1️⃣ Who is Philip Fisher?

Philiper Fisher’s most famouns investment?

He bought Motorola in 1955 and held it until he passed away in 2004.

It’s a beautiful example of letting your winners run.

Philiper Fisher’s most famouns investment?

He bought Motorola in 1955 and held it until he passed away in 2004.

It’s a beautiful example of letting your winners run.

He’s also the inventor of the ‘scuttlebutt’ method, an investment method that Peter Lynch used a lot.

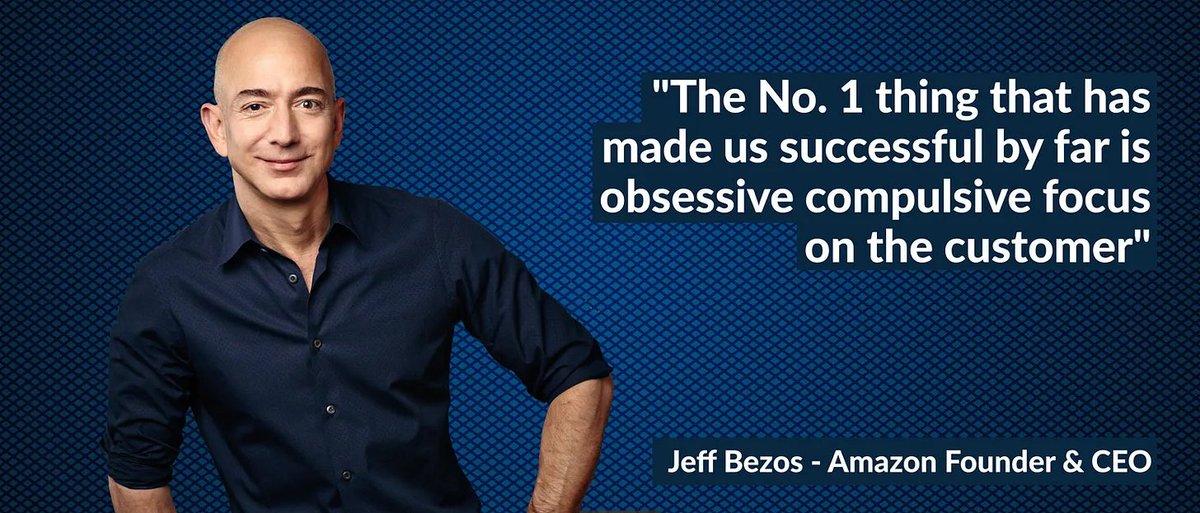

Scuttlebutt refers to the idea that if you’re interested in a certain company, you should go talk with their customers, competitors, (former) employees, and so on.

Scuttlebutt refers to the idea that if you’re interested in a certain company, you should go talk with their customers, competitors, (former) employees, and so on.

Warren Buffett once called Philip Fisher's book Common Stocks and Uncommon Profits one of the best books on investing that has ever been written.

If even Warren Buffett admires Philip Fisher, shouldn’t you?

If even Warren Buffett admires Philip Fisher, shouldn’t you?

2️⃣ 15-Step approach

Now let’s dive into Philip Fisher’s investment approach.

He used the same 15-step approach over and over again to select the best growth companies.

Now let’s dive into Philip Fisher’s investment approach.

He used the same 15-step approach over and over again to select the best growth companies.

▪️Does the company keep developing new products to increase its sales potential?

Innovation is the worst enemy of every (quality) stock.

To stand still is to go backwards. That’s why investing in R&D is essential.

Innovation is the worst enemy of every (quality) stock.

To stand still is to go backwards. That’s why investing in R&D is essential.

It allows companies to stay ahead of competition and keep growing at attractive rates.

Just look at Amazon for example that initially started as an online book store or Netflix that started as a DVD-by-mail service.

Just look at Amazon for example that initially started as an online book store or Netflix that started as a DVD-by-mail service.

▪️How effective is the company’s R&D?

Is the company overspending or underspending in R&D compared to peers?

A great way to look at this is via ratios such as R&D/Sales and R&D/Operating Cash Flow.

Is the company overspending or underspending in R&D compared to peers?

A great way to look at this is via ratios such as R&D/Sales and R&D/Operating Cash Flow.

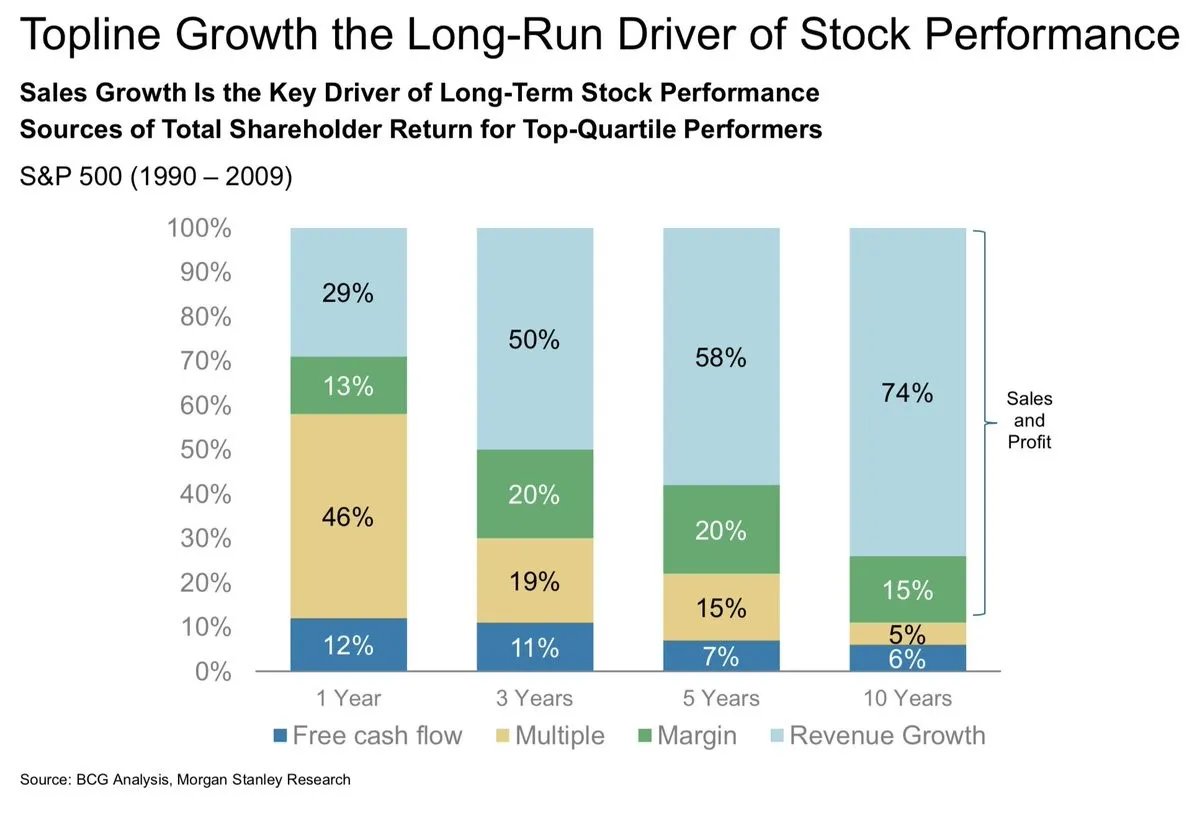

▪️Does the company have an above-average sales organization?

Selling a product or service is the essence of every business.

Without sales, every company would go bankrupt.

Selling a product or service is the essence of every business.

Without sales, every company would go bankrupt.

▪️Has the company a high profit margin?

You want to invest in companies which are very profitable.

Look for companies with a profit margin of at least 10%.

You want to invest in companies which are very profitable.

Look for companies with a profit margin of at least 10%.

This means that for every dollar in sales, the company makes $0.10 in net income.

Invest in companies that consistently report higher profit margins than their peers. It often means that they are operating more efficiently.

Invest in companies that consistently report higher profit margins than their peers. It often means that they are operating more efficiently.

▪️What is the company doing to maintain or improve profit margins?

Investors should always be cautious for reversion to the mean.

A sustainable competitive advantage is one of the only ways a company can maintain or improve its profit margins over time.

Investors should always be cautious for reversion to the mean.

A sustainable competitive advantage is one of the only ways a company can maintain or improve its profit margins over time.

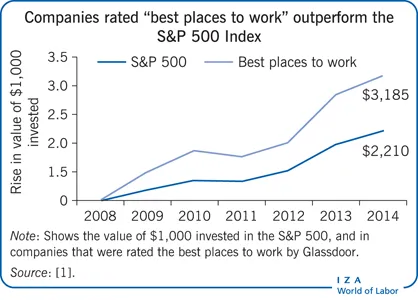

▪️Has the company outstanding executive relations?

Skin in the game matters.

Studies have found that founder-led companies as well as family companies outperform the market on average with more than 3% (!) per year.

Skin in the game matters.

Studies have found that founder-led companies as well as family companies outperform the market on average with more than 3% (!) per year.

▪️Does the company have depth to its management?

All humans are finite.

This also means that when you invest in a company because it’s run by a great founder, one day this excellent owner-operator will be gone.

All humans are finite.

This also means that when you invest in a company because it’s run by a great founder, one day this excellent owner-operator will be gone.

▪️How good are the company's cost analysis/accounting controls?

Companies should break down unit economics in minute detail so that they know where to focus its attention.

You want to invest in companies run by managers who know the company inside and out.

Companies should break down unit economics in minute detail so that they know where to focus its attention.

You want to invest in companies run by managers who know the company inside and out.

▪️Look at patents

Philip Fisher highlights that it’s very important to look at patents.

Strong patent positions can allow a company to operate at high sustained profit margins.

Philip Fisher highlights that it’s very important to look at patents.

Strong patent positions can allow a company to operate at high sustained profit margins.

However, as soon as a patent’s tenure ends, a company’s profit may suffer badly.

Characteristics such as skilled labors, a high reputation, existing market share or patents can help a company to gain or maintain its competitive advantage.

Characteristics such as skilled labors, a high reputation, existing market share or patents can help a company to gain or maintain its competitive advantage.

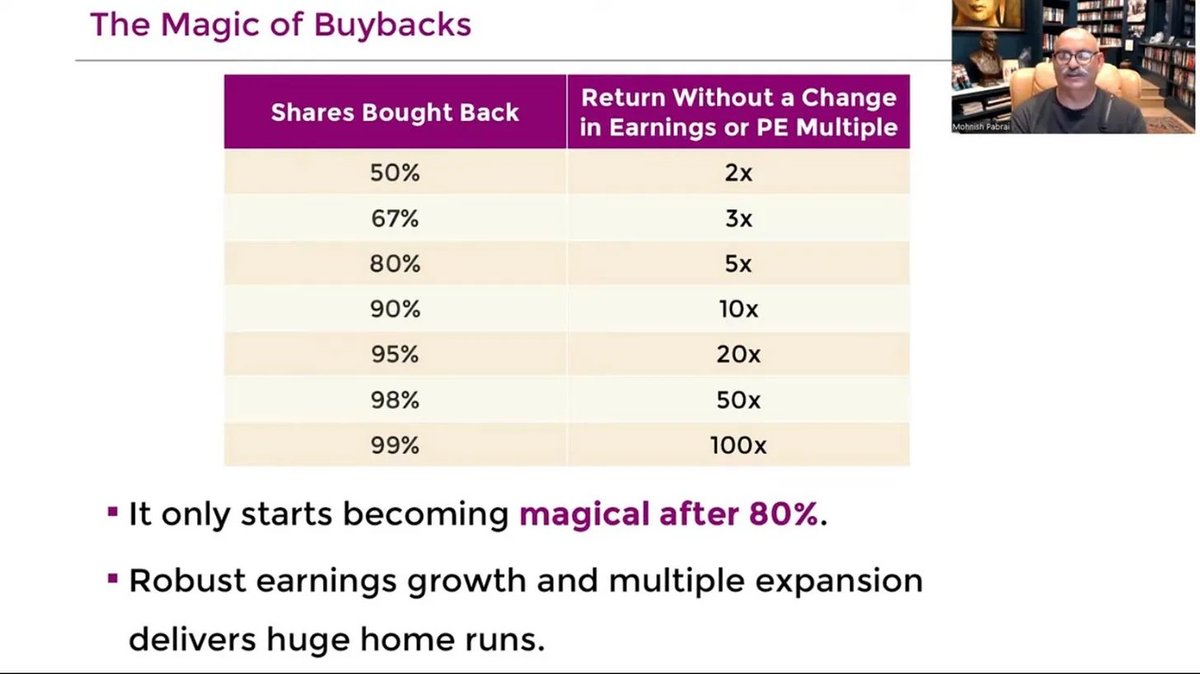

▪️Is the company diluting shareholders?

Capital increases or stock-based compensation (SBCs) are costs for investors as it dilutes your stake in the company.

Capital increases or stock-based compensation (SBCs) are costs for investors as it dilutes your stake in the company.

▪️Does management admit its mistakes?

Charlie Munger once said that there's no way that you can live an adequate life without making many mistakes.

That’s indeed true.

Charlie Munger once said that there's no way that you can live an adequate life without making many mistakes.

That’s indeed true.

The most important thing is how a company handles these mistakes when they occur and how they communicate about them.

Avoid companies which try to hide bad news at all costs.

Avoid companies which try to hide bad news at all costs.

▪️Has the company a management of unquestionable integrity?

Only invest in companies run by people who you want to be around with.

Only invest in companies run by people who you want to be around with.

That's it for today.

If you liked this, you'll LOVE our brand new e-book about investing and the stock market.

It will be published on Amazon soon, but today you can grab it for free.

Sign up here: eepurl.com

If you liked this, you'll LOVE our brand new e-book about investing and the stock market.

It will be published on Amazon soon, but today you can grab it for free.

Sign up here: eepurl.com

Loading suggestions...