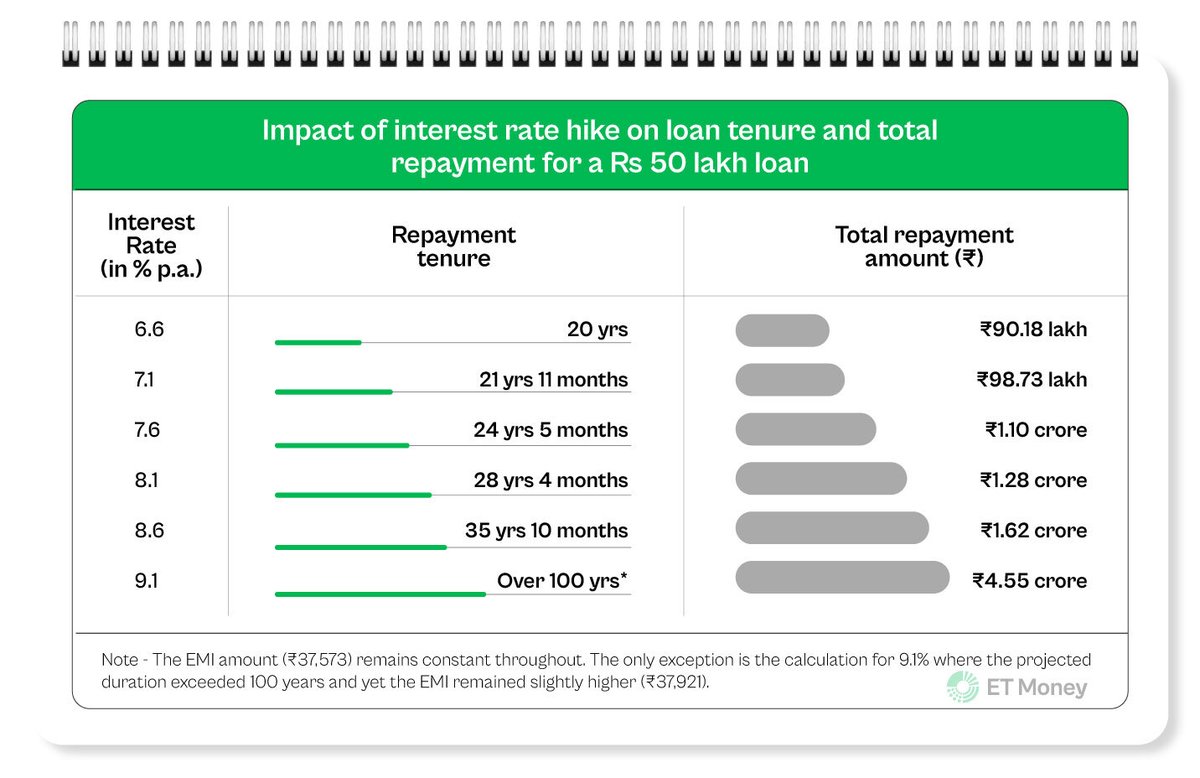

Home loan rates have risen from 6.6% to 9.1%.

It means a 20-yr loan could now be well over 100 yrs (See image)

This ‘UNREASONABLE ELONGATION’ in repayment tenures has miffed #RBI.

But why did this happen?

How can borrowers deal with it?

What RBI plans to do about it?

A 🧵

It means a 20-yr loan could now be well over 100 yrs (See image)

This ‘UNREASONABLE ELONGATION’ in repayment tenures has miffed #RBI.

But why did this happen?

How can borrowers deal with it?

What RBI plans to do about it?

A 🧵

Let’s start with the basics.

Most banks have tied their home loan rates to the repo rate.

Now, in less than 12 months (between May 2022 & Feb 2023), RBI has increased the repo rate by 250 basis points (from 4% to 6.5%).

So, home loan rates have also jumped.

Most banks have tied their home loan rates to the repo rate.

Now, in less than 12 months (between May 2022 & Feb 2023), RBI has increased the repo rate by 250 basis points (from 4% to 6.5%).

So, home loan rates have also jumped.

But how come the loan tenures are increasing?

An increase in loan tenures has a lot to do with how banks calculate your EMI amount.

When loan rates go up, banks don’t change your EMI.

Instead, they increase your tenure, which also results in higher interest outgo.

An increase in loan tenures has a lot to do with how banks calculate your EMI amount.

When loan rates go up, banks don’t change your EMI.

Instead, they increase your tenure, which also results in higher interest outgo.

What can you do to reduce your loan tenure?

Many consider increasing EMI as a solution.

While it can help you reduce loan tenure, it isn’t the best option.

Why? If you face a cash crunch in the future, it’s difficult to reduce it again.

Most lenders may not readily agree.

Many consider increasing EMI as a solution.

While it can help you reduce loan tenure, it isn’t the best option.

Why? If you face a cash crunch in the future, it’s difficult to reduce it again.

Most lenders may not readily agree.

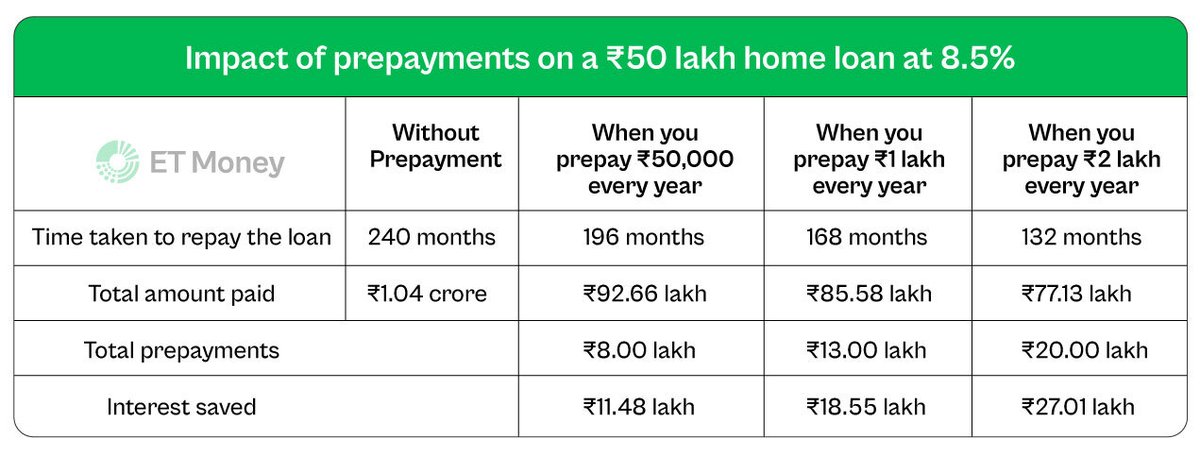

There’s a better option: PREPAY

You are free to do it whenever you have surplus money.

And when you prepay an amount, your outstanding principal comes down by that much.

As the principal loan amount reduces, so does the interest you have to pay.

Check an example 👇

You are free to do it whenever you have surplus money.

And when you prepay an amount, your outstanding principal comes down by that much.

As the principal loan amount reduces, so does the interest you have to pay.

Check an example 👇

Let’s assume you took a loan of Rs 50 lakh at 8.5% for 20 years.

After 3 years, your outstanding principal amount would be nearly Rs 46.7 lakh.

Say, you received a bonus & prepaid Rs 2 lakh.

Your outstanding principal balance would come down to Rs 44.7 lakh.

After 3 years, your outstanding principal amount would be nearly Rs 46.7 lakh.

Say, you received a bonus & prepaid Rs 2 lakh.

Your outstanding principal balance would come down to Rs 44.7 lakh.

There are a few more options you can explore.

One, you can request your lender (especially NBFCs) to shift your existing home loan rate to what they offer to new borrowers, which is usually lower.

Lenders may take a small fee & shift your loan to a lower rate.

One, you can request your lender (especially NBFCs) to shift your existing home loan rate to what they offer to new borrowers, which is usually lower.

Lenders may take a small fee & shift your loan to a lower rate.

What if your lender doesn’t allow migrating to a lower rate?

In that case, you can switch to another lender offering better terms.

In industry parlance, it’s called ‘balance transfer’.

This can save you money by reducing your interest rates.

In that case, you can switch to another lender offering better terms.

In industry parlance, it’s called ‘balance transfer’.

This can save you money by reducing your interest rates.

If you are not able to do any of these, don’t panic.

15-20 years is a long duration.

If the interest rate cycle reverses, interest rates will go down again.

Besides, RBI is planning to take a few steps that can come to your rescue.

15-20 years is a long duration.

If the interest rate cycle reverses, interest rates will go down again.

Besides, RBI is planning to take a few steps that can come to your rescue.

The central bank has a plan that lenders will need to follow.

One, lenders should clearly communicate to borrowers when they change the loan tenure and EMI.

Two, provide options of switching to a fixed rate loan or foreclosure (pay off the entire loan at one go).

One, lenders should clearly communicate to borrowers when they change the loan tenure and EMI.

Two, provide options of switching to a fixed rate loan or foreclosure (pay off the entire loan at one go).

A lender must also inform about extra costs if a borrower wants to switch to a fixed-rate loan or opts for foreclosure.

The RBI has come up with these proposals last week.

The detailed guidelines are expected to come out soon.

The RBI has come up with these proposals last week.

The detailed guidelines are expected to come out soon.

We put a lot of effort into creating such informative threads.

So, if you find this useful, show some love. ❤️

Please like, share, and retweet the FIRST tweet. 👇

So, if you find this useful, show some love. ❤️

Please like, share, and retweet the FIRST tweet. 👇

Loading suggestions...