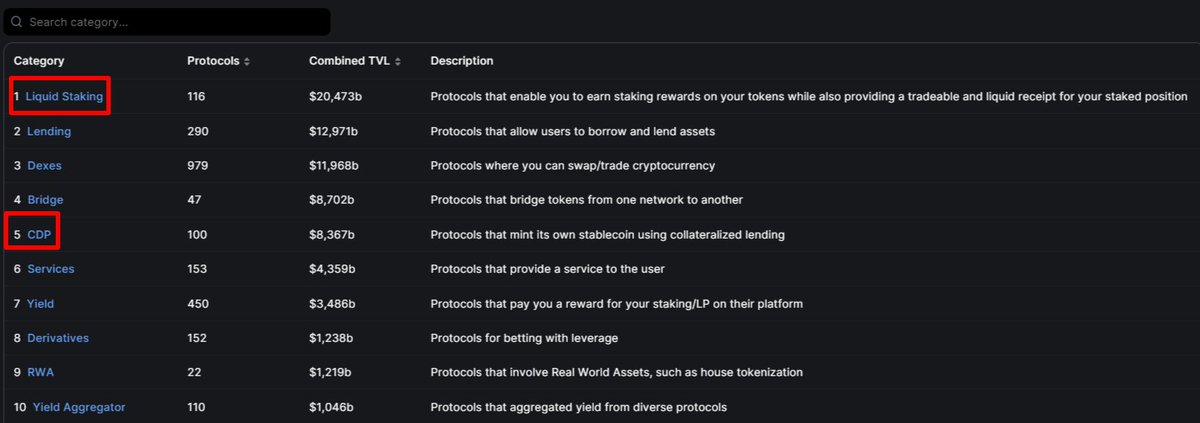

2️⃣ @Adscendo_fi

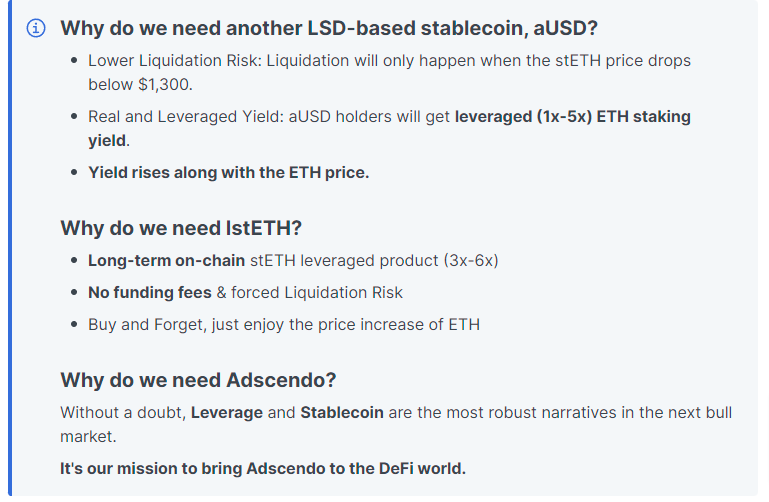

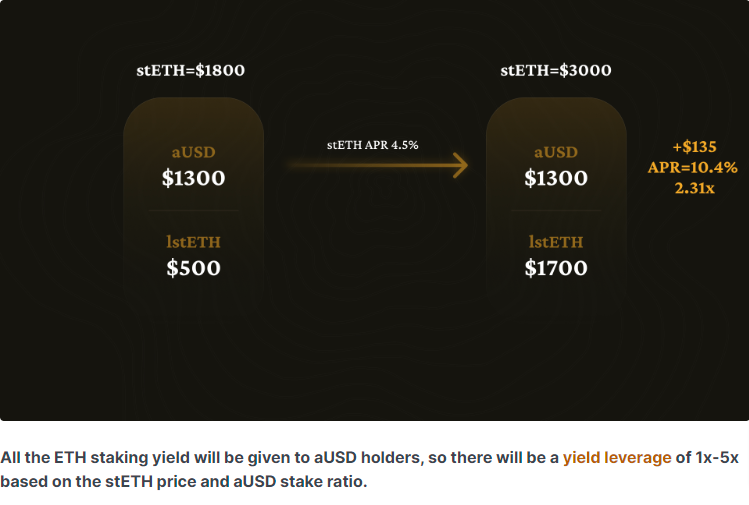

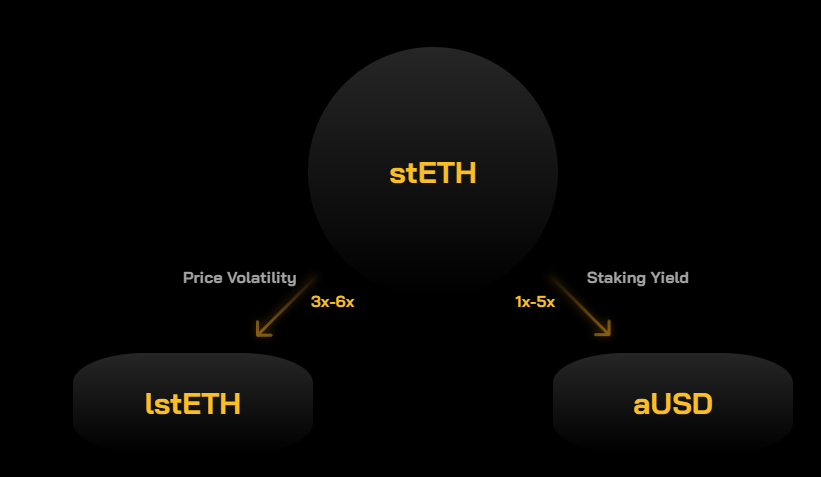

It offers:

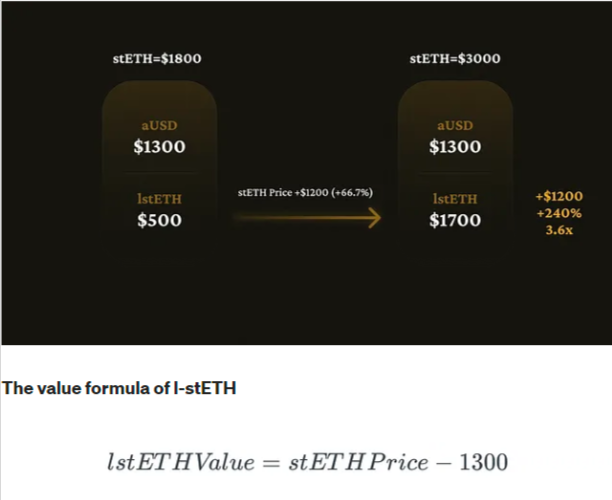

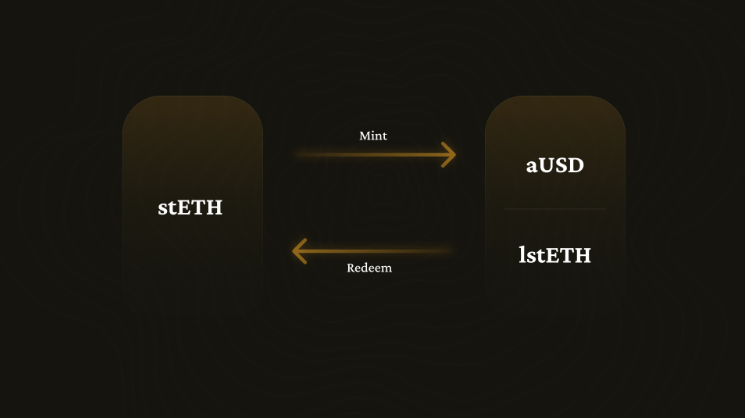

•Leveraged $stETH (3x-6x)

•LSD-native stablecoin with leveraged $ETH staking yield (1x-5x)

This perfectly balances risk and reward.

How?👇

It offers:

•Leveraged $stETH (3x-6x)

•LSD-native stablecoin with leveraged $ETH staking yield (1x-5x)

This perfectly balances risk and reward.

How?👇

🔟Buybacks & burns

Increased income from $stETH is converted to $ADO.

This is done through purchasing $ADO in the secondary market.

Burning will come from esADO Vesting.

If users choose to vest with 14 days they will get only 40%

Rest will be burned🔥

Increased income from $stETH is converted to $ADO.

This is done through purchasing $ADO in the secondary market.

Burning will come from esADO Vesting.

If users choose to vest with 14 days they will get only 40%

Rest will be burned🔥

1️⃣1️⃣Roadmap🗺️

Roadmap includes:

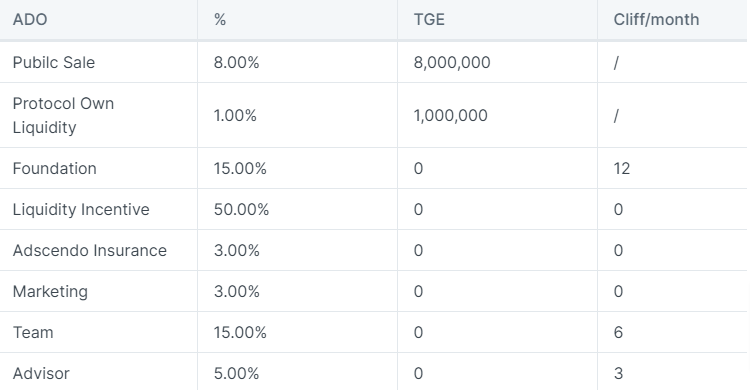

🔷Public Sale

🔷Mainnet launch

🔷aUSD Liquidity on $CRV

🔷ADO liquidity on $UNI

🔷Cross-chain deployment

🔷lstETH Position NFT

🔷Integrate more LSDs

🔷Launch aUSD lending marketplace

and much more.

Check full details.👇

Roadmap includes:

🔷Public Sale

🔷Mainnet launch

🔷aUSD Liquidity on $CRV

🔷ADO liquidity on $UNI

🔷Cross-chain deployment

🔷lstETH Position NFT

🔷Integrate more LSDs

🔷Launch aUSD lending marketplace

and much more.

Check full details.👇

1️⃣2️⃣Thoughts

i think this project is groundbreaking.👀

You get leveraged $ETH yield on stablecoin, but also leveraged upside potential of $stETH.

If you are bullish on ETH or LSDfi sector, consider researching this gem yourself.🔎

NFA

DYOR.

i think this project is groundbreaking.👀

You get leveraged $ETH yield on stablecoin, but also leveraged upside potential of $stETH.

If you are bullish on ETH or LSDfi sector, consider researching this gem yourself.🔎

NFA

DYOR.

If you made it this far, you are in the top 1%.💎

If you enjoyed:

1. Follow me @CryptoGideon_ so you won't miss more VALUABLE threads.

2. RT the tweet below to help others find more about DeFi and crypto insights.

3. Subscribe to "Crypto Stoics" for ALPHA content🤫

If you enjoyed:

1. Follow me @CryptoGideon_ so you won't miss more VALUABLE threads.

2. RT the tweet below to help others find more about DeFi and crypto insights.

3. Subscribe to "Crypto Stoics" for ALPHA content🤫

Loading suggestions...