2. Invest within your circle of competence

Only invest in what you understand.

If you don't understand what you buy, you won't know when it's a good time to sell either.

Only invest in what you understand.

If you don't understand what you buy, you won't know when it's a good time to sell either.

4. Pricing power

Pricing power is the best protection against inflation for companies.

A high and consistent gross margin is a great indication that a company has pricing power.

Pricing power is the best protection against inflation for companies.

A high and consistent gross margin is a great indication that a company has pricing power.

5. Management is important

Management can make or break a company.

Look for companies where insiders invest heavily in their own company.

Management can make or break a company.

Look for companies where insiders invest heavily in their own company.

6. Predictable earnings

Invest in cash machines.

When earnings are predictable, you are able to make better predictions about the future.

Invest in cash machines.

When earnings are predictable, you are able to make better predictions about the future.

7. Governments shouldn't intervene

Avoid investing in companies wherein the government has a stake.

Also avoid companies where a change in regulation can harm the company.

Avoid investing in companies wherein the government has a stake.

Also avoid companies where a change in regulation can harm the company.

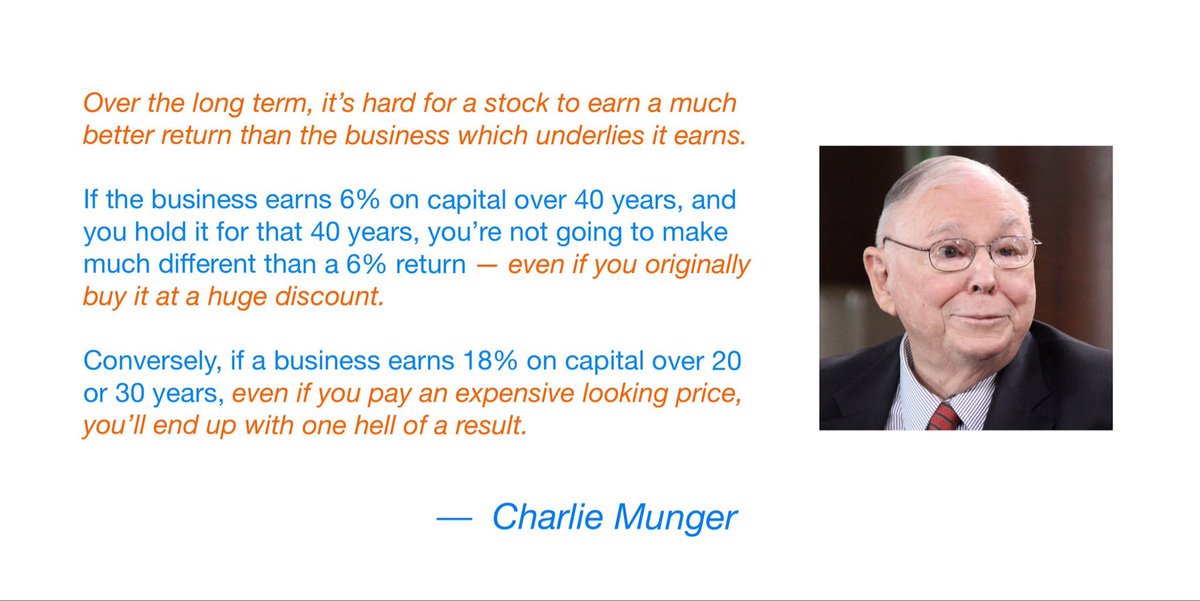

8. Low capital intensity

The best companies require very little capital to operate.

Seek for companies with CAPEX/Sales < 5%.

The best companies require very little capital to operate.

Seek for companies with CAPEX/Sales < 5%.

9. Focus on shareholder value

The track record of a stock already tells you a lot.

You don't want to invest in the next big thing. You want to invest in companies that have already won.

Seek for companies which managed to compound > 12% per year over the past decade.

The track record of a stock already tells you a lot.

You don't want to invest in the next big thing. You want to invest in companies that have already won.

Seek for companies which managed to compound > 12% per year over the past decade.

That's it for today.

If you liked this, you'll love all public writings of Chuck Akre.

You can download them on my website for free.

Sign up here to receive it: eepurl.com

If you liked this, you'll love all public writings of Chuck Akre.

You can download them on my website for free.

Sign up here to receive it: eepurl.com

Loading suggestions...