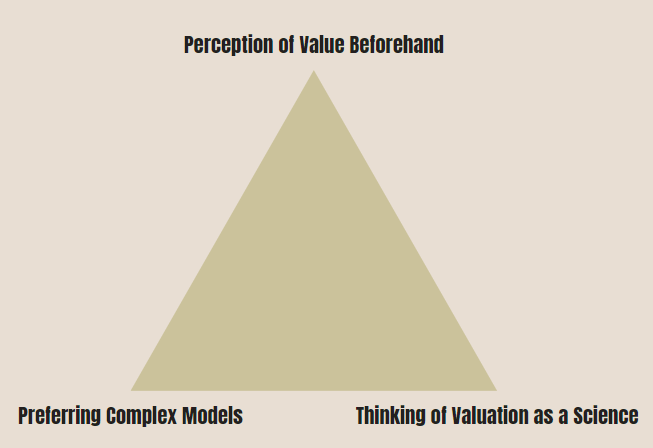

1.2 Thinking of Valuation as a Science:

Whenever numbers are involved, people feel like there should be a clear right or wrong, as if it is a science.

But valuation is not a science. It combines numbers and stories.

You make assumptions and come up with numbers.

Whenever numbers are involved, people feel like there should be a clear right or wrong, as if it is a science.

But valuation is not a science. It combines numbers and stories.

You make assumptions and come up with numbers.

1.3 Thinking Complex Models are Superior:

Less is more.

Your goal is to keep the valuation as simple as possible.

Every layer of complexity makes it more vulnerable.

Less is more.

Your goal is to keep the valuation as simple as possible.

Every layer of complexity makes it more vulnerable.

2. Number People vs. Story People

We generally belong to one of these groups.

Some of us prefer the number side of valuation, others the story side.

Neither one is working without the other.

Improve your weaker side, whatever that may be.

We generally belong to one of these groups.

Some of us prefer the number side of valuation, others the story side.

Neither one is working without the other.

Improve your weaker side, whatever that may be.

3. The Story Part

Valuations work with narratives.

The huge discrepancies between valuations of the same company come down to the narrative.

Is Tesla a car company? A battery company? Both?

Whatever narrative you choose, the numbers will be dramatically different.

Valuations work with narratives.

The huge discrepancies between valuations of the same company come down to the narrative.

Is Tesla a car company? A battery company? Both?

Whatever narrative you choose, the numbers will be dramatically different.

4. The 3 P’s

If it is so important what narrative we choose, how do we come up with the right one?

First of all, getting “the right one” is impossible.

But we can test our story with the 3 P’s:

Is the story …

1. Possible?

2. Plausible?

3. Probable?

If it is so important what narrative we choose, how do we come up with the right one?

First of all, getting “the right one” is impossible.

But we can test our story with the 3 P’s:

Is the story …

1. Possible?

2. Plausible?

3. Probable?

Many stories are possible.

Fewer stories are plausible.

And only a handful of stories are probable.

Your story must answer every one of the 3 P’s with “Yes!”

It must be possible, plausible, and probable.

Fewer stories are plausible.

And only a handful of stories are probable.

Your story must answer every one of the 3 P’s with “Yes!”

It must be possible, plausible, and probable.

5. Don’t get lost in Detail

Today, there’s more information on companies than ever before.

It’s very easy to get lost in details.

Details sound good, but if they don't affect cash flows, risk, or growth, they do not matter.

Focus on what drives value.

Today, there’s more information on companies than ever before.

It’s very easy to get lost in details.

Details sound good, but if they don't affect cash flows, risk, or growth, they do not matter.

Focus on what drives value.

6. Soft Factors

Soft Factors are things like brand name, quality of management, etc.

Soft Factors are often used to justify valuations.

In most cases, they’re worthless.

If they do offer an advantage, the numbers will show that.

Higher margins, faster growth, etc

Soft Factors are things like brand name, quality of management, etc.

Soft Factors are often used to justify valuations.

In most cases, they’re worthless.

If they do offer an advantage, the numbers will show that.

Higher margins, faster growth, etc

7. Valuation vs. Pricing

Last but not least, a key difference you need to internalize.

Valuation and pricing often get confused, but the difference is immense.

Pricing is about demand and supply, mood and momentum.

It only tells you what people are willing to pay.

Last but not least, a key difference you need to internalize.

Valuation and pricing often get confused, but the difference is immense.

Pricing is about demand and supply, mood and momentum.

It only tells you what people are willing to pay.

That price can be detached entirely from the underlying value.

Value is derived from looking at cash flows, growth, and risk.

It isn’t affected by supply and demand, mood and momentum.

If you understand this, you already have a considerable advantage over many investors.

Value is derived from looking at cash flows, growth, and risk.

It isn’t affected by supply and demand, mood and momentum.

If you understand this, you already have a considerable advantage over many investors.

That's it for today!

If you enjoyed it, please Like and Retweet this Thread so more people can see it!

Follow me @MnkeDaniel to learn more about Investing.

Have a great day!

If you enjoyed it, please Like and Retweet this Thread so more people can see it!

Follow me @MnkeDaniel to learn more about Investing.

Have a great day!

جاري تحميل الاقتراحات...