2.2 What you want to see (Rule of Thumb):

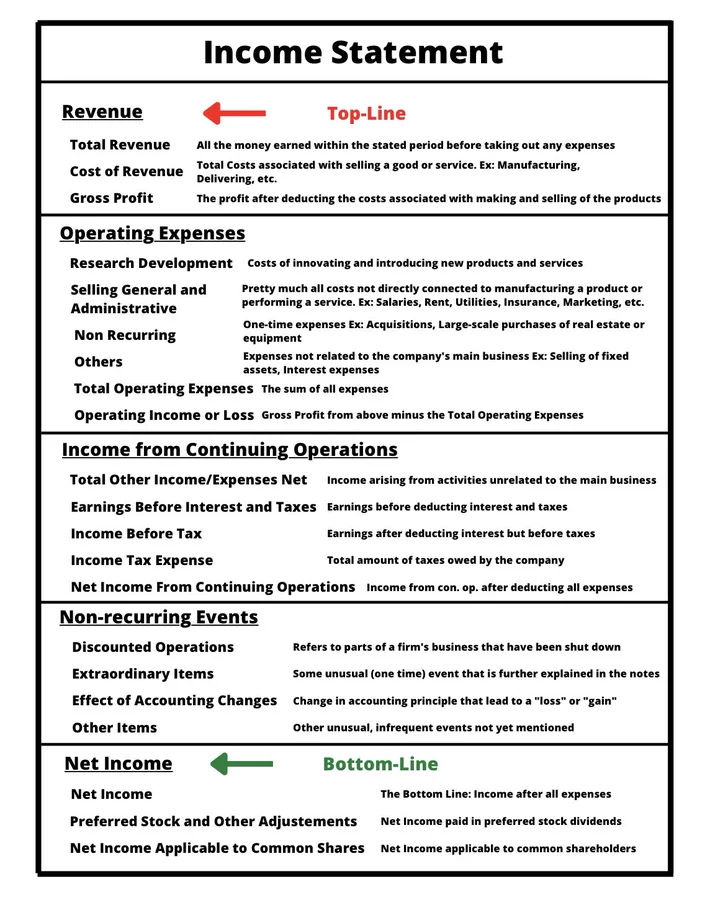

1) Uptrends in Revenues and Earnings >15%

2) Profit Margins >20%

3) EPS Growth >15%

1) Uptrends in Revenues and Earnings >15%

2) Profit Margins >20%

3) EPS Growth >15%

3.2 What you want to see (Rule of Thumb):

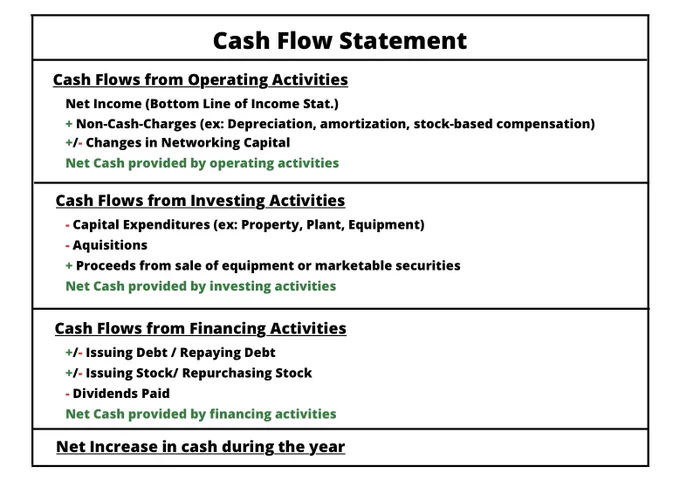

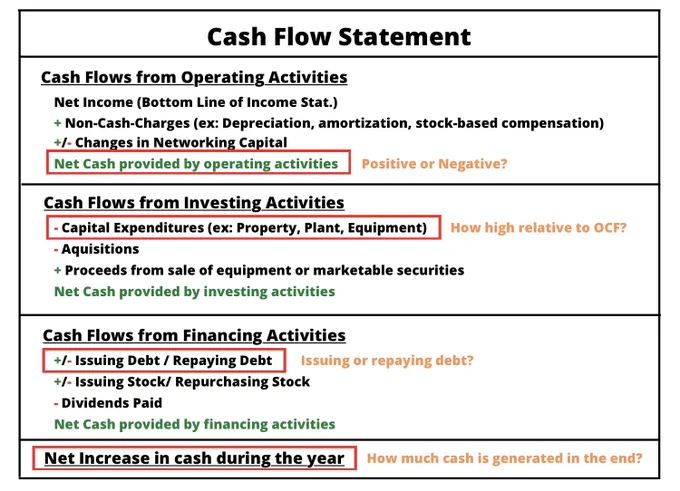

1) Net increase in cash

2) Operating Cash Flow > Capex

3) Debt get’s repaid regularly

1) Net increase in cash

2) Operating Cash Flow > Capex

3) Debt get’s repaid regularly

Important Note: This is an introduction to analyzing financial statements.

Advanced investors rarely use ratios or rules of thumb since every company is different.

Here are free PDFs of three outstanding resources to learn advanced valuation:

danielmnke.com

Advanced investors rarely use ratios or rules of thumb since every company is different.

Here are free PDFs of three outstanding resources to learn advanced valuation:

danielmnke.com

That's it for today!

If you enjoyed it, please Like and Retweet this Thread so more people can see it!

Follow me @MnkeDaniel to learn more about Investing.

Have a great day!

If you enjoyed it, please Like and Retweet this Thread so more people can see it!

Follow me @MnkeDaniel to learn more about Investing.

Have a great day!

جاري تحميل الاقتراحات...