DeFi had its parabolic melt-up in 2020 after the Fed lowered interest rates to zero.

As TradFi yields collapsed, people went further and further out the risk curve to seek any yield whatsoever.

This led to stablecoin TVL ⬆️, fueling the bull market.

As TradFi yields collapsed, people went further and further out the risk curve to seek any yield whatsoever.

This led to stablecoin TVL ⬆️, fueling the bull market.

But as we all know, stablecoin TVL has been DOWN ONLY since the Fed started its fasted rate hiking campaign on March 2022.

As dollar outflows increased, crypto prices crashed, leading to cascading liquidations that we're all familiar with.

As dollar outflows increased, crypto prices crashed, leading to cascading liquidations that we're all familiar with.

So in order for dollars to come back on-chain, DeFi needs to offer a stablecoin yield much higher than 5%, to account for the risk premia.

And this is becoming possible with tokenized T-bills.

And this is becoming possible with tokenized T-bills.

But how will DeFi offer such high rates? Tokenizing t-bills alone isn't going to bring money back on-chain.

Well, enter DeFi money legos which can enhance the risk-free rate through some effective financial engineering.

Well, enter DeFi money legos which can enhance the risk-free rate through some effective financial engineering.

Quick recap of MakerDAO below. TLDR is that they've been buying t-bills hand over fist and is directing the government interest payments on-chain towards $MKR buybacks and enhanced $DAI staking yield.

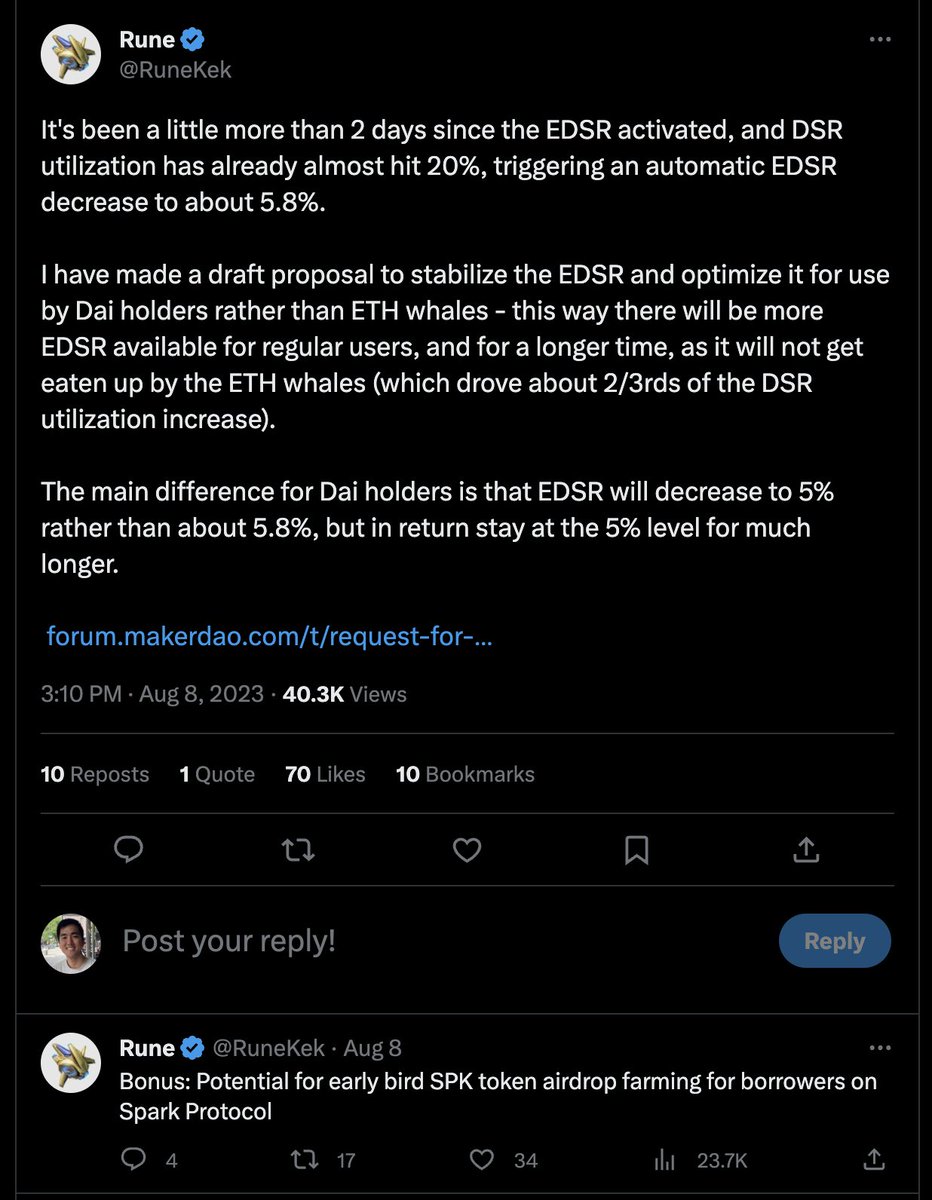

Since we last spoke, the Dai Savings Rate (yield you get for staking DAI) has increased from 3.49% to 8%.

Rune, the founder of @MakerDAO, will lower the DSR to 5% but will leave it there higher for longer (smol alpha about the $SPK airdrop for using Spark Protocol).

Rune, the founder of @MakerDAO, will lower the DSR to 5% but will leave it there higher for longer (smol alpha about the $SPK airdrop for using Spark Protocol).

A mental model I have is that $MKR is the on-chain Federal Reserve. They set the baseline stablecoin interest rate and it squeezes other protocols if they can’t offer something that’s better.

Similar to how stETH is the baseline rate for ETH farms

Similar to how stETH is the baseline rate for ETH farms

10% stablecoin yields may give some people PTSD, but this is a transparent and scalable model since the yield comes not from inflationary token rewards, but from government interest payments.

Economic value is created here.

Economic value is created here.

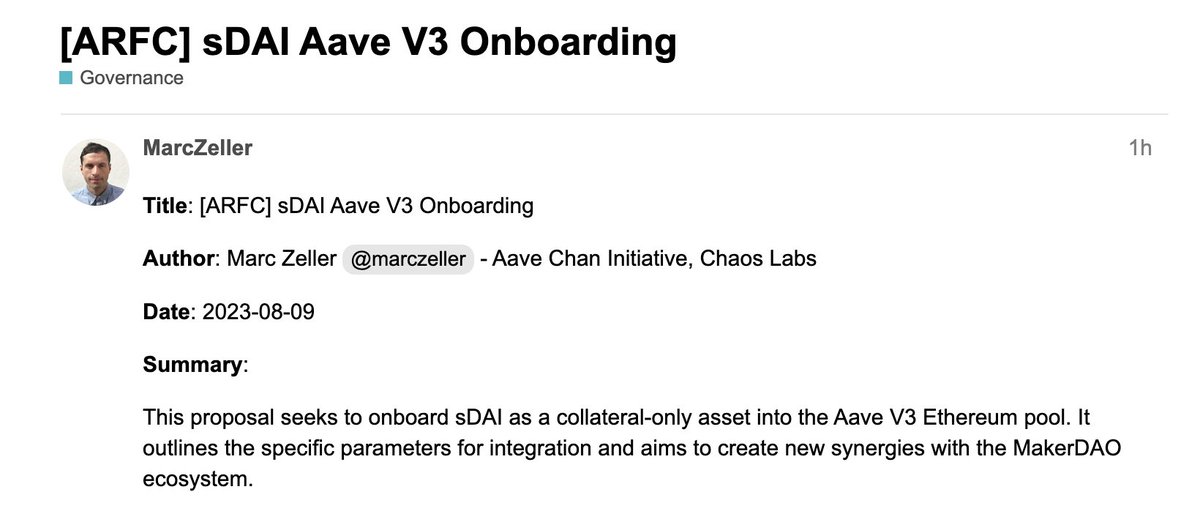

If $sDAI is paying 5%, it's a no brainer for other DeFi protocols to integrate it to their suite of products.

There's even a farm right now to use sDAI as part of a liquidity pool so there's less opportunity cost (versus LPing a naked stablecoin).

There's even a farm right now to use sDAI as part of a liquidity pool so there's less opportunity cost (versus LPing a naked stablecoin).

As assets like stETH and sDAI gain liquidity and lindy, I think it's inevitable that these liquid staking derivatives become the preferred asset to hold instead of other stablecoins.

h/t @MacroMate8

h/t @MacroMate8

Is this even DeFi?

Well if you're an American maybe there's not much value in tokenizing t-bills on-chain. However, tokenization allows for permissionless access to dollar yields, which is extremely useful if you live in a country with a weak currency.

Well if you're an American maybe there's not much value in tokenizing t-bills on-chain. However, tokenization allows for permissionless access to dollar yields, which is extremely useful if you live in a country with a weak currency.

And thus, the DeFi bull market is beginning before our eyes. It's going to take time for these strategies to get more adoption/liquidity but we should see better products with more competition.

I see the beginning of the DeFi bull market. Do you?

I see the beginning of the DeFi bull market. Do you?

(this isn't a call that claims our tokens will pump 10x next week. It's more of my macro prediction that stablecoin TVL will pick up in the coming months, which will inevitably lead to more sustainable pumps across the baord)

Loading suggestions...