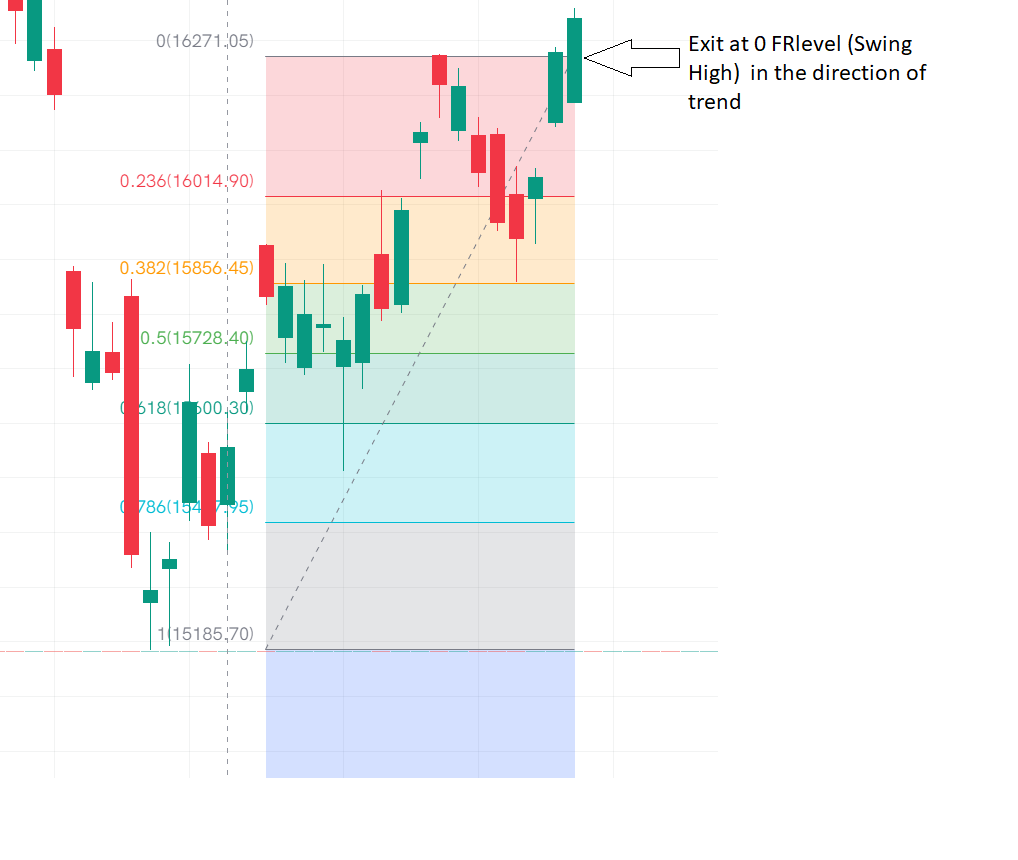

Why Does it work?

FR works due to traders' collective actions on these levels, reflecting natural human behaviors and patterns seen in nature.

It's commonly used, so markets often react as expected.

FR works due to traders' collective actions on these levels, reflecting natural human behaviors and patterns seen in nature.

It's commonly used, so markets often react as expected.

Please Follow @_AsthaTrade for more such content

please RT, Like and share the first tweet.

Comment below with your queries.

We will be happy to help.

please RT, Like and share the first tweet.

Comment below with your queries.

We will be happy to help.

جاري تحميل الاقتراحات...