#KilpestIndia in one of the rare stock that is growing at 30% CAGR and still available at single digit PE.

Thread on its business highlights 👇(1/n)

Thread on its business highlights 👇(1/n)

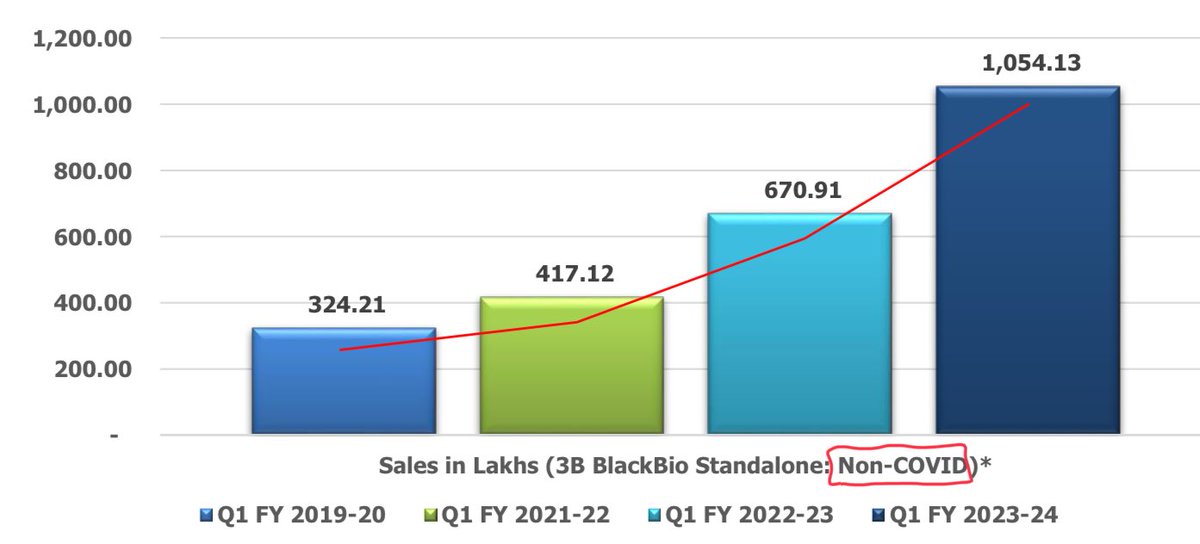

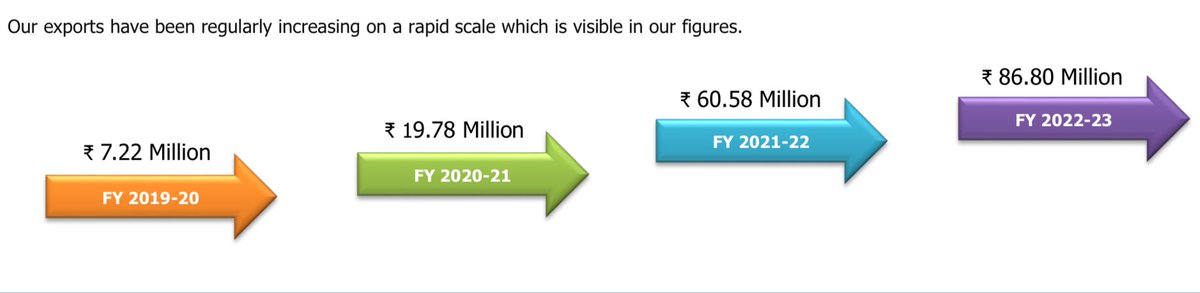

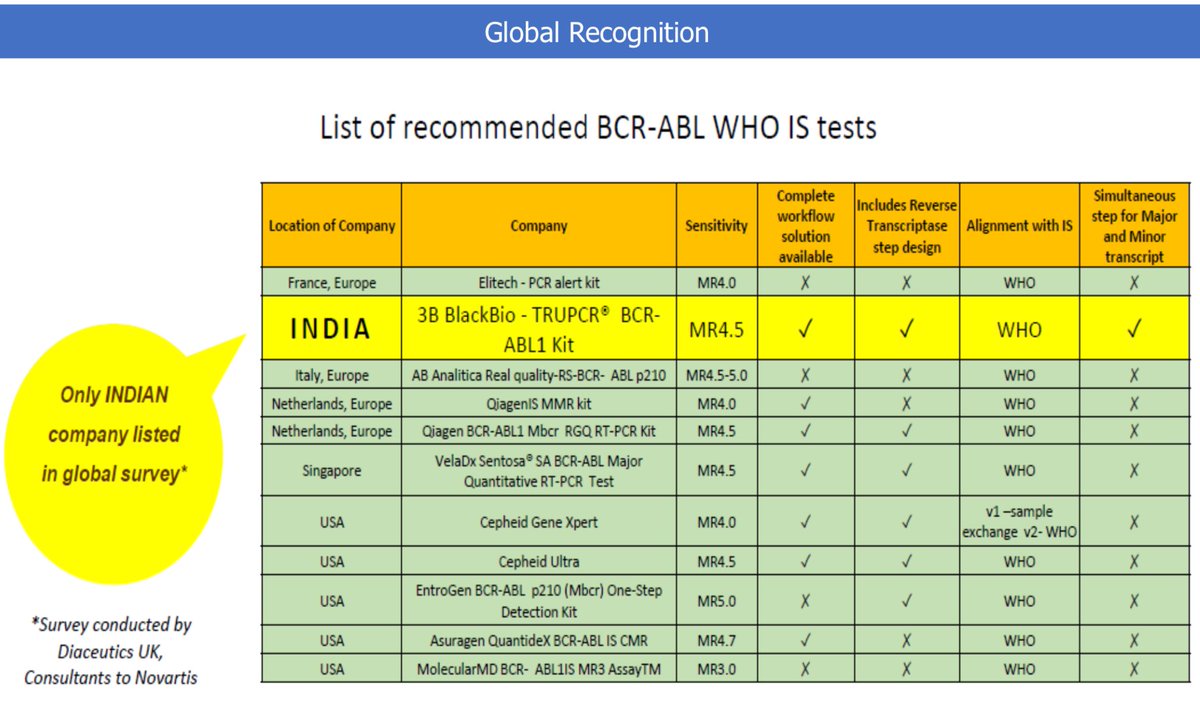

#Kilpest main business is development and manufacturing of PCR based Molecular Diagnostic kits through its subsidiary #3bBlackBio . During FY20 they made revenue of 29cr which is now grown to 62cr with negligible contribution from Covid test kit. This translates to 29% CAGR (2/n)

During Covid years (FY21 & FY22) they made lots of revenue from their Covid test kits and flooded with profits. All these profits are still sitting on books. They currently have 150 Cr of cash and liquid assets. (3/n)

They were looking for acquisition with this cash, however, they couldn’t find any suitable company due to stretched valuations of diagnostic companies across the globe. They have plans to distribute this money through buyback in current or next financial year (4/n)

Current market cap of the company is 385Cr (at 514 share price) they have cash and liquid assets worth 150cr on books so the enterprise value EV is 235cr and TTM profits are 28cr works out to effective PE of ~8.5x. (n/n)

Disclosure: Invested and no transactions recently

This is a micro cap company and investment in micro caps is highly risky.

This is a micro cap company and investment in micro caps is highly risky.

Loading suggestions...