1. Being on the Right Side of the Trade

When you buy or sell a stock, there’s someone else on the other side of the trade doing the exact opposite.

One of you is going to be wrong.

You need to ask yourself: ”Why am I on the right side of this trade?”

When you buy or sell a stock, there’s someone else on the other side of the trade doing the exact opposite.

One of you is going to be wrong.

You need to ask yourself: ”Why am I on the right side of this trade?”

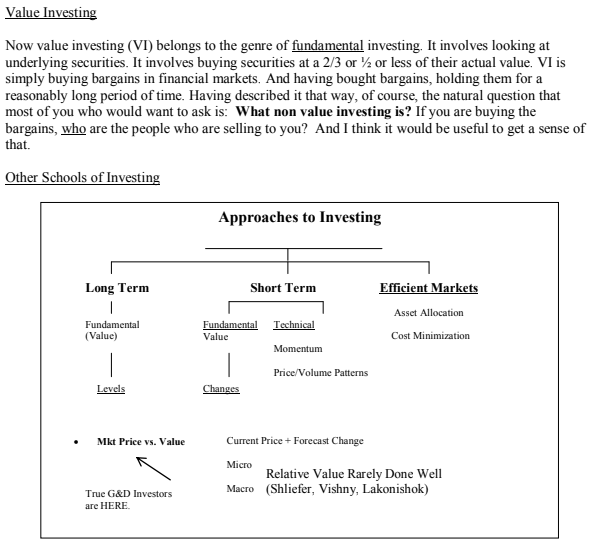

Value Investing is the answer.

Buying non-glamorous, unliked, and overlooked stocks puts you on the right side of the trade.

Why is that, and how can you find these stocks?

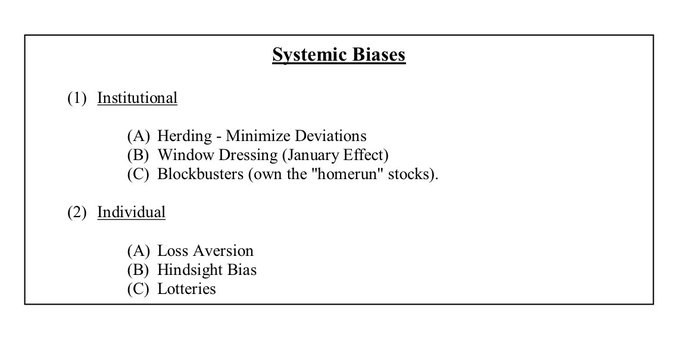

Let’s start with the why and discuss Institutional and Individual biases.

Buying non-glamorous, unliked, and overlooked stocks puts you on the right side of the trade.

Why is that, and how can you find these stocks?

Let’s start with the why and discuss Institutional and Individual biases.

2.1 Institutional Biases - Herding

Most money managers are “Me-Too” managers.

Me-Too managers don’t differ much from competition.

They’re afraid they will lose they jobs if they do something different and are wrong.

Most money managers are “Me-Too” managers.

Me-Too managers don’t differ much from competition.

They’re afraid they will lose they jobs if they do something different and are wrong.

They jump on the bandwagon as other people buy or sell and drive stocks up to ridiculously high or low P/Es.

This bias feeds manias and increases chances for the smaller individual investor.

Especially the ones following the value school.

This bias feeds manias and increases chances for the smaller individual investor.

Especially the ones following the value school.

2.2 Institutional Biases - Window Dressing

Window dressing describes buying the best-performing stocks near or before the end of the quarter.

That way, you have successful companies in your portfolios for your investors to show.

Window dressing describes buying the best-performing stocks near or before the end of the quarter.

That way, you have successful companies in your portfolios for your investors to show.

Interestingly, it’s not a problem your performance doesn't match the performance of these stocks.

It’s enough to have them in the portfolio at the end of the quarter.

Clients will look at the portfolio and think: “These are good companies. No reason to be concerned.”

It’s enough to have them in the portfolio at the end of the quarter.

Clients will look at the portfolio and think: “These are good companies. No reason to be concerned.”

2.3 Institutional Biases - Blockbusters

Institutions compete for investors' money.

To get that money, they need to convince investors they’re the best option.

Something that always works are Blockbuster stocks.

Exciting new businesses with huge growth potential.

Institutions compete for investors' money.

To get that money, they need to convince investors they’re the best option.

Something that always works are Blockbuster stocks.

Exciting new businesses with huge growth potential.

The preference for such stocks is part of the reason why growth is so extensively overvalued.

That’s why you want to be on the other side of such trades.

Now, let’s look at the other side, Individual Biases.

That’s why you want to be on the other side of such trades.

Now, let’s look at the other side, Individual Biases.

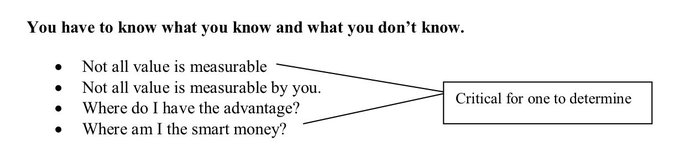

3.1 Individual Biases - Knowing

People often confuse what they know and what they think they know.

And that mistake can get expensive.

Knowable things are facts.

Your investment thesis is just that, a thesis.

People often confuse what they know and what they think they know.

And that mistake can get expensive.

Knowable things are facts.

Your investment thesis is just that, a thesis.

4. Greenwald’s Search Strategy

Where can we find unreflective sellers on the other side of the trade?

That’s mainly in what Greenwald calls “obscure” situations.

Small Caps, Spin-offs, or boring companies that get no coverage.

Most investors are in it for the excitement.

Where can we find unreflective sellers on the other side of the trade?

That’s mainly in what Greenwald calls “obscure” situations.

Small Caps, Spin-offs, or boring companies that get no coverage.

Most investors are in it for the excitement.

Oversold industries are another opportunity.

Why do industries get oversold?

- Regulatory threats

- Supply/Demand imbalances

- Longterm underperformance

- Cycles

Why do industries get oversold?

- Regulatory threats

- Supply/Demand imbalances

- Longterm underperformance

- Cycles

Sooner or later, companies and industries return to their mean.

That’s the number one reason Value Investing works.

But firmly believing in that is hard.

Most people only do until their beliefs get seriously tested.

That’s the number one reason Value Investing works.

But firmly believing in that is hard.

Most people only do until their beliefs get seriously tested.

Here's a free PDF of his Class Notes for further studies:

danielmnke.com

danielmnke.com

That's it for today!

If you enjoyed it, please Like and Retweet this Thread so more people can see it!

Follow me @MnkeDaniel to learn more about Investing.

Have a great day!

If you enjoyed it, please Like and Retweet this Thread so more people can see it!

Follow me @MnkeDaniel to learn more about Investing.

Have a great day!

جاري تحميل الاقتراحات...