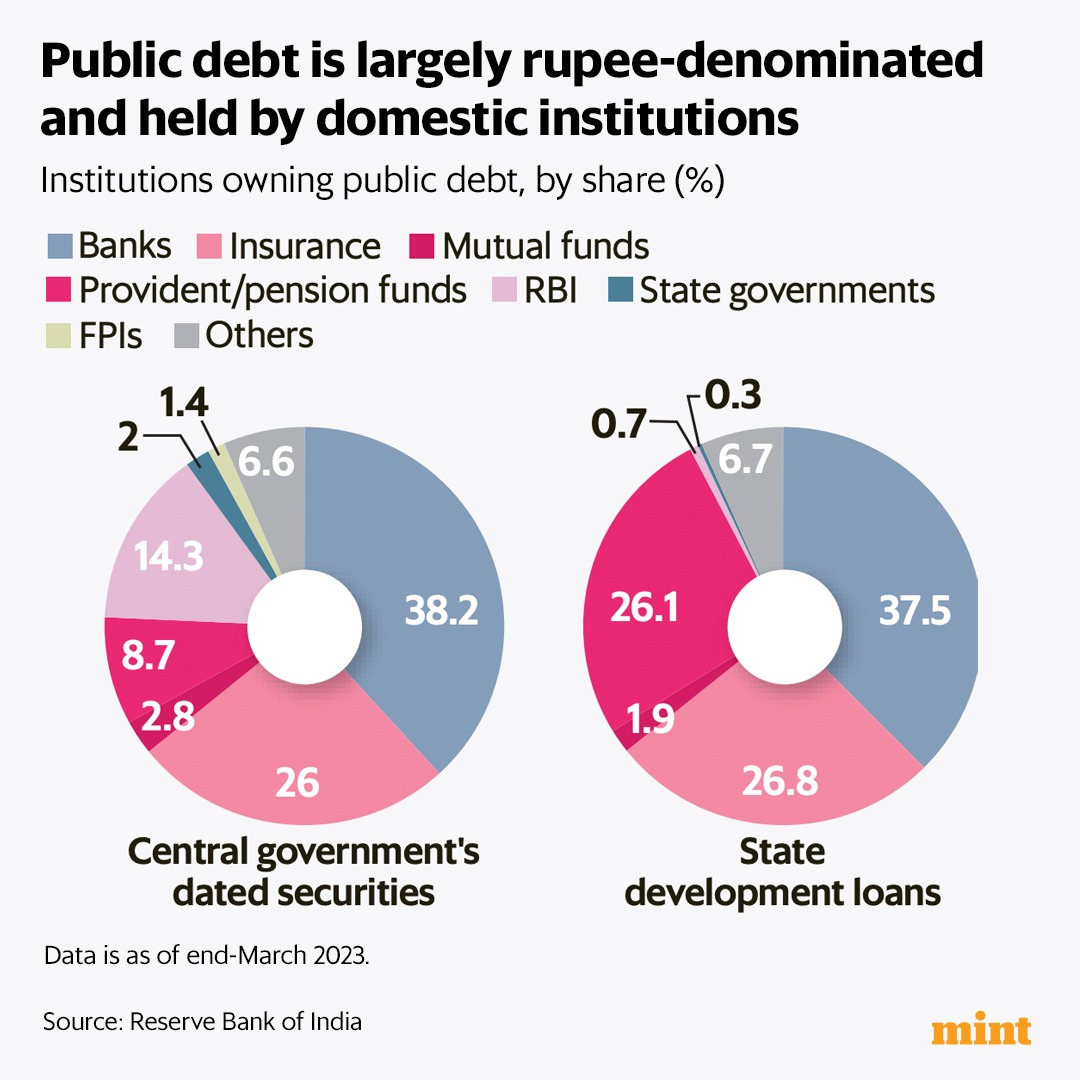

#MintPlainFacts | India’s public debt remains around 84% of #GDP, a fairly high level for an emerging economy.

But it’s considered to be largely sustainable, thanks to the unique structure and market features of our public debt.

Read here: livemint.com.

But it’s considered to be largely sustainable, thanks to the unique structure and market features of our public debt.

Read here: livemint.com.

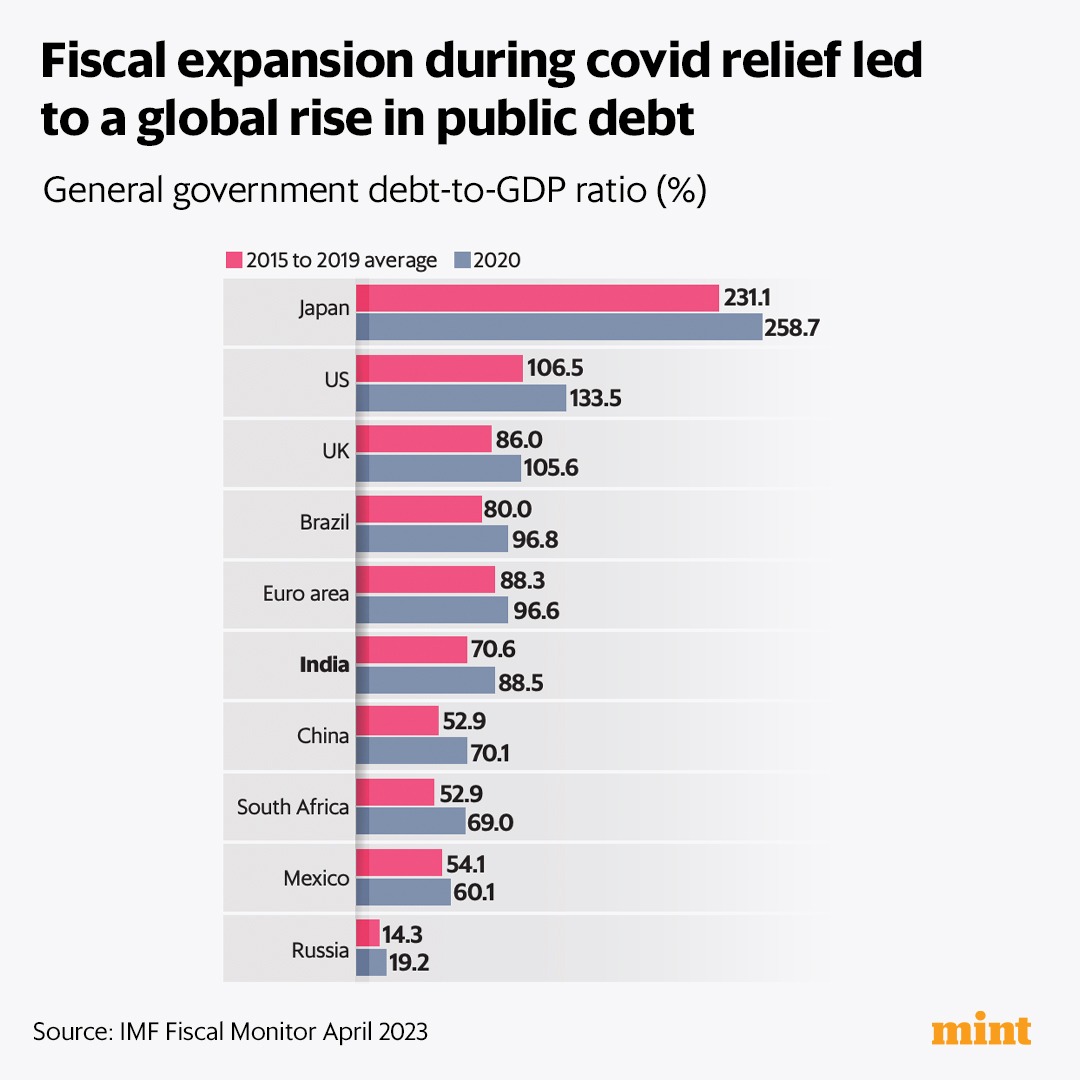

#MintPlainFacts | India falls in the middle of the ranks of indebted countries—better than debt-heavy US or Japan, but worse than comparable emerging economies.

Read here: livemint.com.

Read here: livemint.com.

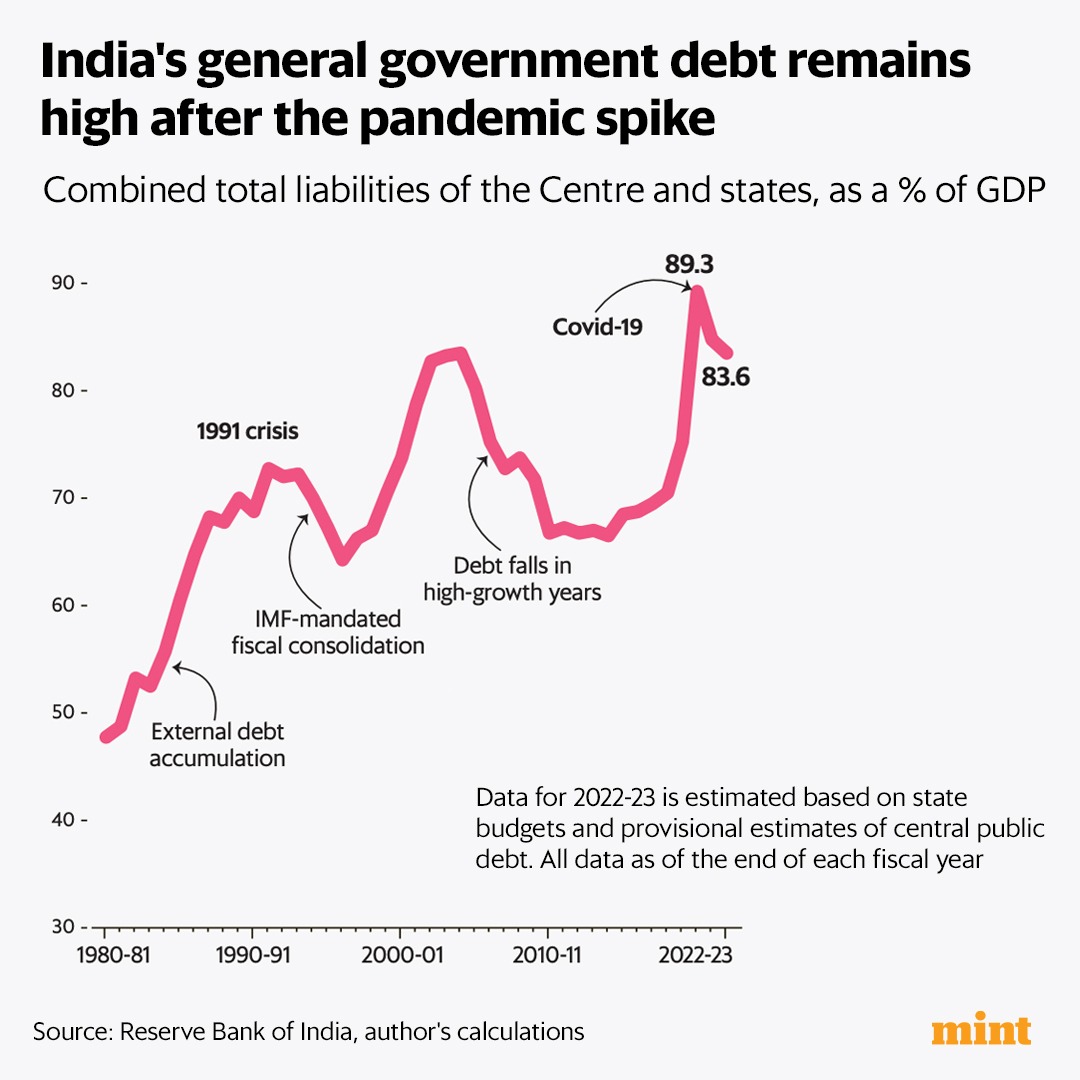

#MintPlainFacts | In 2020, total liabilities of the Centre and states hit an all-time high of 89.3% of #GDP, mainly due to central spending on covid-19 relief.

It declined in the following years, but remains around 84% of GDP, which is fairly high for an emerging economy.

Read…

It declined in the following years, but remains around 84% of GDP, which is fairly high for an emerging economy.

Read…

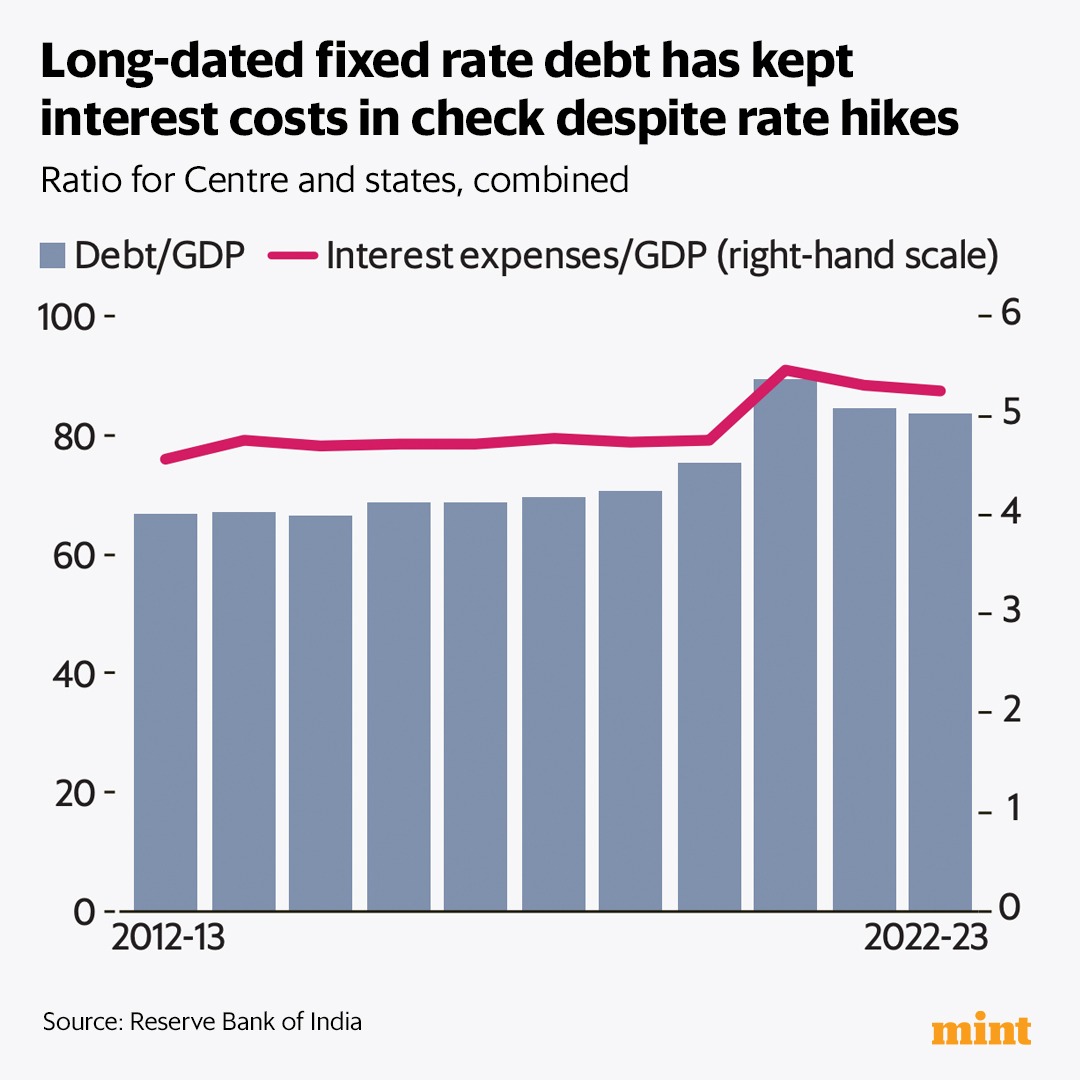

#MintPlainFacts | Further, the low share of floating rate debt (5.6% of central government debt at end-March 2021) reduces interest rate risk.

Together, these structural features explain why the share of interest payments in GDP did not increase with the recent rise in interest…

Together, these structural features explain why the share of interest payments in GDP did not increase with the recent rise in interest…

#MintPlainFacts | As of March 2023, the share of external debt in central government debt was about 3.5%.

The fact that India’s debt is mainly in rupees reduces its currency risk. It also explains why the sharp rupee depreciation in 2022 did not result in ballooning interest…

The fact that India’s debt is mainly in rupees reduces its currency risk. It also explains why the sharp rupee depreciation in 2022 did not result in ballooning interest…

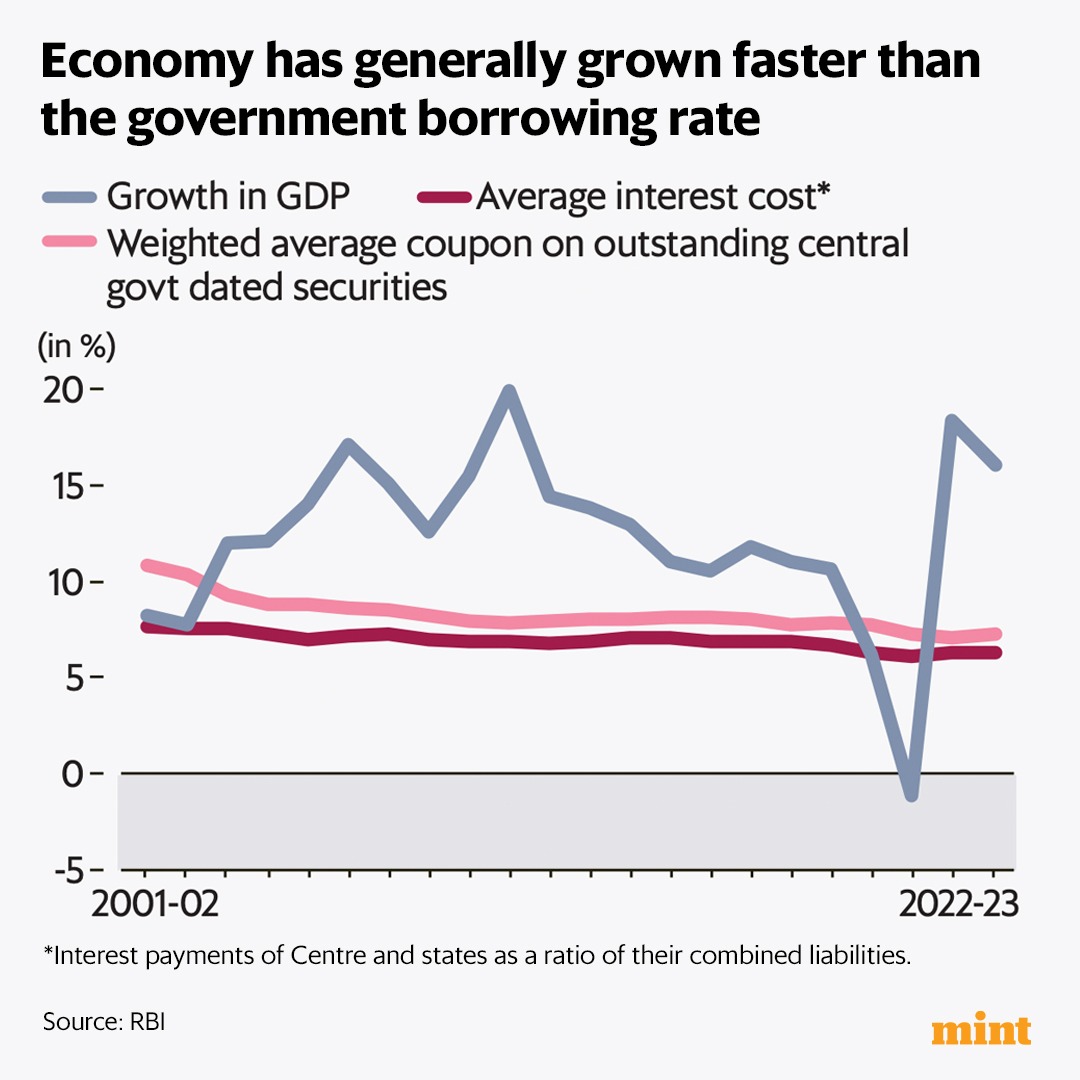

#MintPlainFacts | #India’s #GDP growth has usually been higher than the government borrowing rate. The growth–interest differential remained positive even when rates went up in 2022.

However, keeping a lid on primary deficit is much harder.

Read here: livemint.com.

However, keeping a lid on primary deficit is much harder.

Read here: livemint.com.

Loading suggestions...