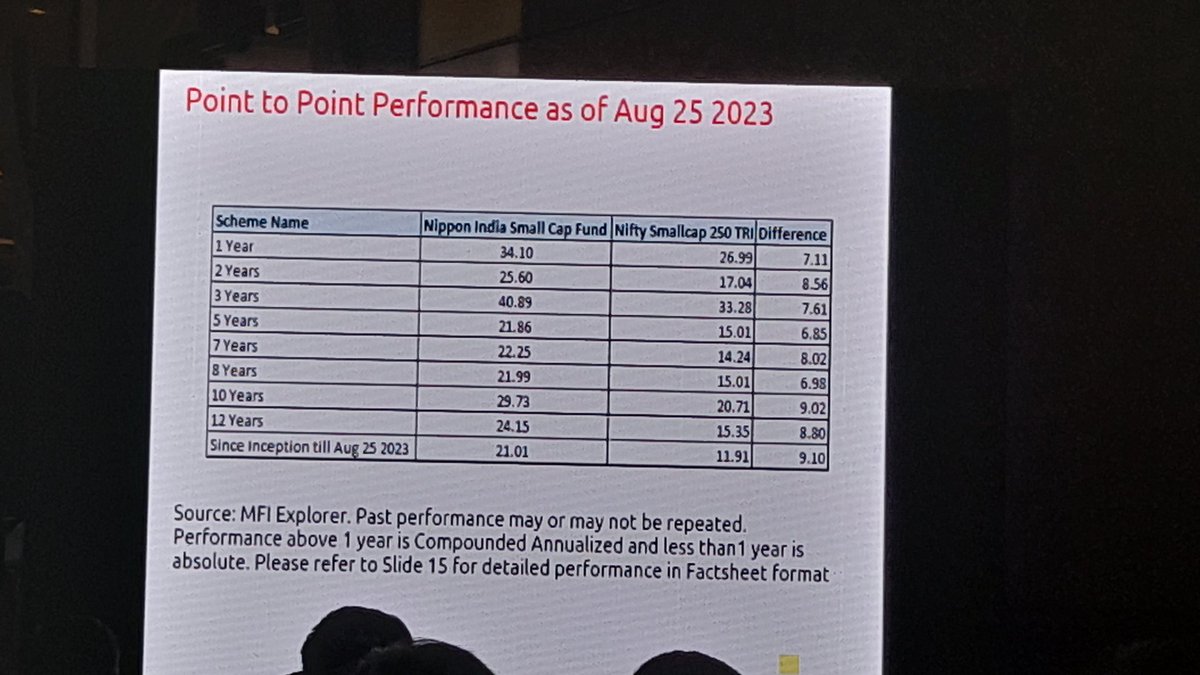

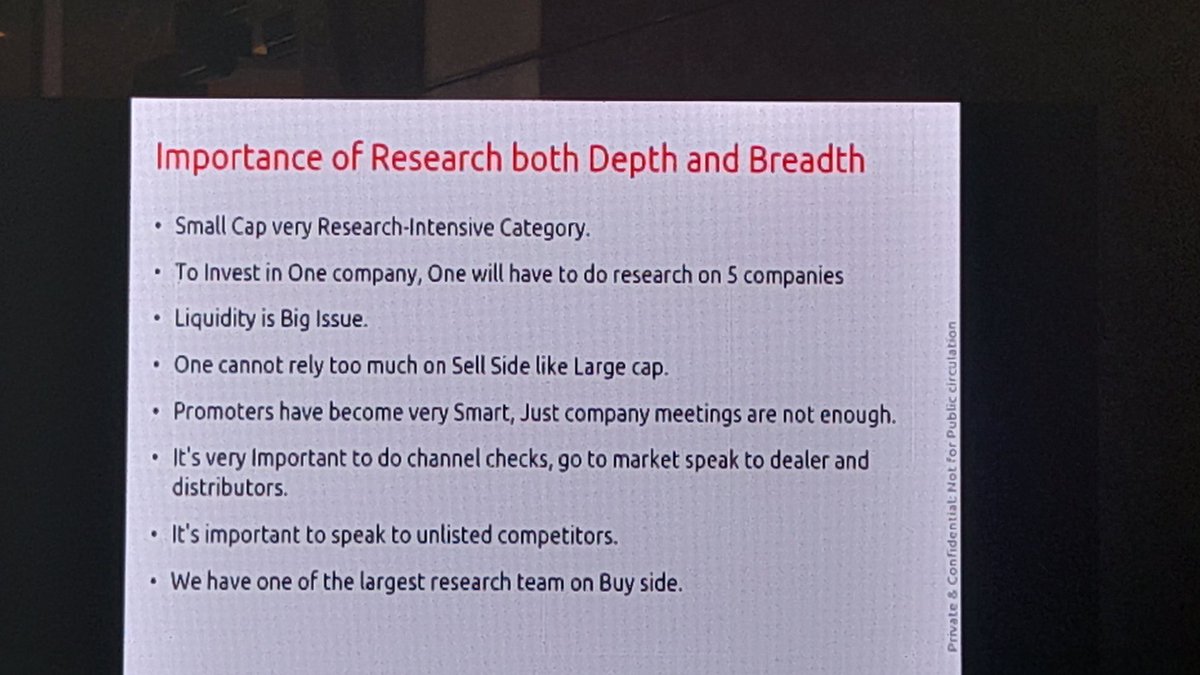

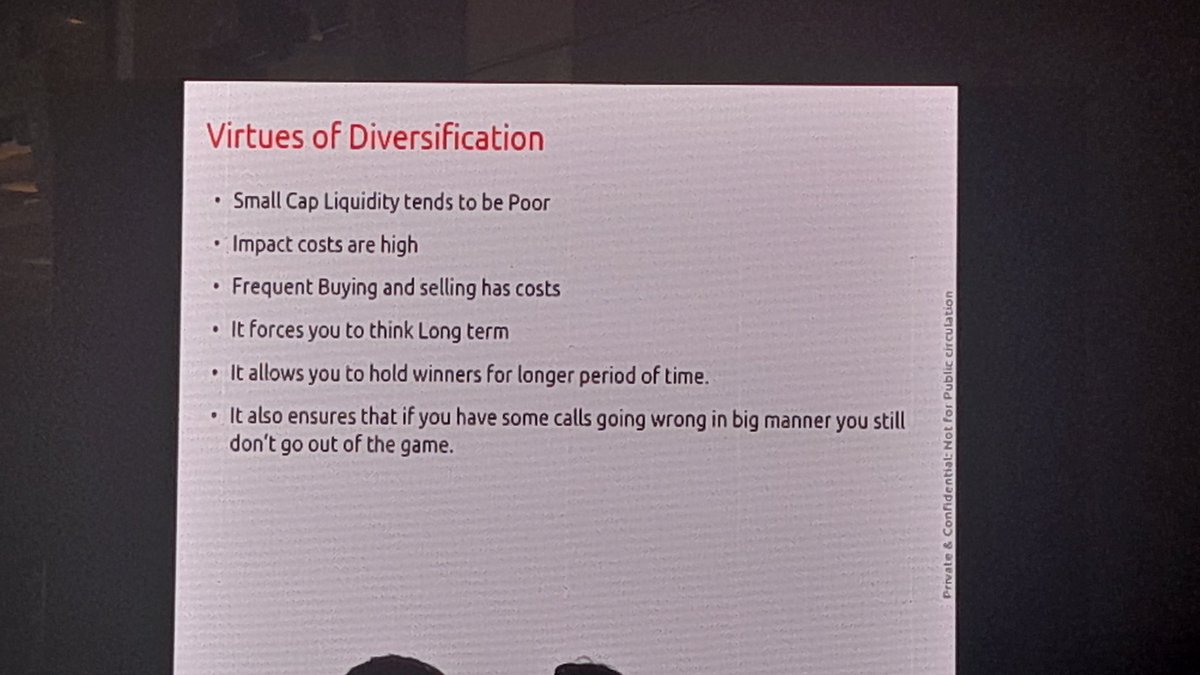

@chokhani_manish The 3rd speaker begins

EA Sundaram

Executive director at O3 wealth & Asset Management

EA Sundaram

Executive director at O3 wealth & Asset Management

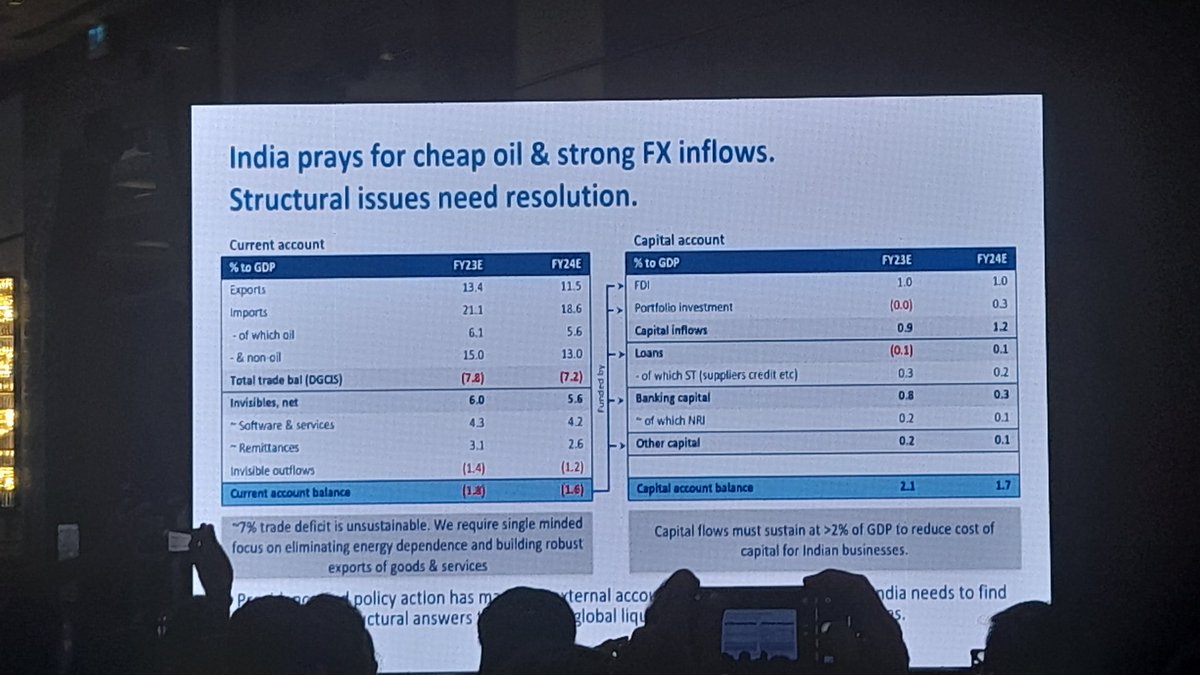

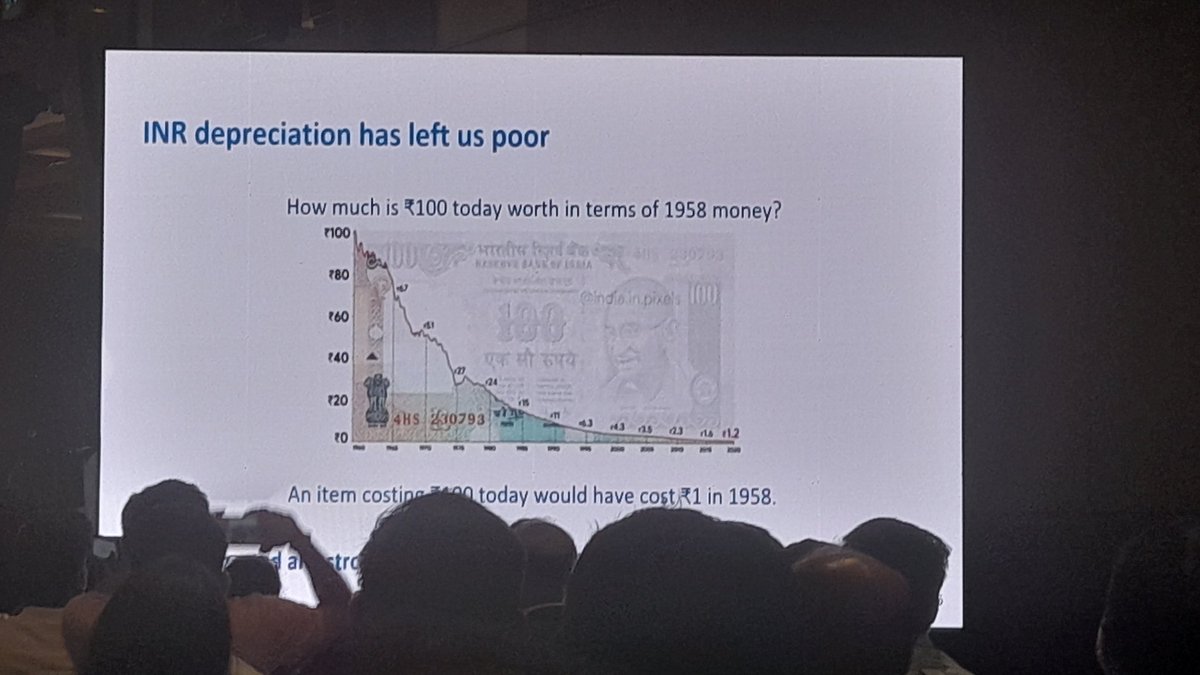

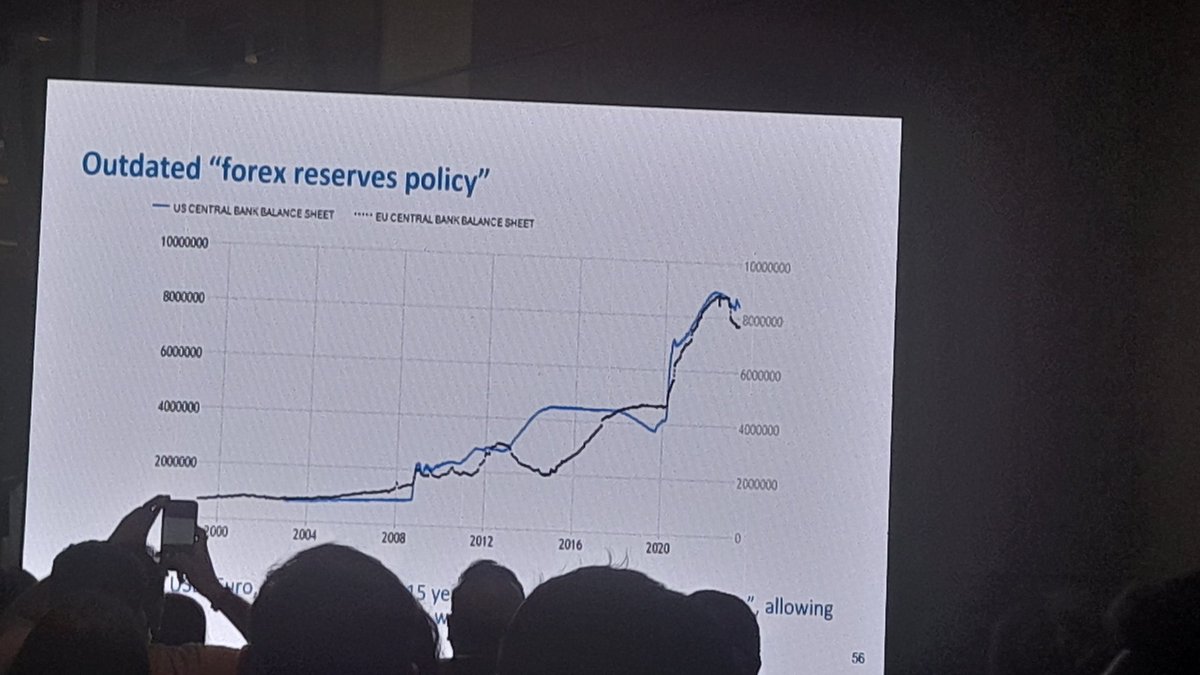

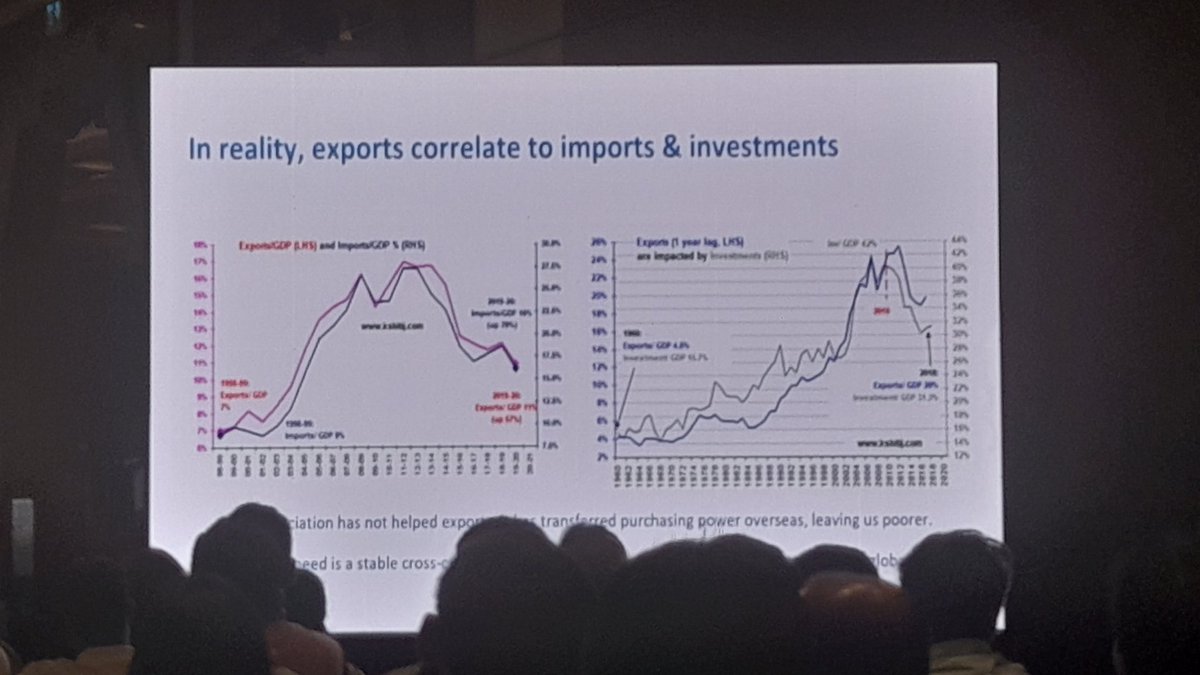

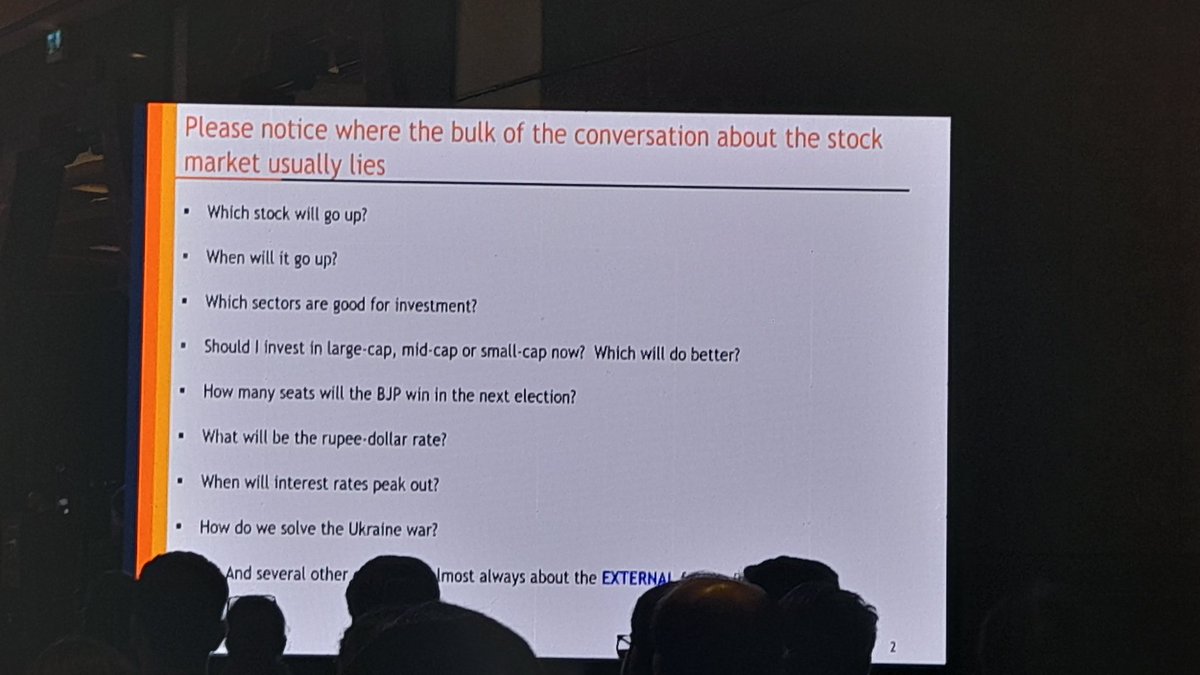

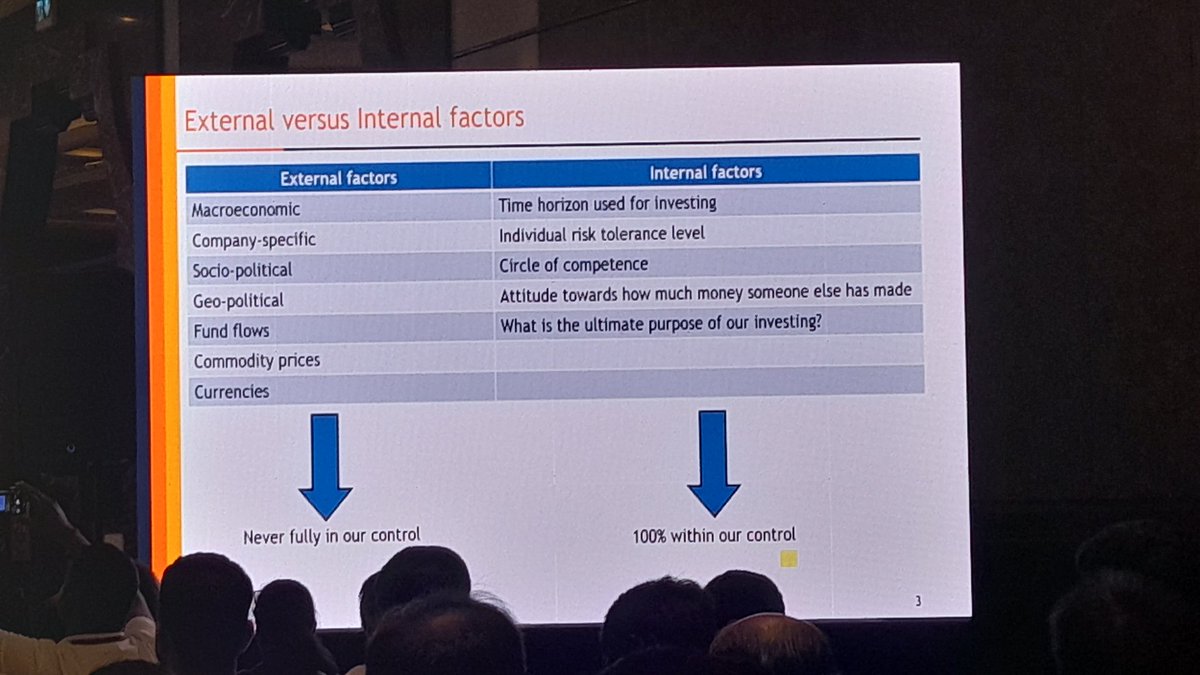

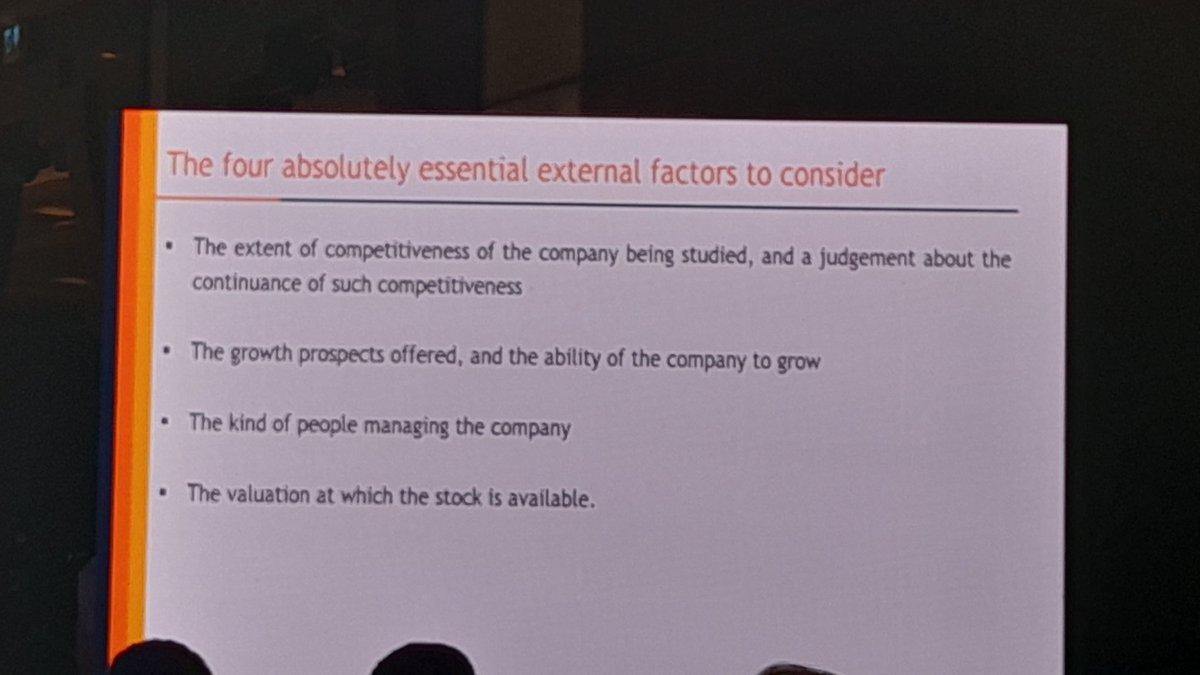

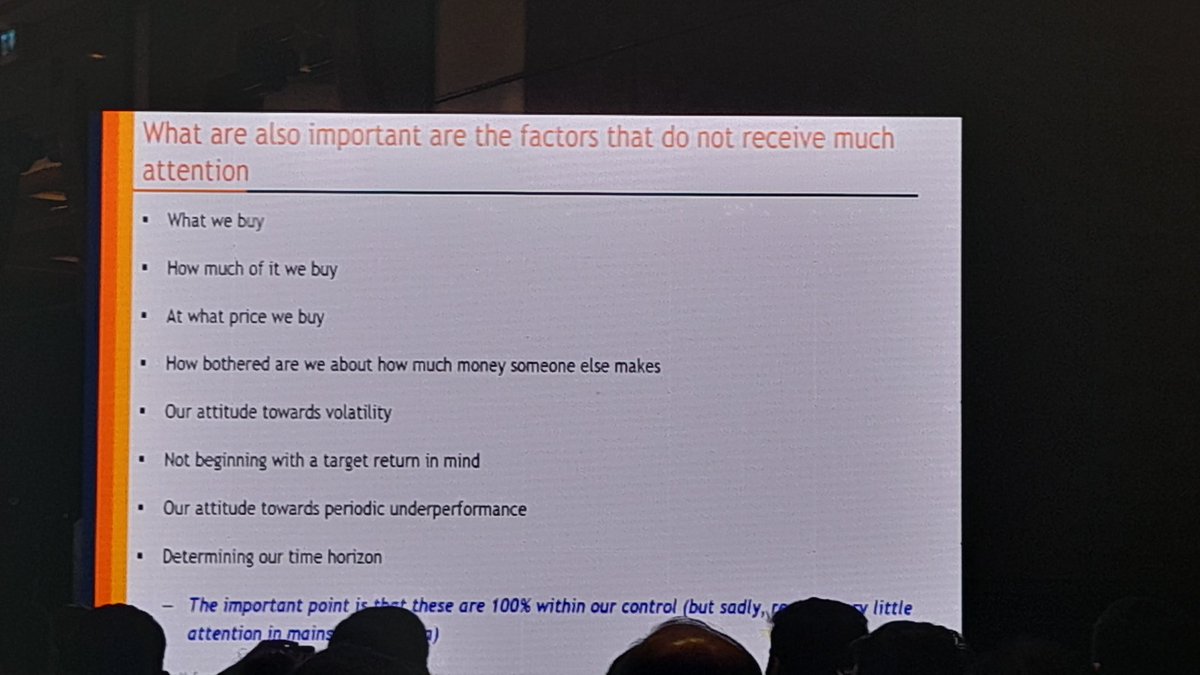

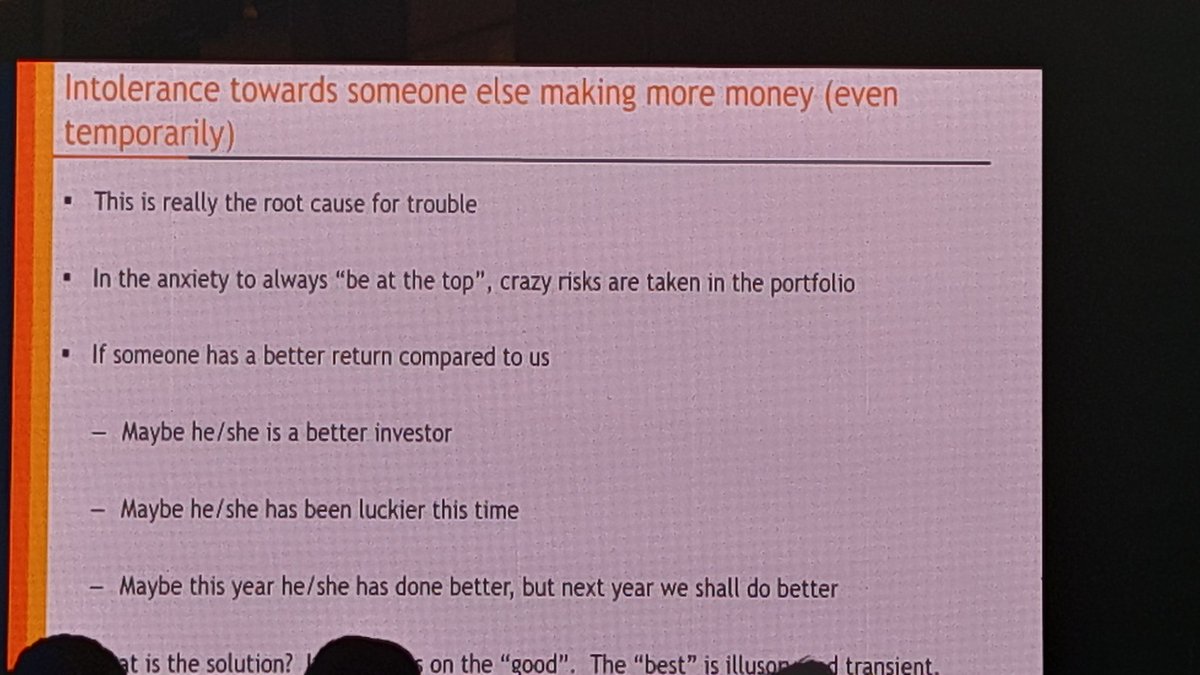

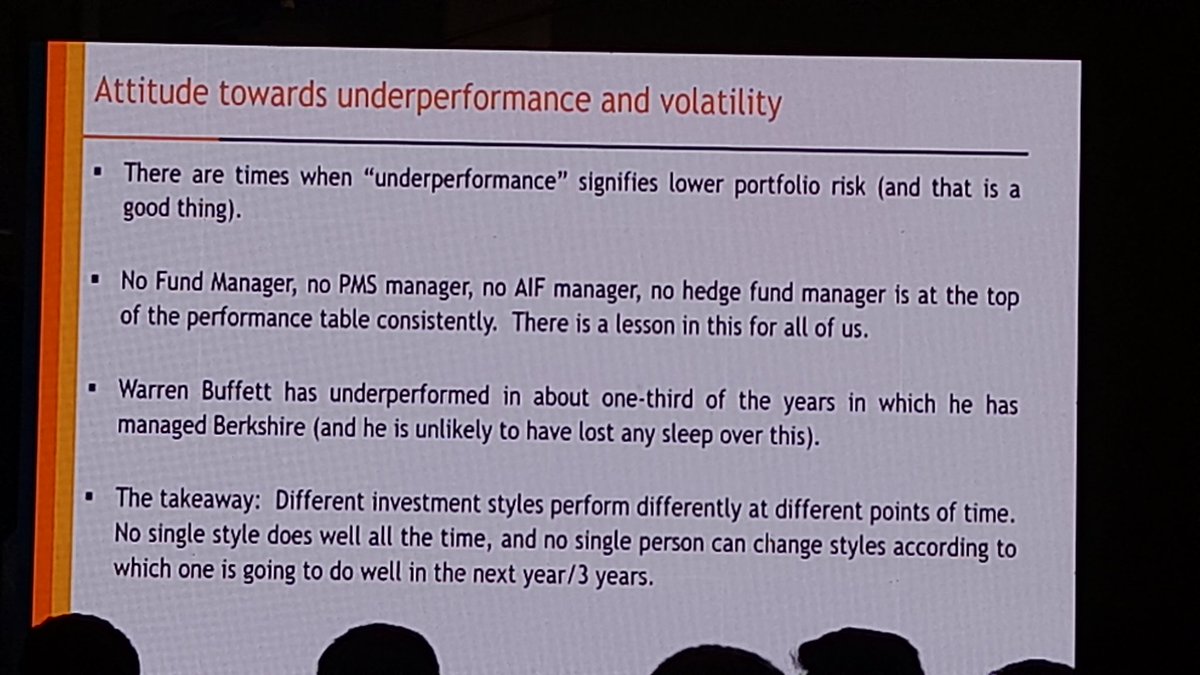

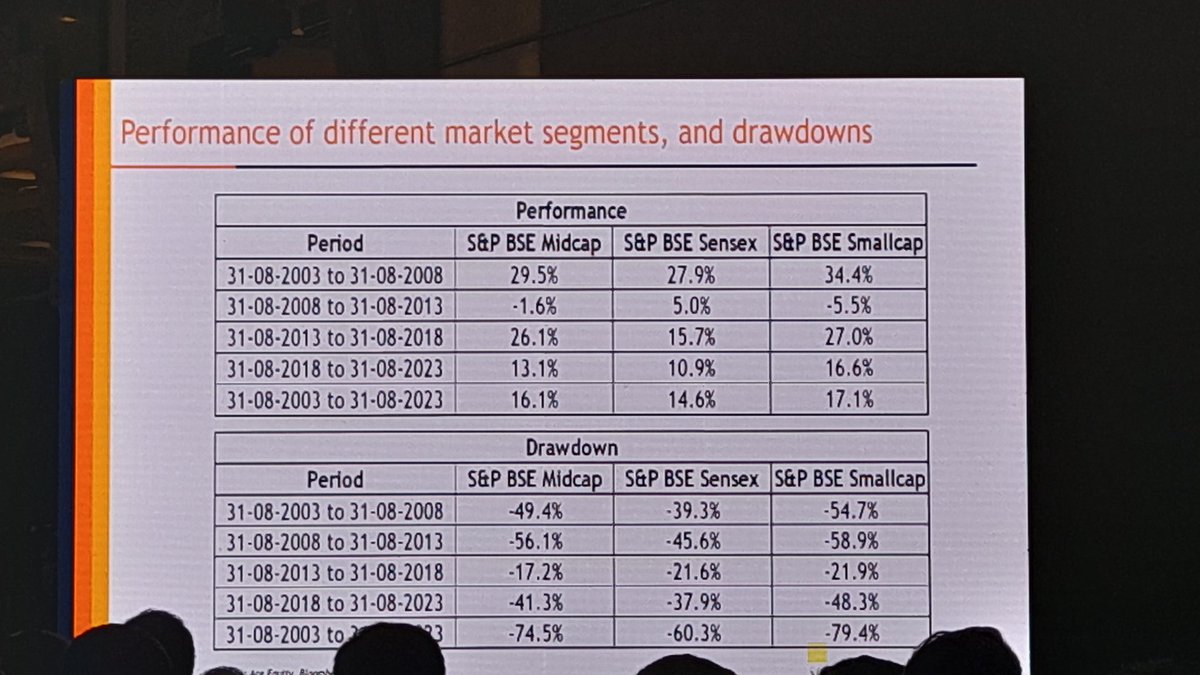

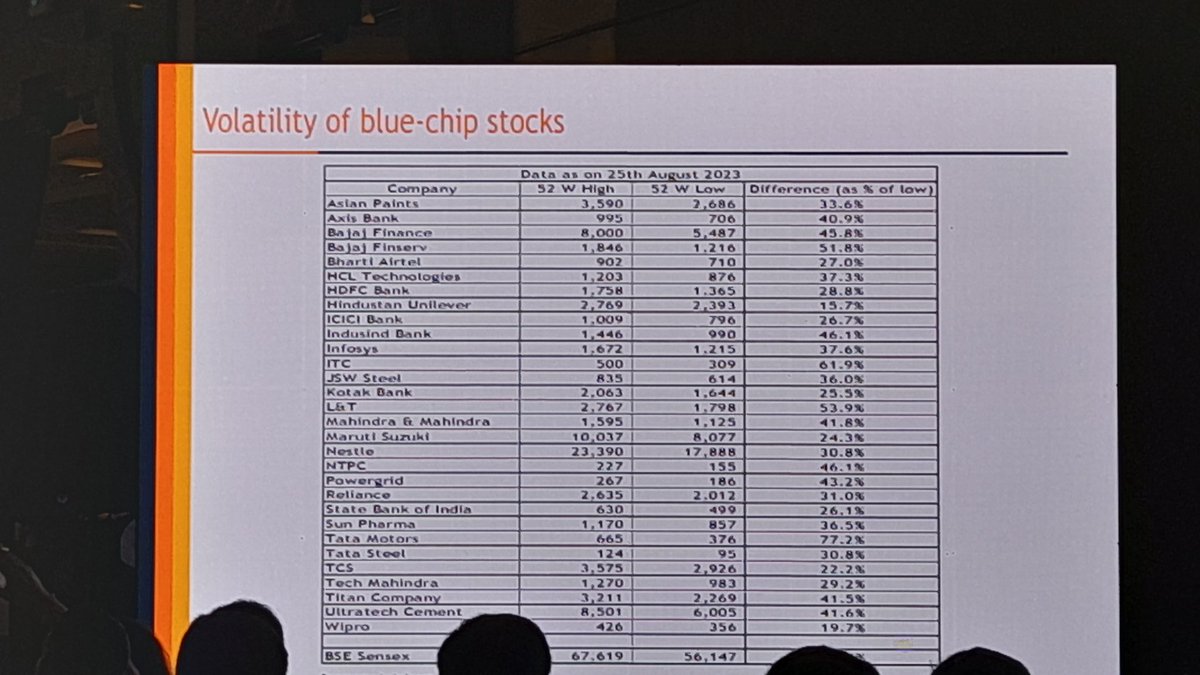

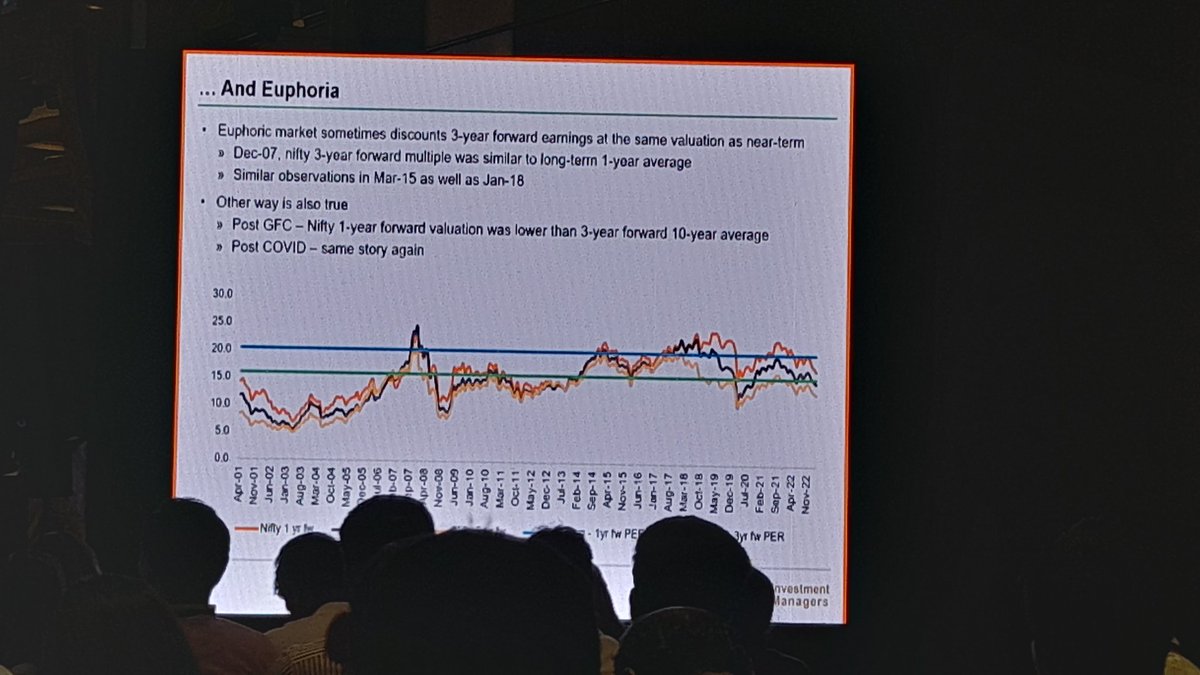

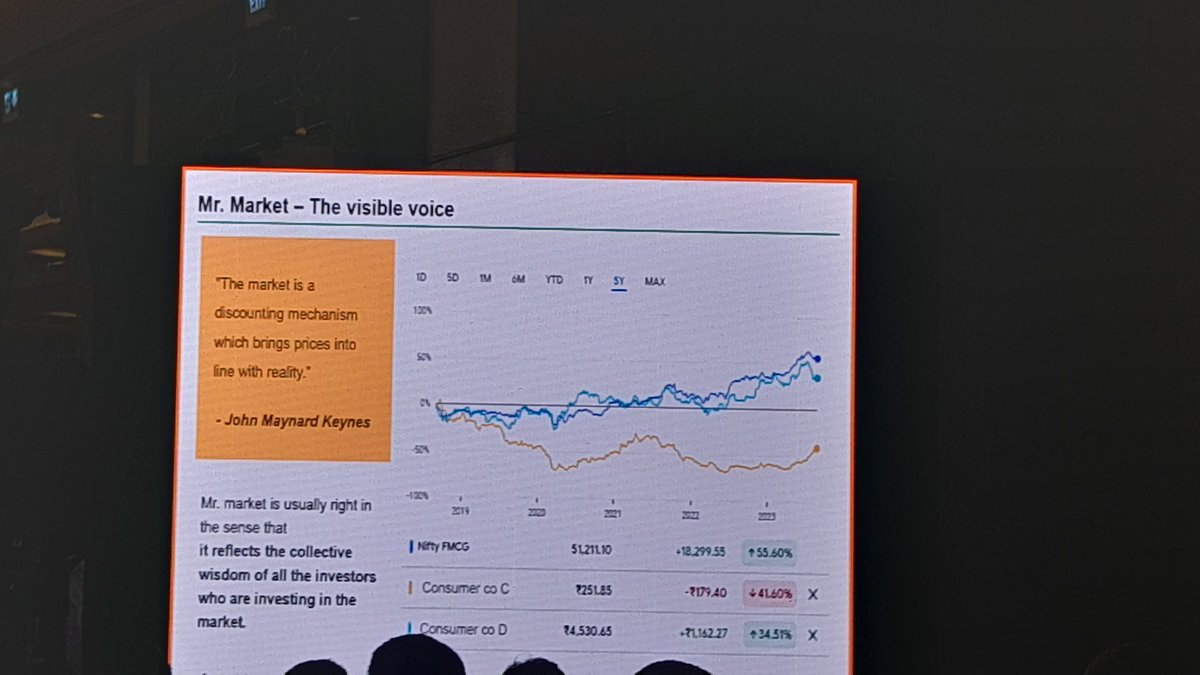

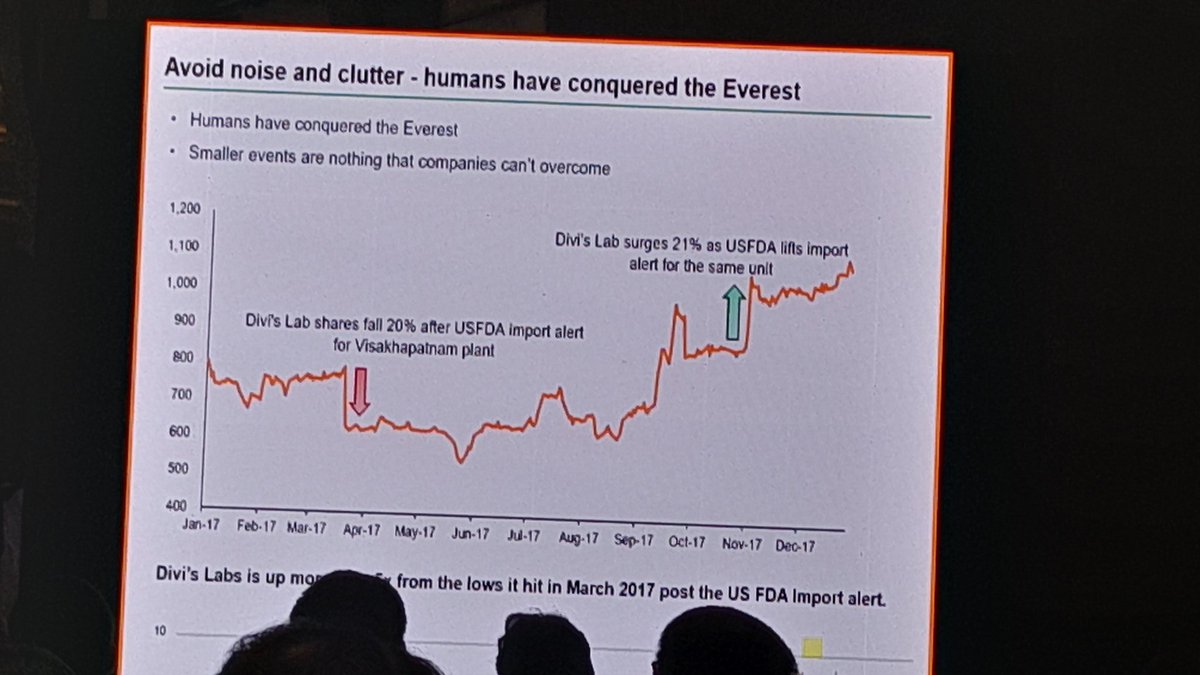

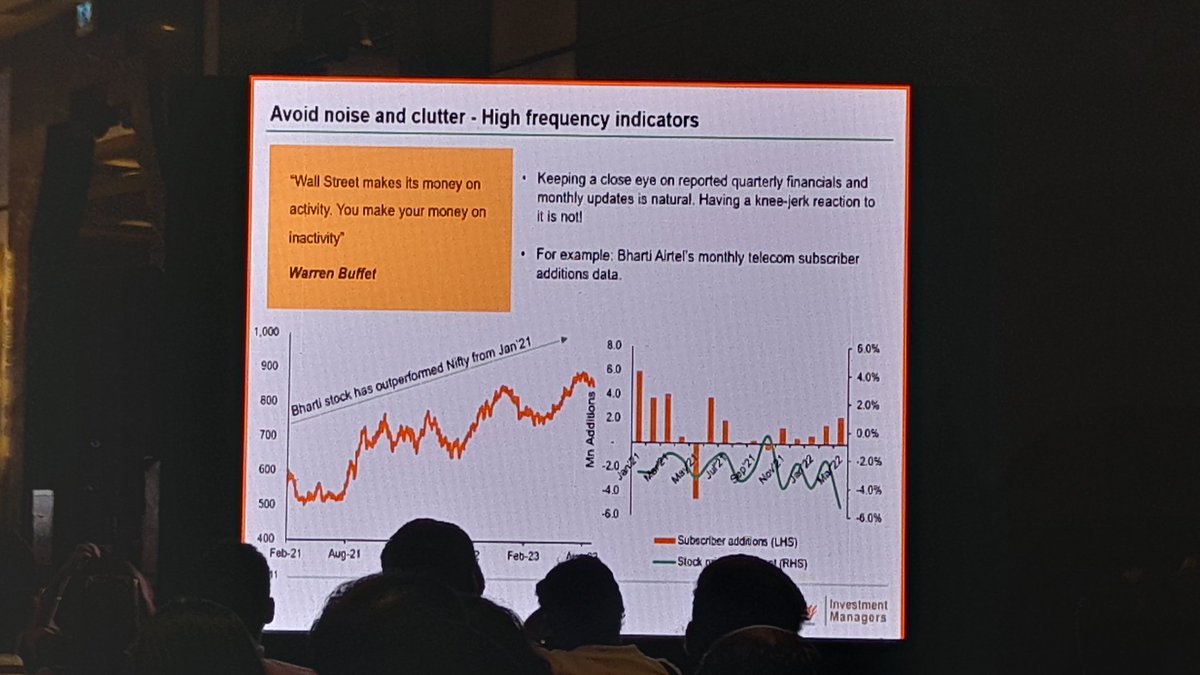

@chokhani_manish Noises

@chokhani_manish Internal Factors > External Factors

While we are about to break for lunch, you may like to read more detailed notes by @akshat96jain on all 3 investors here.

Speaker 1 @RajeevThakkar

Speaker 2 @chokhani_manish

Speaker 3 @EASundaram

Speaker 1 @RajeevThakkar

Speaker 2 @chokhani_manish

Speaker 3 @EASundaram

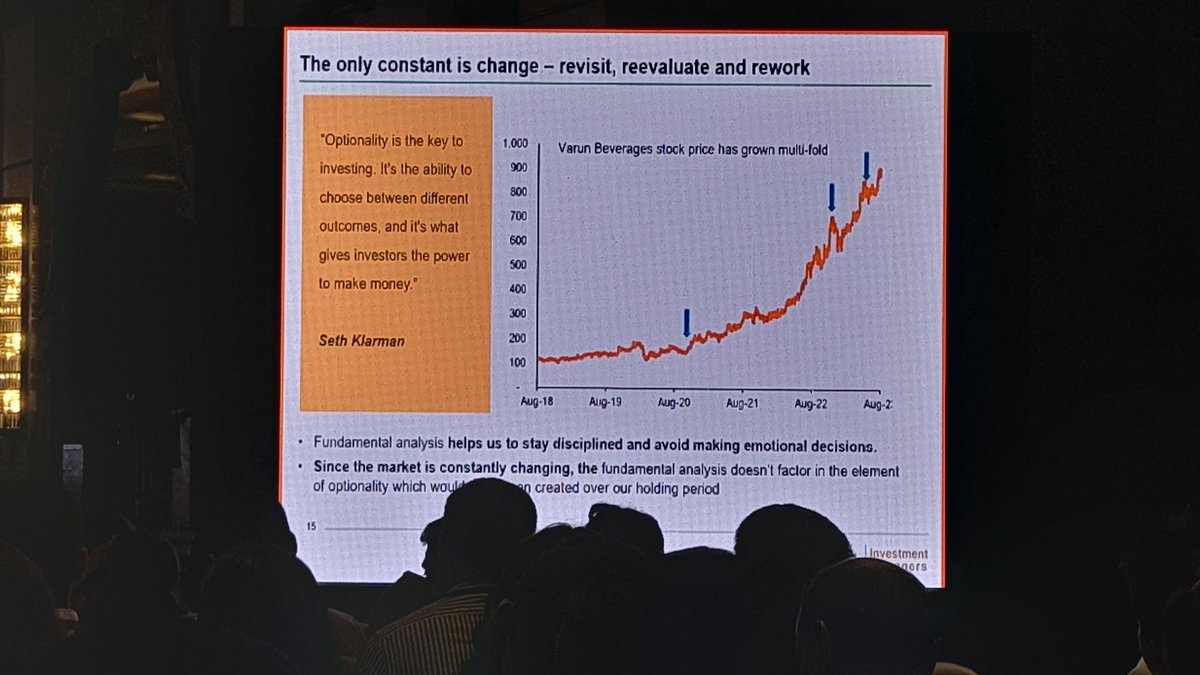

The only constant is change.

Example: Varun Beverages

Revisit

Reevaluate

Rework

@ishmohit1 & @soicfinance you may like this one. 🙂

Example: Varun Beverages

Revisit

Reevaluate

Rework

@ishmohit1 & @soicfinance you may like this one. 🙂

The 4th speaker's session ends.

Q&A starts. :)

Q&A starts. :)

You may like to read the detailed notes of Mr. Karwa's talk here

Compiled by @akshat96jain

Compiled by @akshat96jain

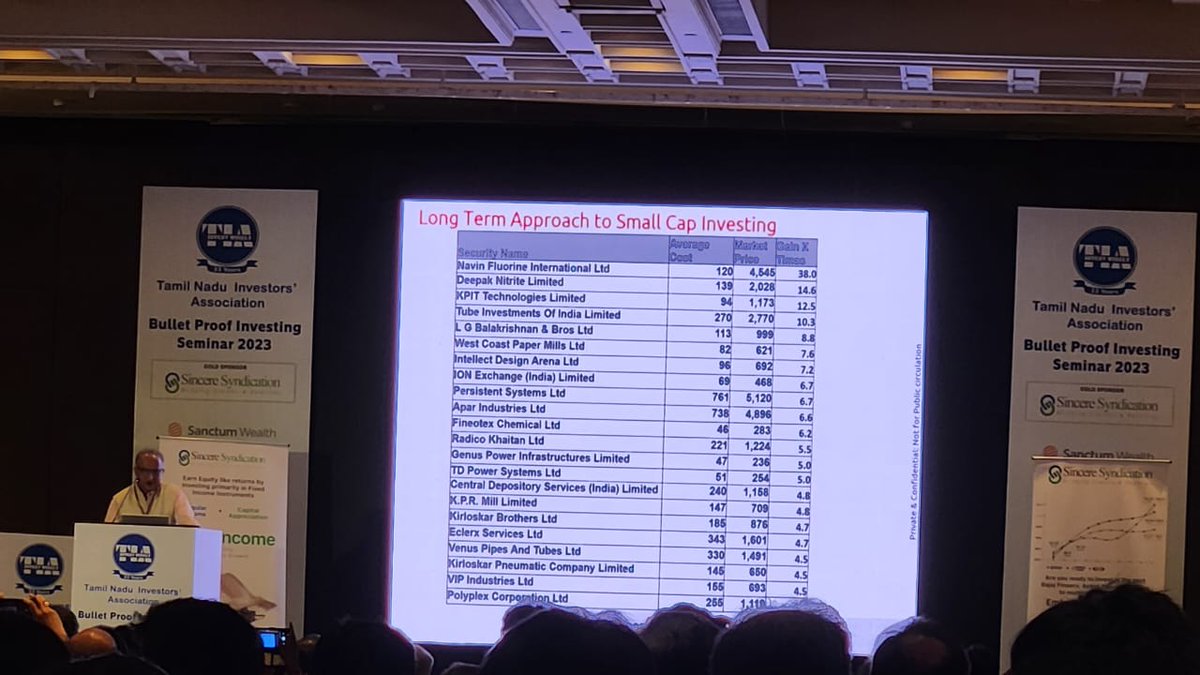

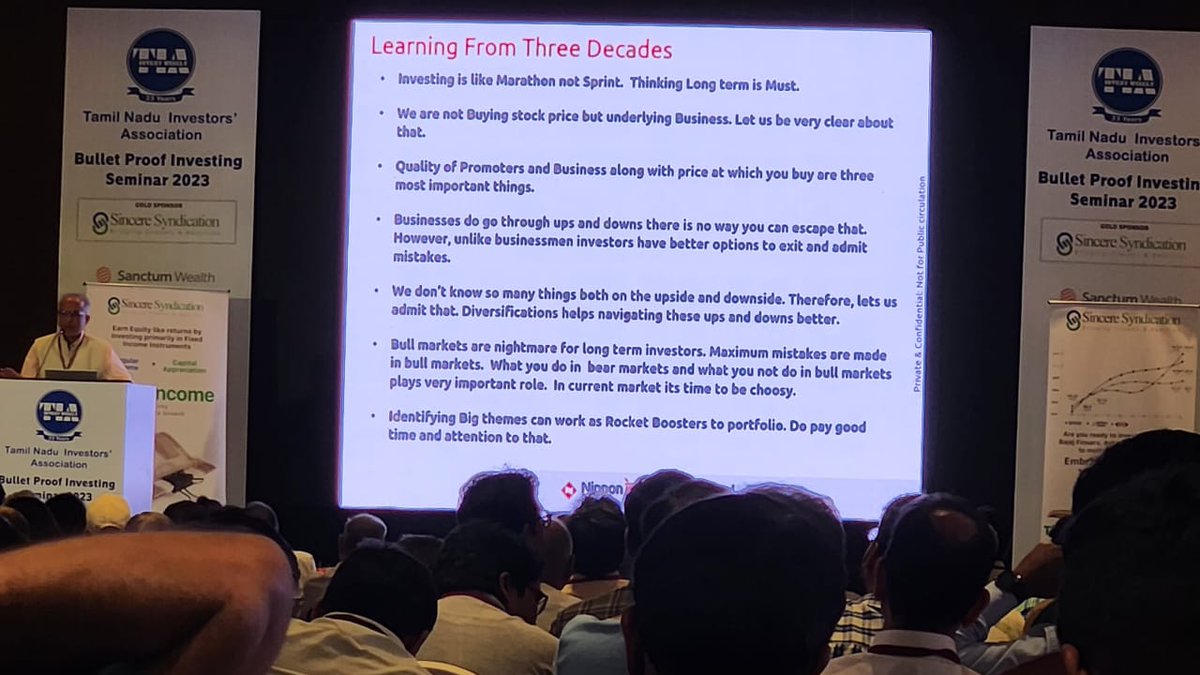

That brings us to the end of this amazing session on smallcaps.

Q&A time.

Q&A time.

More detailed notes made by @akshat96jain here👇

@akshat96jain The 6th Speaker starts

Mr. Sankaran Naren

CIO, ICICI Mutual Funds.

He was not keeping well, so he couldn't come down for the event.

So he recorded a session and sent it.

We are watching that recorded session.

Mr. Sankaran Naren

CIO, ICICI Mutual Funds.

He was not keeping well, so he couldn't come down for the event.

So he recorded a session and sent it.

We are watching that recorded session.

Detailed notes by @akshat96jain here

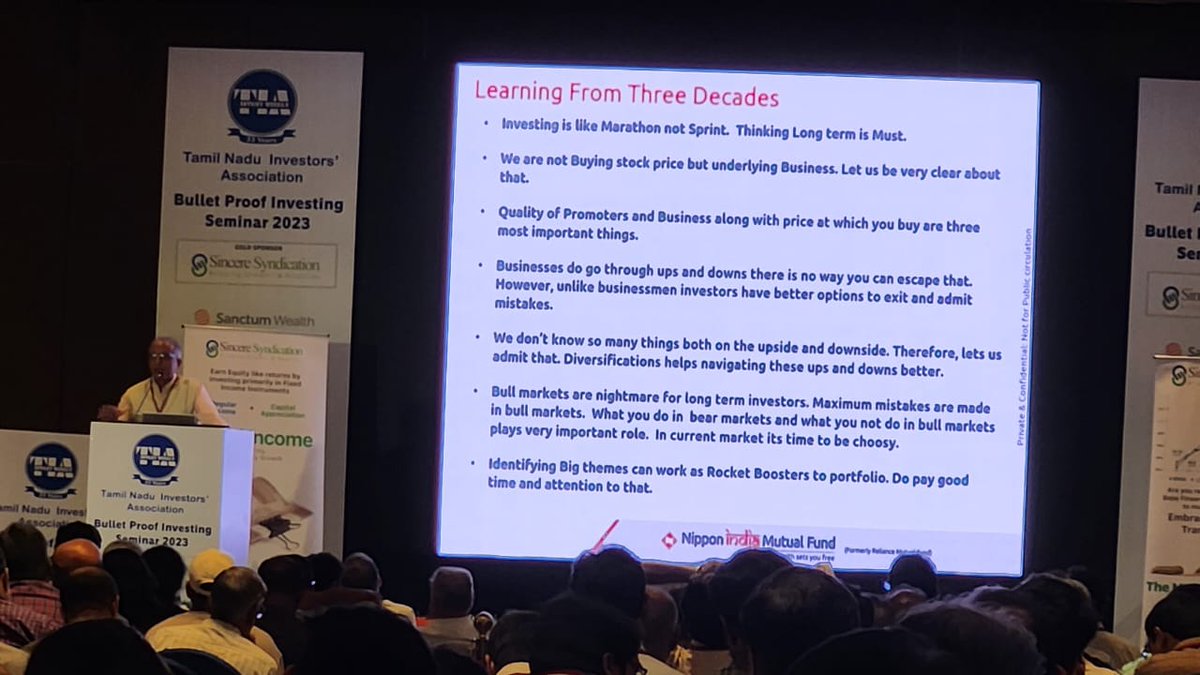

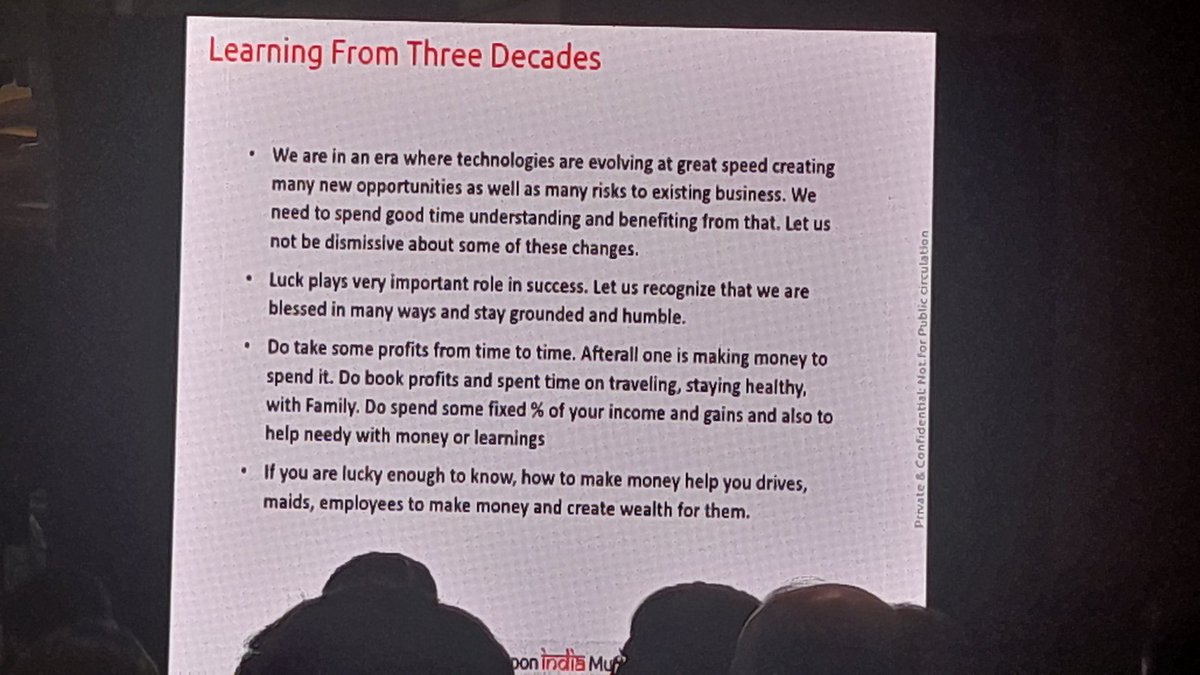

Now comes Mr. Rajeev Khanna (husband of Dolly Khanna, whose name appears in stock exchange filings).

Sharing his amazing journey.

Mesmerizing talk.

Tweets won't justify. You had to be here and watch him speak live. 🙂

Sharing his amazing journey.

Mesmerizing talk.

Tweets won't justify. You had to be here and watch him speak live. 🙂

You can't miss this.

Do read out this note ptepared by @akshat96jain on the excellent talk by Mr. Rajeev Khanna here

Do read out this note ptepared by @akshat96jain on the excellent talk by Mr. Rajeev Khanna here

It's time for a Fireside chat with Mr. Govind Parikh.

Being moderated by Mr. Shyam Sekhar (@shyamsek).

Another fascinating session.

Wait for notes by @akshat96jain.

Being moderated by Mr. Shyam Sekhar (@shyamsek).

Another fascinating session.

Wait for notes by @akshat96jain.

Here it is

Notes of an excellent session between Mr. Govind Parikh & Mr. Shyam Sekhar (@shyamsek) prepared by @akshat96jain

Notes of an excellent session between Mr. Govind Parikh & Mr. Shyam Sekhar (@shyamsek) prepared by @akshat96jain

Excellent closing note by Mr. Shyam Sekhar, to end a great day o learning from the greats in investing.

Check out the notes from @akshat96jain

If you found value, "Repost" the 1st tweet to help us educate maximum investors.

Have a good weekend. 🙂🙏

Check out the notes from @akshat96jain

If you found value, "Repost" the 1st tweet to help us educate maximum investors.

Have a good weekend. 🙂🙏

Loading suggestions...