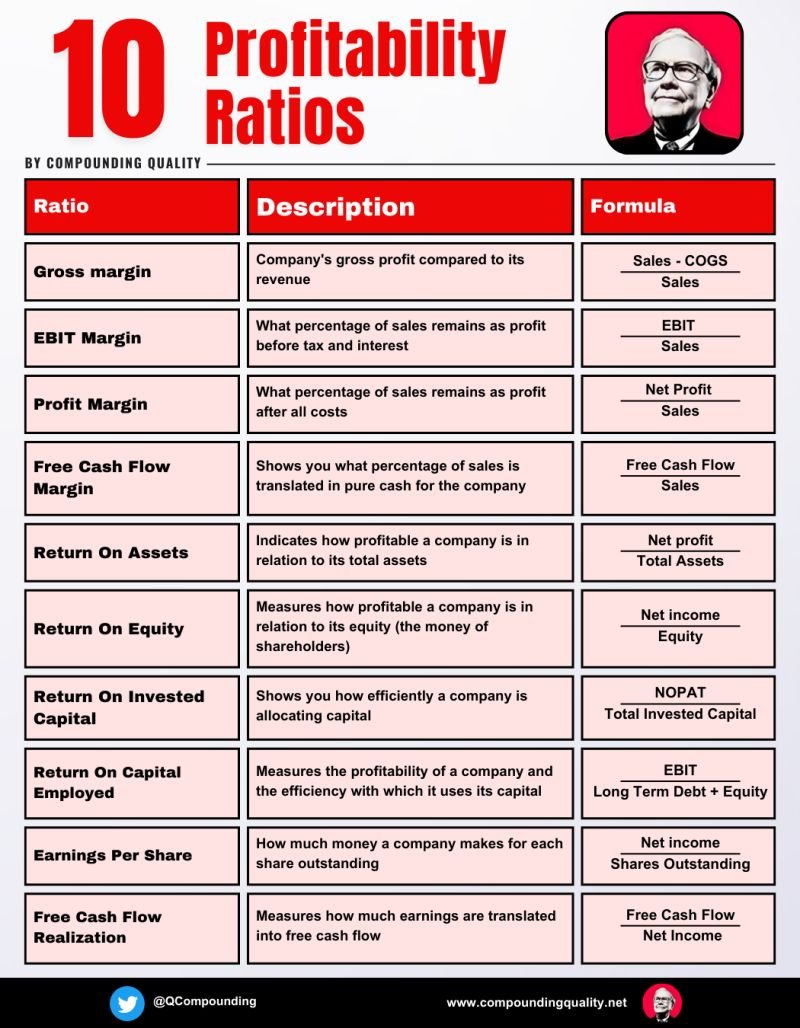

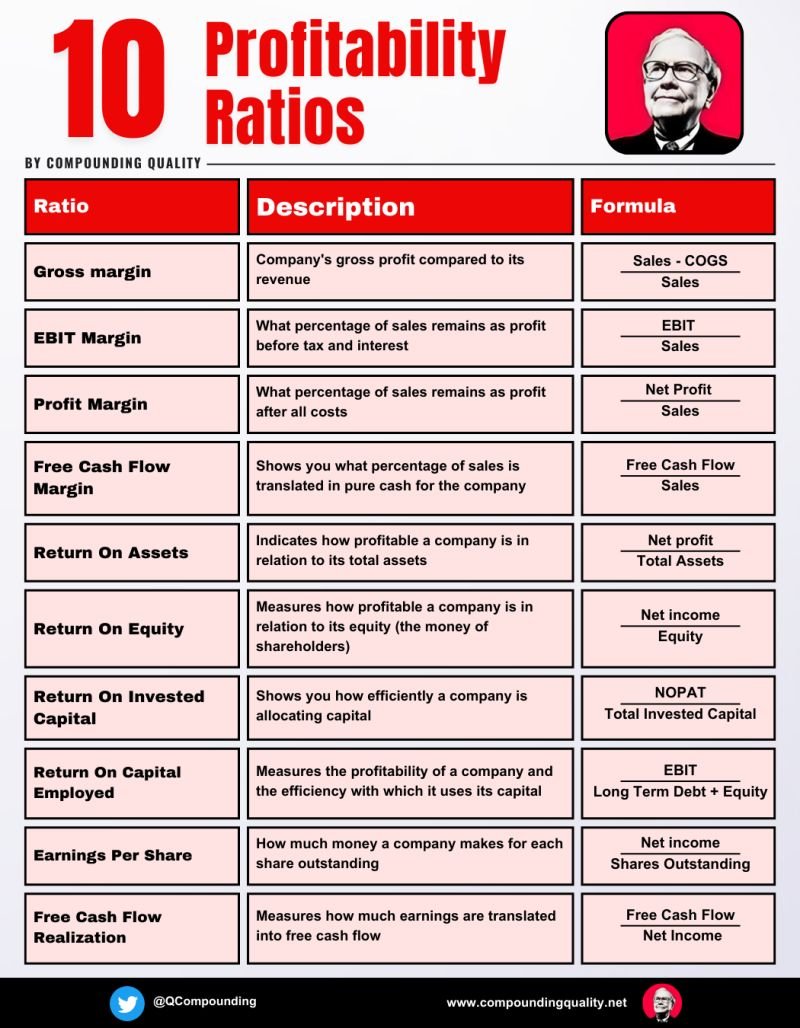

1️⃣ Gross margin (GM)

🎯 What?

Company's gross profit compared to its revenue

💡 Formula?

(Sales - COGS)/Sales

🎯 What?

Company's gross profit compared to its revenue

💡 Formula?

(Sales - COGS)/Sales

2️⃣ EBIT Margin

🎯What?

Percentage of sales that remains as profit before interest and taxes

💡 Formula?

EBIT / Sales

🎯What?

Percentage of sales that remains as profit before interest and taxes

💡 Formula?

EBIT / Sales

3️⃣ Profit Margin

🎯What?

Percentage of sales that remains as profit after all costs

💡 Formula?

Net Income / Sales

🎯What?

Percentage of sales that remains as profit after all costs

💡 Formula?

Net Income / Sales

4️⃣ Free Cash Flow Margin

🎯What?

Shows you what percentage of sales is translated in pure cash for the company

💡Formula?

Free Cash Flow / Sales

🎯What?

Shows you what percentage of sales is translated in pure cash for the company

💡Formula?

Free Cash Flow / Sales

5️⃣ Return On Assets (ROA)

🎯What?

Indicates how profitable a company is in relation to its total assets

💡 Formula?

Net Income / Total Assets

🎯What?

Indicates how profitable a company is in relation to its total assets

💡 Formula?

Net Income / Total Assets

6️⃣ Return On Equity (ROE)

🎯What?

Measures how profitable a company is in relation to its equity (the money of shareholders)

💡 Formula?

Net Income / Equity

🎯What?

Measures how profitable a company is in relation to its equity (the money of shareholders)

💡 Formula?

Net Income / Equity

7️⃣ Return On Invested Capital (ROIC)

🎯What?

Shows you how efficiently a company is allocating capital

💡 Formula?

NOPAT / Total Invested Capital

🎯What?

Shows you how efficiently a company is allocating capital

💡 Formula?

NOPAT / Total Invested Capital

8️⃣ Return On Capital Employed (ROCE)

🎯What?

Measures the profitability of a company and the efficiency with which it uses its capital

💡 Formula?

EBIT / Long-term debt + equity

🎯What?

Measures the profitability of a company and the efficiency with which it uses its capital

💡 Formula?

EBIT / Long-term debt + equity

9️⃣ Earnings Per Share (EPS)

🎯What?

How much money a company makes for each share outstanding

💡 Formula?

Net Income / Shares Outstanding

🎯What?

How much money a company makes for each share outstanding

💡 Formula?

Net Income / Shares Outstanding

🔟 Free Cash Flow Realization

🎯What?

Measures how much earnings are translated into free cash flow

💡Formula?

Free Cash Flow / Net Income

🎯What?

Measures how much earnings are translated into free cash flow

💡Formula?

Free Cash Flow / Net Income

That's it for today.

If you liked this, you'll LOVE our brand new e-book about investing and the stock market.

It will be published on Amazon soon, but today you can grab it for free.

Sign up here: eepurl.com

If you liked this, you'll LOVE our brand new e-book about investing and the stock market.

It will be published on Amazon soon, but today you can grab it for free.

Sign up here: eepurl.com

Loading suggestions...