1. Categories of Investing

Buffett used to distinguish between 3 categories of Investments.

In 1964 he decided to add a fourth one:

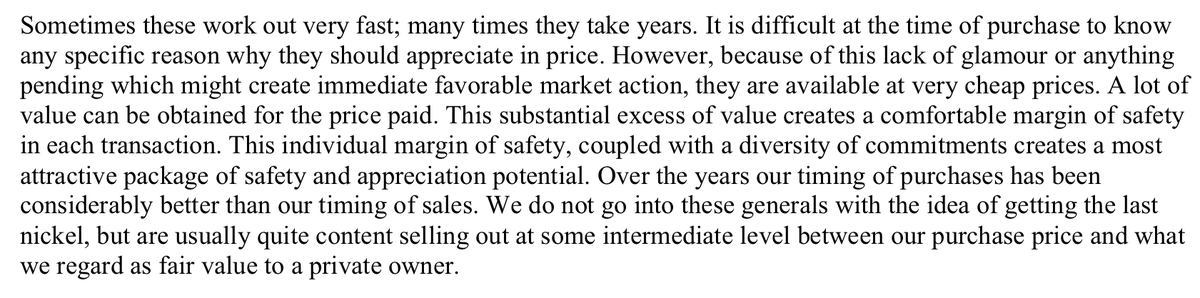

- Generals - Private Owner Basis

- Work-Outs

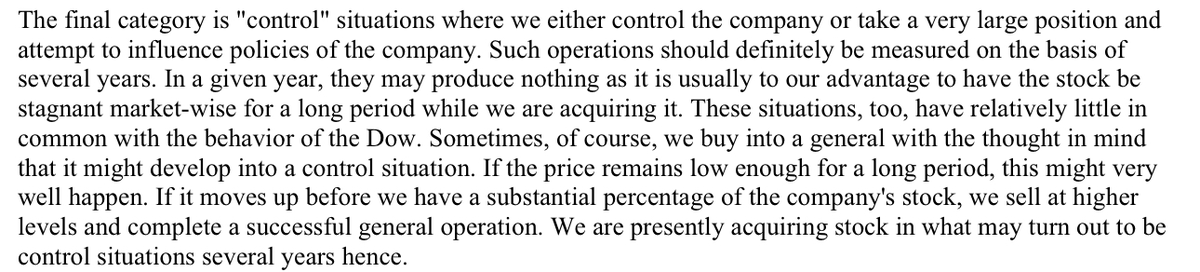

- Control Situations

- Generals - Relatively Undervalued (added in 1964)

Buffett used to distinguish between 3 categories of Investments.

In 1964 he decided to add a fourth one:

- Generals - Private Owner Basis

- Work-Outs

- Control Situations

- Generals - Relatively Undervalued (added in 1964)

1.2. Work-Outs

Work-Outs are better known as “Special Situations” today.

The price of these situations doesn’t depend on supply and demand created by buyers and sellers but on corporate action.

This makes them more predictable and less correlated to the market.

Work-Outs are better known as “Special Situations” today.

The price of these situations doesn’t depend on supply and demand created by buyers and sellers but on corporate action.

This makes them more predictable and less correlated to the market.

2. Conservatism and Diversification

“True conservatism is only possible through knowledge and reason.”

Buffett disagrees with the conventional definition of conservatism.

Buying government bonds, blue chip stocks, and being (over)diversified.

“True conservatism is only possible through knowledge and reason.”

Buffett disagrees with the conventional definition of conservatism.

Buying government bonds, blue chip stocks, and being (over)diversified.

He calls over-diversification the “Noah School of Investing - Two of Everything.”

There are no conservative assets by default.

And being right isn’t measured by how many people hold that opinion.

It’s measured by the facts.

There are no conservative assets by default.

And being right isn’t measured by how many people hold that opinion.

It’s measured by the facts.

That's it for today!

If you enjoyed it, please Like and Retweet this Thread so more people can see it!

Follow me @MnkeDaniel to learn more about Investing.

Have a great day!

If you enjoyed it, please Like and Retweet this Thread so more people can see it!

Follow me @MnkeDaniel to learn more about Investing.

Have a great day!

Here's a more detailed article on Buffett’s Strategy:

danielmnke.com

danielmnke.com

جاري تحميل الاقتراحات...