2️⃣ Irrational Behavior

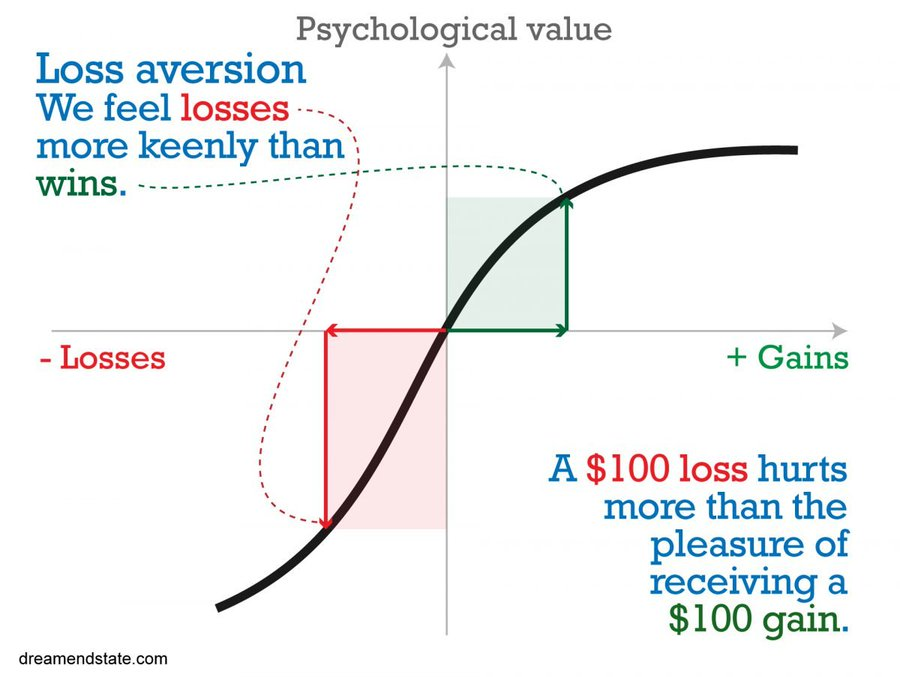

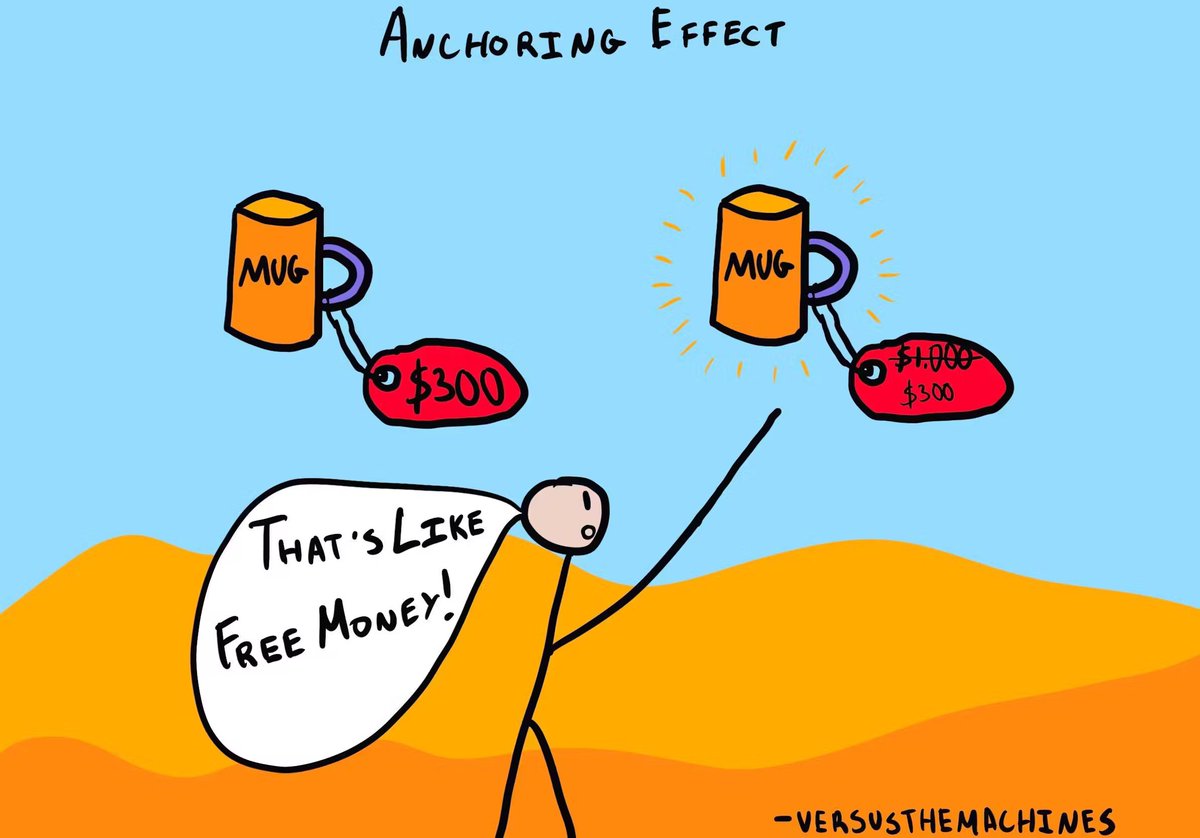

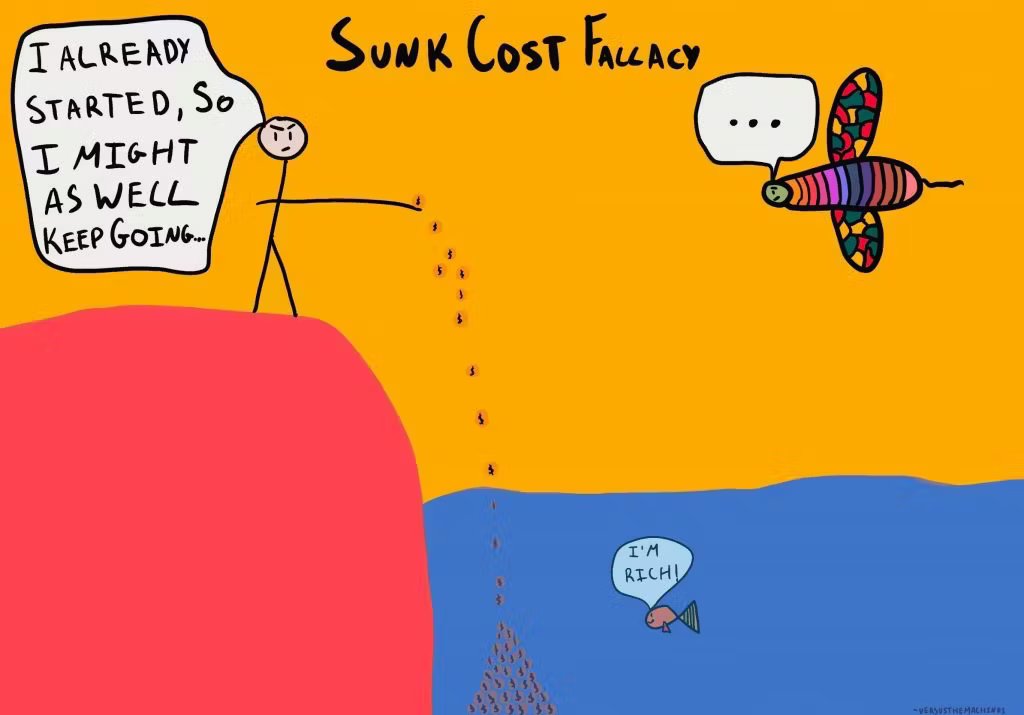

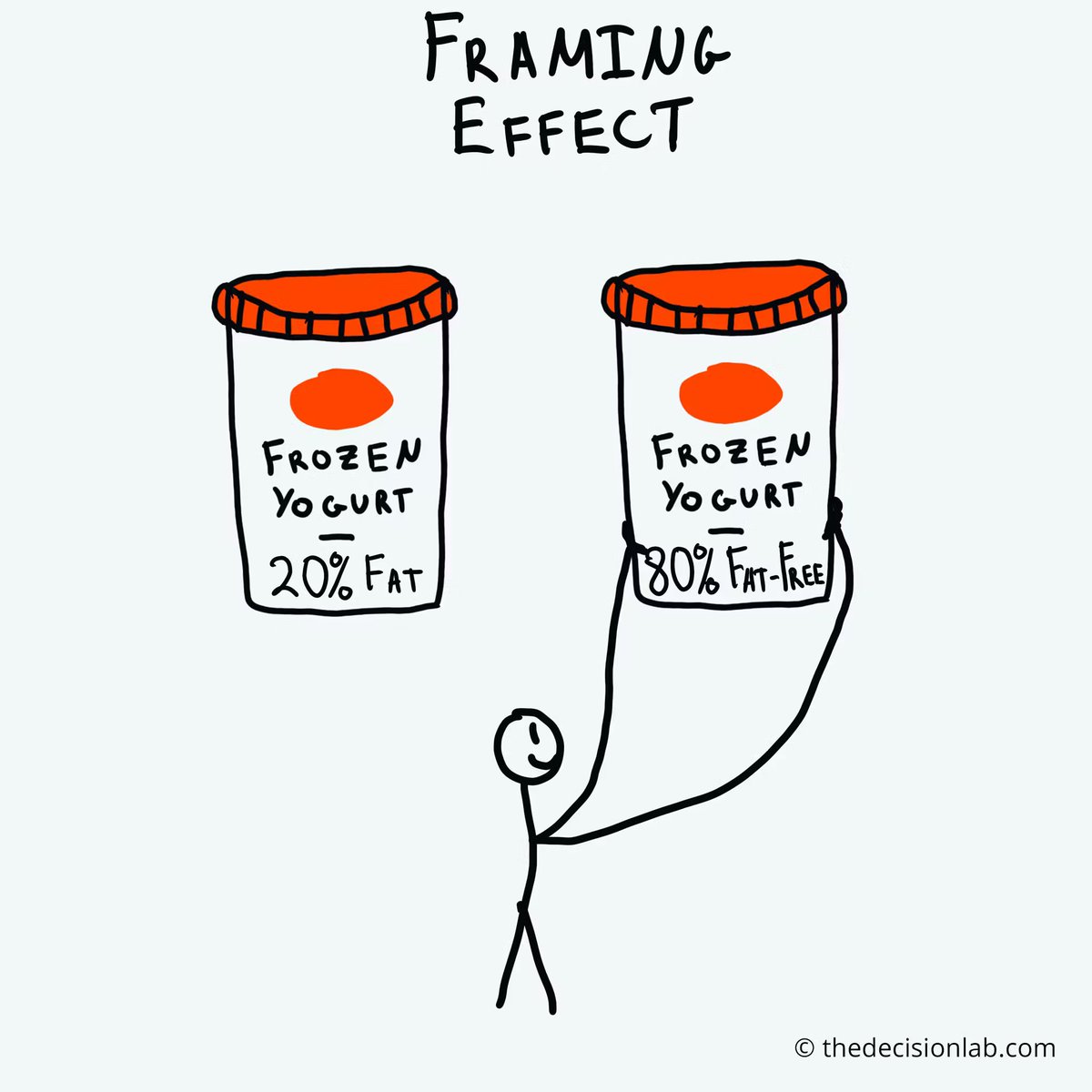

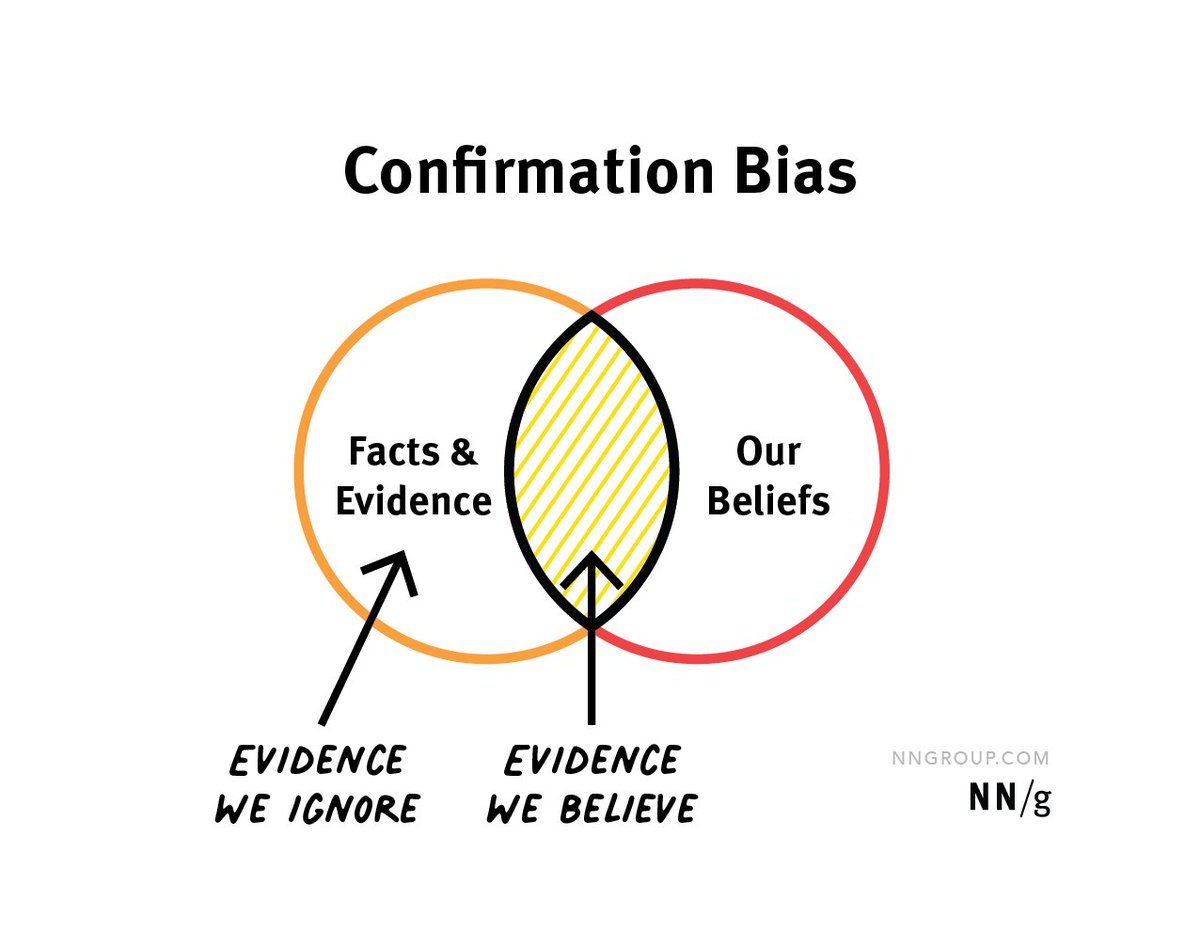

People aren't always rational. We often make irrational choices.

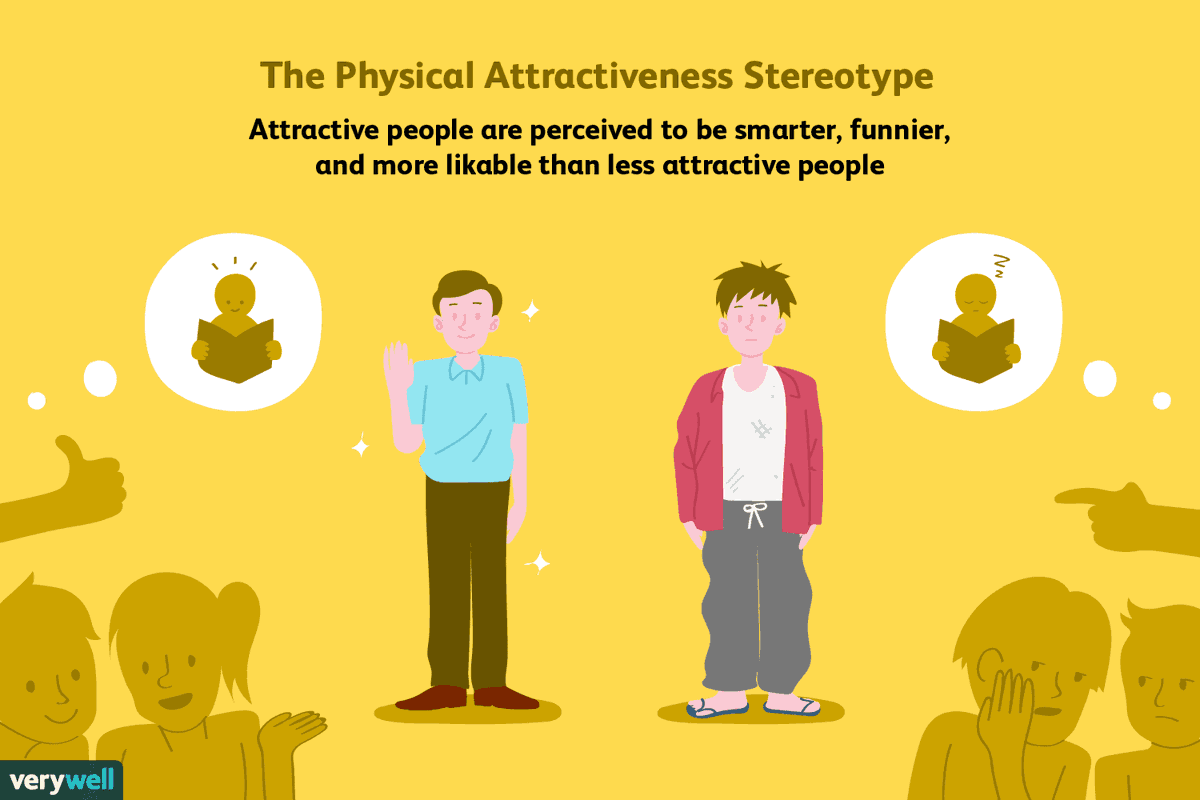

For instance, about 90% of Americans believe they're better drivers than average, and around 70% consider themselves smarter than the average person.

People aren't always rational. We often make irrational choices.

For instance, about 90% of Americans believe they're better drivers than average, and around 70% consider themselves smarter than the average person.

The word is out!

I left my job to transform Compounding Quality into a full investment platform.

To celebrate, I am sharing an e-book with 300 pages (!) full of investment wisdom.

Sign up here if you want to receive it for free: eepurl.com

I left my job to transform Compounding Quality into a full investment platform.

To celebrate, I am sharing an e-book with 300 pages (!) full of investment wisdom.

Sign up here if you want to receive it for free: eepurl.com

Loading suggestions...