in this thread, I will cover the following:

- my way of trading a failed auction

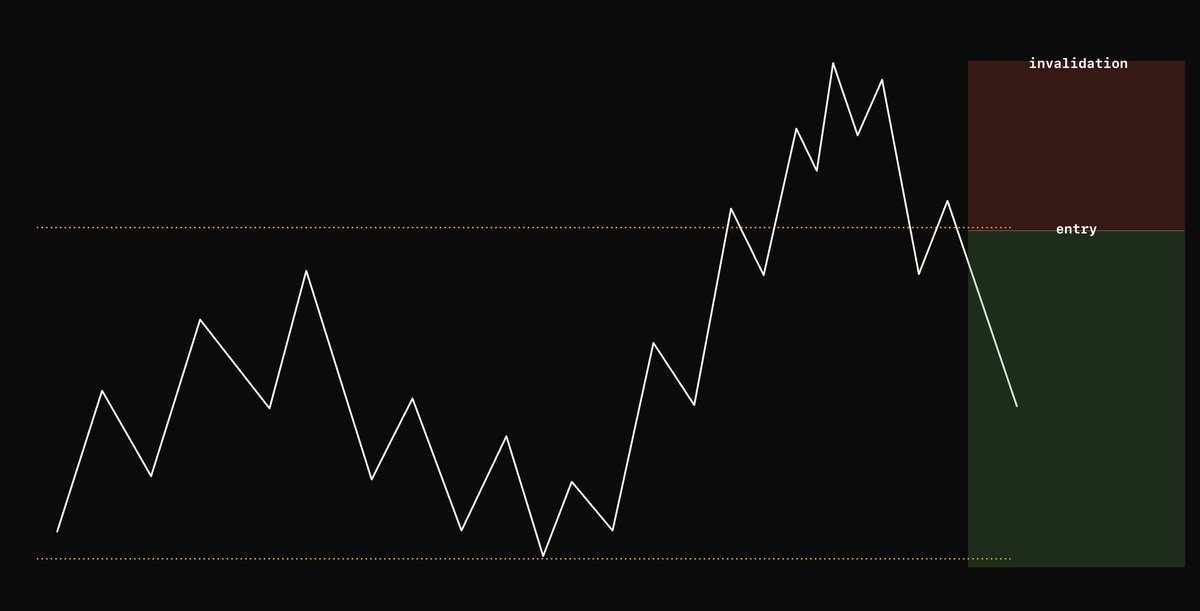

- identifying a potential failed auction

- entry + invalidations

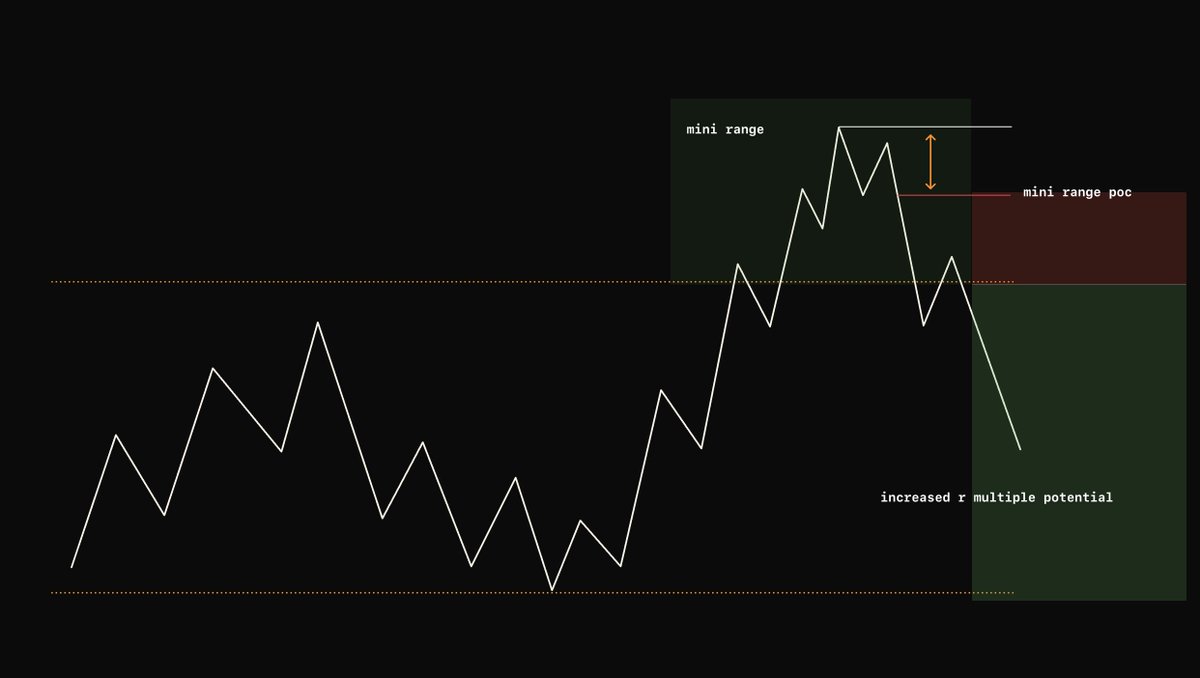

- optimizing your invalidation

- further context using order flow

- my way of trading a failed auction

- identifying a potential failed auction

- entry + invalidations

- optimizing your invalidation

- further context using order flow

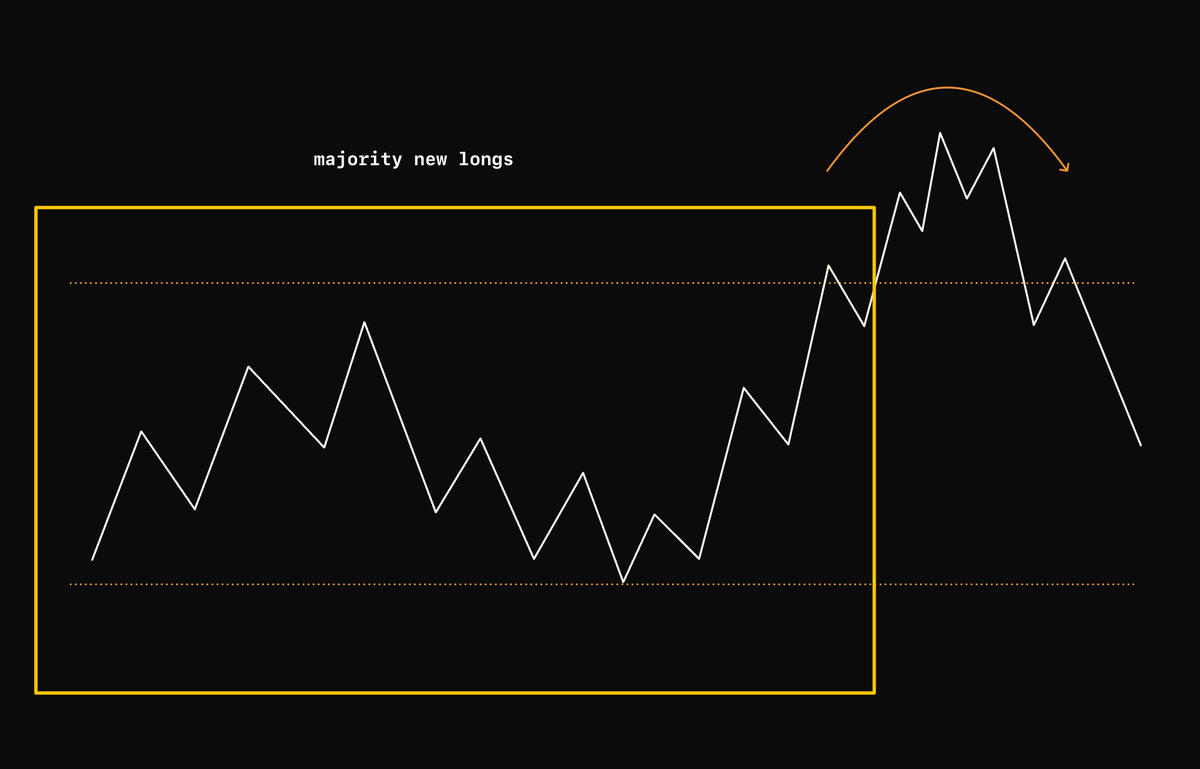

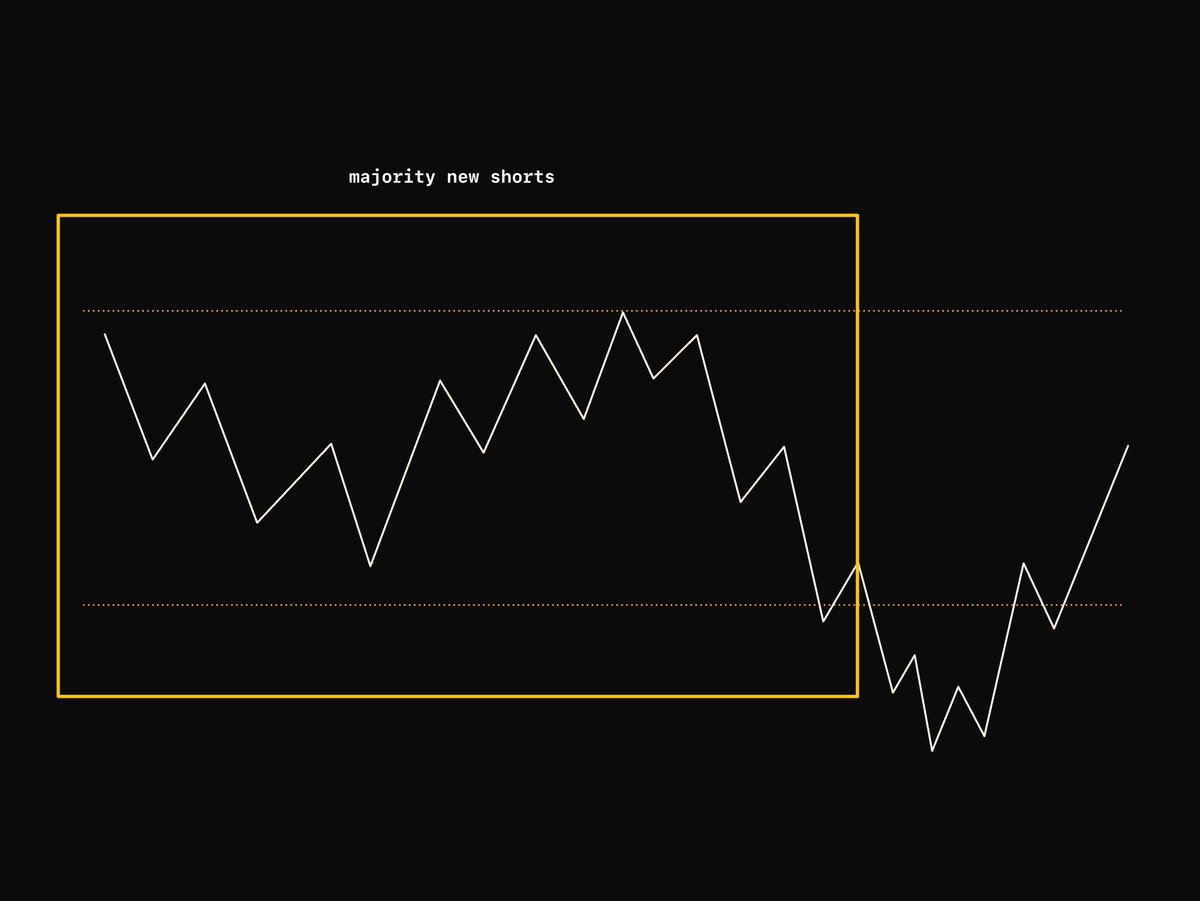

identifying the majority within the range

use Exocharts dynamic profile tool, ive done a complete thread on this over here

use Exocharts dynamic profile tool, ive done a complete thread on this over here

notes

- price must spend a decent length of time creating value before we can see the potential of a failed auction forming. (few days is great) for day traders.

- using dynamic profile to identify if the majority are new positions and which side they are on is crucial...

- price must spend a decent length of time creating value before we can see the potential of a failed auction forming. (few days is great) for day traders.

- using dynamic profile to identify if the majority are new positions and which side they are on is crucial...

notes (2)

for determining the favoured side a failed auction could occur on.

for determining the favoured side a failed auction could occur on.

𝗵𝗼𝗽𝗲 𝘆𝗼𝘂 𝗲𝗻𝗷𝗼𝘆𝗲𝗱, 𝗶 𝗮𝗽𝗽𝗿𝗲𝗰𝗶𝗮𝘁𝗲 𝘁𝗵𝗶𝘀 𝗺𝗮𝘆 𝗻𝗼𝘁 𝗯𝗲 𝗮𝗻 𝗶𝗻𝗱𝗲𝗽𝘁𝗵 𝘃𝗶𝗲𝘄 𝗼𝗻 𝗮 𝗴𝗲𝗻𝗲𝗿𝗶𝗰 𝗳𝗮𝗶𝗹𝗲𝗱 𝗮𝘂𝗰𝘁𝗶𝗼𝗻.

but more so covered some nuances i find helpful when looking at some of them and using context to my aid.

but more so covered some nuances i find helpful when looking at some of them and using context to my aid.

جاري تحميل الاقتراحات...