Imagine this scenario:

Mr X buys a token

( risked more than usual )

• He took a loss

Mr X decides to buy another

( risking more to make up for the loss )

• He took another loss

( PTSD sets in )

He sees another token

( He is afraid of placing a trade )

guess what ?

Mr X buys a token

( risked more than usual )

• He took a loss

Mr X decides to buy another

( risking more to make up for the loss )

• He took another loss

( PTSD sets in )

He sees another token

( He is afraid of placing a trade )

guess what ?

That token eventually pulled an x10

Holy Fvck right ?

His portfolio is down bad

His psychology is crippled

Mr X isn’t a person now

Mr X is a phase

A lot of us have been a/in “Mr X”

This is a phase even the best traders have had to pass through

So …

Holy Fvck right ?

His portfolio is down bad

His psychology is crippled

Mr X isn’t a person now

Mr X is a phase

A lot of us have been a/in “Mr X”

This is a phase even the best traders have had to pass through

So …

when it comes to market psychology

it is best to set an already prepared guideline

Rather than thinking everything would be “under control” when it’s time

How do you do this ?

𝗣𝗼𝗿𝘁𝗳𝗼𝗹𝗶𝗼 𝗱𝗶𝘃𝗲𝗿𝘀𝗶𝗳𝗶𝗰𝗮𝘁𝗶𝗼𝗻

That’s the hack !

That’s the strategy !

Let’s …

it is best to set an already prepared guideline

Rather than thinking everything would be “under control” when it’s time

How do you do this ?

𝗣𝗼𝗿𝘁𝗳𝗼𝗹𝗶𝗼 𝗱𝗶𝘃𝗲𝗿𝘀𝗶𝗳𝗶𝗰𝗮𝘁𝗶𝗼𝗻

That’s the hack !

That’s the strategy !

Let’s …

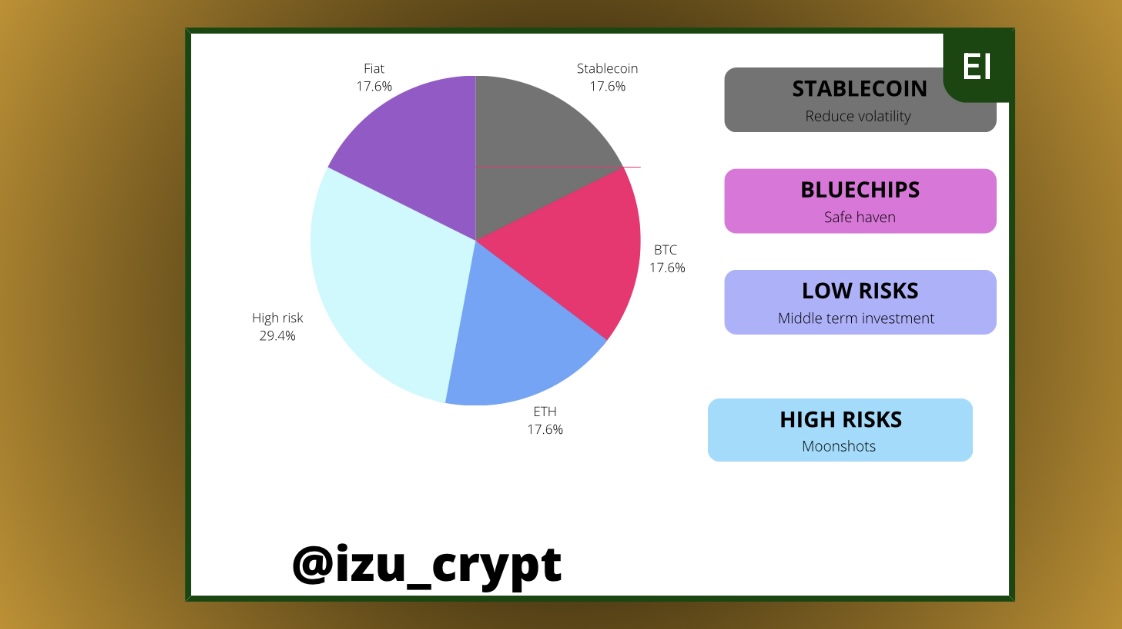

How do you preserve your portfolio ?

By Keeping it simple!

Picture your portfolio as a football team:

Goalkeeper → Stablecoins

Defender → Bluechips

Midlfielder → Low risk plays

Strikers → High risk plays

Failure to strike a balance in the team could lead to chaos

Let’s …

By Keeping it simple!

Picture your portfolio as a football team:

Goalkeeper → Stablecoins

Defender → Bluechips

Midlfielder → Low risk plays

Strikers → High risk plays

Failure to strike a balance in the team could lead to chaos

Let’s …

see how each fulfill their roles

Stablecoin → play a big role in reducing the volatility in your portfolio and preserve capital e.g USDT,Busd…

Bluechips → They are long term investments with low volatility,the best recommendations are BTC & ETH

Low risk plays →

Stablecoin → play a big role in reducing the volatility in your portfolio and preserve capital e.g USDT,Busd…

Bluechips → They are long term investments with low volatility,the best recommendations are BTC & ETH

Low risk plays →

I will regard them as middle term investments, used to build your portfolio and have a medium risk

High risks plays → Allows you boost your portfolio playing around with low caps but ofcourse not gambling for fun but with high conviction

Let’s say …

High risks plays → Allows you boost your portfolio playing around with low caps but ofcourse not gambling for fun but with high conviction

Let’s say …

This allocations too can depend on what season we are in

In alt seasons…we get to bet more on high risk plays to capitalize on the current market condition

But for a bear market, where you want to be a little bit more defensive

The Stablecoins get more allocations

Now…

In alt seasons…we get to bet more on high risk plays to capitalize on the current market condition

But for a bear market, where you want to be a little bit more defensive

The Stablecoins get more allocations

Now…

in as much as stablecoins are regarded as a safe haven

There are still risks involved, which include :

• Top stablecoins being centralized

• lack of transparency of the USDT

• Attack on algorithmic stablecoins

So its best you diversify your stablecoins

Spread

There are still risks involved, which include :

• Top stablecoins being centralized

• lack of transparency of the USDT

• Attack on algorithmic stablecoins

So its best you diversify your stablecoins

Spread

into usdt ,Dai ,usdc ,busd & so many more

In a bear market where the stablecoins have more allocations,you can opt to farm more of it

But then be careful of chasing high yields

Where to farm ;

• Lending platforms like Aave

• Incentivized liquidity pools

& so many more

But,

In a bear market where the stablecoins have more allocations,you can opt to farm more of it

But then be careful of chasing high yields

Where to farm ;

• Lending platforms like Aave

• Incentivized liquidity pools

& so many more

But,

& that’s a wrap!

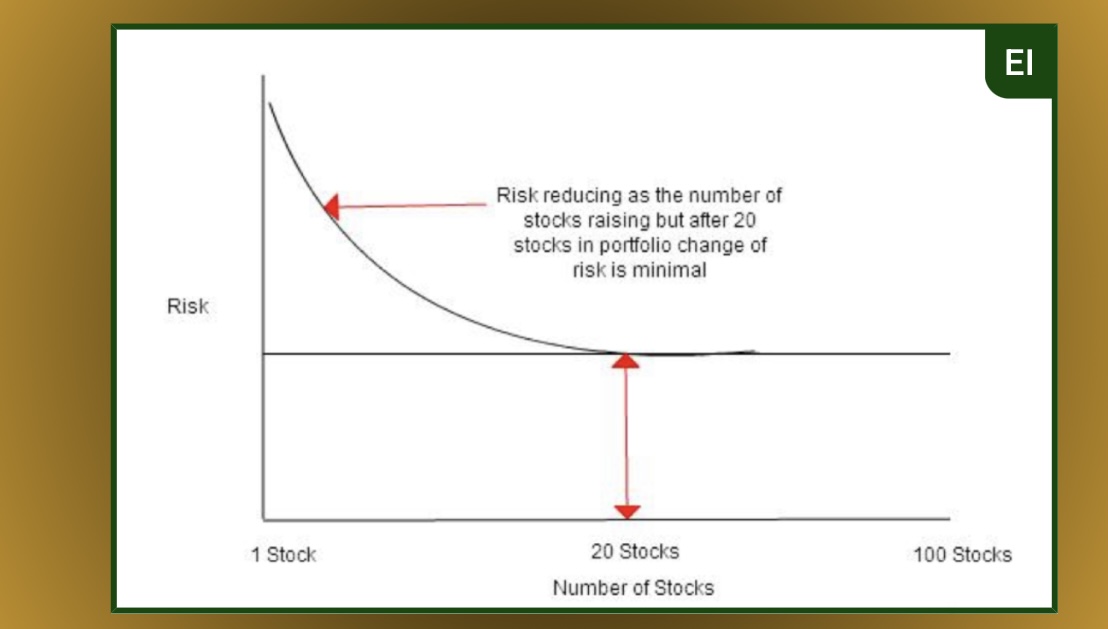

Key takeaways ;

• Keep stacking blue chips ( a mix of solid ones)

• Understand risk management

• Bull & Bear market stablecoin allocation strategy

Key takeaways ;

• Keep stacking blue chips ( a mix of solid ones)

• Understand risk management

• Bull & Bear market stablecoin allocation strategy

If you enjoyed this follow me @izu_crypt for more

& other solid chads with great contents:

@arndxt_xo

@0xSalazar

@crypthoem

@CryptoGirlNova

@MichaelSixgods

@Frank_The_Wiz

@Zaqueen_

@Simple_simeon

@DannyCrypt

@SamuelXeus

@DOLAK1NG

@_Quivira

@stacy_muur

@Hercules_Defi

@belizardd

& other solid chads with great contents:

@arndxt_xo

@0xSalazar

@crypthoem

@CryptoGirlNova

@MichaelSixgods

@Frank_The_Wiz

@Zaqueen_

@Simple_simeon

@DannyCrypt

@SamuelXeus

@DOLAK1NG

@_Quivira

@stacy_muur

@Hercules_Defi

@belizardd

@iam_Riichard @kendrickNoble7 @fitforcrypto_ @VanessaDefi @Defi_Warhol Please like & RT this first post of you found value( the link below )

Also Follow me @izu_crypt for more

Also Follow me @izu_crypt for more

Loading suggestions...