Volume Profiles are an essential tool for traders seeking to identify key support and potential price acceleration zones 📊

In this thread 🧵, I'll explain what they are and how you can use them effectively 👇

In this thread 🧵, I'll explain what they are and how you can use them effectively 👇

Basics: What is it? 💭

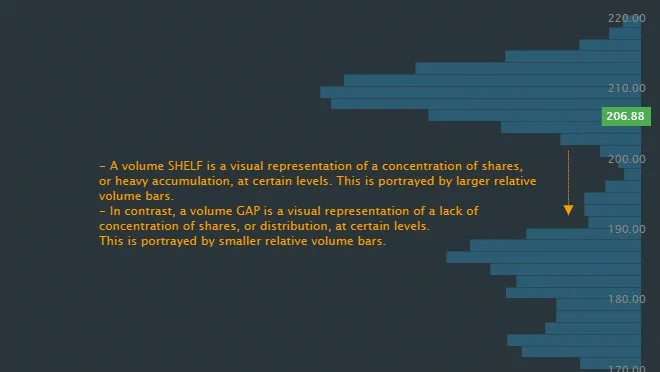

📊 Volume profiles are a powerful tool that traders can use to analyze the trading activity of a stock

Volume Profiles provide a visual representation of the amount of trading activity that has occurred at each price level over a given time period

📊 Volume profiles are a powerful tool that traders can use to analyze the trading activity of a stock

Volume Profiles provide a visual representation of the amount of trading activity that has occurred at each price level over a given time period

Volume Profiles Uses: ✅

✔️ Identify Key Support and Resistance Levels for Setups

✔️ Determine Logical Take Profits and Stop Losses

✔️ Identify Balanced vs. Imbalanced Markets

✔️ Determine the Strength of Trends

Volume Profile's are great to use on ALL time frames!

✔️ Identify Key Support and Resistance Levels for Setups

✔️ Determine Logical Take Profits and Stop Losses

✔️ Identify Balanced vs. Imbalanced Markets

✔️ Determine the Strength of Trends

Volume Profile's are great to use on ALL time frames!

1) Continued...

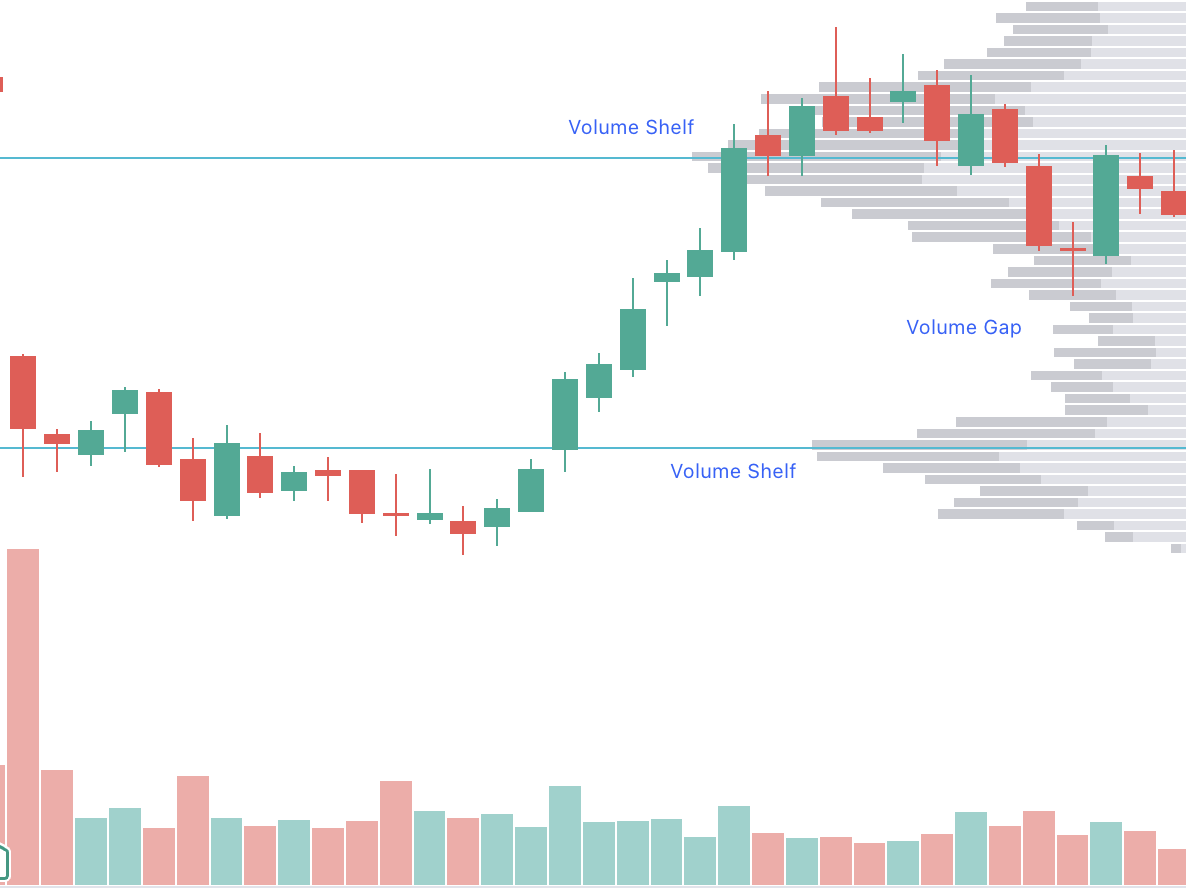

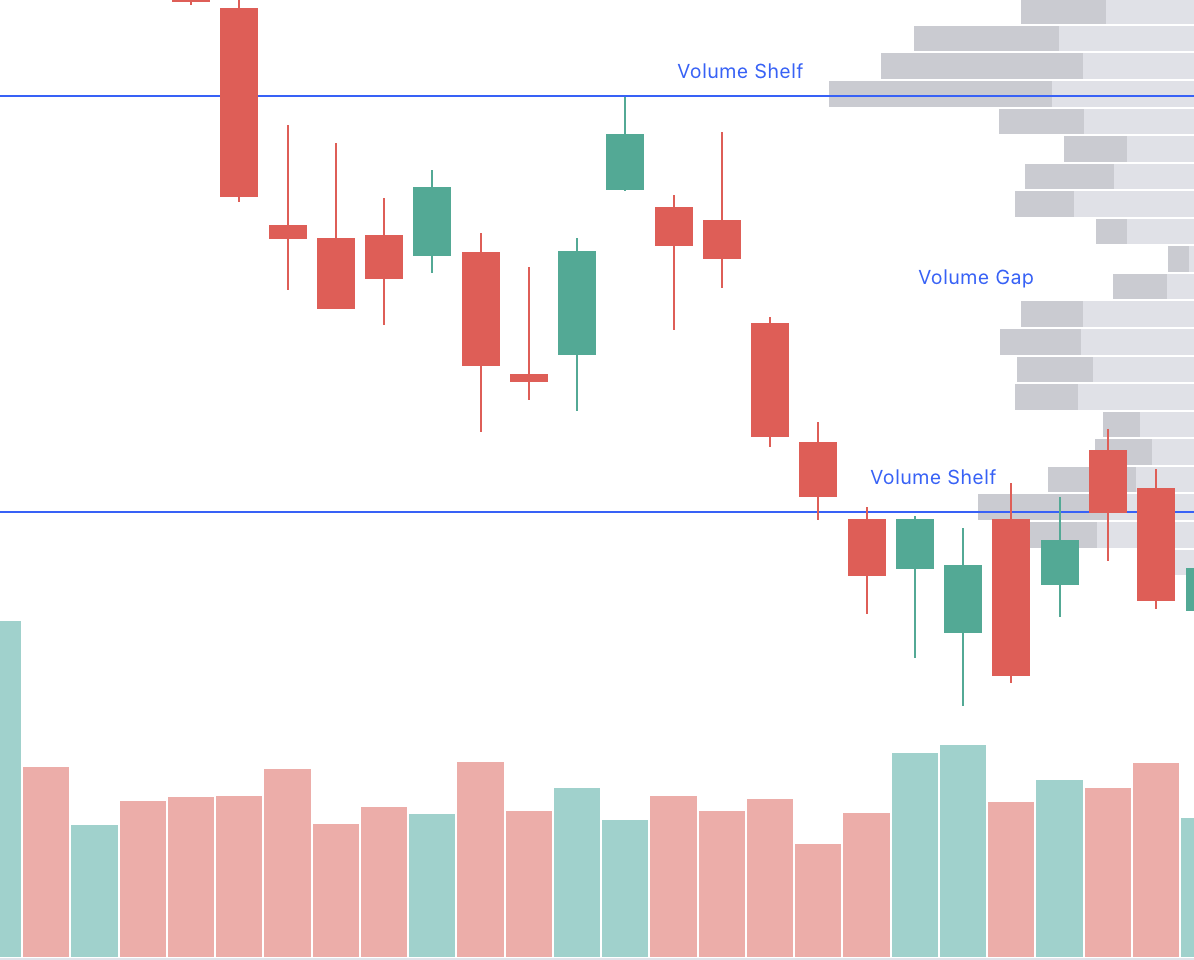

Let's start with support/resistance levels:

When you see a sharp spike in volume at a particular price level, it indicates strong buying/selling interest

This can act as a s/r zone, as buyers/sellers are likely to step in again if the price revisits that level

Let's start with support/resistance levels:

When you see a sharp spike in volume at a particular price level, it indicates strong buying/selling interest

This can act as a s/r zone, as buyers/sellers are likely to step in again if the price revisits that level

2) Continued...

Let's talk about price acceleration zones:

When there's a low-volume area between two volume peaks, it's often referred to as a "low-volume node."

Price can move rapidly through these zones as there's less trading activity to act as resistance

Let's talk about price acceleration zones:

When there's a low-volume area between two volume peaks, it's often referred to as a "low-volume node."

Price can move rapidly through these zones as there's less trading activity to act as resistance

Combining volume profiles with other technical indicators can enhance your trading decisions

Look for confluence with support/resistance levels, trendlines, and candlestick patterns for more accurate entries and exits 🙌

Look for confluence with support/resistance levels, trendlines, and candlestick patterns for more accurate entries and exits 🙌

Volume Profiles are a powerful tool to identify support levels & price acceleration zones

By understanding where traders are most active, you can make more informed trading decisions

Remember, volume profiles are not foolproof

They are just one tool in your trading arsenal 🛡️

By understanding where traders are most active, you can make more informed trading decisions

Remember, volume profiles are not foolproof

They are just one tool in your trading arsenal 🛡️

This 🧵 was very basic, if the people want a more in-depth thread on how I use it day to day within my own system comment down below 👇

That's a wrap!

Volume Profiles should be used as confluence, not to directly trade-off of!

I hope this simple thread helped someone, RT or like if useful, it is much appreciated 😎

Follow for more FREE educational posts and please don't hesitate to ask questions! 🙌

Volume Profiles should be used as confluence, not to directly trade-off of!

I hope this simple thread helped someone, RT or like if useful, it is much appreciated 😎

Follow for more FREE educational posts and please don't hesitate to ask questions! 🙌

As always, to end this thread, I will leave you with a few follow suggestions: ✔️

@DBookTrading: Volume

@ThiccTeddy: Volume

@fabiansoss: Volume

@notmrmanziel: Edu

@StratonOak: Edu

@RockyBTrades: Edu

@Braczyy: Edu

@TSDR_Trading: Edu

@SpencerParsons0: Edu

LMK if I missed any!

@DBookTrading: Volume

@ThiccTeddy: Volume

@fabiansoss: Volume

@notmrmanziel: Edu

@StratonOak: Edu

@RockyBTrades: Edu

@Braczyy: Edu

@TSDR_Trading: Edu

@SpencerParsons0: Edu

LMK if I missed any!

Loading suggestions...