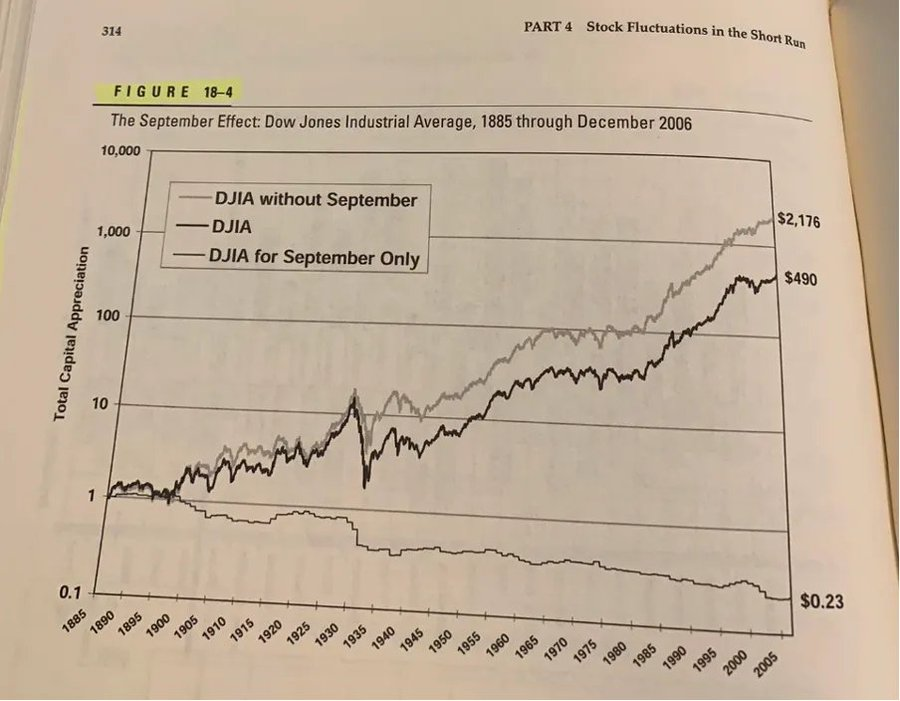

4. Avoid market timing

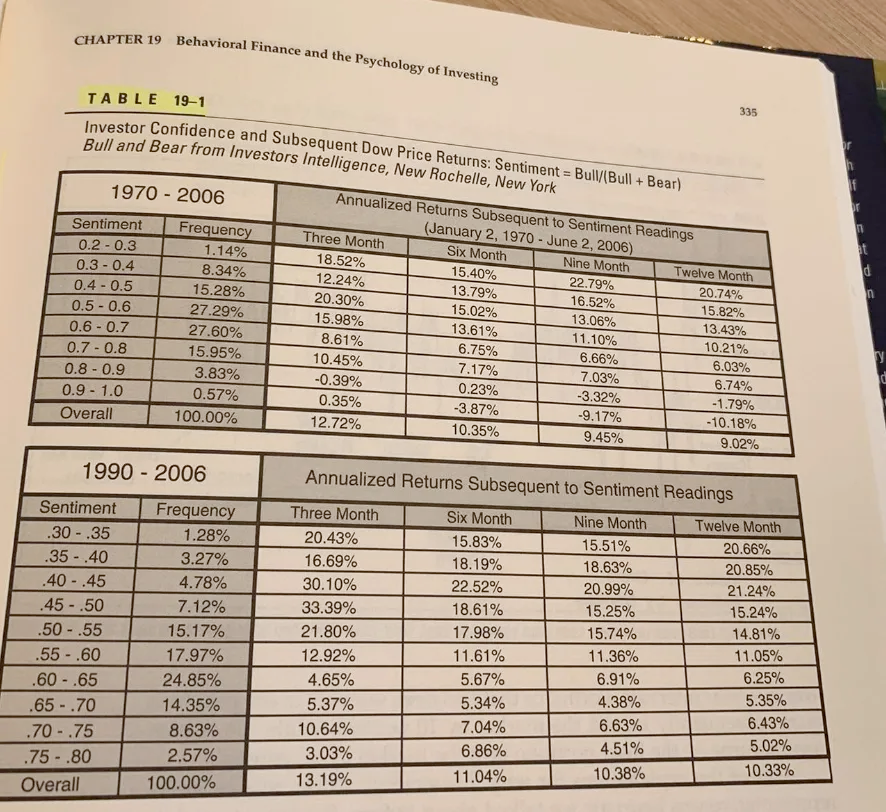

Selling when stocks are high and everyone's optimistic is tough.

Buying at market lows during widespread pessimism is even harder.

Selling when stocks are high and everyone's optimistic is tough.

Buying at market lows during widespread pessimism is even harder.

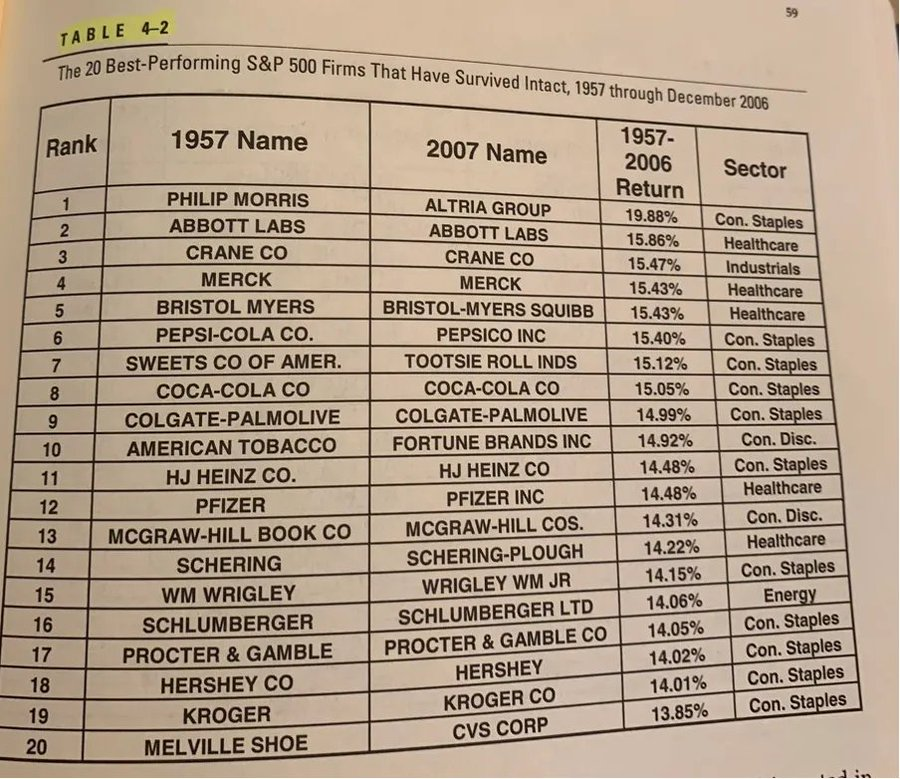

5. The world keeps changing

Quality investors should avoid companies active in fast-changing industries.

Quality investors should avoid companies active in fast-changing industries.

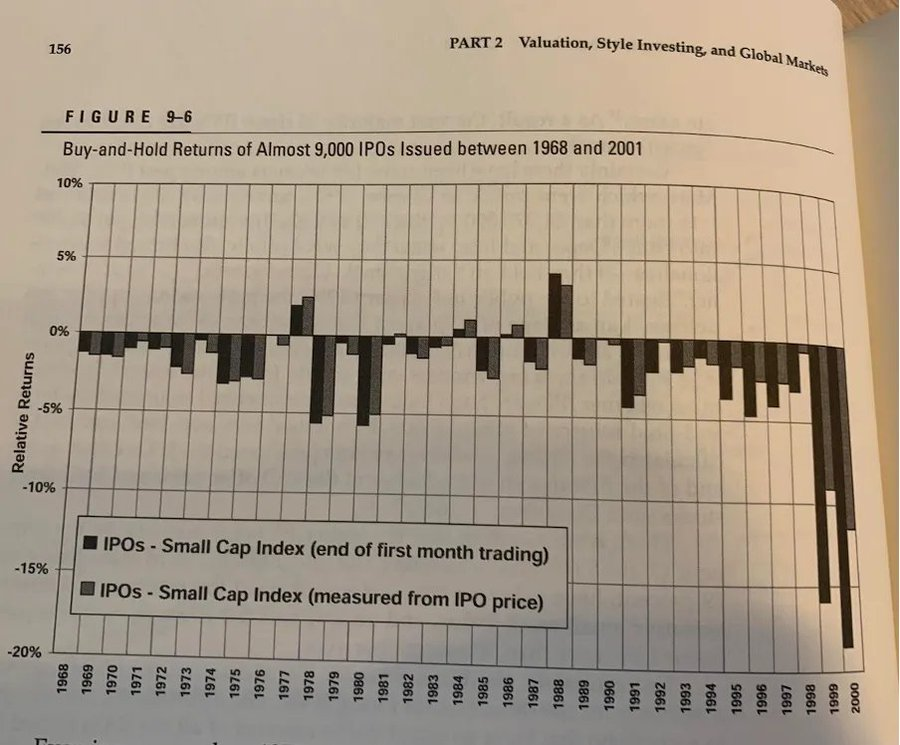

6. This time it’s not different.

“Most of the change we think we see in life is due to truths being in and out of favor.” – Robert Frost (1914)

“Most of the change we think we see in life is due to truths being in and out of favor.” – Robert Frost (1914)

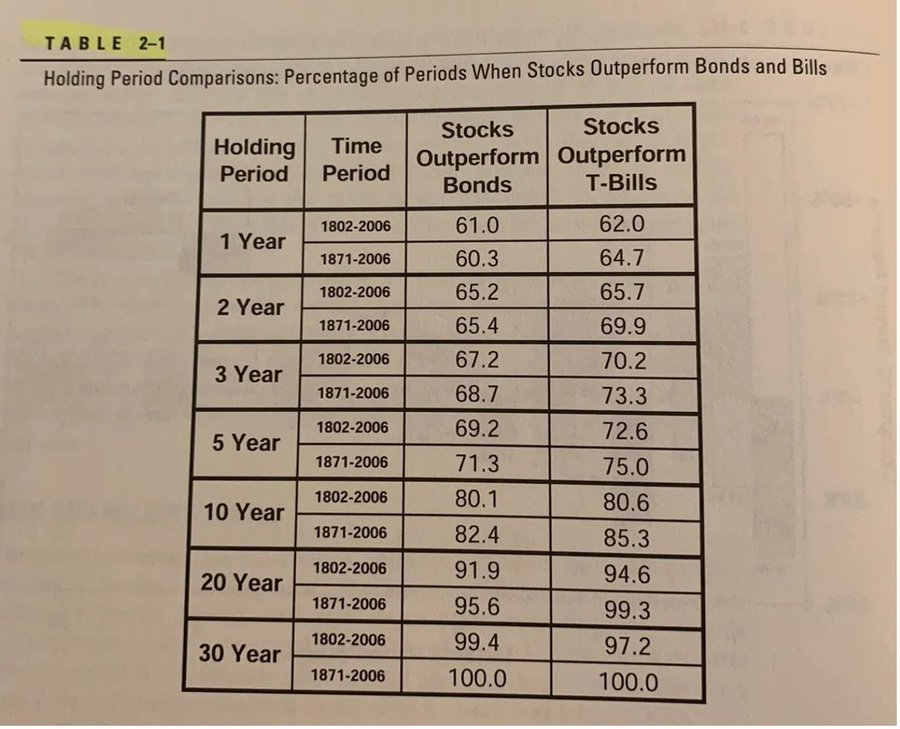

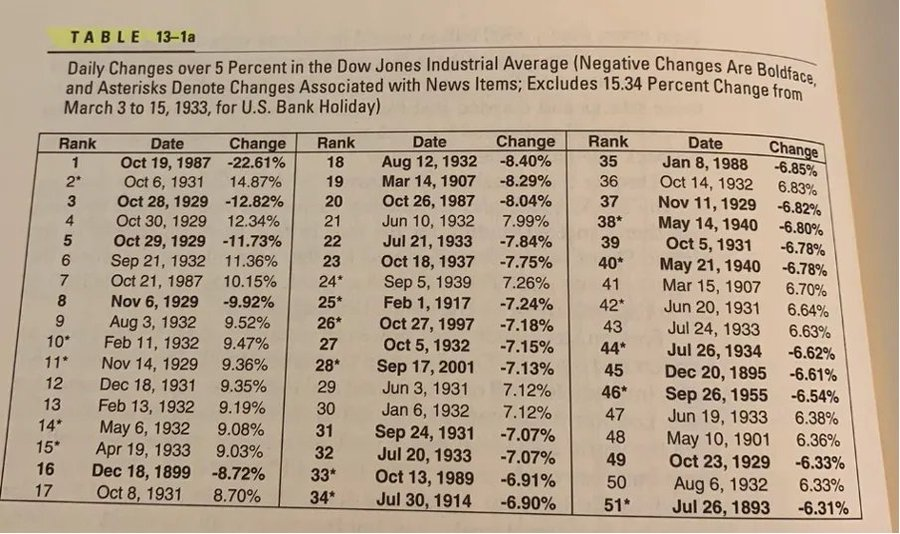

8. Low stock prices are great for investors

When people get too pessimistic, you can buy stocks at a discount.

Bear markets and corrections are good chances for long-term investors.

When people get too pessimistic, you can buy stocks at a discount.

Bear markets and corrections are good chances for long-term investors.

9. Choose companies that convert earnings into cash flow

Earnings are an opinion, cash flow is fact.

Research shows that companies which translate most earnings into cash flow outperform others by over 17% annually.

Earnings are an opinion, cash flow is fact.

Research shows that companies which translate most earnings into cash flow outperform others by over 17% annually.

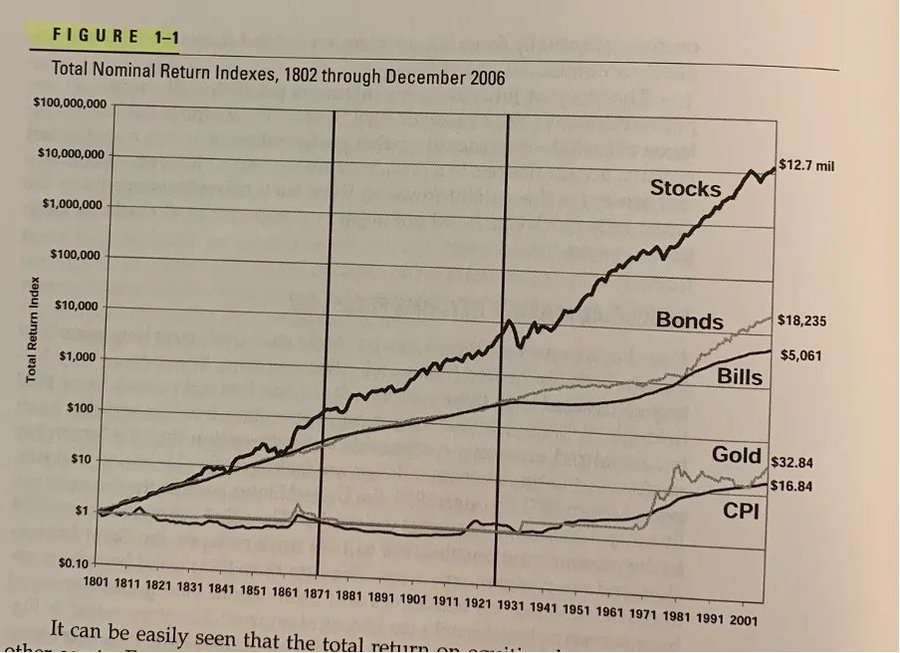

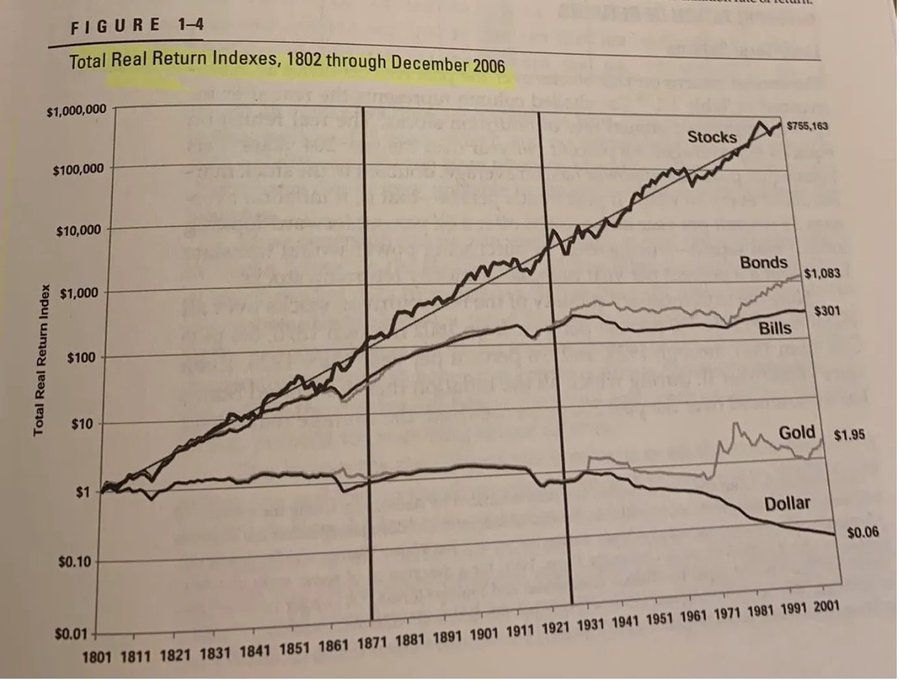

11. Consider the equity premium

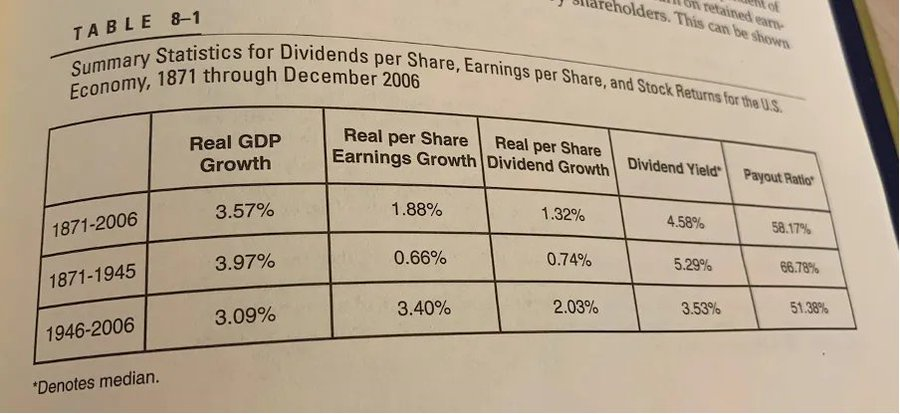

In the last 200 years, it's averaged between 3% and 3.5%, showing the difference between stock and government bond returns.

In the last 200 years, it's averaged between 3% and 3.5%, showing the difference between stock and government bond returns.

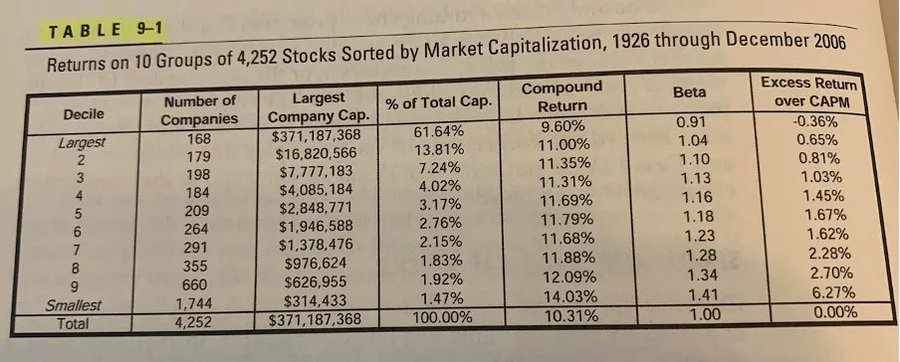

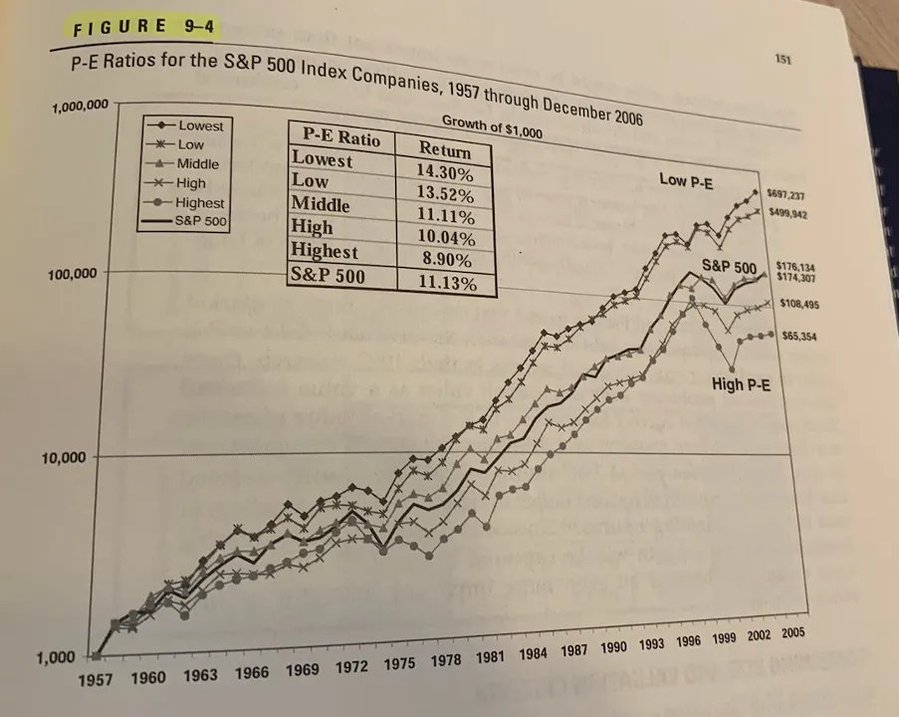

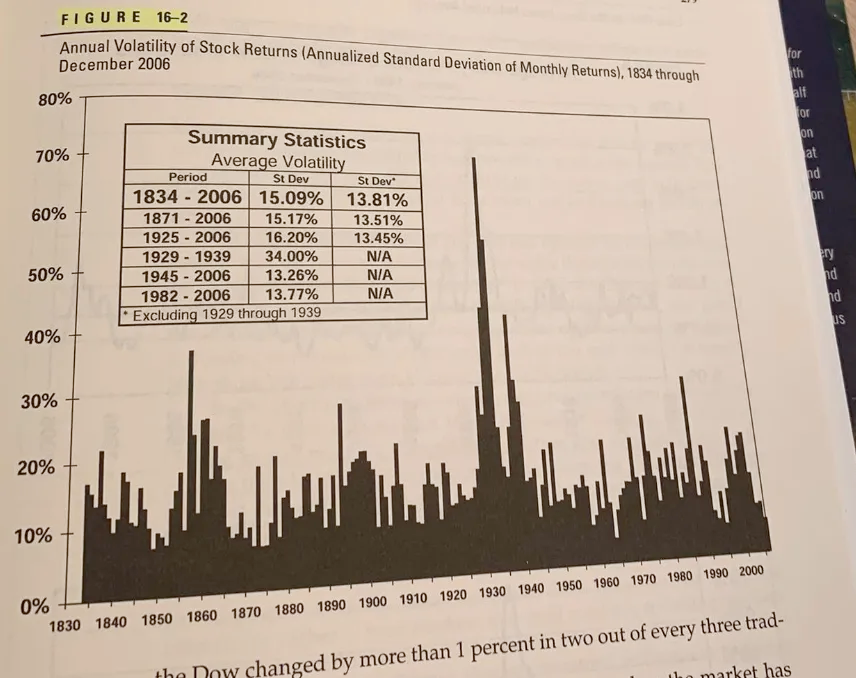

15. Investors can beat the market using factors

Various strategies like low volatility, value, and quality can help.

Remember, no strategy consistently outperforms, so always stick to your plan.

Various strategies like low volatility, value, and quality can help.

Remember, no strategy consistently outperforms, so always stick to your plan.

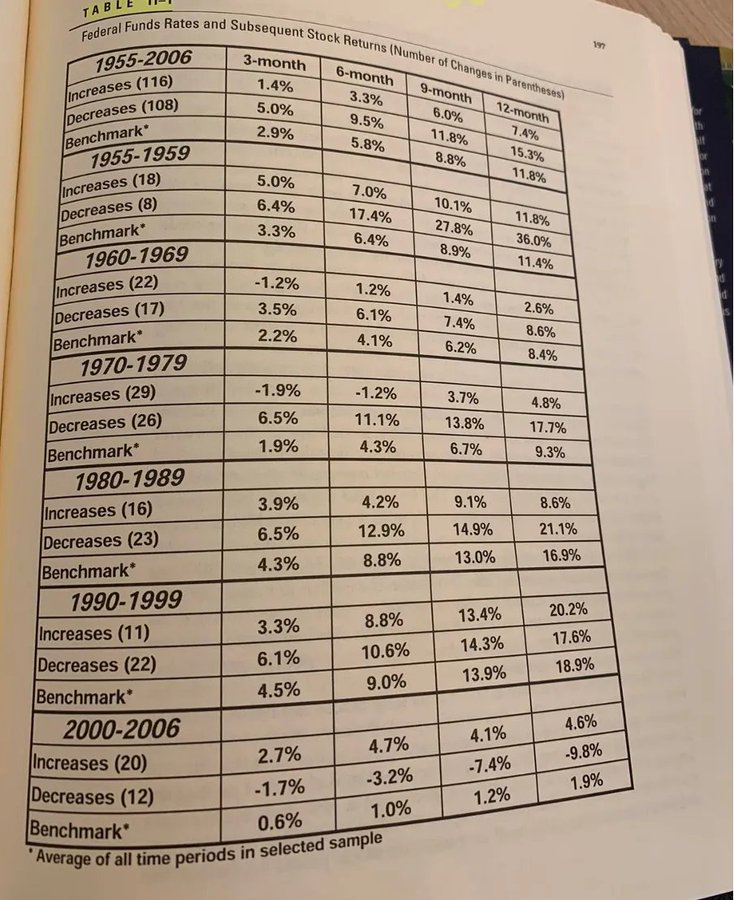

18. Avoid using macroeconomic factors for investment decisions

“Using macro-economic factors will lead to buy at high prices when times are good, and sell at the low when the recessions near its trough and pessimism prevails.” – Jeremy Siegel

“Using macro-economic factors will lead to buy at high prices when times are good, and sell at the low when the recessions near its trough and pessimism prevails.” – Jeremy Siegel

The word is out!

I left my job to transform Compounding Quality into a full investment platform.

To celebrate, I am sharing an e-book with 300 pages (!) full of investment wisdom.

Sign up here if you want to receive it for free: eepurl.com

I left my job to transform Compounding Quality into a full investment platform.

To celebrate, I am sharing an e-book with 300 pages (!) full of investment wisdom.

Sign up here if you want to receive it for free: eepurl.com

Loading suggestions...